In today’s fast-paced industrial landscape, choosing the right investment can be challenging, especially when comparing companies within the same sector. This analysis focuses on Nordson Corporation (NDSN) and JBT Marel Corporation (JBTM), both key players in the Industrial Machinery industry. With overlapping markets and distinct innovation strategies, these companies offer unique opportunities for investors. Join me as we explore which of these firms stands out as the more compelling investment choice.

Table of contents

Company Overview

Nordson Corporation Overview

Nordson Corporation (NDSN) is a leading global provider of precision technology solutions, primarily focused on dispensing, applying, and controlling adhesives, coatings, and other industrial fluids. Established in 1935 and headquartered in Westlake, Ohio, Nordson operates through two main segments: Industrial Precision Solutions and Advanced Technology Solutions. It serves a diverse array of industries, offering innovative solutions that enhance productivity and efficiency in manufacturing processes. With a market capitalization of approximately $13.37B and a stable dividend payout, Nordson is well-positioned in the industrial machinery sector, emphasizing quality and precision in its offerings.

JBT Marel Corporation Overview

JBT Marel Corporation (JBTM), incorporated in 1994 and headquartered in Chicago, Illinois, provides advanced technology solutions tailored for the food and beverage industry. Its extensive product range includes processing, packaging, and material handling solutions, which cater to various sectors from baby food to pharmaceuticals. With a market cap of around $7.34B, JBT Marel aims to enhance operational efficiencies in food production and logistics, underscoring its commitment to innovation and customer satisfaction. The company recently rebranded from John Bean Technologies Corporation in January 2025, signaling a new chapter in its growth trajectory.

Key Similarities and Differences

Both Nordson and JBT Marel operate in the industrial machinery sector and utilize direct sales and distribution networks to reach their customers. However, their primary focus differs; Nordson specializes in adhesive and coating technologies, while JBT Marel emphasizes solutions for the food and beverage industries. This distinction shapes their product offerings and market strategies, highlighting their unique positions within the industrial landscape.

Income Statement Comparison

Below is a comparative overview of the income statements for Nordson Corporation (NDSN) and JBT Marel Corporation (JBTM) for the most recent fiscal year.

| Metric | Nordson Corporation (NDSN) | JBT Marel Corporation (JBTM) |

|---|---|---|

| Revenue | 2.69B | 1.72B |

| EBITDA | 810.58M | 204.20M |

| EBIT | 674.41M | 114.80M |

| Net Income | 467.28M | 85.40M |

| EPS | 8.17 | 2.67 |

Interpretation of Income Statement

In the latest fiscal year, Nordson Corporation experienced a revenue increase to 2.69B, up from 2.63B the previous year, indicating a steady growth trajectory. However, JBT Marel Corporation also showed growth, with revenues rising to 1.72B from 1.66B. While NDSN’s net income slightly decreased from 487.49M to 467.28M, indicating a minor decline in profitability, JBTM’s net income rose substantially from 137.40M to 854M, showcasing a significant improvement in efficiency and margins. Ultimately, JBTM’s performance reflects a notable recovery and growth potential, warranting attention from investors seeking value.

Financial Ratios Comparison

Below is a comparative table showing the most recent revenue and financial ratios for Nordson Corporation (NDSN) and JBT Marel Corporation (JBTM).

| Metric | NDSN | JBTM |

|---|---|---|

| ROE | 15.94% | 5.53% |

| ROIC | 9.65% | 3.65% |

| P/E | 30.56 | 5.46 |

| P/B | 4.87 | 2.14 |

| Current Ratio | 2.41 | 3.48 |

| Quick Ratio | 1.51 | 3.04 |

| D/E | 0.79 | 0.81 |

| Debt-to-Assets | 38.67% | 36.68% |

| Interest Coverage | 7.58 | 6.10 |

| Asset Turnover | 0.45 | 0.61 |

| Fixed Asset Turnover | 4.21 | 7.34 |

| Payout ratio | 34.55% | 2.20% |

| Dividend yield | 1.13% | 0.32% |

Interpretation of Financial Ratios

Comparing the financial ratios of NDSN and JBTM reveals notable differences. NDSN exhibits stronger profitability metrics, notably a higher ROE and ROIC, indicating more efficient use of equity and invested capital. JBTM, while having a better current and quick ratio, reflects weaker margins and higher leverage ratios. The low payout and dividend yield from JBTM suggest a focus on reinvestment rather than returns to shareholders, which may raise concerns regarding liquidity and cash management. Overall, NDSN appears to be the stronger performer, but JBTM’s potential for growth should not be overlooked.

Dividend and Shareholder Returns

Nordson Corporation (NDSN) displays a steady dividend policy with a payout ratio of 34.5% and a dividend yield of 1.13%. The company has demonstrated a consistent trend in dividend payments, supported by a healthy free cash flow. However, risks include potential unsustainable distributions if earnings decline.

Conversely, JBT Marel Corporation (JBTM) maintains a minimal dividend payout ratio of 2.20% and focuses on reinvesting earnings for growth. This strategy aligns with long-term value creation, though it limits immediate shareholder returns. Both companies engage in share buybacks, indicating a commitment to returning capital to shareholders. Overall, NDSN’s dividends and JBTM’s reinvestment strategy both have merits in fostering sustainable shareholder value.

Strategic Positioning

In the industrial machinery sector, Nordson Corporation (NDSN) holds a market cap of approximately $13.4B, while JBT Marel Corporation (JBTM) follows with around $7.3B. NDSN focuses on precision dispensing systems, while JBTM specializes in food processing technologies. Both companies face competitive pressure from emerging technologies and established players. Market share dynamics may shift due to technological disruptions, particularly in automation and operational efficiency, which I closely monitor for potential investment opportunities.

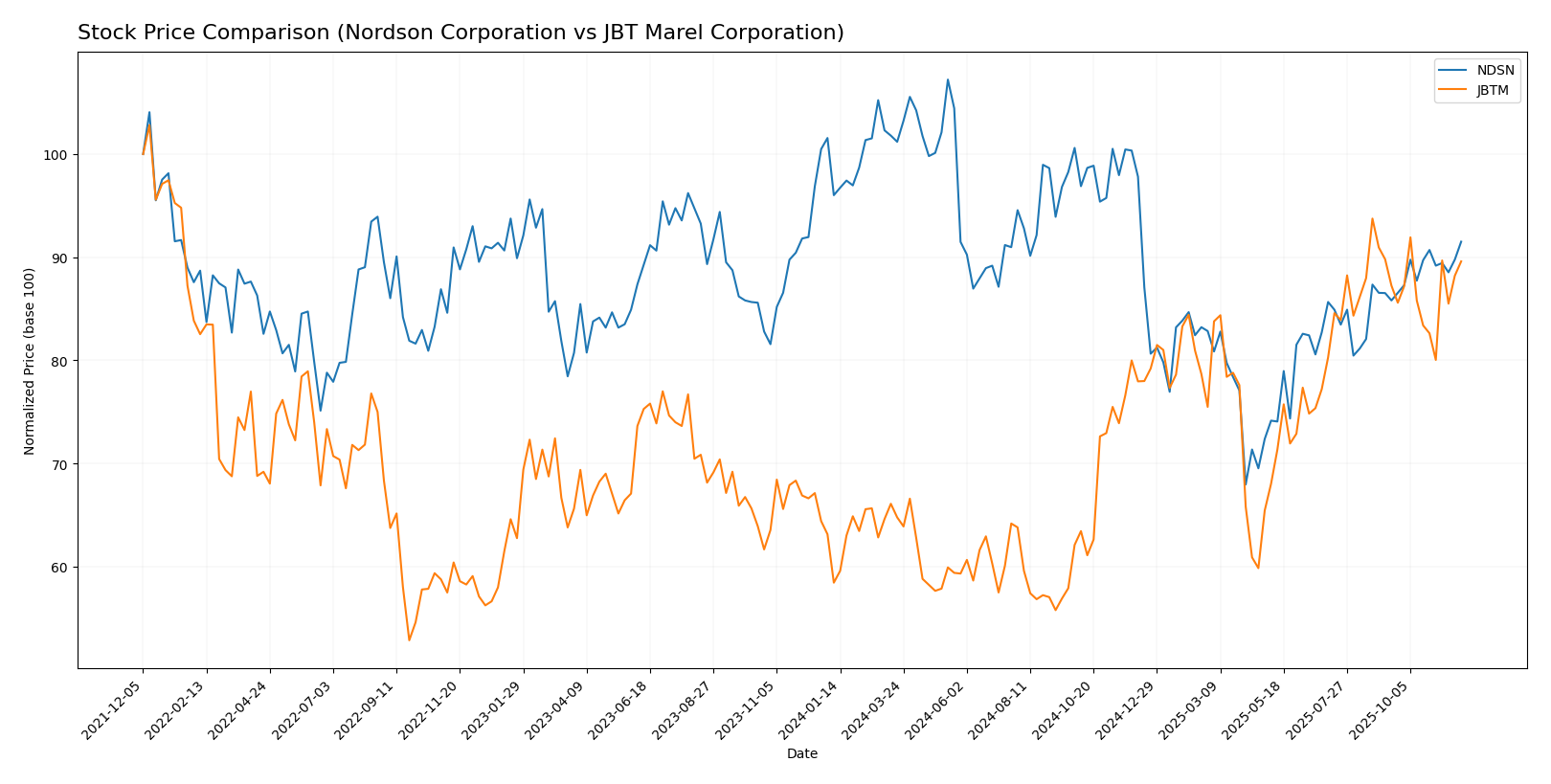

Stock Comparison

In this analysis, I will compare the stock price movements of Nordson Corporation (NDSN) and JBT Marel Corporation (JBTM) over the past year, highlighting significant price dynamics and trading trends.

Trend Analysis

Nordson Corporation (NDSN)

Over the past year, NDSN experienced a price change of -4.7%, indicating a bearish trend. Despite this overall decline, the recent trend from September 14, 2025, to November 30, 2025, has shown a positive movement with a 6.65% increase, suggesting a potential short-term recovery. The highest price reached during the year was 278.89, while the lowest was 176.73. The stock is currently in a phase of acceleration, with a standard deviation of 23.83, indicating notable volatility.

JBT Marel Corporation (JBTM)

In contrast, JBTM has demonstrated a robust bullish trend over the past year, with a significant price increase of 53.35%. However, the recent trend from September 14, 2025, to November 30, 2025, has slowed, with a modest 2.7% increase. The stock’s highest price was 147.7, while the lowest was 87.85. The acceleration status is noted as deceleration, with a standard deviation of 17.44, suggesting a decrease in volatility compared to previous periods.

In summary, while NDSN is currently facing challenges with a bearish overall trend, JBTM exhibits a strong bullish trajectory, albeit with signs of slowing momentum in the recent timeframe.

Analyst Opinions

Recent analyst recommendations for Nordson Corporation (NDSN) indicate a “Buy” rating, with an overall score of 3. Analysts cite strong performance in return on equity (4) and return on assets (5) as key strengths. In contrast, JBT Marel Corporation (JBTM) has received a “Hold” rating (C), reflecting concerns over its lower return on equity (1) and return on assets (1). The consensus for NDSN is a clear buy, while JBTM remains neutral. As an investor, I recommend focusing on NDSN for potential growth.

Stock Grades

In the current market, I have gathered reliable stock grades for two companies: Nordson Corporation (NDSN) and JBT Marel Corporation (JBTM). Here’s a closer look at their recent evaluations.

Nordson Corporation (NDSN) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2025-08-25 |

| Baird | Maintain | Neutral | 2025-08-22 |

| Keybanc | Maintain | Overweight | 2025-07-15 |

| Oppenheimer | Upgrade | Outperform | 2025-05-30 |

| Baird | Maintain | Neutral | 2025-05-30 |

| Keybanc | Maintain | Overweight | 2025-04-08 |

| Keybanc | Upgrade | Overweight | 2025-03-04 |

| Baird | Maintain | Neutral | 2025-02-21 |

| Loop Capital | Upgrade | Buy | 2025-01-22 |

| Seaport Global | Upgrade | Buy | 2024-12-17 |

JBT Marel Corporation (JBTM) Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| William Blair | Upgrade | Outperform | 2025-08-06 |

Overall, the grades for Nordson Corporation reflect a stable outlook with multiple maintain ratings, indicating that analysts have confidence in its performance. JBT Marel Corporation has seen an upgrade to “Outperform,” suggesting a positive shift in sentiment. These trends might indicate a favorable environment for investors looking to add these stocks to their portfolios.

Target Prices

The consensus target prices for the following companies reflect analysts’ expectations for future performance.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Nordson Corporation (NDSN) | 285 | 240 | 263 |

| JBT Marel Corporation (JBTM) | 169 | 169 | 169 |

For Nordson Corporation, the target consensus of 263 indicates potential growth compared to its current price of 238. JBT Marel Corporation’s consensus of 169 aligns with its current price of 141.16, suggesting room for upward movement.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of two companies, Nordson Corporation (NDSN) and JBT Marel Corporation (JBTM), based on their most recent financial data.

| Criterion | Nordson Corporation (NDSN) | JBT Marel Corporation (JBTM) |

|---|---|---|

| Diversification | High – multiple segments in industrial machinery | Moderate – focused on food and beverage technology |

| Profitability | Strong – net profit margin of 17.37% | Weak – net profit margin of 4.98% |

| Innovation | High – significant R&D investments | Moderate – innovative solutions in food processing |

| Global presence | Strong – operations in multiple countries | Strong – broad market reach across continents |

| Market Share | Competitive – solid position in machinery sector | Growing – expanding in food technology sector |

| Debt level | Moderate – debt to equity ratio of 0.79 | High – debt to equity ratio of 0.81 |

Key takeaways indicate that while Nordson Corporation exhibits strong profitability and diversification, JBT Marel Corporation is more focused on a specific niche with growth potential but faces profitability challenges.

Risk Analysis

The following table outlines the key risks associated with Nordson Corporation (NDSN) and JBT Marel Corporation (JBTM).

| Metric | Nordson Corporation | JBT Marel Corporation |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Low | High |

| Environmental Risk | Moderate | High |

| Geopolitical Risk | Moderate | High |

In summary, both companies face significant market and operational risks, particularly JBT Marel Corporation, which operates in a heavily regulated and competitive food and beverage technology sector. The geopolitical landscape may also impact JBTM more severely than NDSN, given its broader international exposure.

Which one to choose?

When comparing Nordson Corporation (NDSN) and JBT Marel Corporation (JBTM), NDSN stands out due to its stronger profit margins, higher return on equity (ROE of 16%), and overall better financial health. NDSN’s gross profit margin is 55.2%, while JBTM’s sits at 36.5%. Analysts rate NDSN as a B+, reflecting its robust fundamentals, whereas JBTM receives a C rating, indicating concerns around its profitability and growth potential. Stock trends also favor NDSN, which is currently in a bearish phase but shows signs of recent recovery, while JBTM has demonstrated significant bullish growth over the past year.

For growth-oriented investors, NDSN appears favorable, while conservative investors might find JBTM’s lower price-to-earnings ratio appealing. However, JBTM’s reliance on market trends raises risks related to competition and valuation.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Nordson Corporation and JBT Marel Corporation to enhance your investment decisions: