In the ever-evolving landscape of industrial machinery, two noteworthy players stand out: Hillenbrand, Inc. (HI) and JBT Marel Corporation (JBTM). Both companies operate within the same sector, focusing on innovative solutions that cater to diverse markets, from food processing to advanced material handling. As they navigate growth strategies and market challenges, understanding their approaches can provide valuable insights for investors. Join me as we explore which of these companies presents the most compelling opportunity for your investment portfolio.

Table of contents

Company Overview

Hillenbrand, Inc. Overview

Hillenbrand, Inc. operates as a diversified industrial company, primarily focusing on manufacturing and providing solutions across various sectors. Founded in 1906 and headquartered in Batesville, Indiana, the company is segmented into three main areas: Advanced Process Solutions, Molding Technology Solutions, and Batesville. Its Advanced Process Solutions segment excels in designing and manufacturing equipment for various industries, including food, pharmaceuticals, and chemicals. In contrast, the Molding Technology Solutions segment supplies advanced injection molding and extrusion technologies. Additionally, the Batesville segment specializes in funeral products and services. With a market cap of $2.23B and a workforce of 10,450, Hillenbrand stands as a key player in the industrial machinery sector.

JBT Marel Corporation Overview

JBT Marel Corporation, formerly known as John Bean Technologies Corporation, is a prominent provider of technology solutions for the food and beverage industry. Headquartered in Chicago, Illinois, and incorporated in 1994, the company offers a comprehensive range of processing and packaging solutions to various segments, including poultry, meat, seafood, and ready meals. JBT Marel also specializes in automated systems for material handling in manufacturing and warehouse settings. With a market cap of $7.34B and 11,700 employees, JBT Marel is known for its innovative approaches that cater to the evolving demands of the global food sector.

Key Similarities and Differences

Both Hillenbrand and JBT Marel operate within the industrial machinery sector, focusing on providing specialized solutions to diverse industries. However, Hillenbrand has a broader industrial application range, including funeral services, while JBT Marel is exclusively oriented toward the food and beverage industry. This distinction highlights their unique market positions, catering to different consumer needs and operational sectors.

Income Statement Comparison

Below is a comparative analysis of the income statements for Hillenbrand, Inc. and JBT Marel Corporation to evaluate their financial performance.

| Metric | Hillenbrand, Inc. (HI) | JBT Marel Corporation (JBTM) |

|---|---|---|

| Revenue | 2.67B | 1.72B |

| EBITDA | 230.6M | 204.2M |

| EBIT | 92.1M | 114.8M |

| Net Income | 43.1M | 85.4M |

| EPS | 0.74 | 2.67 |

Interpretation of Income Statement

In 2025, Hillenbrand, Inc. reported a decline in revenue to 2.67B, down from 3.18B in 2024. This reflects a concerning trend, particularly as net income also dropped to 43.1M, indicating challenges in maintaining profitability. On the other hand, JBT Marel Corporation demonstrated robust growth with a revenue increase to 1.72B and net income rising to 85.4M. This suggests a stronger operational efficiency and better cost management compared to Hillenbrand. Overall, while JBTM shows positive momentum, HI’s performance raises red flags that may require strategic adjustments to enhance profitability and market competitiveness.

Financial Ratios Comparison

The following table provides a comparative overview of the most recent financial metrics for Hillenbrand, Inc. (HI) and JBT Marel Corporation (JBTM).

| Metric | Hillenbrand, Inc. (HI) | JBT Marel Corporation (JBTM) |

|---|---|---|

| ROE | 3.66% | 5.53% |

| ROIC | -32.60% | 3.65% |

| P/E | 36.69 | 47.63 |

| P/B | 1.34 | 2.63 |

| Current Ratio | 1.22 | 3.48 |

| Quick Ratio | 0.88 | 3.04 |

| D/E | 1.12 | 0.81 |

| Debt-to-Assets | 35.86% | 36.68% |

| Interest Coverage | 0.55 | 6.10 |

| Asset Turnover | 0.60 | 0.50 |

| Fixed Asset Turnover | 7.80 | 7.34 |

| Payout Ratio | 121.69% | 15.34% |

| Dividend Yield | 3.32% | 0.32% |

Interpretation of Financial Ratios

The analysis indicates that while HI is showing a troubling ROIC and an elevated payout ratio, suggesting potential sustainability concerns, JBTM demonstrates stronger overall financial health with higher ROE and a lower debt-to-equity ratio. However, JBTM’s higher P/E ratio indicates it may be overvalued in the current market context. Careful consideration of these ratios is essential for making informed investment decisions.

Dividend and Shareholder Returns

Hillenbrand, Inc. (HI) offers a dividend with a yield of 3.32% and a payout ratio exceeding 121%, raising concerns about sustainability. The company also engages in share buybacks, which can enhance shareholder value if managed judiciously. In contrast, JBT Marel Corporation (JBTM) has a lower dividend yield of 0.32% and a modest payout ratio of 15%, indicating a focus on growth and capital reinvestment. Both companies employ buyback strategies, yet the differing approaches to dividends suggest varying priorities in shareholder returns. Overall, HI’s high payout may hinder long-term value creation, while JBTM’s strategy appears more aligned with sustainable growth.

Strategic Positioning

Hillenbrand, Inc. (HI) holds a strong position in the industrial machinery sector with a market cap of $2.23B, focusing on diverse solutions across three segments. However, JBT Marel Corporation (JBTM) leads with a market cap of $7.34B, providing advanced technology solutions to the food and beverage industry. Both companies face competitive pressure from emerging technologies and must continually innovate to maintain their market share against disruptive forces in the industry.

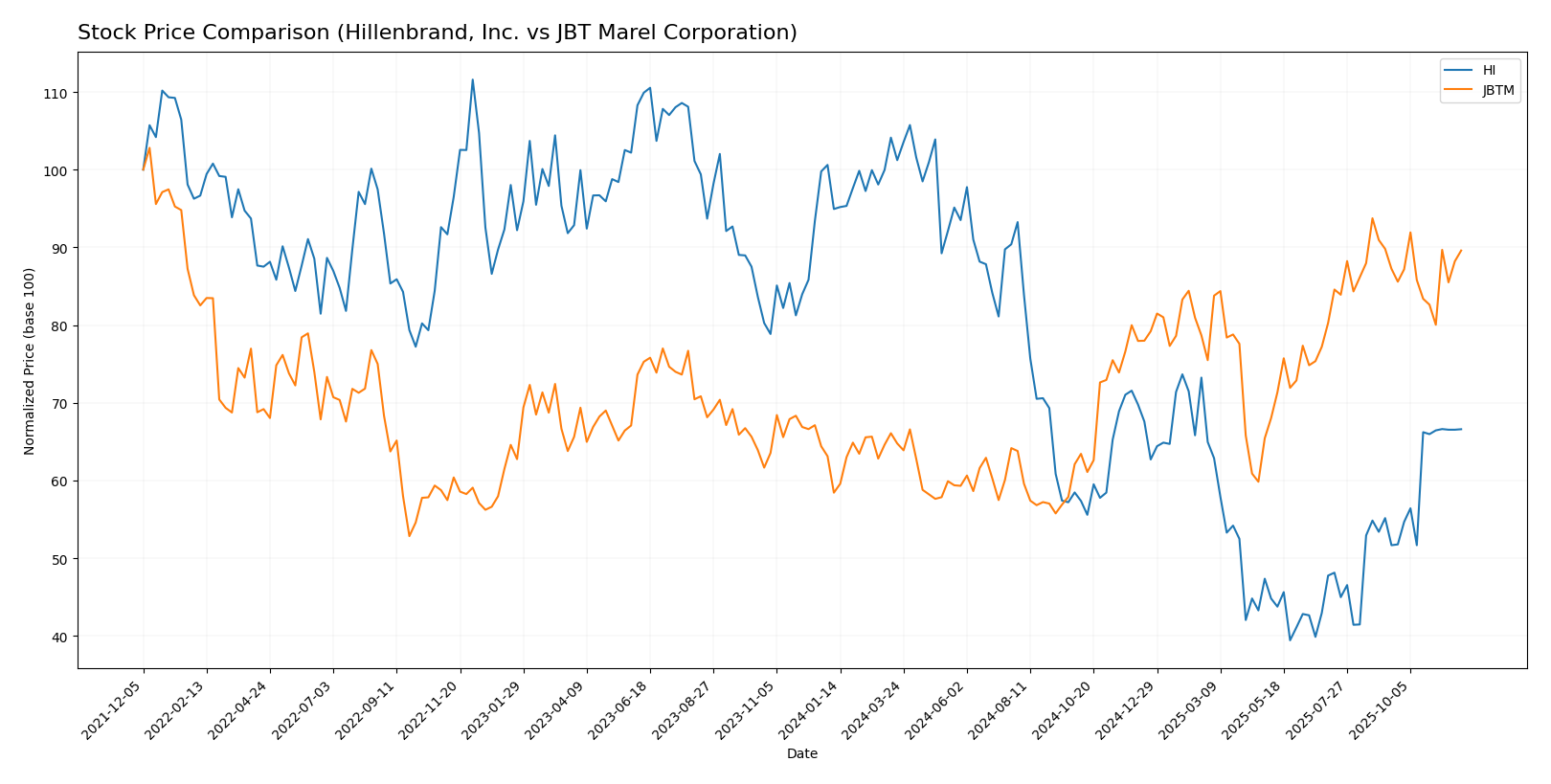

Stock Comparison

In this section, I will analyze the stock price movements of Hillenbrand, Inc. (HI) and JBT Marel Corporation (JBTM) over the past year, highlighting significant price dynamics and trading behaviors.

Trend Analysis

Hillenbrand, Inc. (HI) Over the past year, HI has experienced a significant price change of -29.86%. This indicates a bearish trend, with notable acceleration in the decline. The stock has seen a high of 50.29 and a low of 18.75, suggesting substantial volatility, as evidenced by a standard deviation of 9.44.

In the recent period from September 14, 2025, to November 30, 2025, HI’s price increased by 28.9%, but this is not enough to alter the overall bearish sentiment. The recent standard deviation of 3.15 suggests a moderate level of price fluctuation.

JBT Marel Corporation (JBTM) Conversely, JBTM has shown a robust price increase of 53.35% over the past year, indicating a bullish trend. The acceleration in this uptrend is currently showing signs of deceleration, with a high of 147.7 and a low of 87.85, accompanied by a standard deviation of 17.44, indicating high volatility.

In the recent analysis from September 14, 2025, to November 30, 2025, JBTM’s price rose by 2.7%, which keeps it within a neutral trend range. The standard deviation of 5.02 reflects a moderate level of price variability in this timeframe.

Overall, HI’s bearish trend contrasts sharply with JBTM’s bullish performance, presenting distinct investment profiles for consideration.

Analyst Opinions

Recent analyst recommendations for Hillenbrand, Inc. (HI) indicate a consensus rating of “Buy,” with an overall score of 3 and a strong discounted cash flow score of 4, highlighting its robust financial health. Analysts note its impressive return on assets (score of 5) and favorable price-to-book ratio (score of 4). Conversely, JBT Marel Corporation (JBTM) has a consensus rating of “Sell,” with an overall score of 2, primarily due to poor performance in return on equity (score of 1) and price-to-earnings metrics (score of 1).

Stock Grades

In this section, I will present the latest stock ratings for Hillenbrand, Inc. and JBT Marel Corporation, based on reliable grading data.

Hillenbrand, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Neutral | 2025-11-20 |

| DA Davidson | Maintain | Neutral | 2025-10-16 |

| CJS Securities | Downgrade | Market Perform | 2025-10-16 |

| Keybanc | Downgrade | Sector Weight | 2025-05-08 |

| DA Davidson | Maintain | Neutral | 2025-05-01 |

| DA Davidson | Maintain | Neutral | 2024-11-15 |

| Keybanc | Maintain | Overweight | 2024-11-14 |

| DA Davidson | Downgrade | Neutral | 2024-08-12 |

| DA Davidson | Maintain | Buy | 2021-02-08 |

| DA Davidson | Maintain | Buy | 2021-02-07 |

JBT Marel Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| William Blair | Upgrade | Outperform | 2025-08-06 |

Overall, I observe a trend of cautious outlooks for Hillenbrand, with several downgrades over recent months, leading to a consistent neutral rating. In contrast, JBT Marel Corporation has received an upgrade, suggesting a more favorable view from analysts.

Target Prices

The consensus target prices for Hillenbrand, Inc. and JBT Marel Corporation indicate strong expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Hillenbrand, Inc. | 32 | 32 | 32 |

| JBT Marel Corporation | 169 | 169 | 169 |

For Hillenbrand, the target price aligns closely with its current price of 31.67, suggesting limited upside potential. Meanwhile, JBT Marel’s target price of 169 offers significant upside compared to its current price of 141.16, indicating strong growth expectations.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Hillenbrand, Inc. (HI) and JBT Marel Corporation (JBTM) based on the most recent data.

| Criterion | Hillenbrand, Inc. (HI) | JBT Marel Corporation (JBTM) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Low (Net Margin: 1.9%) | Moderate (Net Margin: 5.0%) |

| Innovation | Moderate | High |

| Global presence | Moderate | Strong |

| Market Share | Moderate | High |

| Debt level | High (Debt/Equity: 1.12) | Moderate (Debt/Equity: 0.81) |

Key takeaways indicate that while JBT Marel exhibits stronger profitability, innovation, and global presence, Hillenbrand has a higher debt level, which could pose risks in economic downturns.

Risk Analysis

Below is a table highlighting various risks associated with Hillenbrand, Inc. and JBT Marel Corporation.

| Metric | Hillenbrand, Inc. (HI) | JBT Marel Corporation (JBTM) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | High | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

In synthesizing the risks, I find that both companies face significant operational and geopolitical risks. Hillenbrand has a high operational risk due to reliance on complex supply chains, while JBT Marel grapples with geopolitical tensions affecting its global operations.

Which one to choose?

In comparing Hillenbrand, Inc. (HI) and JBT Marel Corporation (JBTM), I observe distinct profiles. HI has a market cap of $1.91B and a solid gross profit margin of 33.69%, despite recent volatility with a bearish trend (down 29.86%). Its B+ rating reflects strong return on assets (5) but lower scores in debt metrics (1). Conversely, JBTM, with a market cap of $4.07B, exhibits a bullish trend (up 53.35%) and a gross profit margin of 36.51%, but a lower overall rating of C. The divergence in ratings indicates that HI might be a better fit for value-seeking investors, while JBTM could appeal to those favoring growth.

Investors focused on growth may prefer JBTM, while those prioritizing stability and solid fundamentals may favor HI. However, both face risks tied to market volatility and competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Hillenbrand, Inc. and JBT Marel Corporation to enhance your investment decisions: