In the competitive landscape of industrial manufacturing, Lincoln Electric Holdings, Inc. (LECO) and ESAB Corporation (ESAB) stand out as key players in welding and cutting solutions. Both companies operate within the same sector, focusing on innovative technologies that enhance productivity and efficiency. This comparison will delve into their market strategies, financial performance, and growth potential. As an investor, you’ll want to understand which of these companies offers the most compelling investment opportunity.

Table of contents

Company Overview

Lincoln Electric Holdings, Inc. Overview

Lincoln Electric Holdings, Inc. (LECO) specializes in the design, manufacture, and sale of welding, cutting, and brazing products globally. Established in 1895, Lincoln Electric operates through three segments: Americas Welding, International Welding, and The Harris Products Group. The company provides a comprehensive array of welding products, including arc welding power sources, robotic welding packages, and specialty welding consumables. With a strong market presence in industries like automotive, construction, and heavy fabrication, Lincoln Electric is recognized for its innovative solutions that enhance efficiency and safety in welding applications. The company is headquartered in Cleveland, Ohio, and employs around 12,000 individuals.

ESAB Corporation Overview

ESAB Corporation (ESAB) is a leading manufacturer of consumable products and equipment for cutting, joining, and automated welding. Founded in 2021 and based in Wilmington, Delaware, ESAB caters to a diverse range of sectors, including general industry, construction, and renewable energy. The company’s product offerings include a variety of welding consumables and advanced fabrication technology, along with digital solutions for productivity enhancement. With approximately 8,000 employees, ESAB is focused on leveraging technology to improve operational efficiency and customer satisfaction across its extensive distribution network.

Key similarities between Lincoln Electric and ESAB include their focus on the welding and fabrication industry and a commitment to innovation and quality. However, a key difference lies in their operational scale and product diversity: Lincoln Electric has a broader product range and a longer market history, while ESAB, being a newer entrant, emphasizes digital integration in welding solutions.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Lincoln Electric Holdings, Inc. (LECO) and ESAB Corporation (ESAB), highlighting key financial metrics.

| Metric | Lincoln Electric (LECO) | ESAB Corporation (ESAB) |

|---|---|---|

| Revenue | 4.01B | 2.74B |

| EBITDA | 800.52M | 531.41M |

| EBIT | 712.28M | 464.81M |

| Net Income | 466.11M | 264.84M |

| EPS | 8.23 | 4.36 |

Interpretation of Income Statement

In the most recent fiscal year, Lincoln Electric reported a slight decline in revenue, down from 4.19B to 4.01B, while ESAB experienced a small decrease from 2.77B to 2.74B. Both companies maintained stable EBITDA margins, indicating strong operational efficiency. However, Lincoln Electric’s net income also decreased from 545.25M to 466.11M, reflecting a potential slowdown in growth. In contrast, ESAB’s net income showed resilience, only dipping slightly. Overall, while both firms faced revenue challenges, they demonstrated solid management of expenses, which is a positive sign for investors focused on risk management.

Financial Ratios Comparison

The following table compares the most recent financial ratios for Lincoln Electric Holdings, Inc. (LECO) and ESAB Corporation (ESAB).

| Metric | LECO | ESAB |

|---|---|---|

| ROE | 35.11% | 14.97% |

| ROIC | 18.06% | 10.30% |

| P/E | 22.78 | 27.37 |

| P/B | 8.00 | 4.10 |

| Current Ratio | 1.87 | 1.82 |

| Quick Ratio | 1.25 | 1.18 |

| D/E | 0.99 | 0.66 |

| Debt-to-Assets | 0.37 | 0.29 |

| Interest Coverage | 14.88 | 6.90 |

| Asset Turnover | 1.14 | 0.68 |

| Fixed Asset Turnover | 6.47 | 7.06 |

| Payout Ratio | 34.79% | 6.42% |

| Dividend Yield | 1.53% | 0.23% |

Interpretation of Financial Ratios

Lincoln Electric (LECO) demonstrates a stronger return on equity (ROE) and return on invested capital (ROIC) compared to ESAB, suggesting better profitability and efficiency in capital utilization. However, LECO’s higher price-to-book (P/B) ratio indicates a premium valuation, while ESAB’s lower debt-to-equity (D/E) ratio reflects a more conservative leverage use. It’s crucial to monitor the interest coverage ratio, where LECO outperforms ESAB, indicating better capability to service debt. Overall, LECO appears stronger, but investors should consider valuation and risk profiles before making decisions.

Dividend and Shareholder Returns

Lincoln Electric Holdings, Inc. (LECO) maintains a dividend payout ratio of 34.8%, offering a dividend yield of 1.53% with a steady trend in dividend per share. This approach, coupled with share buybacks, reflects a commitment to shareholder returns while balancing free cash flow. Conversely, ESAB Corporation (ESAB) has a minimal dividend payout ratio of 6.4% and no significant dividends, focusing instead on growth and reinvestment strategies. Both companies’ strategies can support long-term shareholder value, although LECO’s dividends provide direct returns.

Strategic Positioning

Lincoln Electric Holdings, Inc. (LECO) commands a significant market share in the welding and cutting industry, thanks to its extensive product range and established customer base. With a market cap of $13.14B, LECO faces competitive pressure from ESAB Corporation (ESAB), which has a market cap of $6.80B. Both companies leverage technological advancements to enhance product efficiency, but Lincoln’s long-standing reputation provides it with a competitive edge in market stability amidst potential disruptions.

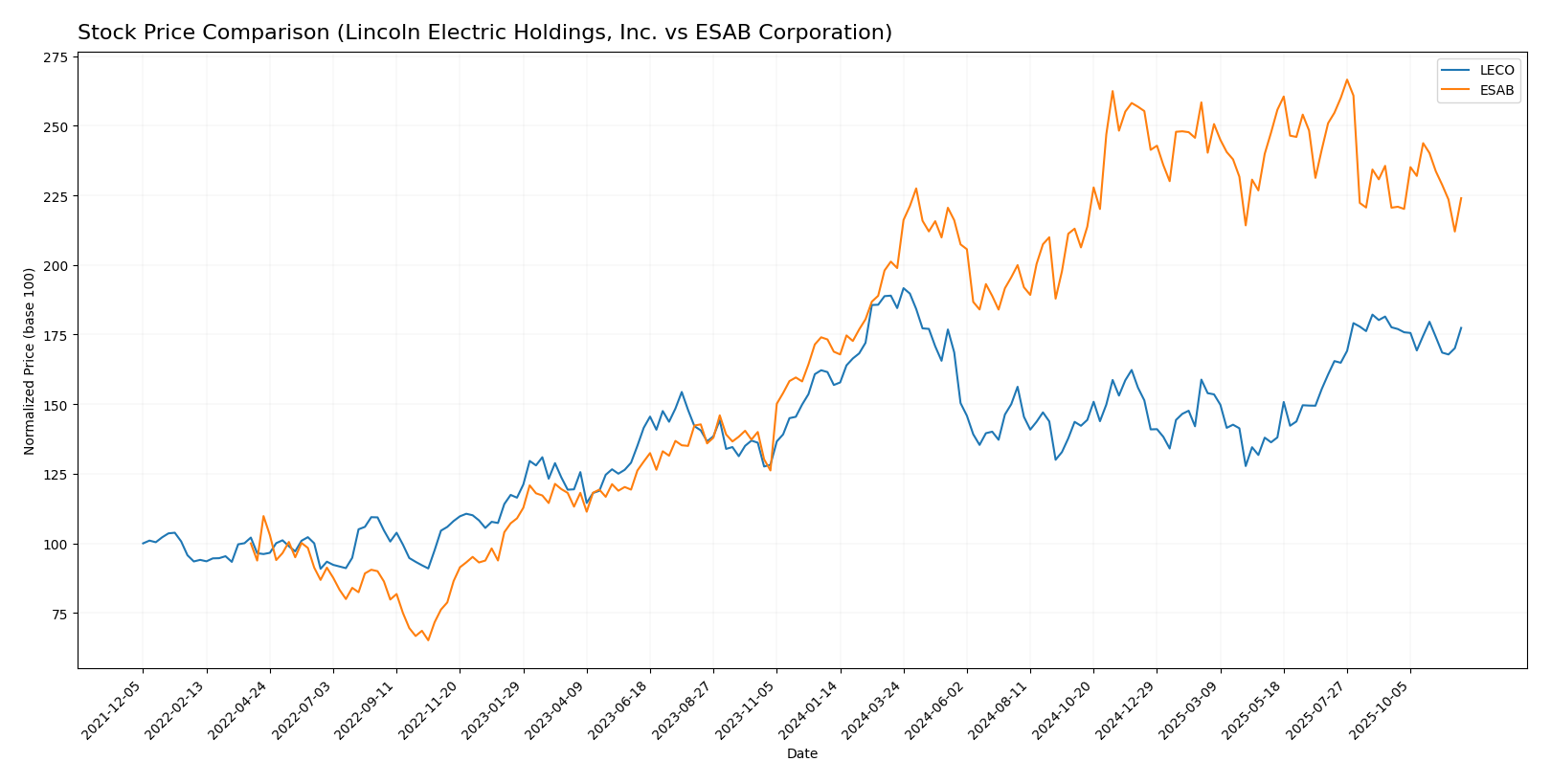

Stock Comparison

Over the past year, Lincoln Electric Holdings, Inc. (LECO) and ESAB Corporation (ESAB) have demonstrated significant price movements and trading dynamics, highlighting their respective positions in the market.

Trend Analysis

Lincoln Electric Holdings, Inc. (LECO) has seen a percentage increase of 13.07% over the past year. This strong performance indicates a bullish trend, despite a recent slight decline of -0.12% from mid-September to the end of November 2025. Notably, LECO reached a high of 258.04 and a low of 172.02 during this period. The trend is characterized by deceleration, suggesting a potential slowdown in momentum, accompanied by a standard deviation of 22.74, indicating considerable volatility in its price movements.

ESAB Corporation (ESAB), on the other hand, has experienced a 32.66% increase over the past year, also reflecting a bullish trend. In the recent period from mid-September to the end of November 2025, ESAB’s price saw a modest rise of 1.55%. The stock’s price has fluctuated between a high of 133.28 and a low of 83.93, and like LECO, it shows signs of deceleration with a standard deviation of 12.53, suggesting moderate volatility.

Investors should consider these trends and the associated volatility when deciding on potential investments in either stock.

Analyst Opinions

Recent analyst recommendations for Lincoln Electric Holdings, Inc. (LECO) indicate a “Buy” rating, reflecting strong scores in return on equity (5) and return on assets (5), as noted by several analysts. Conversely, ESAB Corporation (ESAB) has received a “Hold” rating, primarily due to more moderate scores in return metrics, with a B- rating overall. The consensus for the current year leans towards a “Buy” for LECO while ESAB remains a hold, suggesting a cautious approach for investors considering these stocks.

Stock Grades

In the current market landscape, reliable stock grades provide valuable insights for investors. Here’s a summary of the latest grades for Lincoln Electric Holdings, Inc. and ESAB Corporation.

Lincoln Electric Holdings, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Hold | 2025-10-31 |

| Barclays | maintain | Overweight | 2025-10-20 |

| Keybanc | maintain | Overweight | 2025-08-01 |

| Stifel | maintain | Hold | 2025-08-01 |

| Stifel | maintain | Hold | 2025-07-21 |

| Keybanc | maintain | Overweight | 2025-07-15 |

| Morgan Stanley | maintain | Underweight | 2025-05-06 |

| Keybanc | maintain | Overweight | 2025-05-01 |

| Baird | maintain | Outperform | 2025-05-01 |

| Stifel | maintain | Hold | 2025-05-01 |

ESAB Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-20 |

| JP Morgan | maintain | Overweight | 2025-10-14 |

| Loop Capital | upgrade | Buy | 2025-08-22 |

| JP Morgan | maintain | Overweight | 2025-08-07 |

| Stifel | upgrade | Buy | 2025-08-07 |

| Oppenheimer | maintain | Outperform | 2025-08-07 |

| Stifel | maintain | Hold | 2025-07-21 |

| Evercore ISI Group | maintain | In Line | 2025-05-19 |

| Stifel | maintain | Hold | 2025-05-02 |

Overall, both companies exhibit a trend of maintaining their current grades, with ESAB showing some upgrades in recent months, particularly from Loop Capital and Stifel. This indicates a generally stable outlook, though investors should remain cautious and consider individual risk profiles when making investment decisions.

Target Prices

The consensus target prices from analysts indicate a positive outlook for both Lincoln Electric Holdings, Inc. (LECO) and ESAB Corporation (ESAB).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Lincoln Electric Holdings, Inc. (LECO) | 285 | 260 | 272.5 |

| ESAB Corporation (ESAB) | 150 | 140 | 146.33 |

For Lincoln Electric (LECO), the consensus target price of 272.5 suggests a potential upside compared to the current stock price of 238.84. Similarly, ESAB’s consensus target of 146.33 indicates room for growth from its current price of 111.99.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Lincoln Electric Holdings, Inc. (LECO) and ESAB Corporation (ESAB) based on recent financial data.

| Criterion | Lincoln Electric (LECO) | ESAB Corporation (ESAB) |

|---|---|---|

| Diversification | Strong across segments | Moderate, focused on welding products |

| Profitability | Net margin: 11.6% | Net margin: 7.4% |

| Innovation | High investment in R&D | Growing digital solutions |

| Global presence | Significant worldwide | Expanding international reach |

| Market Share | Leading in welding tools | Competitive in metal fabrication |

| Debt level | Moderate (Debt/Equity: 0.99) | Lower (Debt/Equity: 0.66) |

Key takeaways indicate that Lincoln Electric excels in profitability and diversification, while ESAB is noted for its lower debt levels and innovation in digital solutions. Both companies have unique strengths that cater to different market needs.

Risk Analysis

The following table outlines the potential risks associated with two companies in the industrial sector, Lincoln Electric Holdings, Inc. and ESAB Corporation.

| Metric | Lincoln Electric Holdings, Inc. (LECO) | ESAB Corporation (ESAB) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Low | Moderate |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | Low | Moderate |

In synthesizing the risks, I find that both companies face significant market and environmental risks, particularly due to fluctuations in demand and regulatory changes in manufacturing practices. Recent supply chain disruptions have heightened these vulnerabilities.

Which one to choose?

When comparing Lincoln Electric Holdings, Inc. (LECO) and ESAB Corporation (ESAB), LECO demonstrates stronger fundamentals, including a higher gross profit margin (37% vs. 37.85%) and net profit margin (11.6% vs. 9.7%). LECO’s robust return on equity (35%) also significantly surpasses ESAB’s (15%). In terms of valuation, LECO’s price-to-earnings ratio stands at approximately 22.8 compared to ESAB’s 27.4, indicating a more favorable valuation for LECO.

Analysts rate LECO as a “B” and ESAB as “B-“, suggesting a slight edge for LECO. While both stocks exhibit bullish trends, ESAB has shown a higher price change percentage of 32.66% over the past year compared to LECO’s 13.07%.

For growth-oriented investors, ESAB may be preferable due to its recent performance, while those seeking stability might favor LECO for its superior fundamentals.

Risks include supply chain challenges and market competition, which could impact both firms.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Lincoln Electric Holdings, Inc. and ESAB Corporation to enhance your investment decisions: