Imagine a world where the latest medical innovations are just a prescription away, transforming lives and extending healthspan. Johnson & Johnson epitomizes this vision, standing tall as a powerhouse in the healthcare sector with its cutting-edge pharmaceuticals and advanced medical devices. Renowned for its unwavering commitment to quality and innovation, the company is now strategically focused on high-growth segments following its separation from consumer health. As we delve into the investment potential of JNJ, we must ask: do its fundamentals continue to support its current market valuation and future growth prospects?

Table of contents

Company Description

Johnson & Johnson (NYSE: JNJ), founded in 1886 and headquartered in New Brunswick, NJ, is a global leader in the healthcare sector, primarily in the Drug Manufacturers – General industry. The company specializes in researching, developing, and manufacturing innovative pharmaceuticals and medical devices, having strategically spun off its Consumer Health business into Kenvue Inc. in 2023. Currently, its core operations are divided between Innovative Medicines, which addresses complex diseases, and MedTech, offering advanced surgical and orthopedic solutions, including the renowned ACUVUE contact lenses. With a market cap of $487B and a commitment to advancing human health, Johnson & Johnson continues to shape the industry through its focus on innovation and comprehensive healthcare solutions.

Fundamental Analysis

In this section, I will examine Johnson & Johnson’s income statement, financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

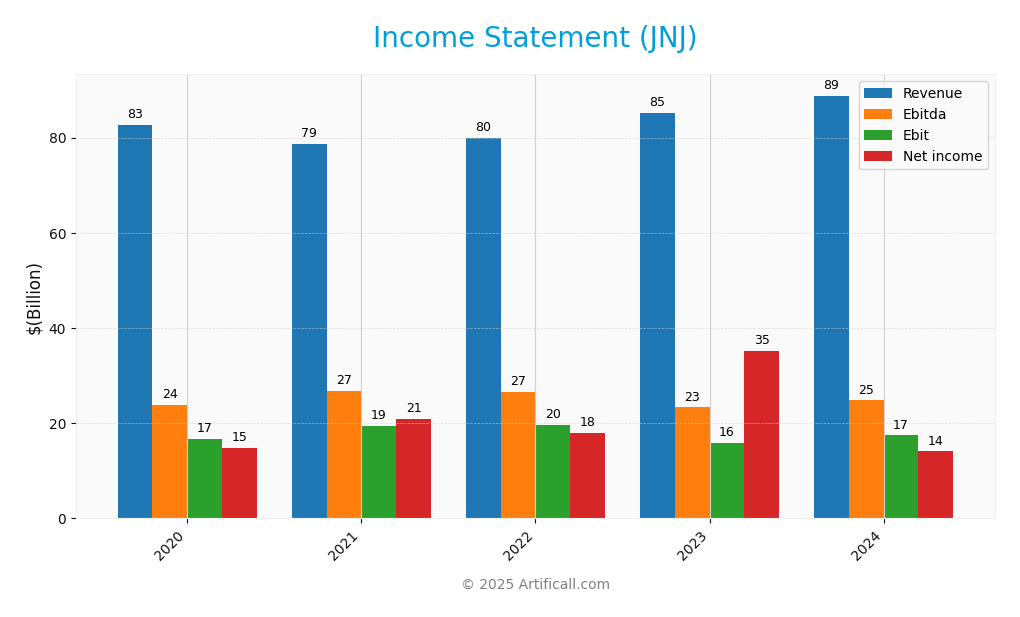

The following table summarizes the income statement for Johnson & Johnson over the last five fiscal years, providing insights into its financial performance trends.

| Income Statement Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 82.58B | 78.74B | 79.99B | 85.16B | 88.82B |

| Cost of Revenue | 28.43B | 23.40B | 24.60B | 26.55B | 27.47B |

| Operating Expenses | 34.42B | 34.40B | 34.38B | 35.20B | 39.20B |

| Gross Profit | 54.16B | 55.34B | 55.39B | 58.61B | 61.35B |

| EBITDA | 23.93B | 26.75B | 26.61B | 23.32B | 24.78B |

| EBIT | 16.70B | 19.36B | 19.64B | 15.83B | 17.44B |

| Interest Expense | 0.20B | 0.18B | 0.28B | 0.77B | 0.76B |

| Net Income | 14.71B | 20.88B | 17.94B | 35.15B | 14.07B |

| EPS | 5.59 | 7.93 | 6.83 | 13.88 | 5.84 |

| Filing Date | N/A | 2022-02-17 | 2023-02-16 | 2024-02-16 | 2025-02-13 |

Interpretation of Income Statement

Over the past five years, Johnson & Johnson has shown a consistent upward trend in revenue, increasing from 82.58B in 2020 to 88.82B in 2024. However, net income has fluctuated significantly, peaking at 35.15B in 2023, before dropping to 14.07B in 2024. This decline can be attributed to rising operating expenses and a decrease in operating income, which indicates that cost management will be crucial moving forward. The EBITDA margin has remained relatively stable, but the recent year’s performance suggests that investors should closely monitor future cost control strategies and revenue growth initiatives.

Financial Ratios

The following table presents the financial ratios for Johnson & Johnson (Ticker: JNJ) over the last few fiscal years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 17.82% | 26.52% | 22.43% | 41.28% | 15.84% |

| ROE | 23.25% | 28.20% | 23.36% | 51.11% | 19.68% |

| ROIC | 13.03% | 13.83% | 12.31% | 16.61% | 13.75% |

| P/E | 28.16 | 21.54 | 25.73 | 11.30 | 24.53 |

| P/B | 6.55 | 6.08 | 6.01 | 5.77 | 4.83 |

| Current Ratio | 1.21 | 1.35 | 0.99 | 1.16 | 1.11 |

| Quick Ratio | 0.99 | 1.12 | 0.81 | 0.91 | 0.86 |

| D/E | 0.56 | 0.46 | 0.52 | 0.43 | – |

| Debt-to-Assets | 20.16% | 18.54% | 21.16% | 17.51% | 21.01% |

| Interest Coverage | 98.17 | 114.44 | 76.13 | 30.32 | 29.34 |

| Asset Turnover | 0.47 | 0.43 | 0.43 | 0.51 | – |

| Fixed Asset Turnover | 4.40 | 4.15 | 4.45 | 4.28 | – |

| Dividend Yield | 2.53% | 2.45% | 2.53% | 2.96% | 3.43% |

Interpretation of Financial Ratios

In analyzing Johnson & Johnson’s financial health for 2024, key ratios provide valuable insights. The liquidity ratios show a current ratio of 1.11 and a quick ratio of 0.86, indicating a moderate ability to cover short-term liabilities, though the quick ratio suggests some concern regarding immediate liquidity. The solvency ratio at 0.197 points to a relatively stable debt position, but the debt-to-equity ratio of 0.53 raises caution regarding leverage. Profitability ratios are robust, with a net profit margin of 15.84% and an operating margin of 24.94%, reflecting operational efficiency. However, the high price-to-earnings ratio at 24.53 may indicate overvaluation. Overall, while the company exhibits strong profitability, its liquidity and leverage warrant careful consideration.

Evolution of Financial Ratios

Over the past five years, Johnson & Johnson has shown mixed trends in its financial ratios. Profitability ratios have generally improved, with net profit margins rising significantly, while liquidity ratios have fluctuated, reflecting challenges in maintaining strong short-term financial health.

Distribution Policy

Johnson & Johnson (JNJ) maintains a robust dividend policy, with a current dividend yield of approximately 3.43%. The dividend payout ratio stands at 84.05%, indicating a commitment to returning value to shareholders, albeit with caution regarding sustainability. The dividend per share has shown a consistent upward trend, supported by healthy free cash flow coverage. Additionally, JNJ engages in share buyback programs, which can enhance shareholder value. Overall, this distribution strategy appears to support long-term value creation, though investors should monitor potential risks associated with high payout ratios.

Sector Analysis

Johnson & Johnson operates in the Drug Manufacturers – General industry, focusing on Innovative Medicine and MedTech segments. Key competitors include Pfizer and Merck, while its competitive advantages lie in its extensive product portfolio and strong brand recognition.

Strategic Positioning

Johnson & Johnson (JNJ) holds a strong position in the healthcare market, with a market capitalization of approximately $486.5B. The company has strategically focused on its Innovative Medicine and MedTech segments following the spin-off of its Consumer Health business into Kenvue Inc. in 2023. This shift allows JNJ to concentrate on high-growth areas, such as advanced medical technologies and complex disease treatments. However, competitive pressure remains significant, with numerous pharmaceutical and medical device companies vying for market share. Additionally, ongoing technological disruption poses both challenges and opportunities, as JNJ continues to innovate within its core segments.

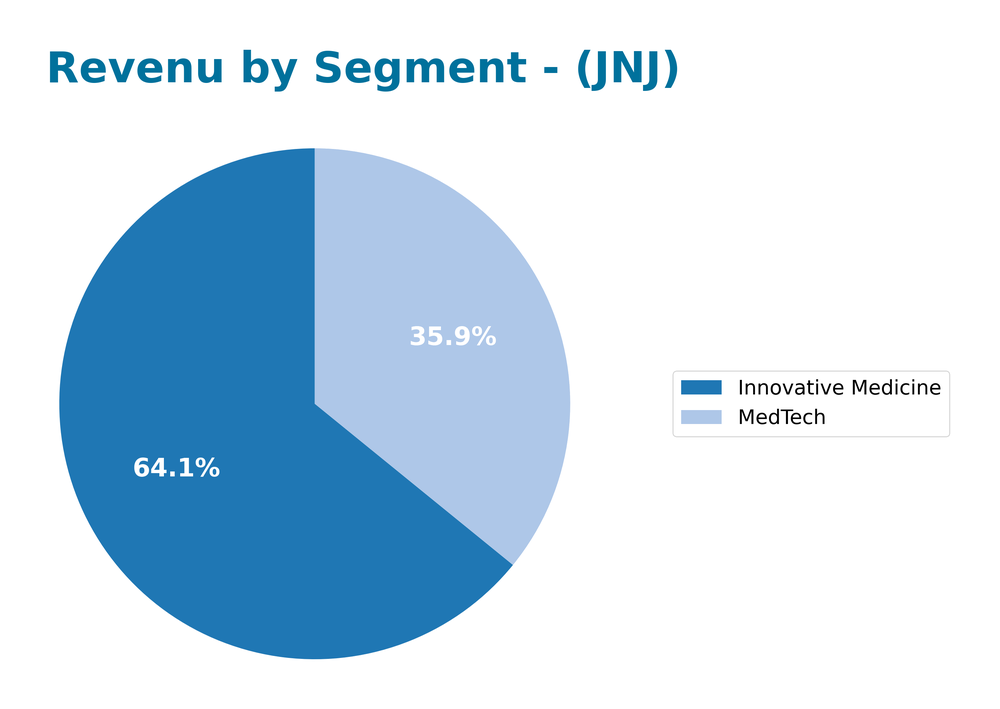

Revenue by Segment

The chart illustrates Johnson & Johnson’s revenue distribution across its segments for the fiscal year 2024, showcasing the performance of each segment.

In 2024, Johnson & Johnson’s revenue from Innovative Medicine reached 57B, while MedTech generated 32B. This marks a continued upward trend for Innovative Medicine, which has seen consistent growth from 52.6B in 2022 to 57B in 2024. MedTech also displayed positive momentum, increasing from 27.4B in 2022 to 32B in 2024. Notably, the growth rate for Innovative Medicine appears to be stabilizing, suggesting potential margin risks if competitive pressures increase. Overall, both segments are critical to the company’s success, but careful monitoring of market dynamics is essential moving forward.

Key Products

Johnson & Johnson has a diverse portfolio of products that cater to various segments of the healthcare industry. Below is a table summarizing some of their key products.

| Product | Description |

|---|---|

| TYLENOL | A widely used over-the-counter pain reliever and fever reducer, effective for mild to moderate pain. |

| ACUVUE | A leading brand of disposable contact lenses known for comfort and clarity, catering to various vision needs. |

| Ethicon Sutures | Surgical sutures and devices that provide advanced solutions for wound closure in surgical procedures. |

| XARELTO | An anticoagulant medication used to reduce the risk of blood clots in patients with certain medical conditions. |

| SIMPONI | A biologic medication used to treat autoimmune diseases such as rheumatoid arthritis and inflammatory bowel disease. |

| Cerenovus | A portfolio of medical devices focused on neurovascular care, including solutions for treating strokes. |

| Biosense Webster | Advanced electrophysiology products used for the diagnosis and treatment of heart rhythm disorders. |

| DePuy Synthes | Offers a range of orthopedic products, including joint replacement and trauma solutions for musculoskeletal health. |

These products illustrate Johnson & Johnson’s commitment to innovation and its focus on advancing human health across various healthcare segments.

Main Competitors

The competitive landscape for Johnson & Johnson (JNJ) includes several major players in the healthcare sector, particularly within the drug manufacturing industry. Below is a table of the main competitors, sorted by market capitalization:

| Company | Market Cap |

|---|---|

| Johnson & Johnson (JNJ) | 487B |

| AbbVie Inc. (ABBV) | 400B |

| UnitedHealth Group Incorporated (UNH) | 300B |

| AstraZeneca PLC (AZN) | 280B |

| Novartis AG (NVS) | 259B |

| Merck & Co., Inc. (MRK) | 251B |

| Novo Nordisk A/S (NVO) | 213B |

| Amgen Inc. (AMGN) | 178B |

| Gilead Sciences, Inc. (GILD) | 150B |

| Pfizer Inc. (PFE) | 148B |

| Sanofi (SNY) | 121B |

The main competitors of Johnson & Johnson are primarily focused on pharmaceuticals and healthcare solutions, operating in a global market. Each of these companies plays a significant role in advancing medical technology and treatment options, making the competitive landscape dynamic and challenging.

Competitive Advantages

Johnson & Johnson (JNJ) holds significant competitive advantages due to its diverse portfolio and strong brand recognition in the healthcare sector. The company’s strategic separation of its Consumer Health business into Kenvue Inc. allows JNJ to concentrate on its high-growth segments: Innovative Medicine and MedTech. Future opportunities include advancements in biologics and digital health solutions, which are expected to drive growth. With a robust R&D pipeline and a commitment to innovation, JNJ is well-positioned to capitalize on emerging markets and address complex health challenges, reinforcing its long-term stability and market leadership.

SWOT Analysis

This SWOT analysis aims to evaluate the internal and external factors affecting Johnson & Johnson (JNJ) to inform potential investment decisions.

Strengths

- Strong market position

- Diverse product portfolio

- Robust R&D capabilities

Weaknesses

- Recent separation of Consumer Health segment

- Exposure to litigation risks

- Dependency on healthcare regulations

Opportunities

- Growth in innovative medicine sector

- Expansion in emerging markets

- Increasing demand for medical devices

Threats

- Intense competition

- Regulatory pressures

- Economic downturn risks

Overall, this SWOT assessment indicates that while Johnson & Johnson has significant strengths and opportunities, it must navigate its weaknesses and external threats carefully. A strategic focus on innovation and market expansion can enhance its competitive edge in the healthcare industry, but risk management will be crucial in sustaining growth and profitability.

Stock Analysis

In the past year, Johnson & Johnson (JNJ) has experienced a significant upward movement in its stock price, showcasing robust trading dynamics that reflect investor confidence and market sentiment.

Trend Analysis

Over the past year, JNJ’s stock has increased by approximately 24.35%. This strong performance indicates a bullish trend, with the stock exhibiting acceleration in its price trajectory. The highest price recorded during this period was 206.92, while the lowest was 142.06. Notably, the standard deviation of 14.1 suggests a moderate level of volatility, which may indicate fluctuations in investor sentiment.

Volume Analysis

Analyzing the trading volumes over the last three months reveals a buyer-dominant market activity, with buyer volume at approximately 316.54M compared to seller volume of about 206.76M. The overall volume trend is decreasing, which may suggest a cautious market sentiment and reduced participation from investors. However, the recent data indicates a notable buyer dominance at 60.49%, reflecting a favorable outlook among participants during this timeframe.

Analyst Opinions

Recent analyst recommendations for Johnson & Johnson (JNJ) indicate a consensus rating of “buy.” Analysts praise the company’s strong fundamentals, highlighted by an “A-” rating and high scores in return on equity (5) and return on assets (5). This indicates robust profitability and efficient asset utilization. However, the lower scores in price-to-earnings (2) and price-to-book (2) suggest some caution around valuation. Notably, the analysts emphasize JNJ’s ability to maintain solid cash flows, making it a potentially stable investment for the upcoming year.

Stock Grades

Recent evaluations of Johnson & Johnson (JNJ) reveal a mix of maintained and downgraded grades from reputable firms, reflecting a cautious sentiment in the market.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Equal Weight | 2025-12-02 |

| Freedom Capital Markets | downgrade | Hold | 2025-10-22 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-15 |

| B of A Securities | maintain | Neutral | 2025-10-15 |

| Stifel | maintain | Hold | 2025-10-15 |

| Citigroup | maintain | Buy | 2025-10-15 |

| Raymond James | maintain | Outperform | 2025-10-15 |

| UBS | maintain | Buy | 2025-10-14 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-10 |

| Goldman Sachs | maintain | Buy | 2025-10-09 |

Overall, the trend indicates that while several firms maintain a positive outlook with “Buy” or “Outperform” ratings, the downgrade from Freedom Capital Markets to “Hold” suggests a cautious tone from some analysts. This mixed sentiment may reflect broader market uncertainties.

Target Prices

The consensus target prices for Johnson & Johnson (JNJ) reflect a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 227 | 190 | 202.58 |

Overall, analysts expect JNJ to perform within a range of 190 to 227, with a consensus value of approximately 202.58, indicating a cautiously optimistic sentiment.

Consumer Opinions

Consumer sentiment about Johnson & Johnson (JNJ) reveals a mix of loyalty and criticism, reflecting the complexities of their product offerings.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable products that I trust.” | “Customer service can be unresponsive.” |

| “Great quality in personal care items.” | “Some products are overpriced.” |

| “Innovative health solutions.” | “Occasional recalls raise concerns.” |

| “Wide range of effective medications.” | “Packaging issues make usage difficult.” |

Overall, consumer feedback highlights Johnson & Johnson’s strong reputation for quality and innovation, while concerns about customer service and pricing persist among some users.

Risk Analysis

Understanding the potential risks associated with investing in Johnson & Johnson (JNJ) is crucial for making informed decisions. Below is a summary of the key risks affecting the company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Regulatory Risk | Changes in healthcare regulations may affect operations and profitability. | Medium | High |

| Litigation Risk | Ongoing lawsuits related to product safety could impact reputation and finances. | High | High |

| Market Competition | Increasing competition in the pharmaceutical sector may affect market share. | High | Medium |

| Supply Chain Disruption | Global supply chain issues could delay production and delivery of products. | Medium | High |

| Currency Fluctuation | As a multinational company, JNJ is exposed to risks from currency exchange rates. | Medium | Medium |

In my analysis, litigation risk is currently the most significant, with JNJ facing multiple lawsuits that could have a substantial financial impact. Additionally, regulatory changes in the healthcare sector are likely to remain a critical focus for investors.

Should You Buy Johnson & Johnson?

Johnson & Johnson displays a robust profitability profile with a net profit margin of 15.84% and a return on invested capital (ROIC) of 13.75%, which exceeds the weighted average cost of capital (WACC) of 5.27%, indicating value creation. The company’s total debt stands at 37.83B, with a manageable debt-to-equity ratio of 0.077, reflecting a solid financial structure. Over recent years, fundamental metrics have shown improvement, contributing to a strong rating of A-. Overall, these factors may suggest that JNJ could be considered for further evaluation in a diversified investment portfolio.

Favorable signals

Johnson & Johnson demonstrates several favorable elements in its financial performance. The company has a gross margin of 69.07%, an EBIT margin of 19.64%, and a net margin of 15.84%. Additionally, it has a return on equity (ROE) of 19.68% and a return on invested capital (ROIC) of 13.75%, both of which indicate effective management of capital and resources. The weighted average cost of capital (WACC) is a favorable 5.27%, suggesting value creation. Furthermore, the company’s interest coverage ratio stands at 23.1, indicating strong capacity to meet interest obligations.

Unfavorable signals

Despite the favorable elements, there are notable unfavorable aspects. The company’s net margin growth is significantly negative at -61.64%, and its earnings per share (EPS) growth is also negative at -57.8%. Additionally, the price-to-book (PB) ratio of 4.83 is considered unfavorable, suggesting potential overvaluation. Furthermore, the asset turnover ratio is low, indicating inefficiencies in asset use.

Conclusion

In summary, while Johnson & Johnson presents several favorable signals, the negative trends in net margin growth and EPS growth may indicate challenges ahead. Given the recent seller volume surpassing buyer volume, it might be prudent to wait for a clearer return of buyers before making any investment decisions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Speaker Johnson under attack from his own as mood darkens in House GOP – CNN (Dec 05, 2025)

- Republican Anger Erupts at Johnson as Party Frets About Future – The New York Times (Dec 03, 2025)

- Will the Bears back up Ben Johnson’s shot at Packers coach Matt LaFleur? – ESPN (Dec 05, 2025)

- Arizona congresswoman says she was pepper sprayed by ICE at a taco joint – The Independent (Dec 05, 2025)

- Speaker Johnson pleads with Republicans to keep concerns private after tumultuous week – AP News (Dec 04, 2025)

For more information about Johnson & Johnson, please visit the official website: jnj.com