As the semiconductor sector continues to evolve, two key players, Microchip Technology Incorporated (MCHP) and Silicon Laboratories Inc. (SLAB), stand out for their innovative approaches and market strategies. Both companies operate in the same industry, focusing on advanced technologies that cater to a variety of applications, including the Internet of Things (IoT). In this article, I will dissect their strengths and weaknesses to help you, the investor, determine which company may be the most compelling addition to your portfolio.

Table of contents

Company Overview

Microchip Technology Incorporated Overview

Microchip Technology Incorporated (MCHP) is a leading provider of smart, connected, and secure embedded control solutions, established in 1989 and headquartered in Chandler, Arizona. With a robust market cap of approximately $28.5B, Microchip specializes in a wide range of semiconductor products, including microcontrollers, embedded microprocessors, and various analog and mixed-signal solutions. The company’s diverse offerings cater to sectors such as automotive, industrial automation, and communications. By focusing on high-quality, reliable technologies, Microchip has positioned itself as a key player in the semiconductor industry, driving innovation for applications in power management, wired and wireless connectivity, and security.

Silicon Laboratories Inc. Overview

Silicon Laboratories Inc. (SLAB), founded in 1996 and based in Austin, Texas, operates as a fabless semiconductor company with a market cap of approximately $4.1B. The company specializes in analog-intensive mixed-signal solutions, particularly in the Internet of Things (IoT) space. Its product lineup includes wireless microcontrollers and sensors, serving diverse applications from smart home devices to industrial automation and medical instrumentation. Silicon Labs emphasizes innovation and integration, positioning itself as a leader in the rapidly expanding IoT market.

Key Similarities and Differences

Both Microchip and Silicon Laboratories operate within the semiconductor industry, focusing on embedded solutions and microcontrollers. However, Microchip’s offerings are broader, encompassing a wide array of sectors beyond IoT, while Silicon Labs centers more on analog and mixed-signal solutions specifically for IoT applications. Additionally, Microchip has a significantly larger workforce and market capitalization, reflecting its extensive product range and market presence.

Income Statement Comparison

The table below provides a snapshot of the most recent income statements for Microchip Technology Incorporated (MCHP) and Silicon Laboratories Inc. (SLAB), comparing key financial metrics.

| Metric | MCHP | SLAB |

|---|---|---|

| Revenue | 4.40B | 0.58B |

| EBITDA | 1.04B | -0.10B |

| EBIT | 0.29B | -0.15B |

| Net Income | -0.50M | -0.19M |

| EPS | -0.005 | -5.93 |

Interpretation of Income Statement

In FY 2025, MCHP reported a significant decline in revenue to 4.40B, down from 7.63B in the previous year, resulting in a net loss of 0.50M. This stark reduction suggests challenges in maintaining market demand. Conversely, SLAB experienced a drop in revenue to 0.58B, continuing a downward trend, with a net loss of 0.19M. Both companies faced deteriorating margins, with MCHP’s EBITDA reflecting operational difficulties. The recent year indicates a slowdown in growth for both entities, highlighting the need for strategic adjustments to improve their financial health.

Financial Ratios Comparison

Below is a comparative overview of the most recent revenue and financial ratios for Microchip Technology Incorporated (MCHP) and Silicon Laboratories Inc. (SLAB).

| Metric | MCHP | SLAB |

|---|---|---|

| ROE | -0.07% | -0.18% |

| ROIC | -0.03% | -0.18% |

| P/E | -52021.39 | -21.53 |

| P/B | 3.67 | 3.81 |

| Current Ratio | 2.59 | 6.15 |

| Quick Ratio | 1.47 | 5.07 |

| D/E | 0.80 | 0.05 |

| Debt-to-Assets | 0.37 | 0.05 |

| Interest Coverage | 1.18 | -126.33 |

| Asset Turnover | 0.29 | 0.48 |

| Fixed Asset Turnover | 3.72 | 4.42 |

| Payout Ratio | -1951.4% | 0% |

| Dividend Yield | 3.75% | 0% |

Interpretation of Financial Ratios

MCHP shows concerning ratios with negative ROE and a high P/E ratio, suggesting potential difficulties in profitability. Conversely, SLAB’s current and quick ratios indicate strong liquidity, but its negative interest coverage ratio raises red flags about its debt sustainability. Overall, both companies exhibit weaknesses in profitability that could warrant caution for investors.

Dividend and Shareholder Returns

Microchip Technology (MCHP) pays dividends with a current yield of 1.87% and a payout ratio of approximately 48%. This indicates a sustainable distribution, supported by cash flow. However, I caution against excessive repurchases that could strain financial stability.

In contrast, Silicon Laboratories (SLAB) does not pay dividends, opting instead to reinvest in growth through R&D and acquisitions. This strategy aligns with long-term shareholder value creation, despite the absence of immediate returns. Ultimately, MCHP’s dividends and SLAB’s reinvestment both present valid paths to value creation.

Strategic Positioning

In the semiconductor market, Microchip Technology (MCHP) holds a significant position with a market cap of 28.5B USD, focusing on a diverse range of microcontrollers and embedded solutions. In comparison, Silicon Laboratories (SLAB), with a market cap of 4.1B USD, specializes in analog-intensive mixed-signal solutions and has a strong foothold in IoT applications. Both companies face competitive pressure from rapid technological advancements and evolving market demands, necessitating continuous innovation to mitigate risks and maintain their market shares.

Stock Comparison

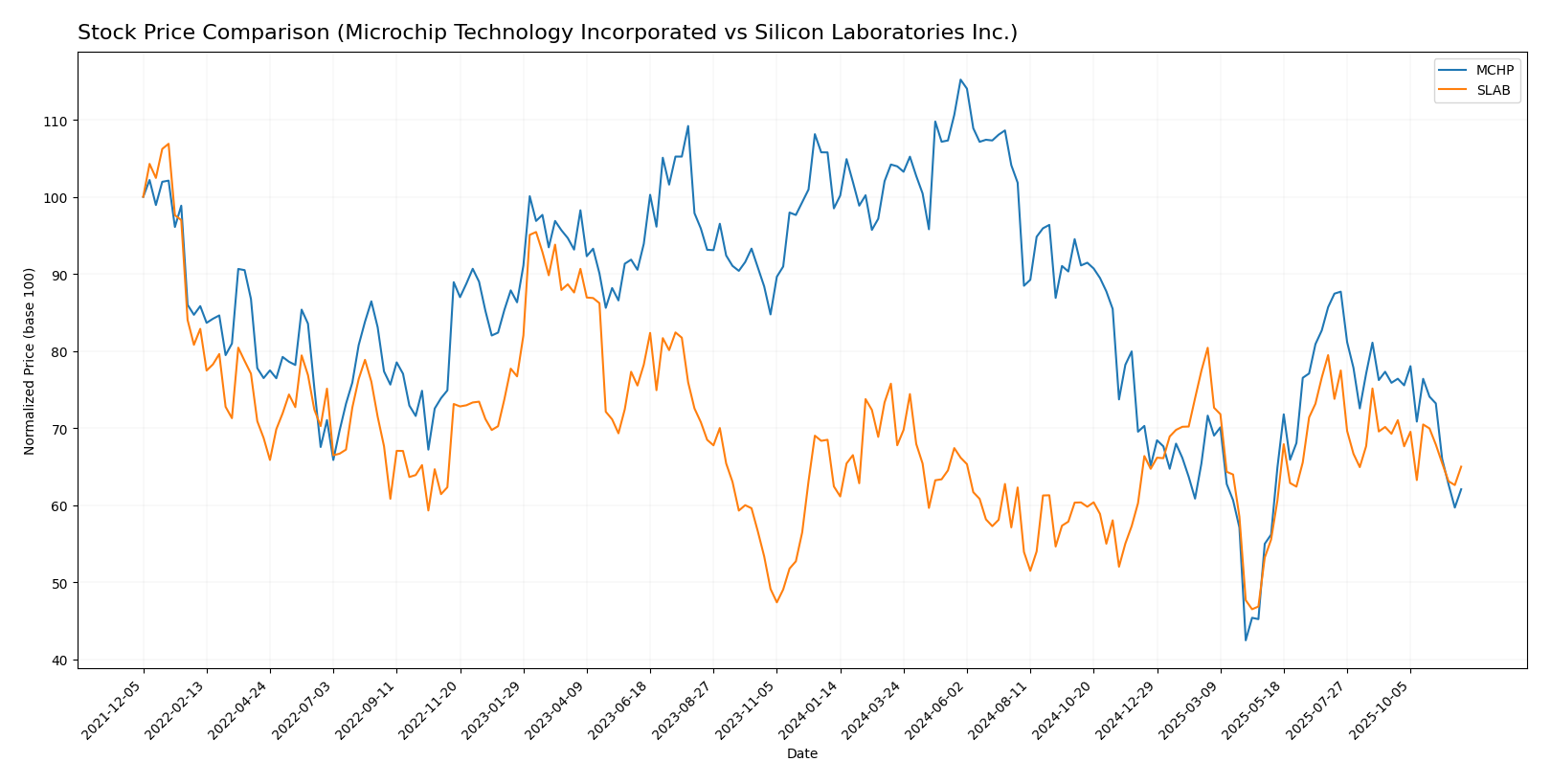

In this section, I will analyze the weekly stock price movements of Microchip Technology Incorporated (MCHP) and Silicon Laboratories Inc. (SLAB) over the past year, focusing on significant price changes and trading dynamics.

Trend Analysis

Microchip Technology Incorporated (MCHP) Over the past year, MCHP has experienced a price change of -36.99%. This signifies a bearish trend, with notable deceleration in its movement. The stock reached a high of 98.23 and a low of 36.22. The standard deviation of 14.87 indicates substantial volatility in its price. Recently, from September 14, 2025, to November 30, 2025, the price decreased by 18.2% with a standard deviation of 5.32, confirming a recent bearish sentiment.

Silicon Laboratories Inc. (SLAB) In contrast, SLAB has seen a price change of +4.1% over the past year, indicating a bullish trend, albeit with deceleration. The stock peaked at 155.33 and dipped to a low of 89.82. The standard deviation of 13.72 suggests moderate volatility. During the recent period from September 14, 2025, to November 30, 2025, SLAB’s price fell by 6.16% while maintaining a standard deviation of 5.7, reflecting some bearish pressure in the short term.

Both stocks exhibit distinct trends, with MCHP showing a significant decline and SLAB remaining cautiously optimistic despite recent challenges.

Analyst Opinions

Recent recommendations for Microchip Technology Incorporated (MCHP) and Silicon Laboratories Inc. (SLAB) have been cautious, with both receiving a rating of C-. Analysts highlight concerns regarding low scores in key financial metrics, such as return on equity and price-to-earnings ratios. Analysts suggest that potential investors should be cautious, with a preference for holding rather than buying. The consensus for both companies appears to lean towards a sell for the current year, reflecting a wait-and-see approach amid uncertain market conditions.

Stock Grades

Here’s a look at the most recent stock grades from reputable grading companies for Microchip Technology Incorporated (MCHP) and Silicon Laboratories Inc. (SLAB).

Microchip Technology Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | maintain | Positive | 2025-11-07 |

| Truist Securities | maintain | Hold | 2025-11-07 |

| Citigroup | maintain | Buy | 2025-11-07 |

| Needham | maintain | Buy | 2025-11-07 |

| Stifel | maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-07 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-04 |

| Needham | maintain | Buy | 2025-08-08 |

| Piper Sandler | maintain | Overweight | 2025-08-08 |

Silicon Laboratories Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | maintain | Neutral | 2025-08-06 |

| Morgan Stanley | maintain | Equal Weight | 2025-08-06 |

| Barclays | maintain | Equal Weight | 2025-08-05 |

| Susquehanna | maintain | Neutral | 2025-07-22 |

| Stifel | maintain | Buy | 2025-07-18 |

| Keybanc | maintain | Overweight | 2025-07-08 |

| Benchmark | maintain | Buy | 2025-05-27 |

| Needham | maintain | Buy | 2025-05-14 |

| Benchmark | maintain | Buy | 2025-05-14 |

| Susquehanna | maintain | Neutral | 2025-05-14 |

In summary, both companies have maintained a mix of positive and neutral grades from reliable sources, indicating a generally stable outlook. MCHP shows strong buy recommendations from multiple firms, while SLAB reflects a more cautious stance with several neutral grades.

Target Prices

The consensus target prices for the following companies indicate positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology (MCHP) | 83 | 60 | 71.33 |

| Silicon Laboratories (SLAB) | 165 | 130 | 147.5 |

For Microchip Technology (MCHP), the current price of 52.91 is significantly below the target consensus of 71.33, suggesting potential upside. Similarly, Silicon Laboratories (SLAB) is trading at 125.84, which is also below its consensus target of 147.5, indicating room for growth.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Microchip Technology Incorporated (MCHP) and Silicon Laboratories Inc. (SLAB) based on their most recent performance metrics.

| Criterion | Microchip Technology (MCHP) | Silicon Laboratories (SLAB) |

|---|---|---|

| Diversification | Strong focus on various embedded solutions | Limited product range focusing on IoT |

| Profitability | Positive margins, but recent profitability issues | Negative margins, struggling with profitability |

| Innovation | Strong R&D investment | Innovative in IoT solutions but recent challenges |

| Global presence | Extensive global operations | Limited global reach |

| Market Share | Significant in semiconductor sector | Small market share in niche markets |

| Debt level | Moderate debt levels | Very low debt levels |

Key takeaways show that while Microchip Technology has a robust global presence and diversified product offerings, Silicon Laboratories is currently struggling with profitability and market share. MCHP may represent a more stable investment, while SLAB’s innovative edge could appeal to specific risk-tolerant investors.

Risk Analysis

In the following table, I outline the key risks associated with Microchip Technology Incorporated (MCHP) and Silicon Laboratories Inc. (SLAB) as of the most recent fiscal year.

| Metric | MCHP | SLAB |

|---|---|---|

| Market Risk | High | Medium |

| Regulatory Risk | Medium | High |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | High |

Both companies face notable risks, particularly in operational and regulatory aspects. SLAB is under pressure from high operational costs and regulatory scrutiny, resulting in a negative net profit margin of -32.7% in 2024. Conversely, MCHP’s market volatility and regulatory challenges are significant, but they maintain a more stable operational profile.

Which one to choose?

When comparing Microchip Technology (MCHP) and Silicon Laboratories (SLAB), both companies present a mixed financial picture. MCHP shows a bearish trend with a significant decline of 36.99% in stock price, while SLAB has experienced a modest bullish trend, gaining 4.1%. MCHP has a market cap of 26B with a net income margin of -0.0001, indicating profitability challenges. In contrast, SLAB’s latest revenue was 584M, but it also reported negative net income. Both companies share a C- rating, reflecting concerns over operational efficiency and profitability.

For growth-oriented investors, SLAB may be more appealing despite its volatility, while those seeking stability might lean towards MCHP, given its larger market cap and established presence. However, be cautious of industry risks including competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Microchip Technology Incorporated and Silicon Laboratories Inc. to enhance your investment decisions: