In the fast-evolving landscape of industrial technology, two companies stand out: Symbotic Inc. (SYM) and Columbus McKinnon Corporation (CMCO). Both operate within the industrial sector, but their approaches and product offerings differ significantly. Symbotic focuses on automation solutions for warehouse efficiency, while Columbus McKinnon provides a wide range of material handling and motion solutions. In this article, I will explore their innovations and market strategies to help you identify which company may be the more compelling investment opportunity.

Table of contents

Company Overview

Symbotic Inc. Overview

Symbotic Inc. is a pioneering automation technology company based in Wilmington, Massachusetts. Its mission is to enhance efficiency in supply chain operations for retailers and wholesalers through advanced robotics and warehouse automation systems. The flagship offering, The Symbotic System, is designed to minimize operational costs and maximize inventory management. With a market capitalization of approximately $52.7B, Symbotic is positioned as a leader in the industrial machinery sector, driven by its innovative solutions that cater to the evolving needs of modern retail and logistics.

Columbus McKinnon Corporation Overview

Columbus McKinnon Corporation, headquartered in Buffalo, New York, specializes in intelligent motion solutions that facilitate the ergonomic movement, lifting, positioning, and securing of materials globally. Established in 1875, the company offers a diverse range of products, including hoists, crane systems, rigging equipment, and automation technologies. With a market capitalization of around $475M, CMCO serves multiple industries, including transportation, energy, and e-commerce, by providing solutions that enhance operational safety and efficiency.

Key Similarities and Differences

Both Symbotic and Columbus McKinnon operate within the industrial sector, focusing on automation and efficiency. However, their business models differ: Symbotic emphasizes warehouse automation technologies tailored for retail and wholesale logistics, while Columbus McKinnon offers a broader range of material handling solutions across various industries. This distinction highlights Symbotic’s niche focus compared to CMCO’s diversified product portfolio.

Income Statement Comparison

The following table provides a detailed comparison of the income statements for Symbotic Inc. (SYM) and Columbus McKinnon Corporation (CMCO), highlighting key financial metrics for the most recent fiscal year.

| Metric | Symbotic Inc. (SYM) | Columbus McKinnon Corp. (CMCO) |

|---|---|---|

| Revenue | 2.25B | 963M |

| EBITDA | -75M | 75M |

| EBIT | -115M | 27M |

| Net Income | -81M | -5M |

| EPS | -0.16 | -0.18 |

Interpretation of Income Statement

In FY 2025, Symbotic Inc. reported a significant revenue increase to 2.25B, compared to 1.79B in FY 2024, indicating a positive growth trend. However, despite the revenue boost, the company continues to experience negative net income of -81M, reflecting ongoing challenges in cost management. On the other hand, Columbus McKinnon posted a revenue of 963M, down from 1.01B in the previous year, but successfully achieved a positive EBITDA of 75M. This suggests improved operational efficiency and effective cost control measures, even as its net income remains negative at -5M. Both companies face challenges, yet CMCO demonstrates stronger margin management amidst declining revenues.

Financial Ratios Comparison

In the following table, I present a comparative analysis of key financial ratios for Symbotic Inc. (SYM) and Columbus McKinnon Corporation (CMCO) based on the most recent available data.

| Metric | SYM | CMCO |

|---|---|---|

| ROE | -16.67% | -0.58% |

| ROIC | -17.47% | 3.60% |

| P/E | -70.32 | 26.56 |

| P/B | 11.73 | 1.40 |

| Current Ratio | 1.09 | 1.81 |

| Quick Ratio | 0.99 | 1.04 |

| D/E | 0 | 0.61 |

| Debt-to-Assets | 0 | 0.31 |

| Interest Coverage | 0 | 1.68 |

| Asset Turnover | 0.94 | 0.55 |

| Fixed Asset Turnover | 19.10 | 9.07 |

| Payout Ratio | 0 | 0.17 |

| Dividend Yield | 0% | 1.65% |

Interpretation of Financial Ratios

The ratios indicate that SYM is currently facing significant operational challenges, reflected in negative ROE and ROIC values. Conversely, CMCO demonstrates stronger financial health with a positive ROIC and manageable debt levels. While CMCO’s P/E ratio suggests a more favorable valuation relative to earnings, SYM’s elevated P/B ratio may raise concerns about overvaluation. Investors should weigh these insights carefully against their risk tolerance and investment strategy.

Dividend and Shareholder Returns

Symbotic Inc. (SYM) does not pay dividends, reflecting its focus on reinvestment to support growth during its current developmental phase. The negative net income and high cash burn signal caution, but it engages in share buybacks, indicating a commitment to enhancing shareholder value. Conversely, Columbus McKinnon Corporation (CMCO) pays dividends, with a modest yield of 1.65% and a payout ratio of 17.25%. This balanced approach, alongside share buybacks, supports sustainable long-term value creation for shareholders.

Strategic Positioning

Symbotic Inc. (SYM) holds a strong market share in the warehouse automation sector, leveraging its advanced robotics technology. With a market cap of $52.7B, it faces competitive pressure from companies like Columbus McKinnon Corporation (CMCO), which specializes in intelligent motion solutions. CMCO, valued at $474.9M, operates in a diverse industry segment, highlighting the technological disruption affecting traditional machinery markets. Both companies must continuously innovate to maintain their competitive edge amid evolving industry demands.

Stock Comparison

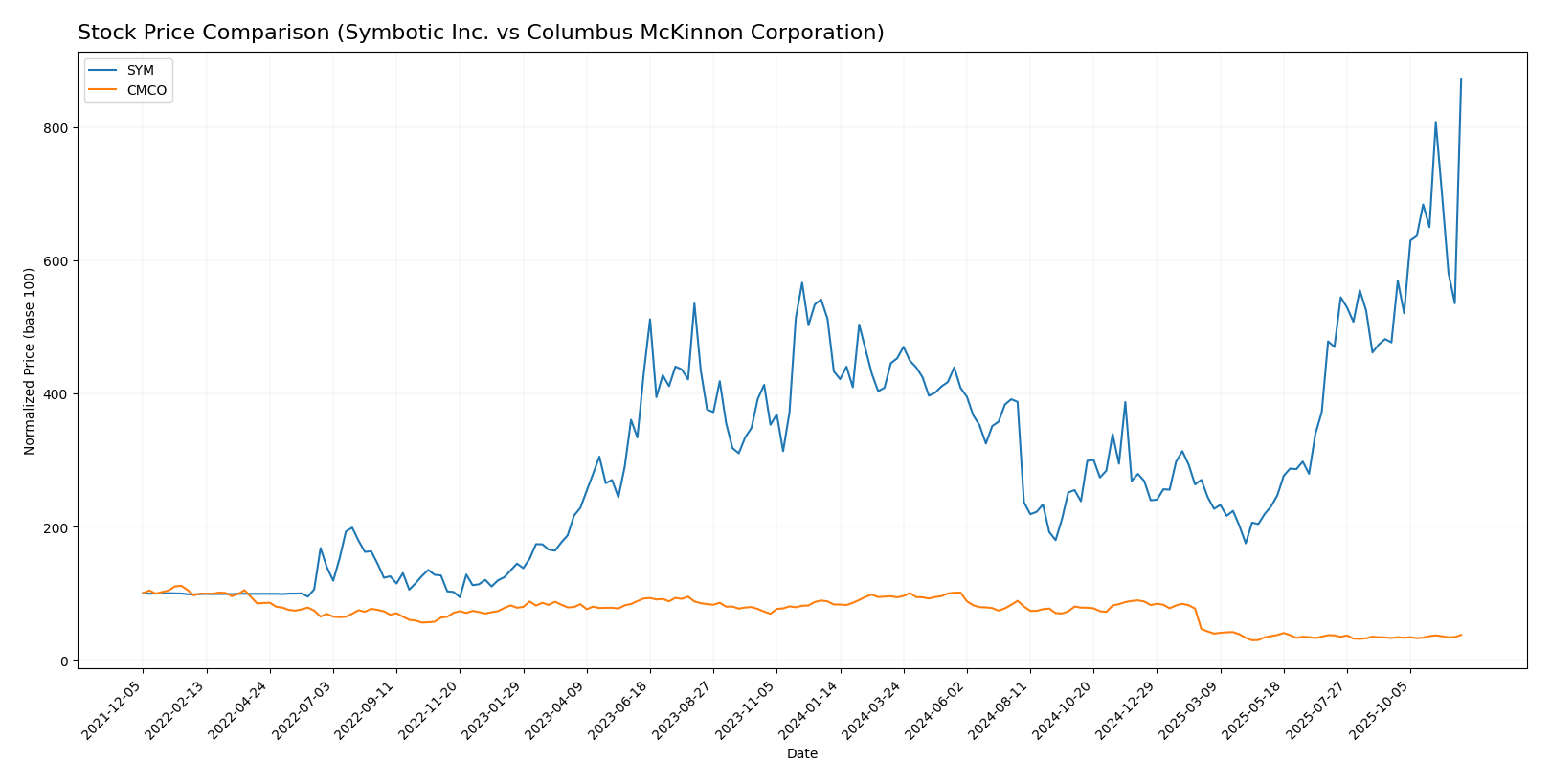

In this section, I will analyze the weekly stock price dynamics for Symbotic Inc. (SYM) and Columbus McKinnon Corporation (CMCO) over the past year, focusing on significant price movements and trading patterns.

Trend Analysis

For Symbotic Inc. (SYM), the overall price change over the past year is +101.2%. This indicates a strong bullish trend, characterized by an acceleration in prices. The stock reached a notable high of 87.3 and a low of 17.5, with a standard deviation of 14.13 reflecting its volatility. Recently, from September 14, 2025, to November 30, 2025, SYM’s price changed by +82.83%, further underscoring its bullish momentum.

In contrast, Columbus McKinnon Corporation (CMCO) experienced a significant overall decline of -55.24%, categorizing it as a bearish trend, also marked by acceleration. The stock’s price peaked at 44.9 and dipped to a low of 12.96, with a standard deviation of 11.25 indicating volatility. Over the recent period from September 14, 2025, to November 30, 2025, CMCO’s price demonstrated a modest increase of +14.47%, yet it remains in a bearish trend overall.

Analyst Opinions

Recent analyst recommendations provide a mixed outlook for investors. Symbotic Inc. (SYM) received a “C” rating, indicating caution due to low scores in critical areas like return on equity and assets, suggesting a hold position. In contrast, Columbus McKinnon Corporation (CMCO) has a more favorable “B+” rating, backed by strong discounted cash flow and price-to-book scores, leading analysts to recommend a buy. Overall, the consensus for CMCO is a buy, while SYM leans towards a hold for the current year.

Stock Grades

In this section, I will present the latest stock grades for two companies, Symbotic Inc. and Columbus McKinnon Corporation, based on reliable evaluations from recognized grading firms.

Symbotic Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | maintain | Neutral | 2025-11-26 |

| Barclays | maintain | Underweight | 2025-11-26 |

| Craig-Hallum | upgrade | Buy | 2025-11-25 |

| Citigroup | maintain | Buy | 2025-11-25 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-25 |

| DA Davidson | maintain | Neutral | 2025-11-25 |

| Northland Capital Markets | maintain | Outperform | 2025-11-25 |

| UBS | downgrade | Sell | 2025-09-23 |

| DA Davidson | downgrade | Neutral | 2025-08-25 |

| Needham | maintain | Buy | 2025-08-07 |

Columbus McKinnon Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | downgrade | Neutral | 2025-02-11 |

| DA Davidson | maintain | Buy | 2024-02-05 |

| DA Davidson | maintain | Buy | 2022-10-04 |

| DA Davidson | maintain | Buy | 2022-10-03 |

| Barrington Research | maintain | Outperform | 2022-07-29 |

| Barrington Research | maintain | Outperform | 2022-07-28 |

| JP Morgan | downgrade | Neutral | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-25 |

| JP Morgan | downgrade | Neutral | 2022-05-25 |

In summary, Symbotic Inc. shows a mixed trend with several upgrades and downgrades, indicating volatility in investor sentiment. Columbus McKinnon Corporation has recently seen a downgrade, which might suggest caution for potential investors.

Target Prices

The consensus target prices from reliable analysts indicate a mixed outlook for the selected companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Symbotic Inc. (SYM) | 83 | 41 | 67.38 |

| Columbus McKinnon Corporation (CMCO) | 50 | 48 | 49 |

For Symbotic Inc. (SYM), the consensus target price of 67.38 suggests potential upside from its current price of 87.3, although it is trading above the consensus. In contrast, Columbus McKinnon Corporation (CMCO) has a target consensus of 49, which presents a more favorable outlook compared to its current price of 16.53.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Symbotic Inc. (SYM) and Columbus McKinnon Corporation (CMCO) based on their latest financial data.

| Criterion | Symbotic Inc. (SYM) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Diversification | Low | Medium |

| Profitability | Negative | Positive |

| Innovation | High | Medium |

| Global presence | Limited | Strong |

| Market Share | Emerging | Established |

| Debt level | None | Moderate |

Key takeaways indicate that while Symbotic Inc. is focused on innovation in automation technology, it currently struggles with profitability and market share. Conversely, Columbus McKinnon shows established profitability and a strong global presence despite a moderate level of debt.

Risk Analysis

Below is a table summarizing key risks associated with both companies, Symbotic Inc. (SYM) and Columbus McKinnon Corporation (CMCO):

| Metric | Symbotic Inc. | Columbus McKinnon Corporation |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | High | Low |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | Low | Moderate |

The most significant risks I see lie in market and operational aspects for Symbotic Inc., where high volatility and operational challenges could impede growth. In contrast, Columbus McKinnon Corporation exhibits a lower operational risk, but it is still vulnerable to geopolitical influences and market fluctuations.

Which one to choose?

In comparing Symbotic Inc. (SYM) and Columbus McKinnon Corporation (CMCO), I note that SYM has experienced a bullish trend with a price change of 101.2%, but it still suffers from negative margins and high debt levels, leading to a C rating. Conversely, CMCO shows a bearish trend with a price decline of 55.24%, yet it maintains a B+ rating, indicating stronger fundamentals with better profitability metrics and lower debt-to-equity ratios.

For investors focused on growth, SYM may seem appealing due to its recent price performance, but the underlying financial health raises concerns. In contrast, CMCO appears more stable and has potential for sustainable growth, making it suitable for those prioritizing stability.

Both companies face industry risks, including competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Symbotic Inc. and Columbus McKinnon Corporation to enhance your investment decisions: