In the rapidly evolving semiconductor industry, two companies stand out: Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. (CEVA). Both firms are pivotal players, yet they adopt distinct innovation strategies to capture market share. While Lattice focuses on field programmable gate arrays and video connectivity, CEVA specializes in wireless connectivity and smart sensing technologies. As we delve into this analysis, I aim to uncover which of these companies presents a more compelling investment opportunity for you.

Table of contents

Company Overview

Lattice Semiconductor Corporation Overview

Lattice Semiconductor Corporation (LSCC) specializes in developing and selling semiconductor products worldwide, focusing on field programmable gate arrays (FPGAs) and application-specific standard products. Founded in 1983, the company is headquartered in Hillsboro, Oregon, and serves diverse markets, including communications, computing, consumer electronics, and automotive sectors. With a market capitalization of approximately $9.72B, Lattice is recognized for its innovative solutions and strong presence in the semiconductor industry. The company’s strategic emphasis on licensing its technology through IP services further solidifies its competitive edge in a rapidly evolving market.

CEVA, Inc. Overview

CEVA, Inc. (CEVA) operates as a licensor of wireless connectivity and smart sensing technologies, primarily for semiconductor and original equipment manufacturer (OEM) companies. Established in 1999 and based in Rockville, Maryland, CEVA focuses on digital signal processors, AI processors, and integrated IP solutions that cater to various applications, including mobile, IoT, and automotive markets. With a market cap of around $494M, CEVA stands out for its comprehensive suite of technologies that enable advanced functionalities in next-generation devices and systems.

Key Similarities and Differences

Both companies operate within the semiconductor industry and focus on licensing their technology to OEMs. However, Lattice primarily emphasizes FPGAs and video connectivity products, while CEVA concentrates on wireless connectivity and smart sensing technologies. This differentiation reflects their unique strategies in addressing market needs and customer demands.

Income Statement Comparison

The following table summarizes the most recent income statements of Lattice Semiconductor Corporation and CEVA, Inc., providing insights into their financial performance.

| Metric | Lattice Semiconductor | CEVA, Inc. |

|---|---|---|

| Revenue | 509M | 107M |

| EBITDA | 107M | -3.4M |

| EBIT | 61M | -7.5M |

| Net Income | 61M | -8.8M |

| EPS | 0.44 | -0.37 |

Interpretation of Income Statement

Lattice Semiconductor Corporation (LSCC) shows a decrease in revenue from 737M in 2023 to 509M in 2024, reflecting a significant drop. However, LSCC maintained a positive net income of 61M, showcasing its ability to manage expenses despite lower sales. In contrast, CEVA, Inc. experienced declining revenue from 97M in 2023 to 107M in 2024, but faced substantial losses with a net income of -8.8M. CEVA’s negative EBITDA indicates operational challenges. Overall, LSCC demonstrates stronger financial health and resilience compared to CEVA, which continues to struggle with profitability.

Financial Ratios Comparison

In the following table, I present a comparative analysis of key financial metrics for Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. (CEVA), focusing on their most recent revenue and financial ratios.

| Metric | LSCC | CEVA |

|---|---|---|

| ROE | 37.4% | -3.3% |

| ROIC | 34.5% | -8.6% |

| P/E | 36.7 | -44.9 |

| P/B | 13.7 | 2.0 |

| Current Ratio | 3.7 | 7.1 |

| Quick Ratio | 2.6 | 7.1 |

| D/E | 0.02 | 0.02 |

| Debt-to-Assets | 1.8% | 2.1% |

| Interest Coverage | 129.5 | 0.0 |

| Asset Turnover | 0.60 | 0.32 |

| Fixed Asset Turnover | 7.6 | 8.4 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Lattice Semiconductor demonstrates strong profitability with a robust ROE and ROIC, indicating effective use of equity and capital. The high P/E ratio suggests elevated market expectations. In contrast, CEVA struggles with negative profitability metrics, indicating potential operational challenges. Despite a solid current and quick ratio, CEVA’s lack of earnings may pose significant risks for investors.

Dividend and Shareholder Returns

Lattice Semiconductor Corporation (LSCC) does not pay dividends and appears to prioritize reinvestment strategies for growth, as evidenced by its negative dividend payout ratio and ongoing share buyback programs. CEVA, Inc. (CEVA) also refrains from distributing dividends, likely focusing on R&D and acquisitions to bolster long-term value. Both companies’ lack of dividends suggests a commitment to sustainable growth, although the absence of immediate returns may pose risks for some investors seeking income.

Strategic Positioning

Lattice Semiconductor Corporation (LSCC) holds a significant market share in the semiconductor industry, primarily through its diverse product offerings like field programmable gate arrays. In contrast, CEVA, Inc. (CEVA) specializes in licensing wireless connectivity and smart sensing technologies, facing stiff competition from both established players and emerging tech disruptors. Both companies must navigate rapid technological changes and competitive pressure, especially in sectors like AI and IoT, where innovation is paramount for sustained growth.

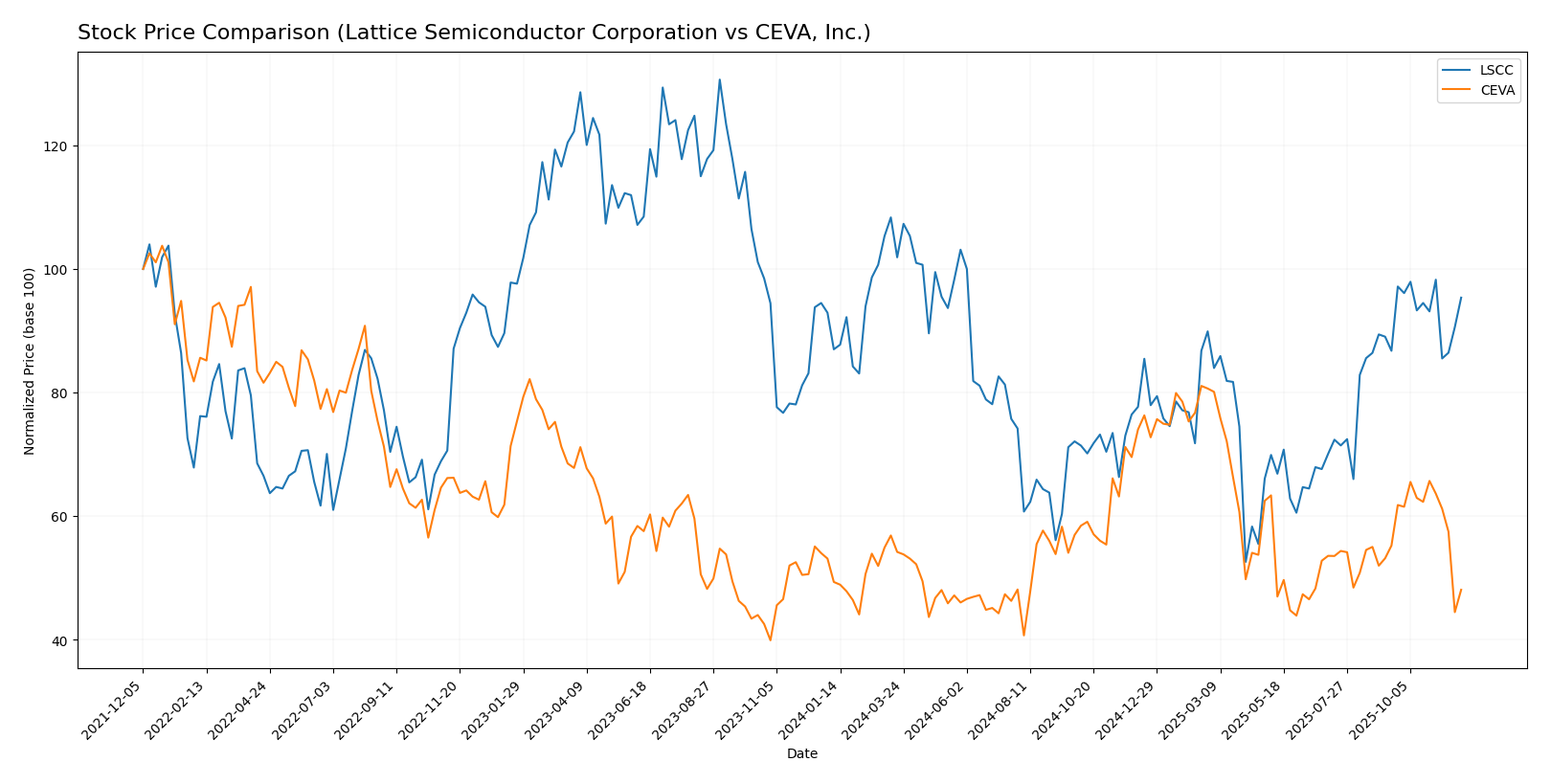

Stock Comparison

In the past year, the stock performance of Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. has exhibited notable price movements, reflecting distinct trading dynamics that are crucial for investors to consider.

Trend Analysis

Lattice Semiconductor Corporation (LSCC) Over the past year, LSCC has seen a percentage change of +9.62%, indicating a bullish trend. The stock reached a high of 80.45 and a low of 39.03, demonstrating a standard deviation of 9.96, which suggests moderate volatility. Recently, from September 14, 2025, to November 30, 2025, the stock experienced a price change of +9.93%, but the trend is showing signs of deceleration with a slight trend slope of -0.21.

CEVA, Inc. In contrast, CEVA has recorded a percentage change of -2.56% over the last year, categorizing it as a bearish trend. The highest price during this period was 34.67, while the lowest was 17.39, with a standard deviation of 4.47, indicating lower volatility compared to LSCC. For the recent period from September 14, 2025, to November 30, 2025, CEVA’s price change was -12.96%, accompanied by a trend slope of -0.42, reflecting ongoing deceleration in its performance.

Analyst Opinions

Recent analyst recommendations for Lattice Semiconductor Corporation (LSCC) indicate a cautious outlook, with a rating of B- based on solid return on assets (4) but a low price-to-earnings score (1). Analysts suggest holding as the company shows potential for growth but faces valuation challenges. In contrast, CEVA, Inc. (CEVA) has a C+ rating, reflecting weaknesses in return on equity (1) and return on assets (1). Analysts recommend selling CEVA due to its underperformance relative to peers. Overall, the consensus leans towards holding LSCC and selling CEVA in 2025.

Stock Grades

I have gathered the latest stock grades from reputable grading companies for Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. Here’s a breakdown of their current ratings.

Lattice Semiconductor Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-09-11 |

| Benchmark | Maintain | Buy | 2025-08-05 |

CEVA, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-11 |

| Rosenblatt | Maintain | Buy | 2025-08-14 |

| Oppenheimer | Maintain | Outperform | 2025-05-09 |

| Barclays | Maintain | Overweight | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-04-23 |

| Rosenblatt | Maintain | Buy | 2025-02-14 |

| Barclays | Maintain | Overweight | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-11 |

Overall, both LSCC and CEVA have maintained strong grades from multiple reputable grading companies, indicating a positive sentiment in the market towards these stocks. The consistency in their ratings suggests stability and confidence among analysts.

Target Prices

The consensus target prices for Lattice Semiconductor Corporation (LSCC) indicate a positive outlook among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Lattice Semiconductor Corporation | 85 | 65 | 79 |

With a current stock price of approximately 71.07, the consensus target price suggests potential upside, reflecting overall bullish sentiment among analysts. Unfortunately, no verified target price data is available for CEVA, Inc. (CEVA), indicating a lack of consensus in the market.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. (CEVA) based on the most recent data available.

| Criterion | Lattice Semiconductor (LSCC) | CEVA, Inc. (CEVA) |

|---|---|---|

| Diversification | High – multiple product families | Moderate – focused on wireless and smart sensing technologies |

| Profitability | Strong – net profit margin 35% | Weak – negative net profit margin -12% |

| Innovation | High – strong R&D investment | Moderate – focused innovation in specific technologies |

| Global presence | Strong – operates in multiple regions | Moderate – presence mainly in select markets |

| Market Share | Significant – leading in FPGAs | Smaller – niche market share in DSPs |

| Debt level | Low – debt to equity 2% | Low – debt to equity 2% |

Key takeaways from the analysis indicate that while LSCC has a robust profitability and diverse product range, CEVA faces profitability challenges despite its innovative capabilities in niche markets. Both companies maintain low debt levels, which is a positive sign for their financial health.

Risk Analysis

Below is a summary table of the risks associated with Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. (CEVA).

| Metric | Lattice Semiconductor (LSCC) | CEVA, Inc. (CEVA) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Low | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

In evaluating these companies, I find that both face notable market and operational risks. LSCC’s focus on semiconductors positions it well in a growing sector, while CEVA struggles with higher operational risks and a challenging market environment, underscored by its negative profit margins.

Which one to choose?

When comparing Lattice Semiconductor Corporation (LSCC) and CEVA, Inc. (CEVA), LSCC stands out as the more profitable option for investors. LSCC boasts higher gross profit margins (67% vs. 88%) and a strong net profit margin of 12% compared to CEVA’s -8%. LSCC’s price-to-earnings ratio of 37 suggests a more favorable valuation than CEVA’s negative earnings. Stock trends also indicate a bullish outlook for LSCC, with a recent price increase of 9.62%, while CEVA has experienced a bearish trend with a -2.56% price change. Analysts have rated LSCC with a B- compared to CEVA’s C+, indicating stronger overall performance.

Investors seeking growth may prefer LSCC, while those prioritizing value might find CEVA’s lower valuation appealing despite its risks. CEVA faces challenges in profitability and increasing competition in its sector, which could impact its future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Lattice Semiconductor Corporation and CEVA, Inc. to enhance your investment decisions: