In today’s fast-paced industrial landscape, understanding the strengths of key players is crucial for savvy investors. This analysis compares Emerson Electric Co. (EMR) and Fortive Corporation (FTV), both giants in the industrial and technology sectors, respectively. With overlapping markets in automation and engineered products, these companies are at the forefront of innovation. Join me as we delve into their strategies, performance, and potential for growth to uncover which company might be the better addition to your investment portfolio.

Table of contents

Company Overview

Emerson Electric Co. Overview

Emerson Electric Co. (Ticker: EMR), founded in 1890 and headquartered in Saint Louis, Missouri, operates as a leading technology and engineering company. Its mission is to provide innovative solutions across industrial, commercial, and residential markets. With a market capitalization of $74B, Emerson focuses on two main segments: Automation Solutions and Commercial & Residential Solutions. The Automation Solutions segment delivers critical measurement and control instruments for industries such as oil and gas and life sciences, while the Commercial segment offers products designed for heating, cooling, and refrigeration systems. With 73K employees, Emerson is well-positioned to tackle the evolving needs of its diverse clientele.

Fortive Corporation Overview

Fortive Corporation (Ticker: FTV), established in 2015 and based in Everett, Washington, emphasizes the development of professional and engineered products, software, and services. The company, valued at $18B, operates under several brands such as FLUKE and GORDIAN, and serves various sectors including manufacturing, healthcare, and utilities. Its Intelligent Operating Solutions segment provides robust reliability tools and software products, while the Precision Technologies segment focuses on test and measurement instruments. Employing 18K individuals, Fortive aims to facilitate operational excellence through its comprehensive technology solutions.

Key similarities between Emerson Electric Co. and Fortive Corporation include their focus on technology and engineering solutions for industrial applications. However, Emerson leans more towards automation and residential systems, whereas Fortive specializes in professional tools and enterprise software. This highlights a nuanced difference in their core business models and target markets.

Income Statement Comparison

Below is a comparison of the most recent income statements for Emerson Electric Co. (EMR) and Fortive Corporation (FTV), highlighting key financial metrics for each company.

| Metric | EMR | FTV |

|---|---|---|

| Revenue | 18.016B | 6.231B |

| EBITDA | 4.860B | 1.666B |

| EBIT | 3.171B | 1.122B |

| Net Income | 2.293B | 0.833B |

| EPS | 4.06 | 2.39 |

Interpretation of Income Statement

In 2025, Emerson Electric (EMR) showed a robust revenue growth to 18.016B, up from 17.492B in 2024. Fortive (FTV) also experienced growth, with revenues reaching 6.231B compared to 6.065B in the previous year. Net income for EMR increased to 2.293B, reflecting strong operational efficiency, while FTV’s net income of 0.833B indicates stable but slower growth. Both companies maintained solid margins, with EMR’s EBITDA margin at approximately 27% and FTV’s around 27%. Overall, EMR’s performance is encouraging, suggesting effective cost management and growth strategies, while FTV’s steady growth signals resilience in a competitive market.

Financial Ratios Comparison

The following table presents a comparative analysis of key financial metrics for Emerson Electric Co. (EMR) and Fortive Corporation (FTV), enabling investors to assess their performance and stability.

| Metric | EMR | FTV |

|---|---|---|

| ROE | 11.30% | 8.17% |

| ROIC | 4.62% | 6.65% |

| P/E | 32.42 | 23.69 |

| P/B | 3.66 | 1.94 |

| Current Ratio | 0.88 | 1.16 |

| Quick Ratio | 0.65 | 0.91 |

| D/E | 0.65 | 0.38 |

| Debt-to-Assets | 31.26% | 22.78% |

| Interest Coverage | 9.44 | 7.70 |

| Asset Turnover | 0.43 | 0.37 |

| Fixed Asset Turnover | 6.28 | 14.39 |

| Payout Ratio | 51.98% | 13.35% |

| Dividend Yield | 1.60% | 0.56% |

Interpretation of Financial Ratios

In comparing EMR and FTV, EMR shows a stronger return on equity (ROE) but higher debt levels, reflected in its debt-to-assets ratio and debt-to-equity ratio. While Fortive has a better interest coverage ratio, indicating stronger ability to meet debt obligations, its lower payout ratio may suggest less commitment to returning capital to shareholders. Investors should weigh EMR’s stronger profitability against its higher leverage, while FTV’s stability could be appealing for risk-averse investors.

Dividend and Shareholder Returns

Emerson Electric Co. (EMR) offers a dividend yield of 1.60% and a payout ratio of approximately 52%, indicating a balanced approach to returning value while maintaining cash flow for growth. In contrast, Fortive Corporation (FTV) has a minimal dividend yield of 0.56% and a low payout ratio of 13%, reflecting a focus on reinvestment for growth. Both companies engage in share buybacks, which can enhance shareholder value, but EMR’s higher dividends may provide more immediate returns. Overall, EMR’s strategy appears more favorable for sustainable long-term value creation.

Strategic Positioning

Emerson Electric Co. (EMR) holds a significant market share in the industrial machinery sector, leveraging its strong Automation Solutions and Commercial & Residential Solutions segments. In contrast, Fortive Corporation (FTV) operates in the hardware and equipment space, focusing on professional tools and software. Both companies face competitive pressures from emerging technologies and industry players, but their distinct offerings allow them to strategically position themselves against potential technological disruptions. Effective risk management remains crucial as market dynamics evolve.

Stock Comparison

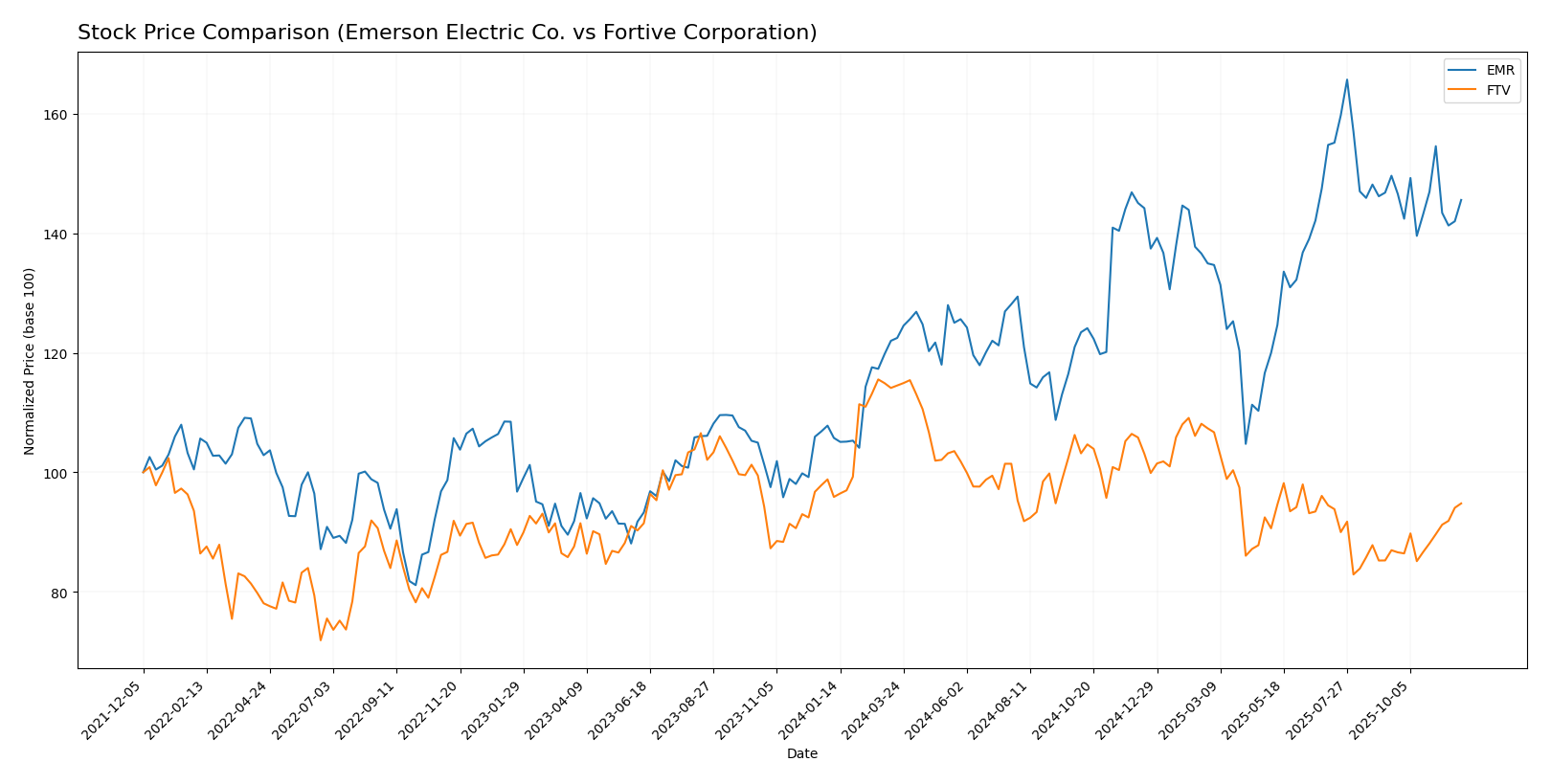

In this section, I will analyze the weekly stock price movements of Emerson Electric Co. (EMR) and Fortive Corporation (FTV), focusing on significant price changes and trading dynamics observed over the past year.

Trend Analysis

Emerson Electric Co. (EMR) Over the past year, EMR has experienced a strong bullish trend, with a percentage change of +37.68%. Despite this overall positive movement, the recent trend shows a slight decline of -2.71% from September 14, 2025, to November 30, 2025. The stock reached a notable high of 149.63 and a low of 93.98, indicating some volatility with a standard deviation of 12.81. However, the acceleration status indicates deceleration, suggesting that while the stock remains bullish overall, it is currently losing momentum.

Fortive Corporation (FTV) FTV has shown a bearish trend with a percentage change of -1.13% over the past year. Recently, from September 14, 2025, to November 30, 2025, the stock rebounded with a positive change of +9.01%. The highest price recorded was 64.89, while the lowest was 46.55, reflecting a standard deviation of 4.63. Notably, the recent trend has an acceleration status indicating acceleration, which could suggest a potential reversal in the downward trajectory.

In summary, while EMR remains on a bullish path despite recent declines, FTV’s bearish trend may be showing signs of improvement in the short term. Investors should carefully consider these trends when making decisions.

Analyst Opinions

Recent analyst recommendations for Emerson Electric Co. (EMR) suggest a “Buy” rating, with analysts highlighting its solid return on assets and overall performance. Analysts appreciate its steady cash flow, although concerns about its debt-to-equity ratio remain. For Fortive Corporation (FTV), the consensus is also a “Buy,” with analysts noting strong discounted cash flow scores and favorable return metrics as key drivers. Overall, both stocks are positioned positively for 2025, with consensus leaning towards a “Buy” for investors seeking growth.

Stock Grades

I have gathered the latest stock grades for two companies: Emerson Electric Co. (EMR) and Fortive Corporation (FTV). Here’s what the grading companies have to say about these stocks.

Emerson Electric Co. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Neutral | 2025-11-10 |

| Barclays | maintain | Equal Weight | 2025-11-06 |

| RBC Capital | maintain | Outperform | 2025-11-06 |

| JP Morgan | maintain | Neutral | 2025-10-15 |

| Wells Fargo | downgrade | Equal Weight | 2025-10-06 |

| Barclays | upgrade | Equal Weight | 2025-08-07 |

| Stephens & Co. | maintain | Equal Weight | 2025-07-16 |

| Citigroup | maintain | Buy | 2025-07-14 |

| Barclays | maintain | Underweight | 2025-07-09 |

| B of A Securities | maintain | Buy | 2025-07-02 |

Fortive Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-11-05 |

| Baird | maintain | Outperform | 2025-11-04 |

| Truist Securities | maintain | Hold | 2025-10-30 |

| Citigroup | maintain | Neutral | 2025-10-30 |

| JP Morgan | maintain | Neutral | 2025-10-30 |

| Barclays | maintain | Equal Weight | 2025-10-30 |

| Mizuho | maintain | Outperform | 2025-10-17 |

| JP Morgan | downgrade | Neutral | 2025-10-15 |

| Morgan Stanley | downgrade | Equal Weight | 2025-09-02 |

| Barclays | downgrade | Equal Weight | 2025-08-14 |

In summary, both EMR and FTV have received a mix of maintain and downgrade actions from various analysts, indicating a cautious sentiment around their performance. The consistent “Equal Weight” ratings suggest that investors are advised to hold these stocks while watching for further developments.

Target Prices

The current consensus target prices for Emerson Electric Co. (EMR) and Fortive Corporation (FTV) are positive indicators for potential investors.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Emerson Electric Co. | 155 | 100 | 121.62 |

| Fortive Corporation | 66 | 40 | 54.57 |

Emerson Electric Co. has a consensus target of 121.62, suggesting a potential upside from its current price of 131.44. Meanwhile, Fortive Corporation’s consensus target of 54.57 indicates a modest upside relative to its current price of 53.23.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Emerson Electric Co. (EMR) and Fortive Corporation (FTV) based on the most recent data:

| Criterion | Emerson Electric Co. (EMR) | Fortive Corporation (FTV) |

|---|---|---|

| Diversification | Strong across multiple sectors | Moderate, focused on specific industries |

| Profitability | High net profit margin (12.73%) | Moderate net profit margin (13.37%) |

| Innovation | Continuous investment in R&D | Active in developing new technologies |

| Global presence | Operates in multiple regions | Primarily U.S. and some international presence |

| Market Share | Significant in industrial machinery | Growing in hardware and software markets |

| Debt level | Moderate debt-to-equity ratio (0.65) | Lower debt-to-equity ratio (0.38) |

Key takeaways indicate that both companies have their strengths, with EMR showing a strong global presence and diversification, while FTV has a lower debt level and is focused on innovation in specific markets. Investors should weigh these factors carefully when considering their portfolio selections.

Risk Analysis

In the table below, I outline various risks associated with Emerson Electric Co. (EMR) and Fortive Corporation (FTV) to help you assess potential investment risks.

| Metric | EMR | FTV |

|---|---|---|

| Market Risk | Moderate | Moderate |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | Low |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | High | Moderate |

Both companies face significant regulatory and geopolitical risks, particularly in light of ongoing global supply chain challenges and regulatory changes. For instance, Emerson has been navigating complex regulations in energy and environmental sectors, while Fortive’s diversified technology focus can somewhat mitigate operational risks.

Which one to choose?

When comparing Emerson Electric Co. (EMR) and Fortive Corporation (FTV), both companies present solid fundamentals. EMR shows a higher gross profit margin of 52.8% compared to FTV’s 59.9%, indicating better efficiency in production. However, EMR has a lower price-to-earnings ratio (P/E) at 32.42 versus FTV’s 23.69, which may suggest that EMR’s stock is more expensive relative to its earnings.

Analyst ratings reflect a cautious outlook, with EMR rated at B and FTV at B+. EMR’s recent stock trend is bullish, yet its recent price change shows a decline of 2.71%. In contrast, FTV’s trend is bearish, but it recently gained 9.01%.

Investors focused on growth may prefer EMR, while those prioritizing stability and lower valuations may favor FTV. Be mindful of competition and market dependence as risks in this sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Emerson Electric Co. and Fortive Corporation to enhance your investment decisions: