In today’s competitive industrial landscape, Rockwell Automation, Inc. (ROK) and Hillenbrand, Inc. (HI) stand out as key players providing innovative solutions. Both companies operate within the Industrial – Machinery sector, yet they distinguish themselves through unique offerings and market strategies. While Rockwell focuses on automation and digital transformation, Hillenbrand diversifies across process solutions and funeral services. As we delve into this analysis, I aim to uncover which of these companies presents the most compelling investment opportunity for you.

Table of contents

Company Overview

Rockwell Automation, Inc. Overview

Rockwell Automation, Inc. (NYSE: ROK) is a leading provider of industrial automation and digital transformation solutions, serving diverse sectors globally. With a market capitalization of approximately $44.6B, the company specializes in three key segments: Intelligent Devices, Software & Control, and Lifecycle Services. Rockwell’s offerings range from advanced hardware and software to comprehensive consulting and maintenance services, catering to industries such as automotive, aerospace, and renewable energy. Founded in 1903 and headquartered in Milwaukee, Wisconsin, Rockwell focuses on enabling companies to enhance productivity and efficiency through innovative automation technologies.

Hillenbrand, Inc. Overview

Hillenbrand, Inc. (NYSE: HI), with a market cap of around $2.2B, operates as a diversified industrial company that provides a wide array of process and material handling solutions. Established in 1906 and based in Batesville, Indiana, Hillenbrand’s operations are segmented into Advanced Process Solutions, Molding Technology Solutions, and Batesville. The company serves a broad spectrum of industries, including automotive and pharmaceuticals, while also offering funeral service products. Hillenbrand’s commitment to engineering excellence positions it as a crucial player in its respective markets.

Key Similarities and Differences

Both Rockwell Automation and Hillenbrand operate within the industrial machinery sector, emphasizing technology-driven solutions. However, Rockwell primarily focuses on automation systems, while Hillenbrand covers a wider range of processes, including funeral services. Their business models differ in specialization, with Rockwell leaning towards automation and digital solutions and Hillenbrand diversifying across various industrial and consumer sectors.

Income Statement Comparison

Below is a comparison of the most recent income statements for Rockwell Automation, Inc. (ROK) and Hillenbrand, Inc. (HI), highlighting their financial performance metrics.

| Metric | ROK | HI |

|---|---|---|

| Revenue | 8.34B | 2.67B |

| EBITDA | 1.40B | 230M |

| EBIT | 1.07B | 92M |

| Net Income | 869M | 43M |

| EPS | 7.69 | 0.74 |

Interpretation of Income Statement

In 2025, Rockwell Automation (ROK) demonstrated a stable revenue growth trend, achieving 8.34B, a slight increase from the previous year’s 8.26B. Their net income also remained strong at 869M, showcasing resilience in margins despite operational challenges. Conversely, Hillenbrand (HI) faced a decline in revenue to 2.67B from 3.18B in 2024, and a significant drop in net income to 43M, which reflects ongoing operational headwinds. The contrasting performance between these companies highlights the importance of assessing both revenue and profitability metrics when considering investments in this sector.

Financial Ratios Comparison

The table below presents a comparative analysis of key financial ratios between Rockwell Automation, Inc. (ROK) and Hillenbrand, Inc. (HI) for the most recent fiscal year ending September 30, 2025.

| Metric | Rockwell Automation (ROK) | Hillenbrand (HI) |

|---|---|---|

| ROE | 0.00% | 3.66% |

| ROIC | 0.00% | -32.60% |

| P/E | N/A | 36.69 |

| P/B | N/A | 1.34 |

| Current Ratio | 2.37 | 1.22 |

| Quick Ratio | 1.56 | 0.88 |

| D/E | 0.97 | 1.12 |

| Debt-to-Assets | 31.67% | 35.86% |

| Interest Coverage | N/A | 0.55 |

| Asset Turnover | 0.00 | 0.60 |

| Fixed Asset Turnover | N/A | 7.80 |

| Payout Ratio | N/A | 121.69% |

| Dividend Yield | N/A | 3.32% |

Interpretation of Financial Ratios

The financial ratios indicate a mixed performance between the two companies. Rockwell Automation shows a strong liquidity position with a current ratio of 2.37, while Hillenbrand struggles with a negative return on invested capital (ROIC) of -32.60%. Additionally, Hillenbrand’s high payout ratio suggests it is returning more to shareholders than it earns, which can be a red flag. Conversely, Rockwell’s lack of earnings visibility raises concerns about sustainability. Investors should weigh these factors carefully when considering their investment.

Dividend and Shareholder Returns

Rockwell Automation, Inc. (ROK) maintains a dividend payout ratio of 59.9% with a yield of 1.87%, reflecting a commitment to returning value to shareholders. Conversely, Hillenbrand, Inc. (HI) does not pay dividends; instead, it focuses on reinvesting in growth initiatives despite its net losses. Both companies engage in share buybacks, but ROK’s sustainable dividend policy aligns better with long-term shareholder value creation compared to HI’s growth strategy, which carries inherent risks.

Strategic Positioning

Rockwell Automation, Inc. (ROK) holds a significant market share in the industrial automation sector, driven by its comprehensive solutions across Intelligent Devices, Software & Control, and Lifecycle Services. The company’s strong focus on technological innovation helps it withstand competitive pressures from emerging players. In contrast, Hillenbrand, Inc. (HI) operates in diversified industrial markets, leveraging its Advanced Process Solutions and Molding Technology segments. Both companies face ongoing technological disruption, necessitating continuous adaptation to maintain their market positions.

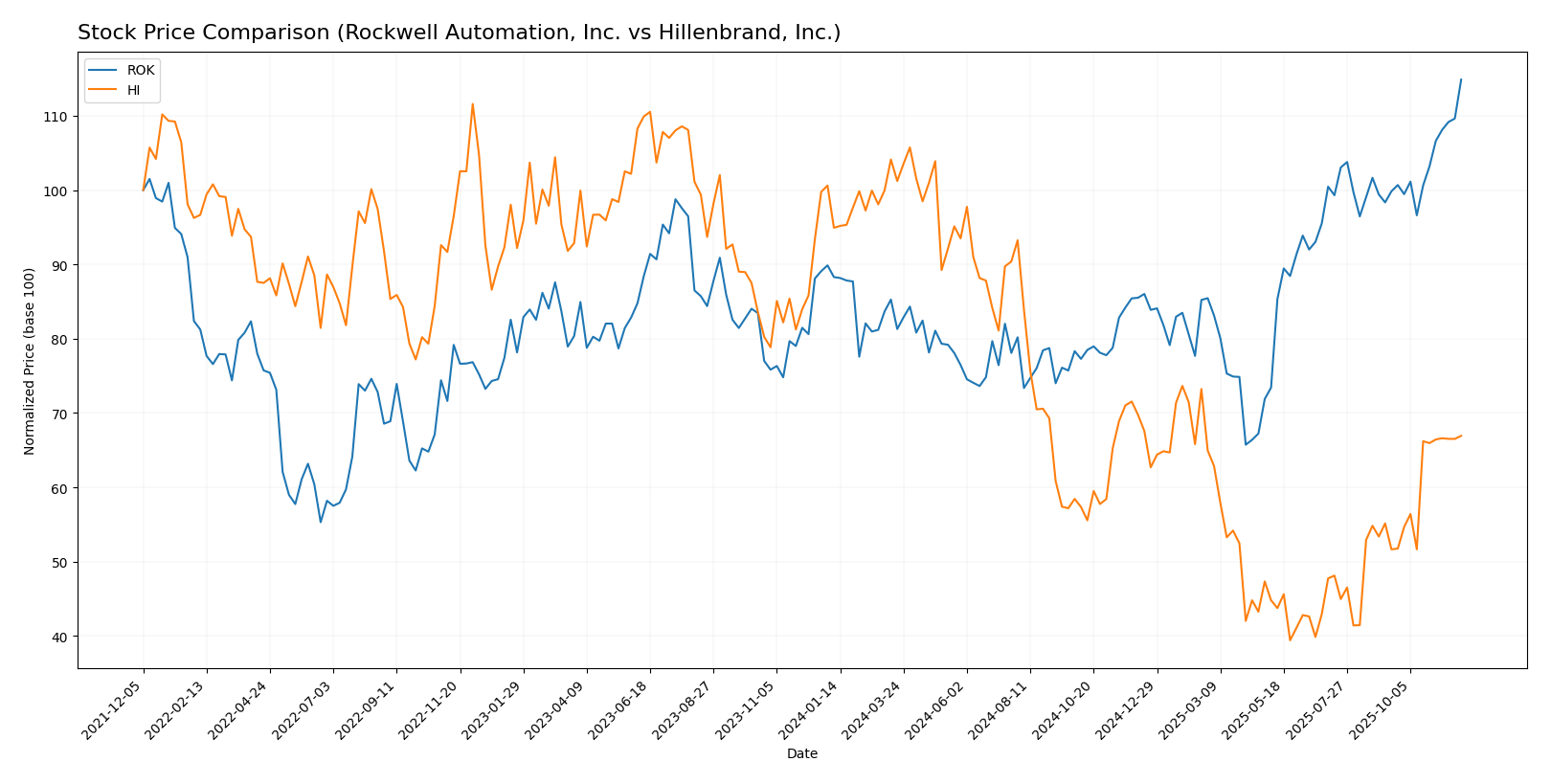

Stock Comparison

In this section, I analyze the weekly stock price performance of Rockwell Automation, Inc. (ROK) and Hillenbrand, Inc. (HI) over the past year, highlighting key price movements and trading dynamics that could influence investment decisions.

Trend Analysis

Rockwell Automation, Inc. (ROK) Over the past year, ROK has experienced a price change of +30.08%. This substantial increase indicates a bullish trend characterized by acceleration. The stock reached a notable high of 396.82 and a low of 227.11. Additionally, the standard deviation of 36.72 suggests a moderate level of volatility in ROK’s stock price. In the recent analysis period from September 14, 2025, to November 30, 2025, the price change was +15.04%, with a standard deviation of 17.94, confirming ongoing upward momentum.

Hillenbrand, Inc. (HI) Conversely, HI has experienced a price change of -29.49% over the last year, indicating a bearish trend that is also characterized by acceleration. The stock has fluctuated between a high of 50.29 and a low of 18.75. The standard deviation of 9.44 points to lower volatility compared to ROK. In the recent timeframe from September 14, 2025, to November 30, 2025, HI showed a price change of +29.57%. Despite this recent uptick, the overall trend remains negative, with caution advised for potential investors.

Analyst Opinions

Recent analyst recommendations show a mixed outlook for Rockwell Automation, Inc. (ROK) and Hillenbrand, Inc. (HI). ROK received a rating of C- from analysts, indicating a hold position due to concerns about its low scores in return on equity and assets. In contrast, HI has been rated B+ with a consensus recommendation to buy, supported by strong performance in return on assets and discounted cash flow metrics. Overall, the consensus for HI is a buy, while ROK suggests caution with a hold recommendation.

Stock Grades

I have gathered the latest stock grades from reliable grading companies for Rockwell Automation, Inc. and Hillenbrand, Inc. Below are the details.

Rockwell Automation, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | maintain | Outperform | 2025-11-21 |

| B of A Securities | maintain | Buy | 2025-11-20 |

| JP Morgan | maintain | Neutral | 2025-11-11 |

| Morgan Stanley | maintain | Overweight | 2025-11-10 |

| Barclays | maintain | Overweight | 2025-11-07 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

| JP Morgan | maintain | Neutral | 2025-10-15 |

| Oppenheimer | maintain | Outperform | 2025-10-14 |

| Wells Fargo | maintain | Equal Weight | 2025-10-06 |

| Barclays | maintain | Overweight | 2025-08-14 |

Hillenbrand, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | maintain | Neutral | 2025-11-20 |

| DA Davidson | maintain | Neutral | 2025-10-16 |

| CJS Securities | downgrade | Market Perform | 2025-10-16 |

| Keybanc | downgrade | Sector Weight | 2025-05-08 |

| DA Davidson | maintain | Neutral | 2025-05-01 |

| DA Davidson | maintain | Neutral | 2024-11-15 |

| Keybanc | maintain | Overweight | 2024-11-14 |

| DA Davidson | downgrade | Neutral | 2024-08-12 |

| DA Davidson | maintain | Buy | 2021-02-08 |

| DA Davidson | maintain | Buy | 2021-02-07 |

In summary, Rockwell Automation shows a consistent trend of maintaining high grades with multiple “Outperform” and “Overweight” ratings, indicating a solid position in the market. Conversely, Hillenbrand has experienced some downgrades recently, suggesting a more cautious outlook among analysts.

Target Prices

The latest consensus on target prices from reliable analysts indicates positive expectations for both Rockwell Automation, Inc. and Hillenbrand, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rockwell Automation, Inc. | 402 | 345 | 377.6 |

| Hillenbrand, Inc. | 32 | 32 | 32 |

For Rockwell Automation, the consensus target price of 377.6 suggests a slight increase potential compared to its current price of 396.79. Hillenbrand, on the other hand, has a consensus target that aligns exactly with its current trading price of 31.825, indicating limited upside potential.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Rockwell Automation, Inc. (ROK) and Hillenbrand, Inc. (HI) based on the most recent data.

| Criterion | Rockwell Automation (ROK) | Hillenbrand (HI) |

|---|---|---|

| Diversification | Strong across multiple segments | Moderate, focused segments |

| Profitability | High net profit margin (15.26%) | Low net profit margin (2.02%) |

| Innovation | Leadership in automation technology | Moderate innovation in niche markets |

| Global presence | Strong international operations | Limited global reach |

| Market Share | Significant in industrial automation | Smaller market presence |

| Debt level | Moderate debt (debt-to-equity: 1.17) | High debt (debt-to-equity: 1.44) |

Key takeaways: Rockwell Automation exhibits strong profitability and global presence, making it a robust contender in the automation sector. In contrast, Hillenbrand struggles with profitability and has a more limited global reach, indicating potential risks for investors.

Risk Analysis

The table below summarizes the key risks associated with Rockwell Automation, Inc. and Hillenbrand, Inc.

| Metric | Rockwell Automation (ROK) | Hillenbrand, Inc. (HI) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and operational risks. Rockwell Automation’s market risk is moderate due to its reliance on industrial sectors, while Hillenbrand is exposed to higher market volatility. Hillenbrand’s operational risk is elevated, reflecting challenges in transforming its business model effectively.

Which one to choose?

When comparing Rockwell Automation, Inc. (ROK) and Hillenbrand, Inc. (HI), I see distinct differences in performance and potential. ROK has demonstrated a bullish stock trend with a 30.08% price change over the last year, but its fundamentals indicate a C- rating, reflecting concerns on margins and profitability. In contrast, HI has a bearish trend, with a -29.49% price change, yet it holds a B+ rating due to stronger operating margins and a better overall score in return metrics.

For investors focused on growth, ROK may be appealing due to its recent stock momentum, despite its weak fundamentals. Conversely, those prioritizing stability and fundamental strength may prefer HI, which, while currently underperforming, shows solid financial metrics.

Both companies face risks, including market dependence and competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Rockwell Automation, Inc. and Hillenbrand, Inc. to enhance your investment decisions: