In today’s dynamic industrial landscape, understanding which companies stand out can greatly influence your investment decisions. This analysis compares Rockwell Automation, Inc. (ROK) and Kadant Inc. (KAI), both prominent players in the industrial machinery sector. With overlapping market focuses and distinct innovation strategies, these companies present unique investment opportunities. Join me as we explore their strengths and weaknesses, ultimately determining which company may be the more compelling choice for your portfolio.

Table of contents

Company Overview

Rockwell Automation, Inc. Overview

Rockwell Automation, Inc. is a leader in industrial automation and digital transformation solutions, catering to a diverse array of markets including automotive, semiconductor, and food and beverage. Founded in 1903 and headquartered in Milwaukee, Wisconsin, the company operates through three primary segments: Intelligent Devices, Software & Control, and Lifecycle Services. Their comprehensive offerings range from hardware and software products to consulting and maintenance services, enabling customers to enhance operational efficiency and productivity. With a market cap of approximately $44.4B, Rockwell is well-positioned to capitalize on the growing demand for automation technologies in various industries.

Kadant Inc. Overview

Kadant Inc., established in 1991 and based in Westford, Massachusetts, specializes in supplying engineered systems and technologies primarily for the manufacturing sector. The company operates through three segments: Flow Control, Industrial Processing, and Material Handling. Kadant’s products include fluid-handling systems, industrial automation solutions, and biodegradable absorbent granules. With a market cap of about $3.3B, Kadant serves a niche market but holds a strong position in sectors such as packaging, wood products, and alternative fuels.

Key Similarities and Differences

Both Rockwell Automation and Kadant operate within the industrial machinery sector, focusing on enhancing operational efficiencies through technology. However, Rockwell’s broader range of offerings and larger market cap suggest a more comprehensive approach to industrial automation, while Kadant specializes in engineered systems for specific applications, positioning it distinctly within specialized niches.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Rockwell Automation, Inc. (ROK) and Kadant Inc. (KAI), highlighting key financial metrics.

| Metric | Rockwell Automation, Inc. (ROK) | Kadant Inc. (KAI) |

|---|---|---|

| Revenue | 8.34B | 1.05B |

| EBITDA | 1.40B | 222M |

| EBIT | 1.07B | 173M |

| Net Income | 869M | 112M |

| EPS | 7.69 | 9.51 |

Interpretation of Income Statement

In the latest fiscal year, Rockwell Automation (ROK) experienced a revenue growth to 8.34B, a slight increase from 8.26B the previous year, while net income rose to 869M despite a decrease in margins. Conversely, Kadant Inc. (KAI) demonstrated solid growth with revenue reaching 1.05B, up from 958M, and net income also increased to 112M. ROK’s margins have shown some pressure, which may be a result of rising costs, while KAI’s efficient cost management has positively impacted their profitability. Overall, both companies are navigating their operational challenges, but KAI appears to be capitalizing better on its growth opportunities.

Financial Ratios Comparison

Below is a comparative analysis of key financial metrics for Rockwell Automation, Inc. (ROK) and Kadant Inc. (KAI) based on the most recent data.

| Metric | ROK | KAI |

|---|---|---|

| ROE | 38.79% | 13.17% |

| ROIC | 16.16% | 10.08% |

| P/E | 27.13 | 28.26 |

| P/B | 8.75 | 4.24 |

| Current Ratio | 2.37 | 2.05 |

| Quick Ratio | 1.56 | 1.34 |

| D/E | 0.97 | 0.38 |

| Debt-to-Assets | 31.67% | 11.54% |

| Interest Coverage | 8.37 | 19.74 |

| Asset Turnover | 0.74 | 0.81 |

| Fixed Asset Turnover | 6.89 | 5.78 |

| Payout Ratio | 59.95% | 11.39% |

| Dividend Yield | 1.87% | 0.40% |

Interpretation of Financial Ratios

ROK demonstrates stronger profitability metrics, with a significantly higher ROE and ROIC compared to KAI, indicating effective capital utilization. However, ROK’s high P/B ratio suggests it may be overvalued relative to its book value. KAI shows better debt management with a lower D/E ratio and higher interest coverage, indicating it can comfortably meet its obligations. Investors should weigh ROK’s growth potential against its valuation and KAI’s stability and lower risk profile.

Dividend and Shareholder Returns

Rockwell Automation, Inc. (ROK) has a dividend payout ratio of 59.9%, yielding approximately 1.87%. This reflects a commitment to returning value to shareholders, despite risks from potential unsustainable distributions. In contrast, Kadant Inc. (KAI) pays a modest dividend with a payout ratio of 13.1% and a yield of 0.36%. Both companies engage in share buybacks, which can enhance shareholder value. Overall, ROK’s higher dividend commitment may better support long-term value creation compared to KAI’s conservative approach.

Strategic Positioning

Rockwell Automation (ROK) holds a significant market share in the industrial automation sector, benefiting from its well-established product lines, including Intelligent Devices and Software & Control. With a market cap of $44.4B, it faces competitive pressure primarily from Kadant Inc. (KAI), which, despite a smaller market cap of $3.3B, has a strong presence in fluid-handling and material handling systems. Both companies must navigate technological disruptions in automation and digital transformation to maintain their positions.

