Shopify Inc. stands at the forefront of e-commerce innovation, transforming how merchants connect with customers worldwide. Yet sustaining its rapid growth and justifying a lofty stock valuation pose significant challenges amid economic uncertainties and rising competition. Understanding these dynamics is crucial for navigating Shopify’s investment potential moving forward.

Table of contents

Key Points

- Institutional investors have recently increased their stakes in Shopify Inc.

- Shopify’s subscription model and international expansion drive its revenue growth.

- High valuation poses risks if growth slows or economic conditions worsen.

Sustaining Growth and Valuation Challenges for Shopify Inc.

Shopify Inc. operates a comprehensive e-commerce platform enabling merchants worldwide to manage and sell products across multiple channels. The company recently reported strong quarterly earnings of $0.27 per share and revenue of $2.84B, exceeding forecasts. Strategic efforts include international expansion and a robust subscription-based model with 38% growth in merchant solutions, driving continued momentum.

The fundamental problem facing Shopify Inc. is how to sustain its high growth rates and justify its elevated stock valuation amidst potential economic challenges and increasing competition in the e-commerce sector. This issue is particularly relevant given Shopify’s valuation at nearly 20 times sales and a forward P/E ratio above 80, leaving limited room for error if market conditions deteriorate or consumer spending slows.

Market Reaction

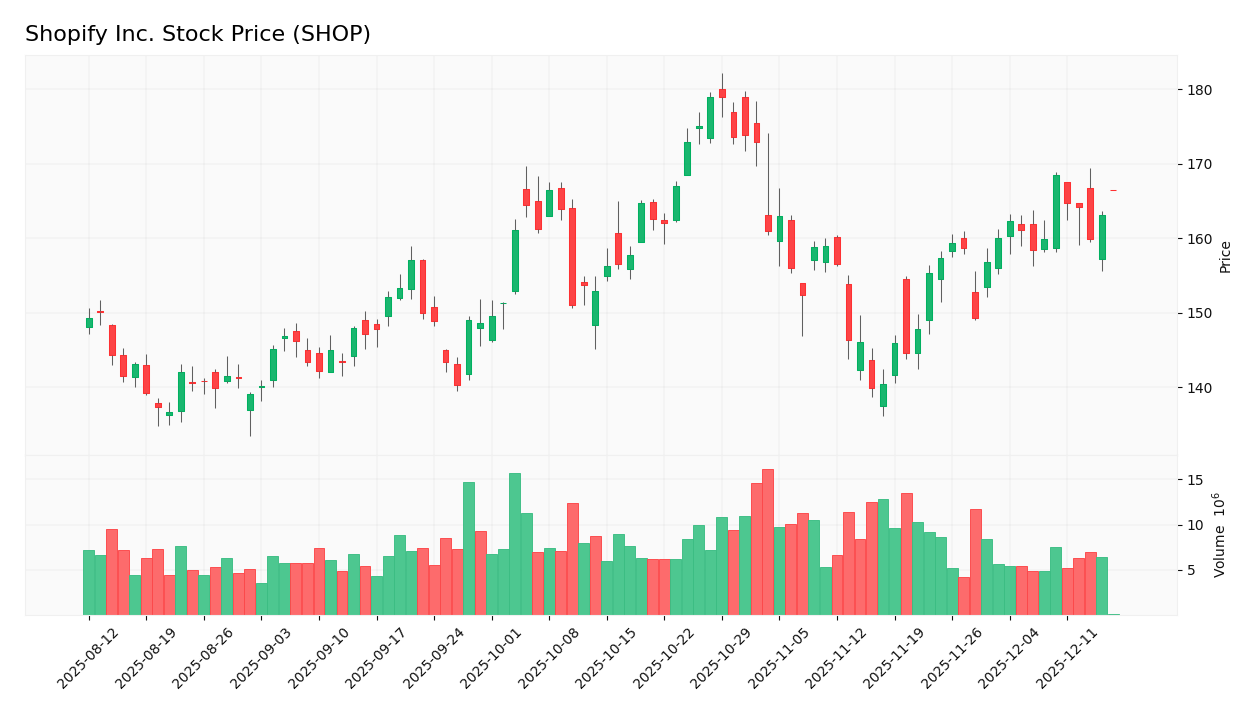

The challenge for Shopify Inc. lies in maintaining its rapid growth and justifying its high valuation amid economic uncertainties and rising competition, which could pressure the stock price. Despite these concerns, the stock price responded positively, rising by 2.94% on the day:

Target Prices

Analysts present a cautiously optimistic outlook for Shopify Inc., reflecting tempered confidence in the company’s growth prospects amid economic and competitive pressures. The target prices suggest moderate upside potential while acknowledging valuation risks.

| Target High | Target Low | Consensus |

|---|---|---|

| 200 | 140 | 184.13 |

Impacts on the Income Statement

Shopify Inc. reported a highly favorable income statement from 2023 to 2024, with revenue growth at 25.78% and net margin rising 22.74%. All key metrics, including an EBIT margin of 14.66% and EPS growth of 1450%, indicate strong profitability, supporting a positive profit-and-loss outlook for investors.

The challenge of sustaining high growth rates and justifying Shopify’s elevated valuation amid economic pressures and rising e-commerce competition could affect future revenue and margin expansions, potentially impacting the company’s ability to maintain its current strong income statement performance.

Stock Grades

The latest stock ratings for Shopify Inc. reflect a cautious but generally stable outlook from leading financial institutions, signaling confidence in the company’s resilience despite its valuation challenges.

Shopify’s grades remain mostly steady, with major firms maintaining their previous assessments. This consistency suggests that while growth concerns persist, there is no urgent push to downgrade the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Scotiabank | Maintain | Sector Perform | 2025-11-05 |

| BMO Capital | Maintain | Outperform | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

Conclusion

Shopify Inc.’s overall results appear favorable, demonstrating strong revenue growth and earnings that beat expectations. However, the fundamental challenge remains sustaining high growth rates and justifying its elevated stock valuation amid economic challenges and increasing e-commerce competition.

Long-term consequences hinge on Shopify’s ability to maintain momentum in merchant solutions and international expansion. Investors should closely monitor consumer spending trends and the company’s capacity to manage valuation risks, as these factors will significantly impact future performance.

Investing involves risks, and this article does not constitute investment advice.

Sources

I wrote this article using the following sources to provide you with a clear, informed analysis of Shopify Inc. (SHOP). I encourage you to consult these sources directly if you want to explore the subject further and gain additional insights.

- 9,424 Shares in Shopify Inc. $SHOP Purchased by Grant Private Wealth Management Inc – This article details a recent purchase of 9,424 shares of Shopify by Grant Private Wealth Management Inc., highlighting institutional interest and potential confidence in the stock.

- 2 Things That Can Lead to a Shopify (SHOP) Stock Rally in 2026 – This piece discusses key growth drivers for Shopify, including merchant solutions growth and international expansion opportunities that could support a stock rally next year.

Shopify Inc. Analysis

I encourage you to read the comprehensive analysis of Shopify Inc. to enhance your investment decisions: Shopify Inc. Analysis