In the dynamic landscape of the industrial machinery sector, Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO) stand out as key players. Both companies operate in overlapping markets, focusing on innovative solutions for material handling and application systems. While Nordson specializes in advanced dispensing technologies, Columbus McKinnon emphasizes ergonomic motion solutions. As we dive deeper, I will help you identify which company presents a more compelling investment opportunity in today’s market.

Table of contents

Company Overview

Nordson Corporation Overview

Nordson Corporation (NDSN) is a leading global manufacturer specializing in precision dispensing, applying, and controlling adhesives, coatings, and other fluids. Founded in 1935 and headquartered in Westlake, Ohio, Nordson operates through two segments: Industrial Precision Solutions (IPS) and Advanced Technology Solutions (ATS). The IPS segment focuses on automated systems for packaging industries, while ATS specializes in packaging, medical, and semiconductor applications. With a market capitalization of approximately $13.37B and a commitment to innovation, Nordson is positioned to meet diverse customer needs in the industrial sector.

Columbus McKinnon Corporation Overview

Columbus McKinnon Corporation (CMCO) has been a key player in the motion control industry since 1875, headquartered in Buffalo, New York. The company designs and manufactures intelligent motion solutions that facilitate the ergonomic movement and positioning of materials across various sectors, including transportation, energy, and industrial automation. With a market cap of around $475M, Columbus McKinnon offers a wide array of products, from hoists and cranes to power delivery systems, positioning itself as a comprehensive solution provider in the industrial machinery sector.

Key Similarities and Differences

Both Nordson and Columbus McKinnon operate within the industrial sector, focusing on manufacturing and precision solutions. However, their business models diverge significantly; Nordson centers on fluid dispensing and coating technologies, while Columbus McKinnon specializes in material handling and lifting solutions. This distinction highlights their unique market positions and target industries.

Income Statement Comparison

The following table presents a comparison of the income statements for Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO) for their most recent fiscal year.

| Metric | NDSN | CMCO |

|---|---|---|

| Revenue | 2.69B | 963M |

| EBITDA | 810M | 75M |

| EBIT | 674M | 27M |

| Net Income | 467M | -5M |

| EPS | 8.17 | -0.18 |

Interpretation of Income Statement

In the most recent fiscal year, Nordson Corporation demonstrated solid revenue growth, increasing from 2.63B to 2.69B, and managed to maintain a healthy net income of 467M despite slight margin fluctuations. Conversely, Columbus McKinnon faced challenges as their revenue decreased from 1.01B to 963M, resulting in a net loss of 5M. This decline is reflective of rising costs and operational inefficiencies. Overall, NDSN’s performance indicates resilience and effective cost management, while CMCO’s struggles highlight the need for a strategic reassessment.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial metrics for Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO). The table below outlines key financial ratios that can help investors assess the financial health and performance of these companies.

| Metric | NDSN | CMCO |

|---|---|---|

| ROE | 15.94% | -0.58% |

| ROIC | 9.65% | 3.60% |

| P/E | 30.56 | -94.69 |

| P/B | 4.87 | 0.55 |

| Current Ratio | 2.41 | 1.81 |

| Quick Ratio | 1.51 | 1.04 |

| D/E | 0.79 | 0.61 |

| Debt-to-Assets | 0.39 | 0.31 |

| Interest Coverage | 7.58 | 1.68 |

| Asset Turnover | 0.45 | 0.55 |

| Fixed Asset Turnover | 4.21 | 9.07 |

| Payout ratio | 34.55% | -156.52% |

| Dividend yield | 1.13% | 1.65% |

Interpretation of Financial Ratios

The financial ratios reveal a stark contrast between NDSN and CMCO. NDSN exhibits strong profitability with a healthy ROE of 15.94% and a solid interest coverage ratio of 7.58, indicating robust financial stability. Conversely, CMCO’s negative P/E ratio and low ROE signal potential financial distress, which is a significant concern for investors. The high payout ratio for CMCO suggests unsustainable dividend practices, raising further red flags. Investors should approach CMCO with caution, while NDSN appears to be a more stable investment option.

Dividend and Shareholder Returns

Nordson Corporation (NDSN) pays a dividend with a payout ratio of approximately 34.5%, reflecting a steady annual yield of about 1.13%. The trend shows consistent growth in dividends per share, supported by healthy free cash flow coverage. In contrast, Columbus McKinnon Corporation (CMCO) does not pay dividends, as it focuses on reinvesting for growth during a challenging financial phase. While it has a minimal share buyback program, I believe NDSN’s approach supports sustainable long-term value creation better than CMCO’s current strategy.

Strategic Positioning

In the industrial machinery sector, Nordson Corporation (NDSN) holds a strong market share with a market cap of $13.37B, focusing on adhesive and coating solutions. It competes fiercely with Columbus McKinnon Corporation (CMCO), which specializes in motion solutions and has a market cap of $474.88M. Both companies face competitive pressure from technological advancements and evolving market demands, necessitating continuous innovation and strategic adaptation to maintain their positions and mitigate risks associated with industry disruptions.

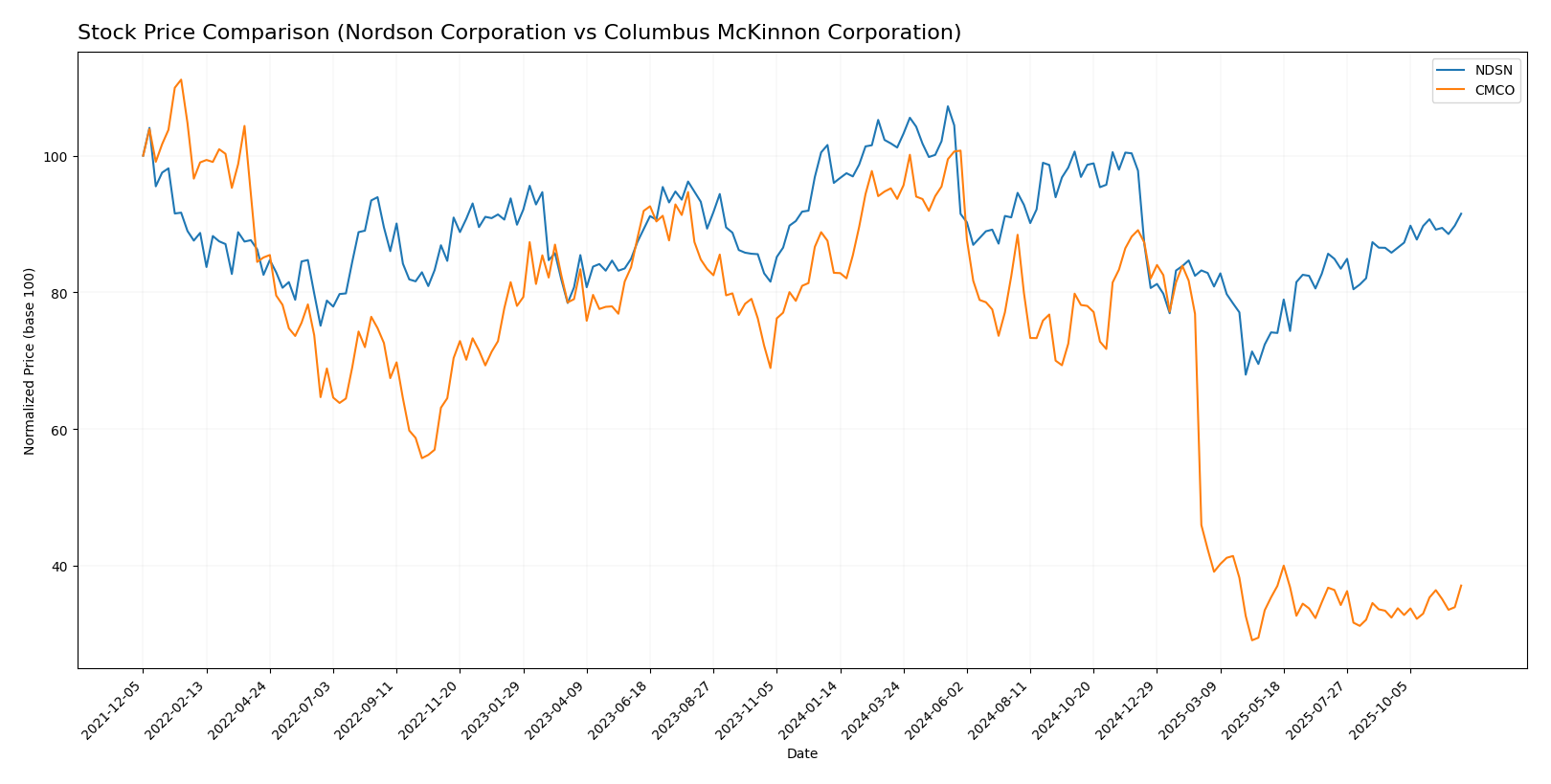

Stock Comparison

In this analysis, I will review the weekly stock price movements of Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO), highlighting significant price dynamics and trading behavior over the past year.

Trend Analysis

Nordson Corporation (NDSN) Over the past year, NDSN has experienced a price change of -4.7%, indicating a bearish trend. The stock reached a high of 278.89 and a low of 176.73, demonstrating notable volatility with a standard deviation of 23.83. Recently, however, the stock has shown a positive shift with a 6.65% price increase from mid-September to late November 2025, suggesting a possible short-term recovery.

Columbus McKinnon Corporation (CMCO) In contrast, CMCO has seen a much more pronounced decline, with a price change of -55.24% over the past year, also reflecting a bearish trend. The stock’s highest price was 44.90, while the lowest dropped to 12.96, accompanied by a standard deviation of 11.25, indicating significant price fluctuations. Interestingly, CMCO has recently rebounded with a 14.47% increase since mid-September 2025, although the overall trend remains negative.

Both stocks present unique opportunities and risks, which I encourage investors to weigh carefully.

Analyst Opinions

Recent analyst recommendations for both Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO) indicate a consensus rating of “B+”. Analysts highlight NDSN’s strong return on assets and equity, suggesting solid performance and potential for growth. Conversely, CMCO’s strengths lie in discounted cash flow and price-to-book ratios, although its price-to-earnings score raises some caution. Analysts recommend a “buy” for both companies, reflecting confidence in their long-term prospects, despite some underlying risks.

Stock Grades

In this section, I will provide you with the latest stock ratings from reliable grading companies for two companies: Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO).

Nordson Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | maintain | Outperform | 2025-08-25 |

| Baird | maintain | Neutral | 2025-08-22 |

| Keybanc | maintain | Overweight | 2025-07-15 |

| Oppenheimer | upgrade | Outperform | 2025-05-30 |

| Baird | maintain | Neutral | 2025-05-30 |

| Keybanc | maintain | Overweight | 2025-04-08 |

| Keybanc | upgrade | Overweight | 2025-03-04 |

| Baird | maintain | Neutral | 2025-02-21 |

| Loop Capital | upgrade | Buy | 2025-01-22 |

| Seaport Global | upgrade | Buy | 2024-12-17 |

Columbus McKinnon Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | downgrade | Neutral | 2025-02-11 |

| DA Davidson | maintain | Buy | 2024-02-05 |

| DA Davidson | maintain | Buy | 2022-10-04 |

| DA Davidson | maintain | Buy | 2022-10-03 |

| Barrington Research | maintain | Outperform | 2022-07-29 |

| Barrington Research | maintain | Outperform | 2022-07-28 |

| JP Morgan | downgrade | Neutral | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-26 |

| Barrington Research | maintain | Outperform | 2022-05-25 |

| JP Morgan | downgrade | Neutral | 2022-05-25 |

Overall, Nordson Corporation shows a consistent trend of maintaining or upgrading grades, indicating strong performance expectations. In contrast, Columbus McKinnon Corporation has experienced a recent downgrade, suggesting a more cautious outlook from analysts.

Target Prices

The current consensus among analysts indicates promising target prices for both Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Nordson Corporation (NDSN) | 285 | 240 | 263 |

| Columbus McKinnon Corporation (CMCO) | 50 | 48 | 49 |

Analysts expect Nordson Corporation’s shares to reach a consensus target of 263, significantly above its current price of 238. Columbus McKinnon Corporation’s target consensus of 49 also represents a favorable outlook compared to its current price of 16.53.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of two companies, Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO).

| Criterion | Nordson Corporation (NDSN) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Diversification | Strong presence in industrial sectors | Limited diversification in machinery |

| Profitability | Net profit margin 17% | Negative net profit margin |

| Innovation | High investment in R&D | Moderate innovation focus |

| Global presence | Operates in over 30 countries | Primarily North America focused |

| Market Share | Significant market leader | Smaller market share |

| Debt level | Debt-to-equity ratio 0.79 | Debt-to-equity ratio 0.61 |

Key takeaways include Nordson’s strong profitability and global presence compared to Columbus McKinnon’s challenges with profitability and market share. This analysis indicates that while NDSN shows robust performance metrics, CMCO may offer potential for improvement and growth in a more diversified portfolio.

Risk Analysis

In the following table, I outline the significant risks associated with Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO) as of the most recent fiscal year.

| Metric | Nordson Corporation (NDSN) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | Low | Moderate |

Both companies face persistent market and regulatory risks, particularly due to their involvement in global supply chains and compliance with industry standards. CMCO’s higher operational and environmental risks reflect its reliance on diverse markets and the impact of changing regulations.

Which one to choose?

In comparing Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO), I find that NDSN presents stronger fundamentals. NDSN boasts a market cap of 14.3B with a net profit margin of 17.37% and a favorable debt-to-equity ratio of 0.79. Its stock trend remains bearish, with a recent price change of -4.7%. Conversely, CMCO has faced significant challenges, reflected in its steep price decline of 55.24% and a negative net income. Both companies hold a B+ rating, yet NDSN’s higher return on equity and assets indicate better operational efficiency.

Investors focused on stability may prefer NDSN, while those with a higher risk tolerance might find CMCO’s lower valuation attractive for potential recovery. However, I advise caution regarding CMCO’s operational sustainability amid market pressures.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Nordson Corporation and Columbus McKinnon Corporation to enhance your investment decisions: