In the rapidly evolving landscape of industrial automation, Rockwell Automation, Inc. (ROK) and Symbotic Inc. (SYM) stand out as compelling players worth analyzing. Both companies operate within the Industrial – Machinery sector, focusing on innovative automation solutions, yet they cater to different facets of the market. Rockwell offers a broad array of industrial automation products, while Symbotic specializes in robotics for warehouse efficiency. Join me as we delve into their distinct strategies and performance to uncover which of these companies presents the more intriguing investment opportunity.

Table of contents

Company Overview

Rockwell Automation, Inc. Overview

Rockwell Automation, Inc. is a leader in industrial automation and digital transformation, founded in 1903 and headquartered in Milwaukee, Wisconsin. The company operates primarily in three segments: Intelligent Devices, Software & Control, and Lifecycle Services. Rockwell’s diverse range of solutions includes hardware, software products, and consulting services targeting various discrete and process industries. With a market capitalization of approximately $44.5B, it serves critical sectors such as automotive, semiconductor, and renewable energy, focusing on enhancing operational efficiency and safety through innovative technology.

Symbotic Inc. Overview

Symbotic Inc. is an emerging player in the automation technology space, particularly known for its robotics solutions that enhance efficiency in warehouse operations. Founded in 2021 and based in Wilmington, Massachusetts, Symbotic offers a comprehensive warehouse automation system designed to reduce costs and maximize inventory management. With a market cap nearing $52.7B, the company primarily caters to retailers and wholesalers, positioning itself as a vital contributor to the evolving landscape of supply chain management.

Key similarities between Rockwell Automation and Symbotic include their focus on industrial machinery and automation technologies. However, they differ in market scope and offerings: Rockwell provides a broader array of solutions across various sectors, while Symbotic specializes in robotics for warehouse efficiency.

Income Statement Comparison

The following table presents a comparison of the most recent Income Statements for Rockwell Automation, Inc. (ROK) and Symbotic Inc. (SYM) for the fiscal year 2025.

| Metric | Rockwell Automation, Inc. (ROK) | Symbotic Inc. (SYM) |

|---|---|---|

| Revenue | 8.34B | 2.25B |

| EBITDA | 1.40B | -75.40M |

| EBIT | 1.07B | -115.01M |

| Net Income | 869M | -80.57M |

| EPS | 7.69 | -0.16 |

Interpretation of Income Statement

In 2025, Rockwell Automation demonstrated solid revenue growth, reaching 8.34B, along with a net income of 869M, showcasing effective cost management and operational efficiency. In contrast, Symbotic faced challenges, with revenue at 2.25B but a negative net income of -80.57M. ROK’s EBITDA margin remained robust, while SYM’s EBITDA was negative, indicating operational struggles. Overall, ROK exhibited stability and growth, whereas SYM’s performance highlighted significant room for improvement in profitability and expense management moving forward.

Financial Ratios Comparison

The following table summarizes the most recent financial ratios for Rockwell Automation, Inc. (ROK) and Symbotic Inc. (SYM), providing insights into their operational efficiency, profitability, and financial health.

| Metric | ROK | SYM |

|---|---|---|

| ROE | 38.79% | -166.74% |

| ROIC | 16.16% | -17.17% |

| P/E | 32.13 | -70.32 |

| P/B | 8.75 | 11.73 |

| Current Ratio | 2.37 | 1.09 |

| Quick Ratio | 1.56 | 0.99 |

| D/E | 0.97 | 0 |

| Debt-to-Assets | 0.36 | 0 |

| Interest Coverage | 8.37 | 0 |

| Asset Turnover | 0.74 | 0.94 |

| Fixed Asset Turnover | 6.89 | 19.10 |

| Payout Ratio | 59.95% | 0% |

| Dividend Yield | 1.87% | 0% |

Interpretation of Financial Ratios

ROK appears to exhibit strong financial health, highlighted by high ROE and ROIC, indicating effective capital usage. Its current and quick ratios suggest robust liquidity. In contrast, SYM shows concerning metrics, with negative returns and high debt leverage, raising red flags about its financial stability. Investors should exercise caution with SYM, focusing on ROK for potential growth.

Dividend and Shareholder Returns

Rockwell Automation, Inc. (ROK) provides a dividend with a payout ratio of approximately 39% and an annual yield of 1.87%. This suggests a sustainable distribution strategy, supported by robust free cash flow coverage. In contrast, Symbotic Inc. (SYM) does not pay dividends, reflecting its reinvestment focus during a growth phase. Despite this, it conducts share buybacks, indicating a commitment to returning value to shareholders. Both approaches—ROK’s dividends and SYM’s buybacks—can create long-term value, depending on execution and market conditions.

Strategic Positioning

Rockwell Automation (ROK) holds a significant market share in the industrial automation sector, leveraging its extensive product range across Intelligent Devices, Software & Control, and Lifecycle Services. With a market cap of $44.5B, it faces competitive pressure from Symbotic Inc. (SYM), which specializes in warehouse automation and has a market cap of $52.7B. The rise of robotics technology poses a potential disruption for traditional automation players like ROK, necessitating continual innovation to maintain its leadership position.

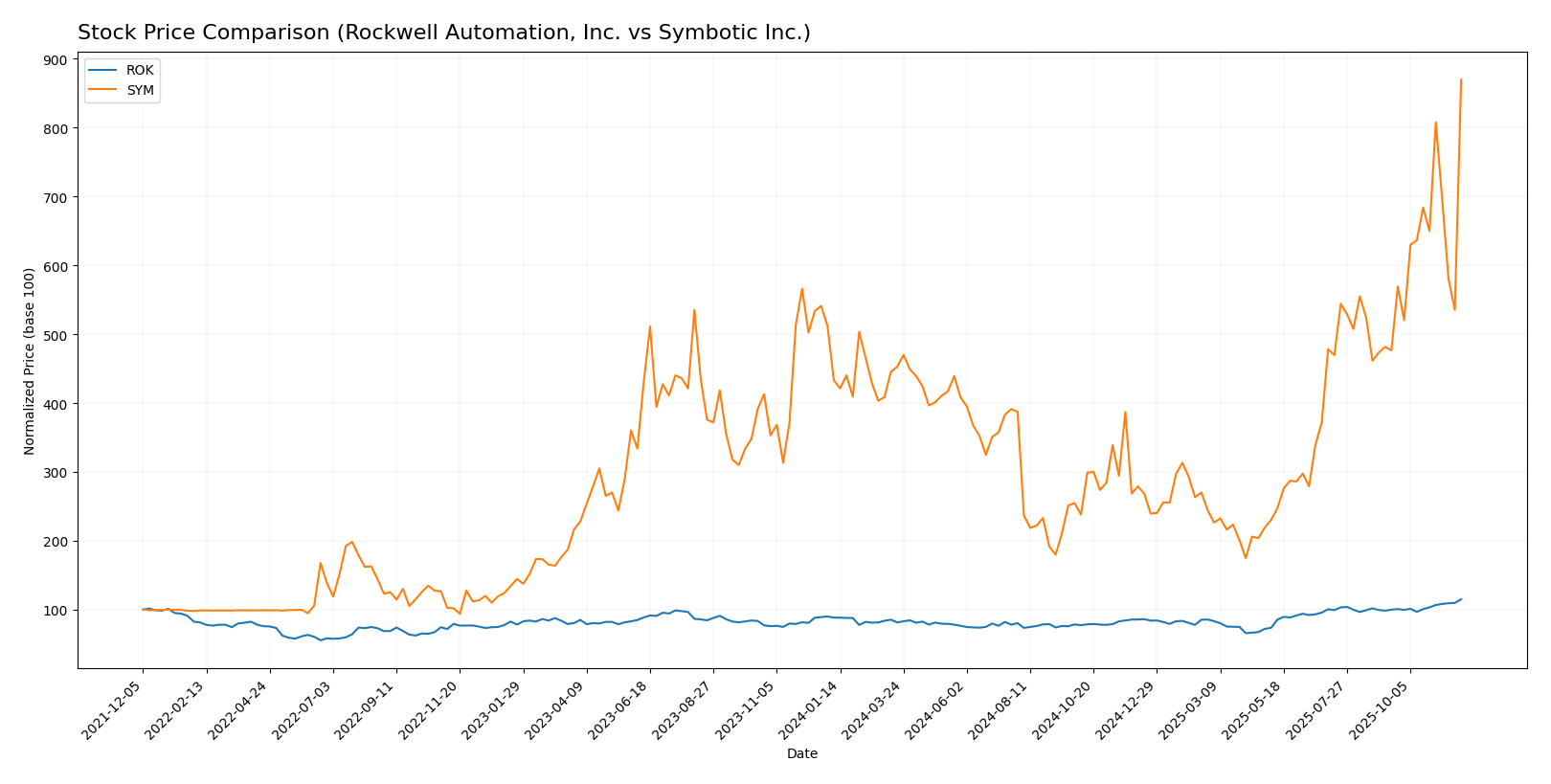

Stock Comparison

In this section, I will analyze the stock price movements and trading dynamics of Rockwell Automation, Inc. (ROK) and Symbotic Inc. (SYM) over the past year, highlighting key trends and price fluctuations that may guide your investment decisions.

Trend Analysis

Rockwell Automation, Inc. (ROK) Over the past year, ROK has experienced a price change of +30.1%, indicating a bullish trend. The recent period from September 14, 2025, to November 30, 2025, reflects a price increase of +15.06%. This trend shows acceleration, with notable highs of $396.88 and lows of $227.11. The standard deviation of 36.72 suggests considerable volatility, which investors should consider when assessing risk.

Symbotic Inc. (SYM) SYM has outperformed with a remarkable price change of +100.86% over the past year, also signaling a bullish trend. During the recent analysis period, the stock increased by +82.52%, with a trend showing acceleration. The highest price reached was $87.16, while the lowest was $17.5. The standard deviation of 14.12 indicates a moderate level of volatility, which is relatively manageable for investors.

In conclusion, both ROK and SYM exhibit strong bullish trends, with ROK showing notable volatility and SYM demonstrating exceptional price growth potential.

Analyst Opinions

Recent analyst recommendations for Rockwell Automation, Inc. (ROK) show a rating of C-, indicating a cautious outlook. Analysts highlight concerns regarding low return on equity and high debt-to-equity ratios. Similarly, Symbotic Inc. (SYM) has a C rating, with analysts pointing to its solid discounted cash flow score but cautioning about its overall financial health. Currently, the consensus for both companies leans towards a “hold” strategy, reflecting a wait-and-see approach in this uncertain market environment.

Stock Grades

In this section, I present the latest stock grades for Rockwell Automation, Inc. (ROK) and Symbotic Inc. (SYM) from recognized grading companies.

Rockwell Automation, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | maintain | Outperform | 2025-11-21 |

| B of A Securities | maintain | Buy | 2025-11-20 |

| JP Morgan | maintain | Neutral | 2025-11-11 |

| Morgan Stanley | maintain | Overweight | 2025-11-10 |

| Barclays | maintain | Overweight | 2025-11-07 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

| JP Morgan | maintain | Neutral | 2025-10-15 |

| Oppenheimer | maintain | Outperform | 2025-10-14 |

| Wells Fargo | maintain | Equal Weight | 2025-10-06 |

| Barclays | maintain | Overweight | 2025-08-14 |

Symbotic Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | maintain | Neutral | 2025-11-26 |

| Barclays | maintain | Underweight | 2025-11-26 |

| Craig-Hallum | upgrade | Buy | 2025-11-25 |

| Citigroup | maintain | Buy | 2025-11-25 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-25 |

| DA Davidson | maintain | Neutral | 2025-11-25 |

| Northland Capital Markets | maintain | Outperform | 2025-11-25 |

| UBS | downgrade | Sell | 2025-09-23 |

| DA Davidson | downgrade | Neutral | 2025-08-25 |

| Needham | maintain | Buy | 2025-08-07 |

Overall, ROK maintains a strong position with consistent “Outperform” and “Buy” ratings from multiple firms, indicating investor confidence. Meanwhile, SYM shows a mix of upgrades and downgrades, suggesting a more cautious approach as it navigates market fluctuations.

Target Prices

The consensus target prices for Rockwell Automation, Inc. (ROK) and Symbotic Inc. (SYM) reflect optimistic expectations among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rockwell Automation | 402 | 345 | 377.6 |

| Symbotic Inc. | 83 | 41 | 67.38 |

For Rockwell Automation, the current stock price of 396.11 is close to the consensus target of 377.6, suggesting limited upside. In contrast, Symbotic Inc. is currently trading at 87.27, significantly above the target consensus of 67.38, indicating potential overvaluation.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of Rockwell Automation, Inc. (ROK) and Symbotic Inc. (SYM).

| Criterion | Rockwell Automation, Inc. (ROK) | Symbotic Inc. (SYM) |

|---|---|---|

| Diversification | Strong product range across industries | Limited to warehouse automation |

| Profitability | Positive net profit margin (15.26%) | Negative net profit margin (-3.59%) |

| Innovation | Leader in industrial automation technology | Developing robotics solutions |

| Global presence | Established international presence | Primarily focused in the US |

| Market Share | Significant share in automation sector | Emerging player in warehouse automation |

| Debt level | Moderate debt-to-equity ratio (1.17) | No current debt |

Key takeaways indicate that Rockwell Automation has a robust portfolio and profitability, while Symbotic is still in its growth phase with potential but facing financial challenges. Investors should weigh these factors carefully when considering their investment options.

Risk Analysis

In this section, I present a concise overview of the risks associated with two prominent companies in the industrial machinery sector: Rockwell Automation, Inc. (ROK) and Symbotic Inc. (SYM).

| Metric | Rockwell Automation (ROK) | Symbotic Inc. (SYM) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and operational risks, particularly Symbotic, which is more exposed to market fluctuations due to its growth stage and reliance on automation technology. Recent reports indicate that the automation sector is experiencing heightened competition, which could impact both companies’ profitability.

Which one to choose?

In comparing Rockwell Automation, Inc. (ROK) and Symbotic Inc. (SYM), I find that ROK has a more established financial foundation with a market capitalization of approximately 30.6B, a revenue of 8.34B for FY 2025, and a positive net income of 869M. However, its overall rating is a C- and reflects a mixed performance in profitability and efficiency ratios. On the other hand, SYM, despite showing impressive stock price growth of 100.86%, is still struggling with negative net income and profitability margins, receiving a C rating overall.

For investors seeking stability and established returns, ROK appears favorable, while those with a higher risk tolerance may consider SYM for potential growth. However, both companies face risks related to competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Rockwell Automation, Inc. and Symbotic Inc. to enhance your investment decisions: