In the rapidly evolving semiconductor industry, two companies stand out for their innovative approaches: Applied Materials, Inc. (AMAT) and Nova Ltd. (NVMI). Both firms operate within the same sector, focusing on essential technologies that drive semiconductor manufacturing. By examining their market strategies and product offerings, we can uncover key insights for investors. Join me as I analyze these two companies to determine which one presents the most compelling investment opportunity.

Table of contents

Company Overview

Applied Materials, Inc. Overview

Applied Materials, Inc. (AMAT) is a leading supplier of manufacturing equipment, services, and software for the semiconductor and display industries. Founded in 1967 and headquartered in Santa Clara, California, the company operates through three primary segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. Its technologies are crucial for the fabrication of semiconductor chips, offering tools for processes such as chemical vapor deposition and metrology. With a market capitalization of approximately $200B, Applied Materials continues to innovate within the technology sector, serving global markets including the U.S., China, and Taiwan.

Nova Ltd. Overview

Nova Ltd. (NVMI) specializes in process control systems utilized in semiconductor manufacturing. Established in 1993 and based in Rehovot, Israel, Nova designs metrology platforms that aid various semiconductor production processes, from lithography to advanced packaging. The company has a market cap of about $9.2B and serves a wide array of sectors within the integrated circuit industry, including foundries and memory manufacturers. Nova’s focus on precision measurement positions it as a critical player in enhancing semiconductor manufacturing efficiency.

Key similarities and differences in their business models include their focus on the semiconductor industry, where both companies provide essential technologies to enhance manufacturing processes. However, Applied Materials has a broader range of services spanning multiple segments, while Nova specializes in metrology and process control, indicating a more niche approach.

Income Statement Comparison

In this section, I will present a comparative income statement for Applied Materials, Inc. (AMAT) and Nova Ltd. (NVMI), highlighting key financial metrics for the most recent fiscal year.

| Metric | AMAT | NVMI |

|---|---|---|

| Revenue | 28.37B | 672.40M |

| EBITDA | 9.65B | 204.92M |

| EBIT | 9.54B | 187.54M |

| Net Income | 6.99B | 183.76M |

| EPS | 8.71 | 6.31 |

Interpretation of Income Statement

Analyzing the latest fiscal year’s income statements reveals that Applied Materials (AMAT) experienced robust revenue growth at 28.37B, up from 27.18B the previous year. In contrast, Nova Ltd. (NVMI) reported a revenue increase to 672.40M, marking a significant rise from 517.92M. AMAT’s net income of 6.99B reflects strong operational efficiency with stable margins, while NVMI’s net income of 183.76M indicates solid growth albeit with a lower margin structure. Overall, AMAT shows a more significant scale and profitability, but both companies exhibit promising growth trajectories in their respective markets.

Financial Ratios Comparison

The following table presents a comparison of key financial ratios for Applied Materials, Inc. (AMAT) and Nova Ltd. (NVMI) based on the most recent data.

| Metric | AMAT | NVMI |

|---|---|---|

| ROE | 34.3% | 19.8% |

| ROIC | 22.0% | 13.4% |

| P/E | 26.8 | 31.2 |

| P/B | 9.2 | 6.2 |

| Current Ratio | 2.61 | 2.32 |

| Quick Ratio | 1.87 | 1.92 |

| D/E | 0.32 | 0.25 |

| Debt-to-Assets | 18.1% | 17.0% |

| Interest Coverage | 30.8 | 116.2 |

| Asset Turnover | 0.78 | 0.48 |

| Fixed Asset Turnover | 6.15 | 5.06 |

| Payout Ratio | 19.3% | 0% |

| Dividend Yield | 0.72% | 0% |

Interpretation of Financial Ratios

Analyzing the financial ratios, AMAT exhibits higher return ratios (ROE and ROIC), suggesting stronger profitability relative to equity and invested capital. Its P/E ratio is lower than NVMI’s, indicating potentially better value. However, NVMI demonstrates an exceptionally strong interest coverage ratio, highlighting its ability to meet interest obligations. While AMAT shows a higher payout ratio, NVMI’s lack of dividends might signal reinvestment in growth. Investors should weigh these factors against their risk tolerance and investment objectives.

Dividend and Shareholder Returns

Applied Materials, Inc. (AMAT) pays a dividend with a payout ratio of approximately 19% and a yield of 0.72%. The trend in dividends per share has shown consistency, indicating a commitment to shareholder returns. In contrast, Nova Ltd. (NVMI) does not distribute dividends, focusing instead on growth through reinvestment and acquisitions. While NVMI’s lack of dividends may concern some, its strategy could align with long-term value creation, supported by share buybacks. Ultimately, both companies’ approaches reflect differing philosophies on balancing immediate shareholder returns with sustainable growth.

Strategic Positioning

Applied Materials, Inc. (AMAT) holds a significant market share in the semiconductor manufacturing equipment sector, with a market cap of $200.4B. Its expansive product portfolio and strong global presence create competitive pressure against companies like Nova Ltd. (NVMI), which specializes in process control systems and has a market cap of $9.2B. Both firms face technological disruption as advancements in semiconductor processes evolve, necessitating continuous innovation to maintain their competitive edge in a rapidly changing industry.

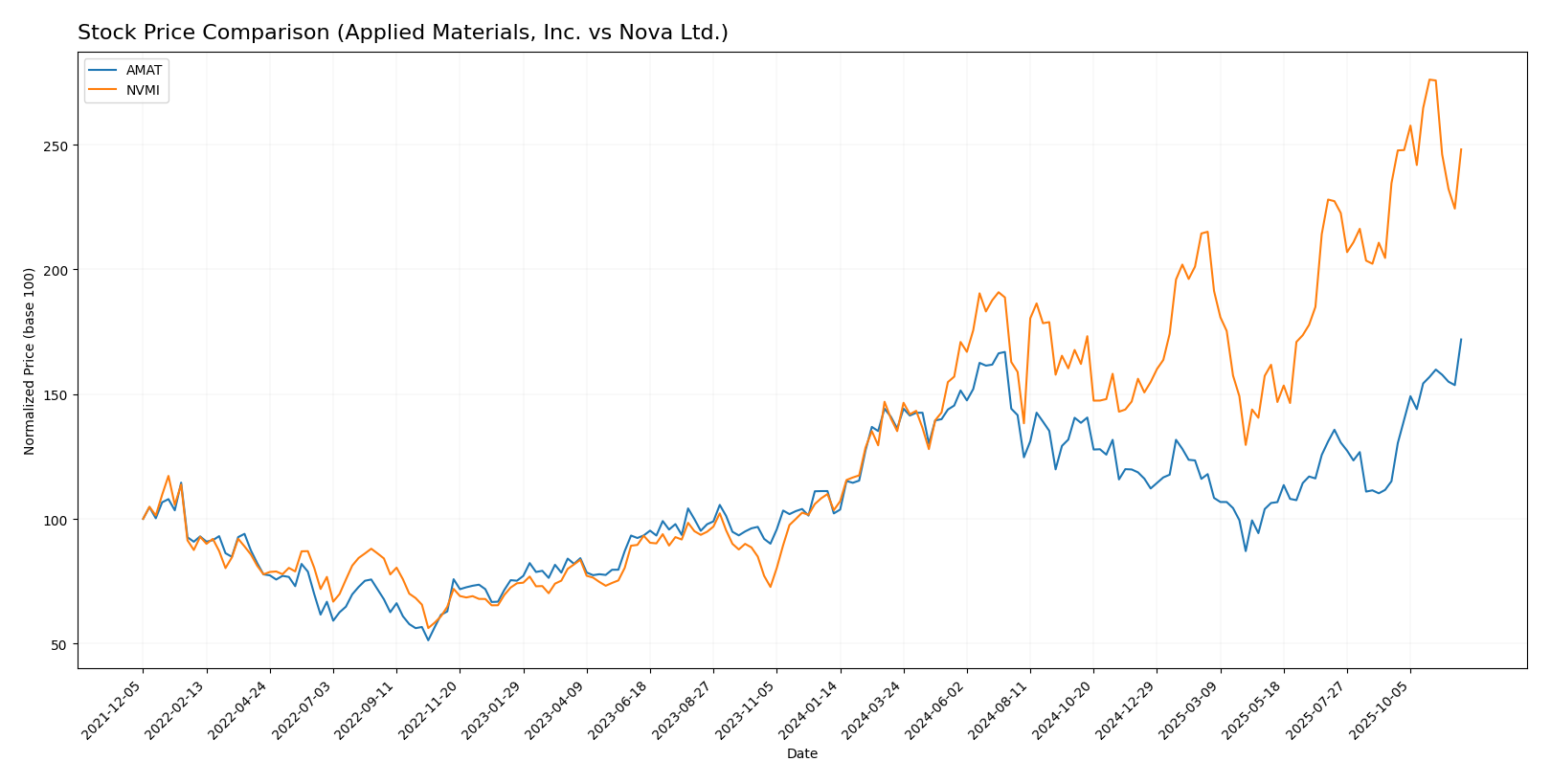

Stock Comparison

In reviewing the stock price movements of Applied Materials, Inc. (AMAT) and Nova Ltd. (NVMI) over the past year, we observe significant price dynamics, including notable highs and lows that reflect the market’s response to various economic factors.

Trend Analysis

Applied Materials, Inc. (AMAT)

- Over the past year, AMAT has experienced a price change of +68.27%, indicating a bullish trend. The stock has shown acceleration in its upward movement, with a highest price of 250.72 and a lowest price of 126.95. The standard deviation of 26.52 suggests a moderate level of volatility. Recently, from September 14, 2025, to November 30, 2025, the stock increased by +49.42%, further reinforcing its bullish trajectory.

Nova Ltd. (NVMI)

- NVMI has demonstrated a remarkable price change of +139.8% over the same period, establishing a bullish trend. However, the acceleration status indicates deceleration in its growth rate. The stock reached a highest price of 345.06 and a lowest price of 129.32, with a standard deviation of 48.47, reflecting higher volatility compared to AMAT. In the recent analysis period from September 14, 2025, to November 30, 2025, NVMI saw a more modest price change of +5.8%, indicating a slowing momentum in its upward movement.

In summary, both stocks exhibit strong upward trends, but with differing levels of acceleration and volatility. Investors should consider these factors in their decision-making process.

Analyst Opinions

Recent analyst recommendations for Applied Materials, Inc. (AMAT) and Nova Ltd. (NVMI) indicate a consensus rating of “B+” for both companies. Analysts emphasize strong return on equity and return on assets, suggesting solid financial health. However, concerns regarding debt-to-equity ratios and price-to-earnings metrics have tempered enthusiasm. Notably, analysts maintain a cautious outlook, recommending a “hold” on both stocks for 2025, indicating the potential for growth but acknowledging existing risks.

Stock Grades

In the current market landscape, it’s crucial to stay updated on stock ratings from reliable sources. Here are the recent grades for Applied Materials, Inc. (AMAT) and Nova Ltd. (NVMI).

Applied Materials, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | upgrade | Buy | 2025-11-25 |

| Citigroup | maintain | Buy | 2025-11-14 |

| Mizuho | maintain | Neutral | 2025-11-14 |

| Needham | maintain | Buy | 2025-11-14 |

| Craig-Hallum | downgrade | Hold | 2025-11-14 |

| JP Morgan | maintain | Overweight | 2025-11-14 |

| Wells Fargo | maintain | Overweight | 2025-11-14 |

| B. Riley Securities | maintain | Buy | 2025-11-14 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-14 |

| Morgan Stanley | maintain | Overweight | 2025-11-14 |

Nova Ltd. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | maintain | Outperform | 2025-11-07 |

| Benchmark | maintain | Buy | 2025-11-07 |

| B of A Securities | maintain | Buy | 2025-06-24 |

| Cantor Fitzgerald | maintain | Overweight | 2025-06-24 |

| Citigroup | maintain | Buy | 2025-05-09 |

| Benchmark | maintain | Buy | 2025-05-09 |

| B of A Securities | maintain | Buy | 2025-04-16 |

| Cantor Fitzgerald | maintain | Overweight | 2025-03-14 |

| Benchmark | maintain | Buy | 2025-02-14 |

| Needham | maintain | Hold | 2025-02-14 |

Overall, both AMAT and NVMI are receiving a mix of strong buy ratings and maintains from respected analysts, indicating a generally positive outlook, although some cautious sentiments are present with grades like “Hold” and “Neutral.” As always, I recommend assessing individual risk tolerance and market conditions before making investment decisions.

Target Prices

The consensus target prices for Applied Materials, Inc. (AMAT) and Nova Ltd. (NVMI) indicate a positive outlook from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Applied Materials, Inc. | 290 | 205 | 249.27 |

| Nova Ltd. | 224 | 210 | 217 |

For AMAT, the consensus target price of 249.27 suggests a slight upside potential compared to its current price of 251.50. NVMI has a target consensus of 217, indicating a potential decrease from its current price of 310.62.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Applied Materials, Inc. (AMAT) and Nova Ltd. (NVMI) based on their recent performance metrics.

| Criterion | Applied Materials, Inc. (AMAT) | Nova Ltd. (NVMI) |

|---|---|---|

| Diversification | High (multiple segments) | Moderate (focus on metrology) |

| Profitability | Strong (net profit margin: 24.67%) | Good (net profit margin: 27.33%) |

| Innovation | High (significant R&D investment) | Moderate (steady improvements) |

| Global presence | Extensive (operates globally) | Moderate (focuses on key markets) |

| Market Share | Leading in semiconductors | Niche player in specific areas |

| Debt level | Low (debt-to-equity: 0.32) | Low (debt-to-equity: 0.25) |

Key takeaways: Both companies demonstrate strong profitability and low debt levels, but Applied Materials shows greater diversification and global presence, while Nova Ltd. maintains a strong position in specific market segments.

Risk Analysis

In the table below, I outline key risks associated with Applied Materials (AMAT) and Nova Ltd. (NVMI). Understanding these risks can help you make informed investment decisions.

| Metric | Applied Materials (AMAT) | Nova Ltd. (NVMI) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | High | Moderate |

Both companies face significant market and geopolitical risks, primarily due to their dependence on the global semiconductor supply chain, which is volatile. Recent tensions in the US-China trade relations further exacerbate these risks.

Which one to choose?

When comparing Applied Materials, Inc. (AMAT) and Nova Ltd. (NVMI), both companies exhibit strong fundamentals. AMAT boasts a higher revenue of $28.37B and a solid gross profit margin of 49%. Its net profit margin is also impressive at 25%, supported by a B+ rating from analysts. In contrast, NVMI, with a market cap of $5.73B, has a gross profit margin of 58% but lower overall revenue at $672M. Both companies have a B+ rating, indicating good investment potential.

For investors focused on growth, NVMI’s recent price performance (up 139.8% over the last year) may be appealing, while those prioritizing stability might lean towards AMAT, given its larger scale and consistent margins. However, both face risks related to market volatility and competition in the semiconductor sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Applied Materials, Inc. and Nova Ltd. to enhance your investment decisions: