In the rapidly evolving semiconductor industry, KLA Corporation (KLAC) and Nova Ltd. (NVMI) are two prominent players worth analyzing. Both companies specialize in process control systems, yet they have distinct approaches to innovation and market coverage. KLA focuses on a broader range of semiconductor manufacturing solutions, while Nova excels in metrology platforms for specific process steps. This comparison will help you determine which company presents a more compelling investment opportunity. Let’s dive deeper into their strategies and performances.

Table of contents

Company Overview

KLA Corporation Overview

KLA Corporation, trading under the ticker KLAC, is a leading provider of process control and yield management solutions for the semiconductor and electronics industries. Founded in 1975 and headquartered in Milpitas, California, KLA focuses on enhancing the efficiency and effectiveness of semiconductor manufacturing processes through advanced technology. With a market capitalization of approximately $152B and a diverse product portfolio, KLA operates through four main segments: Semiconductor Process Control, Specialty Semiconductor Process, PCB, Display and Component Inspection, and Other. The company’s innovative solutions encompass everything from wafer inspection to chemical/materials quality analysis, making it a cornerstone in the semiconductor ecosystem.

Nova Ltd. Overview

Nova Ltd., listed as NVMI, specializes in process control systems that are crucial for semiconductor manufacturing. Established in 1993 and based in Rehovot, Israel, Nova has carved out a niche in metrology, offering solutions that facilitate quality assurance throughout the production cycle. With a market cap of around $9.2B, their product line includes metrology platforms for various semiconductor processes, serving a broad client base that spans logic, foundries, and memory manufacturers. Nova’s adaptability and focus on cutting-edge technology position it as a significant player in the global semiconductor landscape.

Key Similarities and Differences

Both KLA Corporation and Nova Ltd. operate within the semiconductor industry, providing essential process control and metrology solutions. However, KLA has a broader product range and larger scale, while Nova focuses on specific metrology platforms for various manufacturing processes. KLA’s extensive segmentation contrasts with Nova’s concentrated approach, reflecting differing strategies in addressing market needs.

Income Statement Comparison

The following table presents a comparison of key income metrics for KLA Corporation and Nova Ltd. for their most recent fiscal years. This will help us analyze their financial performance effectively.

| Metric | KLA Corporation | Nova Ltd. |

|---|---|---|

| Revenue | 12.16B | 672.40M |

| EBITDA | 5.34B | 204.92M |

| EBIT | 4.95B | 187.54M |

| Net Income | 4.06B | 183.76M |

| EPS | 30.53 | 6.31 |

Interpretation of Income Statement

In 2025, KLA Corporation showed a robust revenue increase to 12.16B, significantly higher than Nova Ltd.’s 672.40M. KLA’s net income also rose to 4.06B, indicating strong profitability. KLA’s EBITDA margin improved slightly, suggesting operational efficiency gains, while Nova’s profitability metrics reflect growth potential but remain lower in comparison. Overall, KLA Corporation’s growth trajectory reflects a healthy business environment, whereas Nova demonstrates room for improvement but with positive trends in earnings and revenue growth year-over-year.

Financial Ratios Comparison

In this section, I will present a comparative analysis of the most recent financial ratios for KLA Corporation (KLAC) and Nova Ltd. (NVMI) to help investors assess their performance.

| Metric | KLAC | NVMI |

|---|---|---|

| ROE | 86.56% | 19.81% |

| ROIC | 38.11% | 13.39% |

| P/E | 29.34 | 31.20 |

| P/B | 25.39 | 6.18 |

| Current Ratio | 2.62 | 2.32 |

| Quick Ratio | 1.83 | 1.92 |

| D/E | 1.30 | 0.25 |

| Debt-to-Assets | 37.89% | 16.98% |

| Interest Coverage | 17.16 | 116.20 |

| Asset Turnover | 0.76 | 0.48 |

| Fixed Asset Turnover | 9.70 | 5.06 |

| Payout Ratio | 22.27% | 0% |

| Dividend Yield | 0.76% | 0% |

Interpretation of Financial Ratios

KLA Corporation exhibits significantly stronger performance metrics compared to Nova Ltd., particularly in ROE and ROIC, indicating efficient use of equity and capital. However, NVMI shows a remarkable interest coverage ratio, suggesting excellent ability to meet interest obligations. Key concerns for KLAC include a high P/B ratio and significant debt levels, which may signal overvaluation and increased financial risk, respectively. Overall, investors should weigh these factors carefully when considering their investment options.

Dividend and Shareholder Returns

KLA Corporation (KLAC) pays dividends, with a current annual yield of 0.76% and a payout ratio of 22.27%. The trend shows a steady increase in dividend per share, indicating healthy cash flow coverage. However, caution is warranted due to potential risks associated with unsustainable distributions. In contrast, Nova Ltd. (NVMI) does not pay dividends, focusing on reinvestment for growth. This strategy aligns with long-term shareholder value creation, as it prioritizes capital appreciation over immediate income. Overall, KLAC’s dividends and NVMI’s reinvestment approach reflect different paths to sustainable value creation.

Strategic Positioning

KLA Corporation (KLAC) holds a significant market share in semiconductor process control, boasting a market cap of 152B. Its comprehensive solutions position it well against competitors like Nova Ltd. (NVMI), which, with a market cap of 9.2B, specializes in metrology systems for semiconductor manufacturing. Competitive pressure remains high due to rapid technological advancements, necessitating continuous innovation. Both companies face potential disruption from emerging technologies in the semiconductor space, emphasizing the importance of strategic agility and investment in R&D for sustained growth.

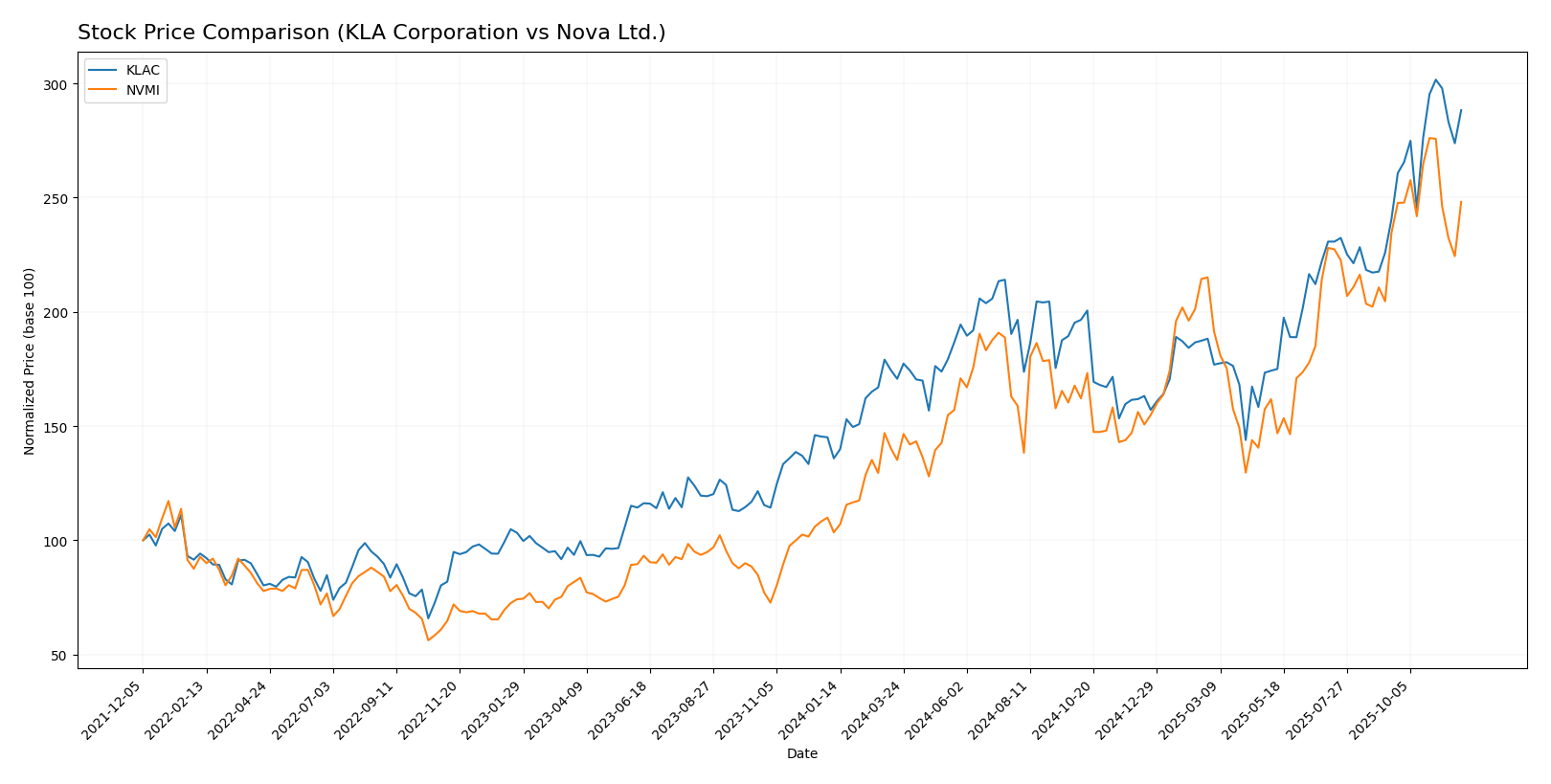

Stock Comparison

In this section, I will analyze the weekly stock price movements of KLA Corporation (KLAC) and Nova Ltd. (NVMI) over the past year, highlighting key price changes and trading dynamics.

Trend Analysis

KLA Corporation (KLAC) Over the past year, KLAC has experienced a remarkable price change of +112.22%. This bullish trend indicates strong investor confidence and an acceleration in price movements, with notable price extremes at a highest of 1208.74 and a lowest of 544.31. The stock has also shown volatility, with a standard deviation of 148.37, reflecting significant price fluctuations. Recent data from September 14, 2025, to November 30, 2025, shows a further increase of +19.83%, reinforcing the bullish sentiment.

Nova Ltd. (NVMI) Conversely, NVMI has recorded a price change of +139.8% over the past year, also indicating a bullish trend. However, unlike KLAC, NVMI is experiencing a deceleration in its acceleration status. The stock’s price has fluctuated between a high of 345.06 and a low of 129.32, with a standard deviation of 48.47. For the recent period from September 14, 2025, to November 30, 2025, the stock has shown a modest increase of +5.8%, suggesting a potential stabilization in price growth.

In summary, both KLAC and NVMI are on bullish trajectories, but KLAC is experiencing stronger momentum compared to NVMI, which is showing signs of deceleration. Investors should consider these trends when evaluating potential additions to their portfolios.

Analyst Opinions

Recent analyst recommendations for KLA Corporation (KLAC) suggest a “Buy” rating, reflecting strong metrics in return on equity and assets. Analysts highlight its solid fundamentals, although the price-to-earnings score indicates some caution. Conversely, Nova Ltd. (NVMI) receives a “Buy” rating as well, supported by its robust return on assets and overall strong performance. The consensus for both companies in 2025 leans towards a “Buy,” indicating confidence in their growth potential amidst careful risk management.

Stock Grades

In this section, I will present the most recent stock ratings for KLA Corporation (KLAC) and Nova Ltd. (NVMI) based on credible assessments from recognized grading companies.

KLA Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-10-31 |

| Goldman Sachs | maintain | Neutral | 2025-10-30 |

| TD Cowen | maintain | Hold | 2025-10-30 |

| Needham | maintain | Buy | 2025-10-30 |

| UBS | maintain | Neutral | 2025-10-30 |

| Wells Fargo | maintain | Equal Weight | 2025-10-30 |

| JP Morgan | maintain | Overweight | 2025-10-30 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-30 |

| Barclays | maintain | Overweight | 2025-10-30 |

| Evercore ISI Group | maintain | Outperform | 2025-10-30 |

Nova Ltd. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | maintain | Outperform | 2025-11-07 |

| Benchmark | maintain | Buy | 2025-11-07 |

| B of A Securities | maintain | Buy | 2025-06-24 |

| Cantor Fitzgerald | maintain | Overweight | 2025-06-24 |

| Citigroup | maintain | Buy | 2025-05-09 |

| Benchmark | maintain | Buy | 2025-05-09 |

| B of A Securities | maintain | Buy | 2025-04-16 |

| Cantor Fitzgerald | maintain | Overweight | 2025-03-14 |

| Benchmark | maintain | Buy | 2025-02-14 |

| Needham | maintain | Hold | 2025-02-14 |

Overall, the stock grades for both companies indicate a stable sentiment among analysts, with KLA Corporation receiving a mix of “Buy” and “Neutral” grades, while Nova Ltd. showcases a strong performance with consistent “Buy” and “Outperform” ratings from various grading companies. This trend reflects a cautious but positive outlook on both stocks, suggesting that they may be worthwhile additions to an investment portfolio.

Target Prices

The consensus target prices for KLA Corporation (KLAC) and Nova Ltd. (NVMI) indicate strong upside potential compared to current market prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| KLA Corporation | 1400 | 1154 | 1286.29 |

| Nova Ltd. | 224 | 210 | 217 |

For KLA Corporation, the target consensus suggests a potential upside of approximately 11% from its current price of 1155.18. Meanwhile, Nova Ltd. shows a target consensus of 217, presenting a significant upside from its current price of 310.99. Overall, analysts express optimism regarding both stocks’ future performance.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of KLA Corporation (KLAC) and Nova Ltd. (NVMI) based on the latest financial data.

| Criterion | KLA Corporation (KLAC) | Nova Ltd. (NVMI) |

|---|---|---|

| Diversification | High, multiple segments | Moderate, focused on metrology |

| Profitability | Strong net margin (33%) | Moderate net margin (27%) |

| Innovation | High R&D investment | Moderate innovation focus |

| Global presence | Extensive global reach | Growing international presence |

| Market Share | Leading in semiconductor | Niche player in metrology |

| Debt level | Moderate (38% debt to assets) | Low (17% debt to assets) |

Key takeaways: KLA Corporation demonstrates robust profitability and global presence, while Nova Ltd. offers lower debt levels and a more focused approach. Both companies have strengths that may suit different investor strategies.

Risk Analysis

In the following table, I outline the key risks associated with KLA Corporation (KLAC) and Nova Ltd. (NVMI) based on the most recent year.

| Metric | KLA Corporation (KLAC) | Nova Ltd. (NVMI) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and regulatory risks, particularly in the context of the semiconductor industry, which is sensitive to global demand fluctuations and regulatory changes. Recent geopolitical tensions could further impact their operations, especially for NVMI, which has a considerable international presence.

Which one to choose?

When comparing KLA Corporation (KLAC) and Nova Ltd. (NVMI), both companies show strong fundamentals, but they differ in some key areas. KLAC has a higher market cap of 119B and a robust profit margin of 33.4%, while NVMI, with a market cap of approximately 5.7B, has a profit margin of 27.3%. KLAC shows a better return on equity (ROE) of 86.6% compared to NVMI’s 19.8%. The stock trends for both companies are bullish, with KLAC’s price increasing by 112.2% and NVMI by 139.8%. Analysts give both a rating of B, with NVMI slightly higher at B+.

Investors focused on growth may prefer NVMI due to its higher price change percentage, while those prioritizing stability and high profitability may favor KLAC. However, investors should be aware of risks related to competition and market dependence in the semiconductor industry.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of KLA Corporation and Nova Ltd. to enhance your investment decisions: