In the rapidly evolving landscapes of technology and industrial automation, two companies stand out for their innovative approaches: Teradyne, Inc. and Symbotic Inc. Both operate within sectors that are crucial for enhancing operational efficiency, albeit from different angles—Teradyne focuses on semiconductors, while Symbotic excels in warehouse automation. This analysis will compare their strategies, market presence, and growth potential, ultimately guiding you to the more compelling investment opportunity. Let’s uncover which company deserves a spot in your portfolio.

Table of contents

Company Overview

Teradyne, Inc. Overview

Teradyne, Inc. is a leader in the semiconductor test equipment market, committed to enhancing the efficiency of electronic device manufacturing. Established in 1960 and headquartered in North Reading, MA, Teradyne designs and manufactures automated test solutions for various applications, including automotive, industrial, and consumer electronics. With a diverse portfolio that includes testing platforms for memory devices and wireless technologies, the company serves a wide range of clients, from integrated device manufacturers to semiconductor assembly providers. Teradyne’s focus on innovation and quality positions it as a vital player in the tech industry, with a market cap of approximately $28.8B.

Symbotic Inc. Overview

Founded in 2021 and based in Wilmington, MA, Symbotic Inc. specializes in automation technology aimed at revolutionizing warehouse operations for retailers and wholesalers across the United States. The company offers the Symbotic System, a comprehensive automation solution designed to optimize warehouse efficiency, reduce operational costs, and enhance inventory management. With a market cap nearing $52.7B, Symbotic is rapidly expanding its footprint in the industrial sector, leveraging robotics to streamline logistics and supply chain processes.

Key Similarities and Differences

Both Teradyne and Symbotic operate within technologically advanced sectors, focusing on automation and efficiency. However, Teradyne primarily serves the semiconductor industry with testing equipment, while Symbotic targets the logistics and warehousing sector with its robotics solutions. Their business models reflect distinct approaches: Teradyne emphasizes precision testing for electronics, whereas Symbotic aims at transforming supply chain operations through automation technology.

Income Statement Comparison

Below is a comparison of the most recent income statements for Teradyne, Inc. and Symbotic Inc., highlighting key financial metrics for your evaluation.

| Metric | Teradyne, Inc. (TER) | Symbotic Inc. (SYM) |

|---|---|---|

| Revenue | 2.82B | 2.25B |

| EBITDA | 732M | -75M |

| EBIT | 613M | -115M |

| Net Income | 542M | -81M |

| EPS | 3.41 | -0.16 |

Interpretation of Income Statement

In the latest fiscal year, Teradyne, Inc. experienced notable revenue growth, rising from 2.67B in 2023 to 2.82B in 2024, alongside a significant increase in net income from 449M to 542M. This reflects improved operating efficiency and robust demand. In contrast, Symbotic Inc. reported widening losses, with a decrease in revenue from 1.78B in 2024 to 2.25B in 2025. The company’s negative EBITDA and EBIT indicate persistent operational challenges. Overall, Teradyne showcases solid growth and profitability, while Symbotic’s financial instability signals potential risks for investors.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent revenue and financial ratios for Teradyne, Inc. (TER) and Symbotic Inc. (SYM).

| Metric | Teradyne, Inc. (TER) | Symbotic Inc. (SYM) |

|---|---|---|

| ROE | 19.24% | -16.67% |

| ROIC | 17.25% | -17.47% |

| P/E | 36.93 | -70.32 |

| P/B | 7.10 | 11.73 |

| Current Ratio | 2.91 | 1.09 |

| Quick Ratio | 1.84 | 0.99 |

| D/E | 0.03 | 0.00 |

| Debt-to-Assets | 0.02 | 0.00 |

| Interest Coverage | 165.54 | N/A |

| Asset Turnover | 0.76 | 0.94 |

| Fixed Asset Turnover | 4.88 | 19.10 |

| Payout Ratio | 14.09% | 0.00% |

| Dividend Yield | 0.38% | 0.00% |

Interpretation of Financial Ratios

Teradyne, Inc. displays strong financial health with solid profitability ratios, indicating effective use of equity and capital. The company’s current and quick ratios suggest good liquidity, while a low debt-to-assets ratio reflects conservative leverage. In contrast, Symbotic Inc. presents concerning ratios, including negative returns and a high P/B ratio, which may indicate overvaluation. Their liquidity ratios are below ideal levels, raising potential solvency concerns. Caution is advised when considering investments in SYM.

Dividend and Shareholder Returns

Teradyne, Inc. (TER) pays a dividend with a payout ratio of approximately 14.1%, reflecting a stable dividend per share trend and an annual yield of 0.38%. The company also engages in share buybacks, which can enhance shareholder value but may carry risks if done excessively. In contrast, Symbotic Inc. (SYM) does not distribute dividends, as it focuses on reinvestment for growth amid negative net income. While this approach can foster long-term value creation, it requires careful monitoring of financial health.

Strategic Positioning

In the semiconductor sector, Teradyne, Inc. (TER) holds a market cap of $28.8B, primarily focusing on automatic test equipment, giving it a robust position amidst competitive pressures. Symbotic Inc. (SYM), with a market cap of $52.7B, leverages automation technology to enhance warehouse efficiency, positioning itself strongly in the industrial machinery space. Both companies face technological disruptions but maintain distinct competitive advantages—Teradyne in testing solutions and Symbotic in warehouse automation systems.

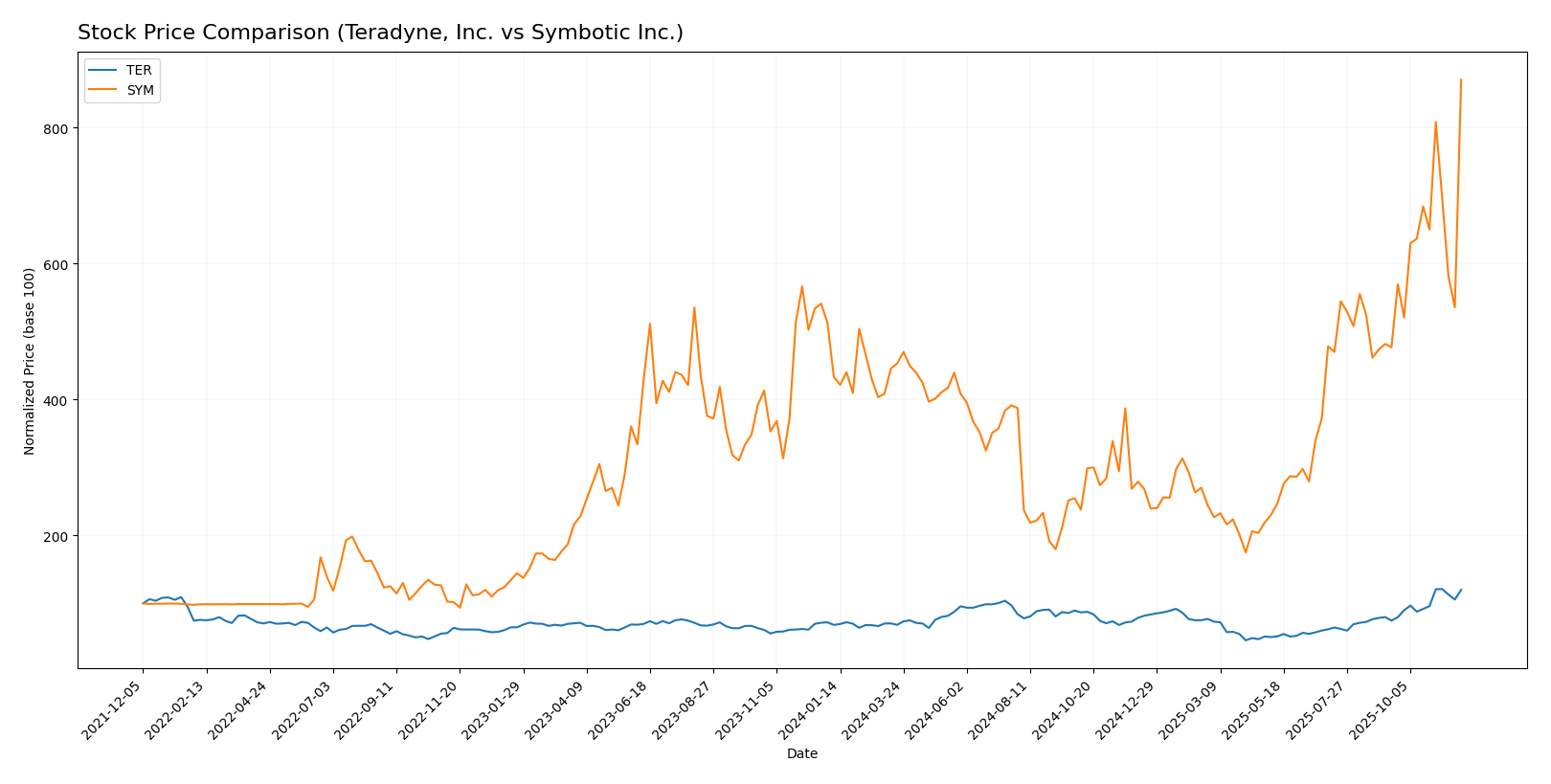

Stock Comparison

In analyzing the stock price movements of Teradyne, Inc. (TER) and Symbotic Inc. (SYM) over the past year, notable trends reveal significant bullish momentum for both companies, characterized by substantial percentage gains and increasing trading volumes.

Trend Analysis

Teradyne, Inc. (TER) has experienced a remarkable price change of 75.64% over the past year, indicating a bullish trend. The stock has shown acceleration, with notable highs reaching 182.28 and lows at 68.72. The standard deviation of 24.49 suggests moderate volatility in the stock’s price movements. In the recent period from September 14, 2025, to November 30, 2025, the price change is 60.83%, maintaining a strong upward slope.

Symbotic Inc. (SYM) has recorded an even more impressive price change of 100.97% over the past year, also reflecting a bullish trend with acceleration. The stock’s price peaked at 87.2 and fell to a low of 17.5. The standard deviation here is 14.12, indicating relatively lower volatility compared to TER. In the recent timeframe from September 14, 2025, to November 30, 2025, SYM’s price change stands at 82.62%, further supporting its upward momentum.

Both companies exhibit strong buyer dominance in their trading volumes, with TER showing a buyer percentage of 59.83% and SYM at 54.2%, both indicating an increasing volume trend that aligns with their price movements.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for Teradyne, Inc. (TER) and Symbotic Inc. (SYM). Analysts rate TER as a “Buy” with a solid overall score of 3, driven by strong return on assets (5) and return on equity (4), suggesting robust financial health. In contrast, SYM holds a “Hold” rating with an overall score of 2, primarily hindered by low scores in return on equity (1) and return on assets (1). The consensus for TER is a “Buy,” while SYM leans towards a cautious “Hold.”

Stock Grades

I have gathered the most recent stock grades for two companies, Teradyne, Inc. (TER) and Symbotic Inc. (SYM). Below are the reliable grades provided by recognized grading companies.

Teradyne, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-12 |

| Goldman Sachs | maintain | Sell | 2025-10-30 |

| JP Morgan | maintain | Neutral | 2025-10-30 |

| UBS | maintain | Buy | 2025-10-30 |

| Evercore ISI Group | maintain | Outperform | 2025-10-30 |

| Stifel | maintain | Hold | 2025-10-28 |

| Evercore ISI Group | maintain | Outperform | 2025-10-28 |

| UBS | maintain | Buy | 2025-10-20 |

| Morgan Stanley | maintain | Equal Weight | 2025-10-14 |

| Stifel | maintain | Hold | 2025-10-13 |

Symbotic Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | maintain | Neutral | 2025-11-26 |

| Barclays | maintain | Underweight | 2025-11-26 |

| Craig-Hallum | upgrade | Buy | 2025-11-25 |

| Citigroup | maintain | Buy | 2025-11-25 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-25 |

| DA Davidson | maintain | Neutral | 2025-11-25 |

| Northland Capital Markets | maintain | Outperform | 2025-11-25 |

| UBS | downgrade | Sell | 2025-09-23 |

| DA Davidson | downgrade | Neutral | 2025-08-25 |

| Needham | maintain | Buy | 2025-08-07 |

Overall, the grades for Teradyne show a mix of maintains and a couple of sells, indicating a cautious sentiment among analysts, whereas Symbotic has seen some upgrades, which reflects a more positive outlook despite some downgrades. This indicates a need for careful consideration when evaluating these stocks for investment.

Target Prices

The consensus target prices for the companies analyzed reflect the expectations of analysts regarding future stock performance.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Teradyne, Inc. | 215 | 119 | 172.67 |

| Symbotic Inc. | 83 | 41 | 67.38 |

For Teradyne, analysts expect a consensus target price of 172.67, which is slightly below the current price of 179.38. Symbotic’s consensus target of 67.38 indicates potential upside, given its current price of 87.30.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Teradyne, Inc. (TER) and Symbotic Inc. (SYM) based on the most recent data.

| Criterion | Teradyne, Inc. (TER) | Symbotic Inc. (SYM) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (Net Margin: 19.23%) | Weak (Net Margin: -3.59%) |

| Innovation | High | Moderate |

| Global presence | Strong | Limited |

| Market Share | Significant | Emerging |

| Debt level | Low (Debt to Equity: 0.03) | None (Debt to Equity: 0) |

Key takeaways indicate that Teradyne demonstrates strong profitability and low debt levels, positioning it favorably in the market. In contrast, Symbotic shows promise in innovation but struggles with profitability and market presence, suggesting higher risk for investors.

Risk Analysis

The following table outlines the key risks associated with Teradyne, Inc. (TER) and Symbotic Inc. (SYM):

| Metric | Teradyne, Inc. | Symbotic Inc. |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | Medium | High |

| Operational Risk | Low | High |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | Medium |

In recent evaluations, Symbotic faces significant operational and market risks, particularly due to its high debt-to-equity ratio and negative profit margins. Teradyne, while exposed to market fluctuations, maintains a stronger financial position with a lower operational risk profile.

Which one to choose?

In comparing Teradyne, Inc. (TER) and Symbotic Inc. (SYM), Teradyne appears to be the more favorable choice for investors. TER boasts a solid market cap of $20.03B, a gross profit margin of 58.5%, and a robust net profit margin of 19.2%. Its price-to-earnings ratio stands at 36.93, indicating a stronger valuation compared to SYM, which has a negative net profit margin and a price-to-earnings ratio of -70.32. Analyst ratings reflect this sentiment, with TER rated B and SYM rated C, suggesting a more stable outlook for Teradyne.

For growth-oriented investors, Teradyne seems suitable, while those seeking higher risk and potential rewards may consider Symbotic. However, investors should be aware of inherent risks in Teradyne’s industry, such as competition and supply chain challenges.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Teradyne, Inc. and Symbotic Inc. to enhance your investment decisions: