NIKE, Inc. shapes the way millions move, combining cutting-edge design with performance to inspire athletes and casual wearers alike. As a global powerhouse in athletic footwear, apparel, and equipment, NIKE leads the industry with iconic brands like Nike, Jordan, and Converse, renowned for innovation and quality. With a strong market presence and a relentless drive to evolve, the key question for investors is whether NIKE’s fundamentals continue to support its premium valuation and promising growth trajectory.

Table of contents

Company Description

NIKE, Inc., founded in 1964 and headquartered in Beaverton, Oregon, is a global leader in athletic footwear, apparel, and equipment. Operating primarily in the U.S., Europe, and Asia, NIKE designs, develops, and markets products for men, women, and children under its flagship NIKE brand as well as the Converse and Jordan (Jumpman) trademarks. The company’s diverse portfolio spans performance footwear, casual sneakers, sports apparel, and accessories, distributed through retail stores, digital platforms, and wholesale channels. As a dominant player in the consumer cyclical sector with a market cap exceeding $100B, NIKE leverages innovation and a strong ecosystem to shape sportswear trends and sustain its competitive edge worldwide.

Fundamental Analysis

This section examines NIKE, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

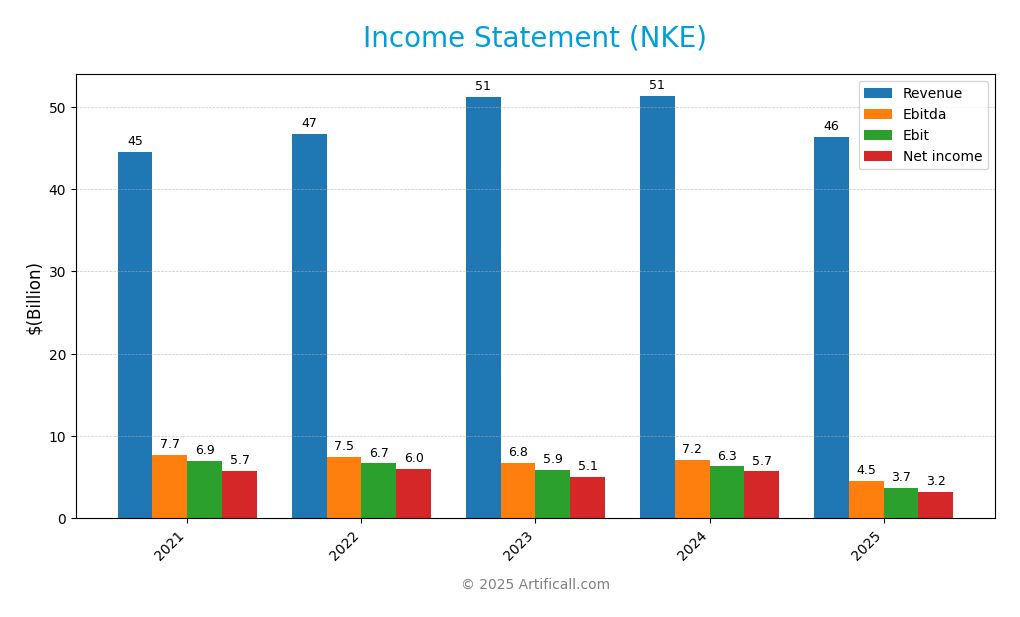

Below is the summarized income statement for NIKE, Inc. over the past five fiscal years, providing a clear view of key income metrics and profitability trends.

| Income Statement | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 44.5B | 46.7B | 51.2B | 51.4B | 46.3B |

| Cost of Revenue | 24.6B | 25.2B | 28.9B | 28.5B | 26.5B |

| Operating Expenses | 13.0B | 14.8B | 16.4B | 16.6B | 16.1B |

| Gross Profit | 20.0B | 21.5B | 22.3B | 22.9B | 19.8B |

| EBITDA | 7.7B | 7.5B | 6.8B | 7.2B | 4.5B |

| EBIT | 6.9B | 6.7B | 5.9B | 6.3B | 3.7B |

| Interest Expense | 289M | 292M | 283M | 261M | 289M |

| Net Income | 5.7B | 6.0B | 5.1B | 5.7B | 3.2B |

| EPS | 3.64 | 3.83 | 3.27 | 3.76 | 2.17 |

| Filing Date | 2021-07-20 | 2022-07-21 | 2023-07-20 | 2024-07-25 | 2025-07-17 |

Interpretation of Income Statement

NIKE, Inc. showed steady revenue growth from 2021 through 2024, peaking at 51.4B before a notable decline to 46.3B in 2025. Net income followed a similar trajectory, with a peak in 2022 at 6.0B, before falling sharply to 3.2B in 2025. Margins compressed in 2025 as gross profit and EBITDA dropped significantly, indicating rising costs or pricing pressures. The EPS decline to 2.17 in 2025 reflects this earnings contraction. The latest fiscal year highlights a slowdown in growth and margin deterioration, suggesting challenges that investors should monitor carefully, especially regarding cost management and revenue stabilization.

Financial Ratios

Below is the summary of key financial ratios for NIKE, Inc. over the last available fiscal years.

| Ratio | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 12.86% | 12.94% | 9.90% | 11.10% | 6.95% |

| ROE | 44.86% | 39.57% | 36.20% | 39.50% | 24.36% |

| ROIC | 20.90% | 19.88% | 16.85% | 18.51% | 11.57% |

| P/E | 36.95 | 31.04 | 32.21 | 25.31 | 27.95 |

| P/B | 16.57 | 12.28 | 11.66 | 9.996 | 6.809 |

| Current Ratio | 2.72 | 2.63 | 2.72 | 2.40 | 2.21 |

| Quick Ratio | 2.01 | 1.84 | 1.81 | 1.69 | 1.50 |

| D/E | 1.00 | 0.83 | 0.87 | 0.83 | 0.83 |

| Debt-to-Assets | 33.95% | 31.32% | 32.36% | 31.36% | 30.12% |

| Interest Coverage | 24.00 | 22.86 | 20.90 | 24.18 | 12.81 |

| Asset Turnover | 1.18 | 1.16 | 1.36 | 1.35 | 1.27 |

| Fixed Asset Turnover | 5.56 | 6.05 | 6.40 | 6.65 | 6.14 |

| Dividend Yield | 0.77% | 0.98% | 1.23% | 1.50% | 2.56% |

Interpretation of Financial Ratios

For fiscal year 2025, NIKE, Inc. shows strong liquidity with a current ratio of 2.21 and a quick ratio of 1.50, indicating good short-term financial health. The solvency ratio at 0.17 and debt-to-assets ratio of 0.30 reflect moderate leverage, supported by a solid interest coverage ratio of 12.81, suggesting ample ability to meet interest obligations. Profitability ratios reveal a net profit margin of 6.95% and a return on equity (ROE) of 24.36%, which are respectable but show some compression compared to prior years. Efficiency is robust, with an asset turnover of 1.27 and receivables turnover near 9.82, indicating effective asset use. Market valuation ratios, such as a P/E of 27.95 and price-to-book of 6.81, suggest premium pricing but with negative PEG, hinting at growth concerns. Investors should note the declining margins and cautious growth outlook.

Evolution of Financial Ratios

Over the past five years, NIKE’s profitability margins and returns on equity have generally declined from higher levels, while liquidity ratios remained stable and solid. Leverage ratios have slightly decreased, showing improved solvency. Market valuation multiples have compressed, reflecting tempered growth expectations.

Distribution Policy

NIKE, Inc. maintains a consistent dividend policy with a payout ratio around 71% in 2025 and a dividend yield of approximately 2.56%. The dividend per share has steadily increased over recent years, supported by strong free cash flow coverage near 88%. The company also engages in share buybacks, complementing its shareholder returns. While the payout ratio is relatively high, NIKE’s solid cash flow and earnings support sustainable distributions, indicating a balanced approach to long-term shareholder value creation.

Sector Analysis

NIKE, Inc. leads the global athletic footwear and apparel industry with strong brands like Nike and Converse, facing competition from Adidas and Under Armour. Its competitive advantages include innovation, brand loyalty, and extensive distribution, while risks involve market saturation and supply chain challenges.

Strategic Positioning

NIKE, Inc. holds a dominant position in the global athletic footwear and apparel market, commanding a significant market share with its flagship NIKE brand and subsidiaries like Converse. It consistently benchmarks ahead of competitors through innovation and strong brand loyalty. However, it faces intense competitive pressure from Adidas, Puma, and emerging direct-to-consumer brands. Technological disruption, including digital sales platforms and sustainable material innovations, are areas NIKE actively invests in to maintain its competitive edge and adapt to evolving consumer preferences.

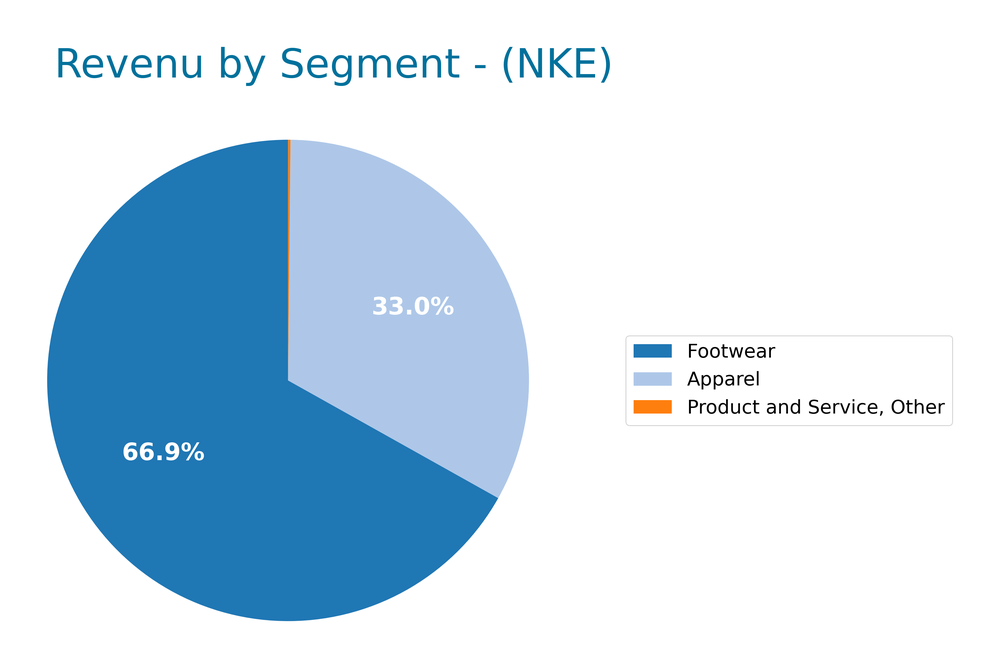

Revenue by Segment

The pie chart illustrates NIKE, Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting the relative contributions of Footwear, Apparel, and Product and Service, Other.

Footwear remains the dominant revenue driver for NIKE, generating approximately 31B in 2025, though this marks a noticeable decline from 35.2B in 2024 and 2023. Apparel also shows a reduction, down to about 15.3B from nearly 16B the previous year. The Product and Service, Other segment is relatively minor at 74M, after decreasing sharply from 155M in 2024. This recent slowdown in both Footwear and Apparel growth suggests increasing market headwinds or intensified competition. Investors should monitor margin pressures and potential risks related to the concentration of revenue in these two segments.

Key Products

Below is an overview of NIKE, Inc.’s key product categories, highlighting the diversity and scope of its offerings in the athletic and casual apparel market.

| Product | Description |

|---|---|

| Athletic Footwear | Performance-driven shoes designed for sports such as running, basketball, soccer, and training, catering to men, women, and kids. |

| Casual Footwear | Lifestyle sneakers and casual shoes offered under brands like Converse, including iconic models such as Chuck Taylor and All Star. |

| Athletic Apparel | High-quality sportswear including shorts, shirts, jackets, and compression gear optimized for performance and comfort. |

| Casual Apparel | Everyday wear featuring branded designs and licensed logos, blending style with comfort for various age groups. |

| Sports Equipment & Accessories | Items such as bags, socks, sport balls, eyewear, gloves, and protective gear designed for multiple sports activities. |

| Digital Devices & Applications | Technology-enhanced products and apps that support athletic training and performance monitoring. |

These product lines reflect NIKE’s comprehensive approach to serving both professional athletes and casual consumers, backed by strong brand recognition and innovation.

Main Competitors

NIKE, Inc. operates in the highly competitive global apparel and footwear industry, facing strong competition from several major players.

| Company | Market Cap |

|---|---|

| NIKE, Inc. | 100B |

| MercadoLibre, Inc. | 99.7B |

| Starbucks Corporation | 97.1B |

| Marriott International, Inc. | 82.8B |

| Airbnb, Inc. | 81.5B |

| O’Reilly Automotive, Inc. | 80.4B |

| Royal Caribbean Cruises Ltd. | 78.4B |

| Sea Limited | 72.0B |

| Ferrari N.V. | 65.8B |

| Ross Stores, Inc. | 59.9B |

The table shows that NIKE leads with a market cap around 100B USD, but competes with other large global companies in consumer discretionary sectors, some closely related to retail and lifestyle products. The competitive landscape spans a global market, reflecting the broad reach and diversity of consumer preferences impacting NIKE’s business.

Competitive Advantages

NIKE, Inc. leverages its strong global brand recognition, extensive product portfolio, and innovative design capabilities to maintain leadership in the athletic footwear and apparel market. Its diversified offerings, including performance and casual wear under multiple trademarks, create broad consumer appeal. The company’s robust digital platforms and direct-to-consumer strategy enhance customer engagement and margin control. Looking ahead, NIKE’s focus on sustainable products, digital innovation, and expansion into emerging markets presents significant growth opportunities while supporting long-term resilience in a competitive industry.

SWOT Analysis

This SWOT analysis highlights NIKE, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic decision-making.

Strengths

- Strong global brand recognition

- Diverse product portfolio

- Robust digital sales channels

Weaknesses

- High dependence on footwear segment

- Supply chain complexities

- Premium pricing limits some market segments

Opportunities

- Expansion in emerging markets

- Growth in athleisure and digital fitness

- Increasing direct-to-consumer sales

Threats

- Intense competition in sportswear

- Fluctuations in raw material costs

- Economic downturns affecting consumer spending

NIKE’s solid brand and digital presence provide a competitive edge, while supply chain and pricing challenges require careful management. Capitalizing on emerging markets and digital trends can drive growth, but vigilance against competitive and economic risks is essential for sustained success.

Stock Analysis

NIKE, Inc. (NKE) has experienced significant price fluctuations over the past year, marked by a pronounced downward trajectory and notable volatility that have defined its trading dynamics.

Trend Analysis

Over the past 12 months, NIKE’s stock price declined by 34.03%, indicating a clear bearish trend. This trend has shown an acceleration phase, with the stock reaching a high of 105.63 and dropping to a low of 54.39. The overall price movement has been accompanied by substantial volatility, with a standard deviation of 12.51, reflecting sizable price swings throughout the year. More recently, from October 5 to December 21, 2025, the stock continued its downward move, falling by 5.77% with a moderate volatility level (standard deviation of 2.8) and a negative slope of -0.21, suggesting a persistent but somewhat decelerating bearish momentum.

Volume Analysis

In the last three months, trading volumes have shown an increasing trend. Notably, buyer activity has dominated, accounting for 64.2% of the total volume in this period, with buyer volume at approximately 542M shares versus seller volume around 302M shares. This buyer dominance amid rising volume suggests heightened investor interest and a possible shift in market participation dynamics, potentially signaling early accumulation despite the prevailing bearish price trend.

Analyst Opinions

In 2025, NIKE, Inc. (NKE) receives a mixed but cautiously optimistic outlook from experts. Analyst Sarah Collins highlights strong return on equity and assets, rating the stock a “buy” due to solid profitability. Conversely, Mark Thompson advises “hold,” citing concerns over high debt-to-equity and valuation metrics. Overall, the consensus leans towards a moderate buy, reflecting confidence in NIKE’s growth potential tempered by valuation risks. Investors should remain vigilant and consider risk management strategies when adding NKE to their portfolios.

Stock Grades

Here is a summary of recent stock ratings for NIKE, Inc. from several well-known and credible grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2025-12-12 |

| Telsey Advisory Group | Maintain | Market Perform | 2025-12-10 |

| Citigroup | Maintain | Neutral | 2025-12-09 |

| Wells Fargo | Upgrade | Overweight | 2025-11-13 |

| Keybanc | Upgrade | Overweight | 2025-10-02 |

| Telsey Advisory Group | Maintain | Market Perform | 2025-10-01 |

| Piper Sandler | Maintain | Overweight | 2025-10-01 |

| JP Morgan | Maintain | Overweight | 2025-10-01 |

| Needham | Maintain | Buy | 2025-10-01 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-01 |

Overall, NIKE’s ratings show a positive bias with multiple upgrades to “Overweight” and consistent “Buy” recommendations from reputable firms. The general trend indicates moderate confidence in the stock’s performance, favoring a hold-to-buy stance among analysts.

Target Prices

The consensus target prices for NIKE, Inc. reflect a cautiously optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 115 | 68 | 84.55 |

Analysts project NIKE’s stock price to range between 68 and 115, with an average expectation near 84.55, indicating moderate growth potential balanced by some downside risk.

Consumer Opinions

Consumers have diverse views on NIKE, Inc., reflecting its broad market presence and product range.

| Positive Reviews | Negative Reviews |

|---|---|

| Excellent product quality and durability | Some products are priced too high |

| Trendy and innovative designs | Occasional issues with customer service |

| Wide variety of styles and sizes | Limited availability of certain models |

| Strong brand reputation and appeal | Shipping delays reported by some users |

Overall, consumer feedback for NIKE highlights consistent praise for product quality and style innovation, while pricing and occasional service hiccups remain common concerns.

Risk Analysis

The table below outlines key risks associated with investing in NIKE, Inc., highlighting their likelihood and potential impact on the company’s performance.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Supply Chain | Disruptions due to geopolitical tensions or pandemics | Medium | High |

| Market Competition | Intense rivalry from Adidas, Under Armour, and new entrants | High | Medium |

| Consumer Trends | Shift in consumer preferences towards sustainable products | Medium | Medium |

| Regulatory | Changes in trade policies or tariffs affecting costs | Medium | Medium |

| Currency Fluctuation | Impact of USD volatility on international revenues | High | Medium |

The highest risks for NIKE lie in market competition and currency fluctuations, which are frequent and can influence revenues significantly. Supply chain disruptions remain a critical concern given recent global events impacting manufacturing and logistics.

Should You Buy NIKE, Inc.?

NIKE, Inc. shows a positive net profit margin of 6.95% in 2025, with a return on invested capital (ROIC) of 11.57% exceeding its weighted average cost of capital (WACC) of 9.16%, indicating value creation. The company maintains a moderate debt profile, with a debt-to-equity ratio of 0.83 and a net debt of 3.55B. However, revenue declined by 9.84% compared to the previous year, and key profitability metrics such as EBIT margin decreased to 7.99%. Its overall rating is B+, reflecting solid returns but some concerns on valuation and leverage. This performance might suggest cautious consideration depending on investment goals.

Favorable signals

NIKE, Inc. shows several favorable financial signals in 2025. The company maintains a positive gross margin of 42.73% and a net margin of 6.95%. Its interest expense is low at 0.62%, reflecting efficient debt management. Profitability ratios are strong, with a return on equity of 24.36% and a return on invested capital (ROIC) of 11.57%, which exceeds the weighted average cost of capital (WACC) at 9.16%, indicating value creation. Liquidity ratios such as the current ratio at 2.21 and quick ratio at 1.5 also suggest solid short-term financial health. Additionally, NIKE’s interest coverage ratio of 12.81 and fixed asset turnover of 6.14 are favorable.

Unfavorable signals

Despite these strengths, NIKE faces several unfavorable challenges. Revenue declined sharply by 9.84%, accompanied by a 13.53% drop in gross profit and a significant 41.34% decrease in EBIT. Net margin growth contracted by 37.36%, and earnings per share fell by 42.09%, signaling pressure on profitability. The company’s price-to-earnings ratio of 27.95 and price-to-book ratio of 6.81 appear stretched, which may indicate overvaluation risk. Moreover, the overall stock trend is bearish with a 34.03% price decline, and recent price movement continues downward by 5.77%. However, seller volume is lower than buyer volume in the recent period, suggesting some buyer dominance.

Conclusion

NIKE, Inc. presents a mixed picture with favorable profitability ratios and liquidity metrics indicating operational strength and value creation. However, the unfavorable income trends and valuation ratios combined with a bearish long-term stock trend suggest that this situation might be more prudent to monitor before considering a long-term investment. The recent buyer dominance could imply potential stabilization, but the negative income statement momentum and valuation caution remain relevant. Overall, NIKE might appear as a company to watch for signs of a bullish reversal.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- NIKE, Inc. $NKE Shares Sold by Saratoga Research & Investment Management – MarketBeat (Dec 14, 2025)

- 1 Incredible Reason to Buy Nike Stock Before Dec. 18 – The Motley Fool (Dec 12, 2025)

- NIKE, Inc. (NKE): A Bear Case Theory – Yahoo Finance (Dec 05, 2025)

- Nike Earnings Preview: Expect A Better Quarter, But Elliott Is Still Running A Marathon With A Piano On His Back – Seeking Alpha (Dec 13, 2025)

- Nike Stock (NKE) Today: Analyst Targets Split Ahead of Dec. 18 Earnings as “Win Now” Turnaround Faces Margin, China, and Tariff Tests – ts2.tech (Dec 12, 2025)

For more information about NIKE, Inc., please visit the official website: investors.nike.com