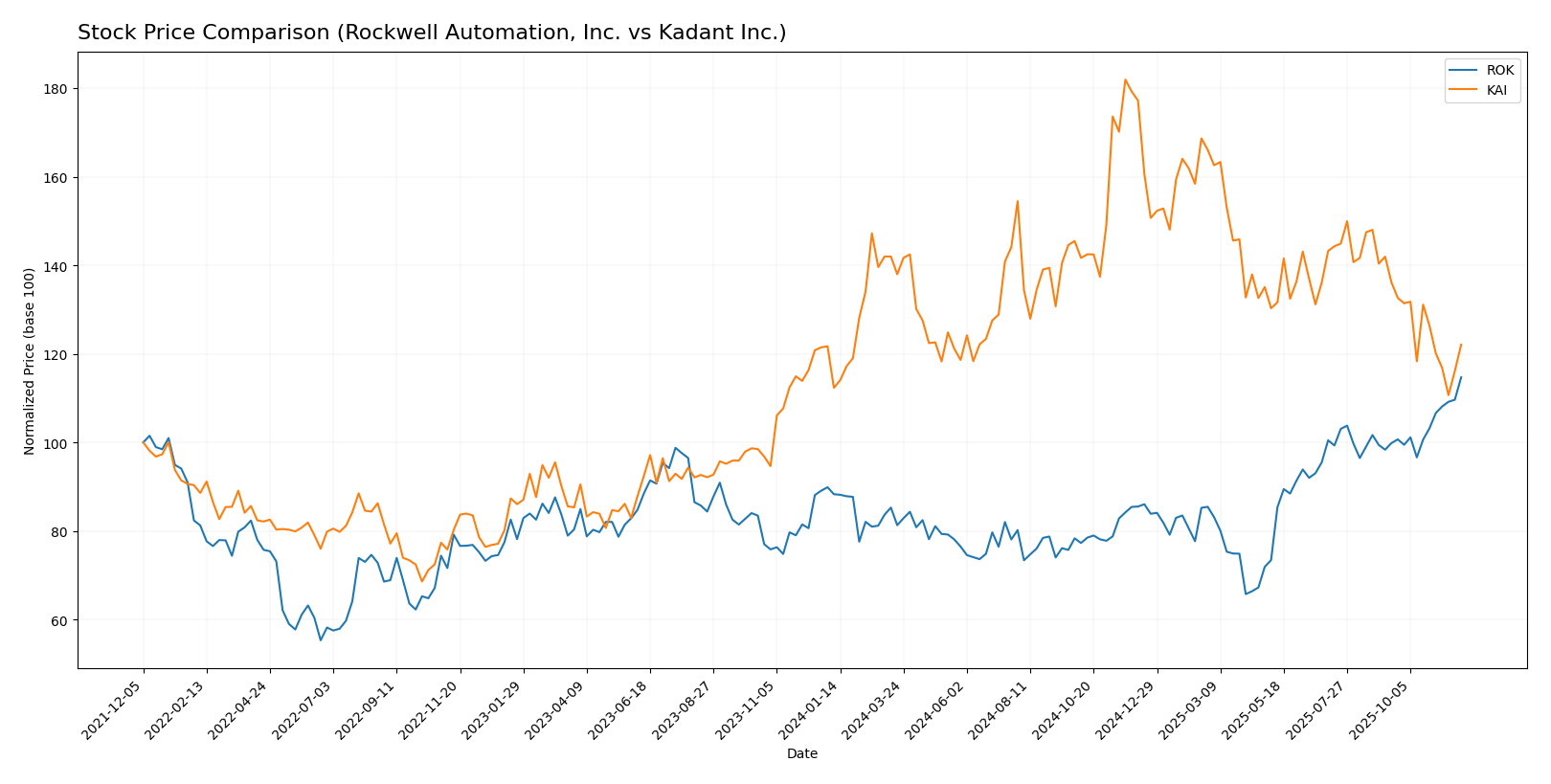

Stock Comparison

In the past year, the stock price movements of Rockwell Automation, Inc. (ROK) and Kadant Inc. (KAI) have exhibited notable dynamics, reflecting varying investor sentiments and market conditions.

Trend Analysis

Rockwell Automation, Inc. (ROK) has demonstrated a bullish trend with a price change of +29.89% over the past year. The stock has experienced notable acceleration, with a highest price of 396.23 and a lowest price of 227.11. The standard deviation of 36.7 indicates a moderate level of volatility, suggesting active trading behavior. Recent trends show a 14.87% increase from September 14, 2025, to November 30, 2025, with a trend slope of 4.58.

Kadant Inc. (KAI) also reflects a bullish trend, with an overall price change of +8.67% over the past year; however, it is currently facing a deceleration in momentum. The stock reached a high of 419.01 and a low of 254.91, accompanied by a standard deviation of 35.56. Recently, from September 14, 2025, to November 30, 2025, KAI has seen a -10.32% decline, indicated by a negative trend slope of -4.21.

In summary, while ROK shows strong upward movement and acceleration, KAI’s recent downturn suggests caution despite its overall positive performance over the year.

Analyst Opinions

Recent analyst ratings reflect a mixed outlook for Rockwell Automation, Inc. (ROK), which has received a C- rating, indicating a cautious stance. Analysts highlight concerns regarding its return on equity and debt levels. Conversely, Kadant Inc. (KAI) has garnered a more favorable B+ rating, with analysts praising its strong return on assets and overall financial health. The consensus for KAI leans towards a buy, while ROK is generally viewed as a hold. As an investor, I recommend closely monitoring these trends before making any decisions.

Stock Grades

In the latest evaluations, we see consistent ratings from reputable grading companies for Rockwell Automation, Inc. (ROK) and Kadant Inc. (KAI), indicating a stable outlook for both stocks.

Rockwell Automation, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | Maintain | Outperform | 2025-11-21 |

| B of A Securities | Maintain | Buy | 2025-11-20 |

| JP Morgan | Maintain | Neutral | 2025-11-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-10 |

| Barclays | Maintain | Overweight | 2025-11-07 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-10-15 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

| Barclays | Maintain | Overweight | 2025-08-14 |

Kadant Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barrington Research | Maintain | Outperform | 2025-10-30 |

| Barrington Research | Maintain | Outperform | 2025-10-29 |

| Barrington Research | Maintain | Outperform | 2025-10-27 |

| Barrington Research | Maintain | Outperform | 2025-10-10 |

| Barrington Research | Maintain | Outperform | 2025-09-23 |

| DA Davidson | Maintain | Neutral | 2025-08-04 |

| Barrington Research | Maintain | Outperform | 2025-07-30 |

| Barrington Research | Maintain | Outperform | 2025-07-29 |

| Barrington Research | Maintain | Outperform | 2025-05-01 |

| DA Davidson | Maintain | Neutral | 2025-05-01 |

Overall, both ROK and KAI exhibit strong support from analysts, with a majority maintaining positive ratings, suggesting a favorable investment climate for these stocks. The consistent grades reflect a solid confidence in their operational performance and market positioning.

Target Prices

The consensus target prices for Rockwell Automation, Inc. (ROK) and Kadant Inc. (KAI) indicate positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rockwell Automation, Inc. | 402 | 345 | 377.6 |

| Kadant Inc. | 410 | 275 | 342.5 |

For Rockwell Automation (ROK), the current stock price of 395.83 is close to the consensus target of 377.6, suggesting that analysts expect stability. In contrast, Kadant Inc. (KAI) is trading at 281.06, which is below its consensus target of 342.5, indicating potential upside.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Rockwell Automation, Inc. (ROK) and Kadant Inc. (KAI) based on the most recent data.

| Criterion | Rockwell Automation, Inc. (ROK) | Kadant Inc. (KAI) |

|---|---|---|

| Diversification | Strong across various sectors | Moderate, focused on specific industries |

| Profitability | High profit margins (15.3% net) | Moderate margins (10.6% net) |

| Innovation | Leader in automation technology | Steady improvements in technology |

| Global presence | Extensive international reach | Limited compared to ROK |

| Market Share | Strong in industrial automation | Niche player in engineered systems |

| Debt level | Moderate (debt-to-equity 1.17) | Low (debt-to-equity 0.38) |

Key takeaways indicate that while Rockwell Automation excels in profitability and global reach, Kadant Inc. maintains a lower debt level and operates in specific niches effectively. Diversification in Rockwell’s portfolio may provide a buffer against market volatility.

Risk Analysis

In this section, I will outline the key risks associated with two companies, Rockwell Automation, Inc. (ROK) and Kadant Inc. (KAI), using relevant metrics.

| Metric | Rockwell Automation (ROK) | Kadant Inc. (KAI) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | Low |

The most impactful risks for ROK are market and regulatory risks, given its heavy reliance on industrial sectors and potential regulatory changes. KAI faces significant regulatory risk, particularly in environmental compliance, which could affect its operations and profitability.

Which one to choose?

When comparing Rockwell Automation, Inc. (ROK) and Kadant Inc. (KAI), the latter appears more favorable for investors seeking stability and growth. KAI has a strong overall rating of B+ compared to ROK’s C-, indicating better performance in key financial metrics such as return on assets and equity. Moreover, KAI’s gross profit margin of approximately 43% suggests stronger profitability relative to ROK, which has faced challenges reflected in stagnant profit margins.

From a technical perspective, ROK has shown a bullish trend with a 29.89% price increase recently, while KAI’s growth has decelerated, with a 10.32% decline in the same timeframe. KAI’s lower debt-to-equity ratio (0.38) further highlights its stable financial position compared to ROK’s (0.97).

Investors focused on growth may prefer KAI, while those prioritizing short-term gains with a bullish trend may look at ROK. However, both companies face risks relating to competition and market dependence in their respective industries.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Rockwell Automation, Inc. and Kadant Inc. to enhance your investment decisions: