Tesla, Inc. stands at a crossroads, grappling with a troubling decline in sales amid a fiercely competitive electric vehicle landscape. As the market evolves, the question looms: can Tesla reverse this trend while simultaneously investing in groundbreaking technologies? Understanding this dynamic will be crucial for investors navigating the future of the automotive industry.

Table of contents

Key Points

- Investors show strong optimism about Tesla’s driverless technology advancements.

- Tesla implements incentives to boost sales amid declining performance.

- The company is pivoting towards AI and robotics for future growth.

Can Tesla Reverse Its Declining Sales Trend?

Tesla, Inc. operates in the electric vehicle industry, with its main business segments including electric cars, energy storage, and solar products, primarily focusing on markets in North America, Europe, and Asia. Recently, Tesla has faced a challenging year, marked by its first-ever year-over-year sales decline in 2024 and ongoing pressure to boost sales through various incentives. The company has also pivoted towards artificial intelligence and robotics, underlining its commitment to future technologies. Broader sector challenges, including competition in China and changes in U.S. tax credits, have compounded these issues, leading to mixed market sentiment and divided analyst expectations regarding Tesla’s valuation and growth potential.

Market Reaction

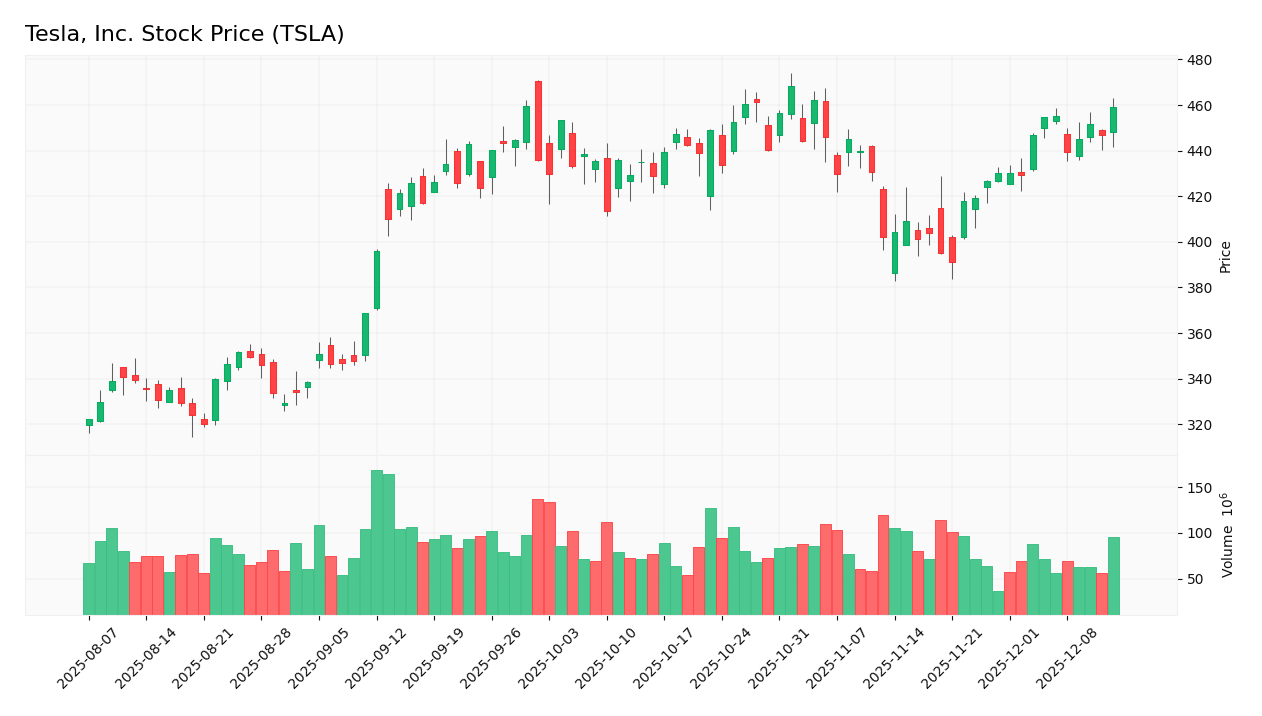

The stock price of Tesla, Inc. (TSLA) reacted positively to the news, increasing by 2.71% in one day.

Target Prices

The consensus among analysts indicates a clear outlook for Tesla, Inc. (TSLA). Analysts generally expect a target price range that reflects both optimism and caution regarding the company’s ability to navigate its declining sales trend while investing in future technologies.

| Target High | Target Low | Consensus |

|---|---|---|

| 600 | 247 | 433.31 |

Impacts on the Income Statement

Tesla, Inc. (TSLA) is experiencing a challenging fiscal period, with declining revenue and profit metrics signaling potential issues for investors.

The current news surrounding Tesla’s ability to reverse its declining sales while investing in future technologies could further pressure its income, potentially affecting revenues and margins negatively.

With revenue growth at 0.95% and gross profit growth declining by 1.19%, investors should be cautious as the overall income statement evaluation remains unfavorable, reflecting a concerning trend for TSLA.

Stock Grades

As we assess Tesla, Inc. (TSLA), it’s crucial to understand the latest stock ratings from recognized grading companies, especially given the company’s current challenge of reversing its declining sales trend while investing in future technologies.

Here are the five most recent grades for TSLA:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | maintain | Overweight | 2025-12-09 |

| Morgan Stanley | downgrade | Equal Weight | 2025-12-08 |

| Mizuho | maintain | Outperform | 2025-11-25 |

| Stifel | maintain | Buy | 2025-11-17 |

| Wedbush | maintain | Outperform | 2025-11-07 |

These ratings reflect a mix of maintenance and some adjustments, indicating a cautious yet optimistic outlook among analysts.

Summary

Tesla, Inc. (TSLA) is currently facing the dual challenge of reversing a declining sales trend while simultaneously investing in future technologies to maintain its competitive edge in the electric vehicle market. As of now, TSLA is trading at $459.02, with a market cap of approximately $1.48T, and the stock has shown a positive change of 2.71%. However, the company reported a significant sales decline of 35% from September to October 2024, largely influenced by competitive pressures in China and reduced incentives in the U.S.

To combat this downturn, Tesla has introduced a series of incentives, including 0% APR financing on select Model Y vehicles and enhanced trade-in offers. Simultaneously, CEO Elon Musk is pivoting the company’s focus toward automation and AI technologies, including the Cybercab and the Tesla Optimus robot. This strategic combination of immediate sales initiatives and long-term technological investments aims to stabilize the company while preparing it for future growth.

In conclusion, Tesla’s ability to navigate its current sales challenges while investing in innovative technologies will be crucial for its future success. Investors should closely monitor the effectiveness of these initiatives, as they will significantly impact TSLA’s market position and growth trajectory.

Sources

I wrote this article using information from the following sources. I encourage you to consult these sources to delve deeper into the subject.

1. Should Investors Buy Tesla Stock Before 2026? – An article by The Motley Fool discussing the polarizing nature of Tesla (TSLA +2.57%) as an investment opportunity. (Published: 2025-12-13)

2. Tesla is offering a barrage of deals as it races to avoid another annual sales decline – A report from Business Insider detailing Tesla’s introduction of various incentives to boost EV sales before year-end, including free paint jobs and financing deals. (Published: 2025-12-13)

I also published a complete review of Tesla: Tesla’s 2025 Outlook: Navigating Risks and Opportunities Ahead