In today’s competitive industrial landscape, Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO) stand out as two prominent players. Both companies operate within the industrial machinery sector, albeit with distinct focuses; Hillenbrand specializes in diversified process solutions, while Columbus McKinnon excels in intelligent motion solutions. Their overlapping market segments and innovative strategies offer an intriguing comparison for potential investors. Join me as we explore which company presents the most compelling investment opportunity.

Table of contents

Company Overview

Hillenbrand, Inc. Overview

Hillenbrand, Inc. operates as a diversified industrial company, offering a range of solutions in the machinery sector. With a market capitalization of approximately $2.23B, the company focuses on three segments: Advanced Process Solutions, Molding Technology Solutions, and Batesville. Its Advanced Process Solutions segment is dedicated to designing and manufacturing process equipment for various industries, while the Molding Technology Solutions segment specializes in injection molding and extrusion equipment. Notably, the Batesville segment provides products for the funeral services industry, showcasing Hillenbrand’s unique market positioning. Founded in 1906 and headquartered in Batesville, Indiana, the company emphasizes innovation and customer-focused solutions.

Columbus McKinnon Corporation Overview

Columbus McKinnon Corporation, with a market cap of around $475M, specializes in intelligent motion solutions for material handling. Founded in 1875 and based in Buffalo, New York, it offers a diverse product range including hoists, rigging equipment, and automation solutions. The company serves various market verticals such as energy, transportation, and life sciences, positioning itself as a leader in ergonomic lifting and securing solutions. Columbus McKinnon’s commitment to safety and efficiency is evident in its innovative designs and comprehensive service offerings.

Key Similarities and Differences

Both Hillenbrand and Columbus McKinnon operate within the industrial machinery sector, focusing on innovative solutions for their respective markets. However, Hillenbrand has a unique segment dedicated to funeral services, setting it apart from Columbus McKinnon’s wider emphasis on motion solutions across various industries. Each company reflects a different niche within the broader industrial landscape, catering to distinct customer needs while sharing a commitment to quality and innovation.

Income Statement Comparison

Below is a concise comparison of the latest income statements for Hillenbrand, Inc. and Columbus McKinnon Corporation, highlighting essential financial metrics.

| Metric | Hillenbrand, Inc. | Columbus McKinnon Corporation |

|---|---|---|

| Revenue | 2.67B | 963M |

| EBITDA | 230.6M | 75.1M |

| EBIT | 92.1M | 26.9M |

| Net Income | 43.1M | -5.1M |

| EPS | 0.74 | -0.18 |

Interpretation of Income Statement

In the latest fiscal year, Hillenbrand, Inc. reported a decrease in revenue compared to the previous year, dropping from 3.18B to 2.67B. Despite this, their net income remained positive at 43.1M, indicating a resilient bottom line amid challenges. Conversely, Columbus McKinnon Corporation showed an increase in revenue from 1.01B to 963M but suffered a net loss of 5.1M, signaling potential operational issues. Overall, Hillenbrand’s margins appear more stable, while CMCO’s negative net income suggests a need for significant operational improvements to regain profitability.

Financial Ratios Comparison

The following table presents a comparative analysis of key financial ratios between Company A (Hillenbrand, Inc.) and Company B (Columbus McKinnon Corporation) based on the most recent data.

| Metric | Hillenbrand, Inc. (HI) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| ROE | 3.66% | -0.58% |

| ROIC | -32.60% | 3.68% |

| P/E | 36.69 | 21.95 |

| P/B | 1.34 | 1.27 |

| Current Ratio | 1.22 | 1.80 |

| Quick Ratio | 0.88 | 1.03 |

| D/E | 1.12 | 0.68 |

| Debt-to-Assets | 35.86% | 32.84% |

| Interest Coverage | 0.55 | 1.68 |

| Asset Turnover | 0.60 | 0.55 |

| Fixed Asset Turnover | 7.80 | 9.07 |

| Payout Ratio | 121.69% | 17.25% |

| Dividend Yield | 3.32% | 0.65% |

Interpretation of Financial Ratios

The ratios indicate varying financial health between the two companies. Hillenbrand shows a high P/E ratio and a concerning payout ratio, suggesting potential overvaluation and unsustainable dividend payments. In contrast, Columbus McKinnon exhibits a lower P/E and a manageable payout ratio, indicating a more stable financial outlook. However, both companies have a high debt-to-equity ratio, which could pose risks in a rising interest rate environment.

Dividend and Shareholder Returns

Hillenbrand, Inc. (HI) distributes dividends with a yield of approximately 3.3% and a payout ratio of 121.7%, indicating potential sustainability concerns. Meanwhile, Columbus McKinnon Corporation (CMCO) does not pay dividends, likely prioritizing reinvestment for growth, as evidenced by its negative net income. However, CMCO engages in share buybacks, which may enhance shareholder value. Overall, HI’s dividends and CMCO’s buyback strategy could support long-term shareholder value creation, despite inherent risks.

Strategic Positioning

Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO) operate in the industrial machinery sector, yet they serve different market niches. HI holds a market cap of $2.23B, focusing on advanced process solutions and manufacturing equipment, while CMCO, with a market cap of $475M, specializes in intelligent motion solutions. Both face competitive pressure from technological advancements and evolving customer demands. As they navigate this landscape, strategic innovation and operational efficiency will be crucial to maintaining market share and mitigating risks.

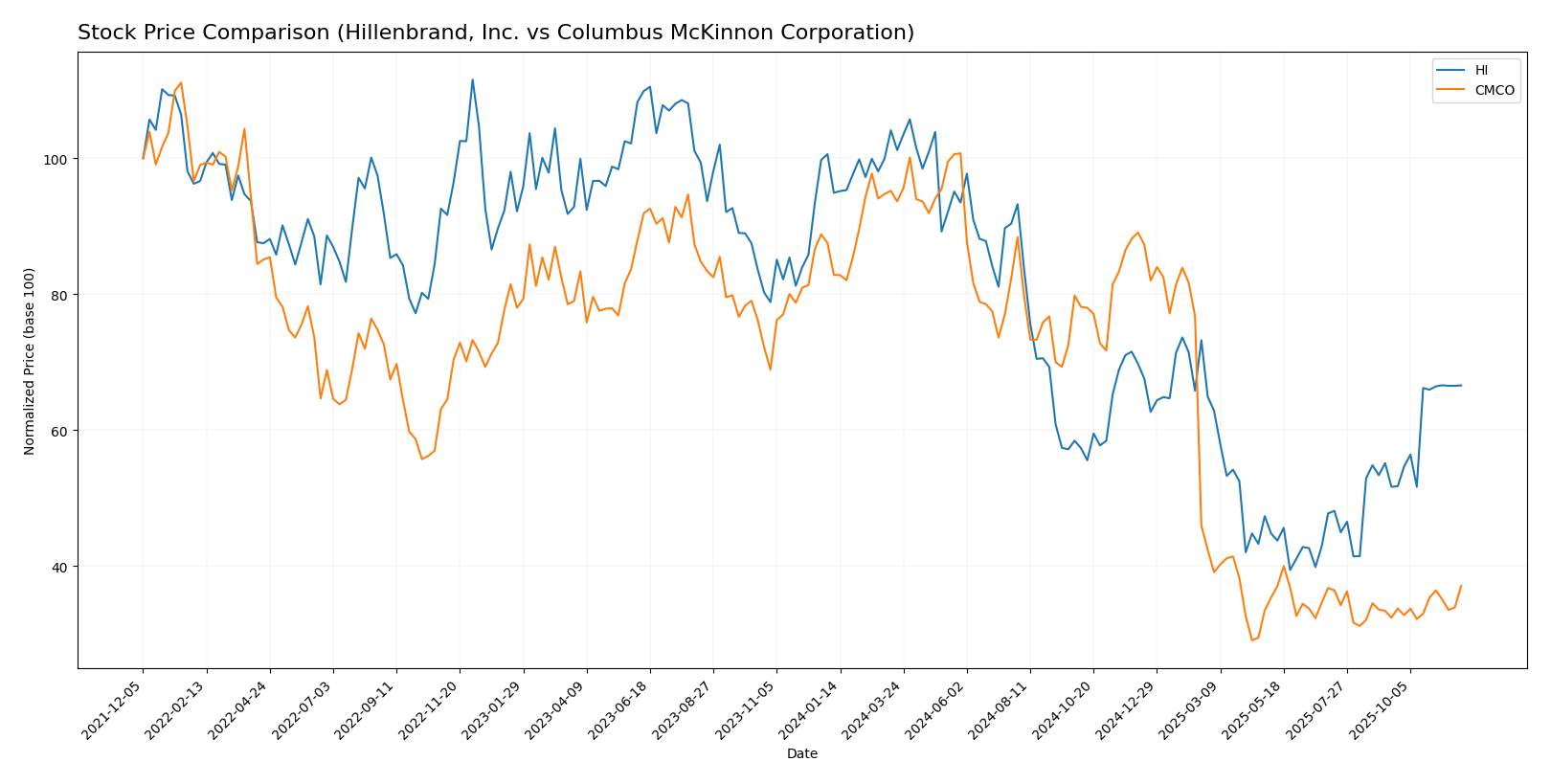

Stock Comparison

In this section, I will analyze and compare the stock price movements of Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO) over the past year, highlighting key trading dynamics and price fluctuations.

Trend Analysis

Hillenbrand, Inc. (HI) The stock has experienced a -29.86% change over the past year, indicating a bearish trend. The highest price recorded was 50.29, while the lowest was 18.75, reflecting notable volatility with a standard deviation of 9.44. Additionally, the recent trend from September 14, 2025, to November 30, 2025, shows a more favorable 28.9% increase, suggesting a potential rebound with a standard deviation of 3.15 and a trend slope of 0.79. This indicates acceleration in the recent positive movement.

Columbus McKinnon Corporation (CMCO) This stock has seen a significant -55.24% decrease over the last year, also categorizing it as a bearish trend. The highest price was 44.9, while the lowest was 12.96, with a standard deviation of 11.25, illustrating high volatility. However, the recent trend analysis between September 14, 2025, and November 30, 2025, shows a 14.47% increase, with a lower standard deviation of 0.67 and a trend slope of 0.12, indicating a slight acceleration in its recovery.

In summary, both companies are currently in bearish long-term trends, but recent performance suggests potential short-term recoveries, with HI showing a stronger rebound compared to CMCO.

Analyst Opinions

Recent analyst recommendations for Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO) have both rated them as B+, indicating a consensus to hold. Analysts highlight HI’s strong discounted cash flow score of 4 and solid return on assets score of 5, while CMCO benefits from a leading discounted cash flow score of 5 and a robust price-to-book score of 5. Despite their strengths, both companies face challenges in return on equity and debt-to-equity ratios. Overall, the consensus for 2025 leans towards a cautious hold for investors.

Stock Grades

I have gathered the latest stock ratings from recognized grading companies for two companies: Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO). Below, you will find the detailed grades for each company.

Hillenbrand, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | maintain | Neutral | 2025-11-20 |

| DA Davidson | maintain | Neutral | 2025-10-16 |

| CJS Securities | downgrade | Market Perform | 2025-10-16 |

| Keybanc | downgrade | Sector Weight | 2025-05-08 |

| DA Davidson | maintain | Neutral | 2025-05-01 |

| DA Davidson | maintain | Neutral | 2024-11-15 |

| Keybanc | maintain | Overweight | 2024-11-14 |

| DA Davidson | downgrade | Neutral | 2024-08-12 |

| DA Davidson | maintain | Buy | 2021-02-08 |

| DA Davidson | maintain | Buy | 2021-02-07 |

Columbus McKinnon Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | downgrade | Neutral | 2025-02-11 |

| DA Davidson | maintain | Buy | 2024-02-05 |

| DA Davidson | maintain | Buy | 2022-10-04 |

| DA Davidson | maintain | Buy | 2022-10-03 |

| Barrington Research | maintain | Outperform | 2022-07-29 |

| Barrington Research | maintain | Outperform | 2022-07-28 |

| JP Morgan | downgrade | Neutral | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-25 |

| JP Morgan | downgrade | Neutral | 2022-05-25 |

In summary, Hillenbrand, Inc. has seen a trend toward more neutral ratings, with recent downgrades indicating decreased confidence. Conversely, Columbus McKinnon Corporation has maintained a rating of “Buy” for an extended period, though a recent downgrade to “Neutral” suggests a cautious outlook.

Target Prices

The consensus target prices for Hillenbrand, Inc. and Columbus McKinnon Corporation reflect positive analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Hillenbrand, Inc. (HI) | 32 | 32 | 32 |

| Columbus McKinnon Corporation (CMCO) | 50 | 48 | 49 |

Hillenbrand has a consensus target price equal to its current stock price of 31.67, indicating a stable outlook. In contrast, Columbus McKinnon’s target consensus of 49 suggests significant upside potential from its current price of 16.53.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO).

| Criterion | Hillenbrand, Inc. (HI) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Diversification | High | Medium |

| Profitability | Moderate | Low |

| Innovation | Medium | High |

| Global presence | Strong | Moderate |

| Market Share | 1.25% | 0.35% |

| Debt level | Moderate | Low |

Key takeaways from the analysis indicate that while Hillenbrand has a strong global presence and diversification, its profitability is moderate. Columbus McKinnon, on the other hand, excels in innovation and has a lower debt level, though it faces challenges regarding profitability and market share.

Risk Analysis

The table below outlines the key risks associated with two companies, Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO), based on the most recent fiscal year data.

| Metric | Hillenbrand, Inc. (HI) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Market Risk | Medium | Medium |

| Regulatory Risk | High | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | Low |

Both companies face notable risks. Hillenbrand has high regulatory risk due to stringent industry standards, while Columbus McKinnon grapples with operational risks stemming from supply chain complexities. It’s vital to remain cautious and assess these risks when considering investments.

Which one to choose?

When comparing Hillenbrand, Inc. (HI) and Columbus McKinnon Corporation (CMCO), both companies receive a rating of B+ from analysts, indicating a generally favorable outlook. However, HI exhibits stronger profitability metrics with a net profit margin of 1.95% and a higher return on equity compared to CMCO, which struggles with a negative net income and a return on equity of -0.58%.

In terms of stock trends, both companies face bearish momentum; HI has recently seen a price increase of 28.9%, while CMCO has gained 14.47%. Given these factors, I believe investors seeking growth might favor HI for its better profitability and recent positive momentum, whereas those prioritizing value might consider CMCO for its lower price-to-book ratio.

Risks include market dependence and competition, which could impact revenue stability for both companies.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Hillenbrand, Inc. and Columbus McKinnon Corporation to enhance your investment decisions: