In the ever-evolving semiconductor industry, two notable players, STMicroelectronics N.V. (STM) and Lattice Semiconductor Corporation (LSCC), stand out for their innovative approaches and market strategies. Both companies operate within the same sector, catering to diverse markets, from automotive to consumer electronics. Their focus on cutting-edge technology and unique product offerings makes this comparison vital for investors. Join me as we delve into their strengths and weaknesses to uncover which company presents the most compelling investment opportunity.

Table of contents

Company Overview

STMicroelectronics N.V. Overview

STMicroelectronics N.V., headquartered in Schiphol, the Netherlands, is a global leader in semiconductor solutions, primarily targeting automotive, industrial, and personal electronics markets. The company operates through several segments, including Automotive and Discrete Group, Analog, MEMS and Sensors Group, and Microcontrollers and Digital ICs Group. STMicroelectronics is known for its extensive product portfolio, which ranges from automotive integrated circuits to advanced analog products and microcontrollers. With a strong market presence across Europe, the Middle East, Africa, the Americas, and Asia Pacific, STMicroelectronics aims to drive innovation in key industries, contributing to the development of smart, connected devices.

Lattice Semiconductor Corporation Overview

Lattice Semiconductor Corporation, based in Hillsboro, Oregon, specializes in designing and marketing semiconductor products, particularly field programmable gate arrays (FPGAs). The company serves a diverse range of end markets, including communications, computing, consumer electronics, and automotive sectors. Lattice’s innovative offerings include popular product families like Certus-NX and iCE40, along with application-specific standard products for video connectivity. Their business model emphasizes direct sales to customers and partnerships with independent distributors, allowing them to effectively penetrate global markets, particularly in Asia, Europe, and the Americas.

Key Similarities and Differences

Both STMicroelectronics and Lattice Semiconductor operate within the semiconductor industry, focusing on innovative technology solutions. However, STMicroelectronics has a broader product range, including automotive and industrial applications, while Lattice specializes in FPGAs and video connectivity solutions. Their market strategies also differ: STMicroelectronics serves a wider array of sectors, while Lattice focuses on niche markets through direct sales and licensing.

Income Statement Comparison

In this section, I present a comparative analysis of the most recent income statements for STMicroelectronics N.V. (STM) and Lattice Semiconductor Corporation (LSCC), highlighting key financial metrics.

| Metric | STM | LSCC |

|---|---|---|

| Revenue | 13.27B | 509.40M |

| EBITDA | 3.72B | 106.94M |

| EBIT | 1.96B | 60.68M |

| Net Income | 1.56B | 61.13M |

| EPS | 1.73 | 0.44 |

Interpretation of Income Statement

The income statements indicate that STM experienced a decline in revenue from 17.29B in 2023 to 13.27B in 2024, reflecting a significant contraction. Conversely, LSCC faced a decrease in revenue as well, dropping from 737.15M to 509.40M. STM’s net income also fell sharply from 4.21B to 1.56B, indicating a material impact on profitability, while LSCC’s net income remained relatively stable at 61.31M. Notably, STM’s margins have been adversely affected, which may suggest increased operational challenges. In contrast, LSCC’s performance remained resilient, showing only minor fluctuations in earnings despite the revenue downturn.

Financial Ratios Comparison

The table below presents a comparative analysis of key financial metrics for STMicroelectronics N.V. (STM) and Lattice Semiconductor Corporation (LSCC) as of the most recent fiscal year.

| Metric | STM | LSCC |

|---|---|---|

| ROE | 25.17% | 37.44% |

| ROIC | 19.46% | 34.48% |

| P/E | 14.43 | 36.67 |

| P/B | 1.29 | 13.73 |

| Current Ratio | 3.11 | 3.66 |

| Quick Ratio | 2.37 | 2.62 |

| D/E | 0.18 | 0.02 |

| Debt-to-Assets | 0.13 | 0.02 |

| Interest Coverage | 19.72 | 129.54 |

| Asset Turnover | 0.54 | 0.60 |

| Fixed Asset Turnover | 1.22 | 7.62 |

| Payout Ratio | 18.50% | 0% |

| Dividend Yield | 1.28% | 0% |

Interpretation of Financial Ratios

The financial ratios indicate that STM demonstrates solid profitability with a robust ROE and ROIC, although its P/E ratio suggests it may be undervalued compared to LSCC. LSCC shows higher efficiency ratios, particularly in asset management, but its elevated P/B and P/E ratios raise concerns about potential overvaluation. Both companies maintain healthy liquidity ratios, but STM’s higher debt metrics imply a more leveraged position. Careful consideration of these factors is essential before making investment decisions.

Dividend and Shareholder Returns

STMicroelectronics (STM) pays a dividend of $0.32 per share, with a payout ratio of approximately 18.5% and a dividend yield of around 1.3%. Their free cash flow coverage indicates sustainable distributions, though caution is warranted regarding potential risks of excessive repurchases. Conversely, Lattice Semiconductor (LSCC) does not pay dividends, focusing instead on reinvestment for growth. Their strong cash flow positions and share buyback programs suggest a commitment to enhancing long-term shareholder value. Overall, STM’s dividends and LSCC’s reinvestment both support sustainable value creation for shareholders.

Strategic Positioning

STMicroelectronics N.V. (STM) holds a significant market share in the semiconductor sector, particularly in automotive and industrial applications, while Lattice Semiconductor Corporation (LSCC) focuses on niche areas like field programmable gate arrays. STM’s broader product range and established market presence create competitive pressure for LSCC, which is innovating in specific applications. Both companies face technological disruption as demand for advanced semiconductor solutions grows, further intensifying competition. Overall, I see STM’s diversified portfolio as a strength, while LSCC’s focus on specialized products could offer growth opportunities.

Stock Comparison

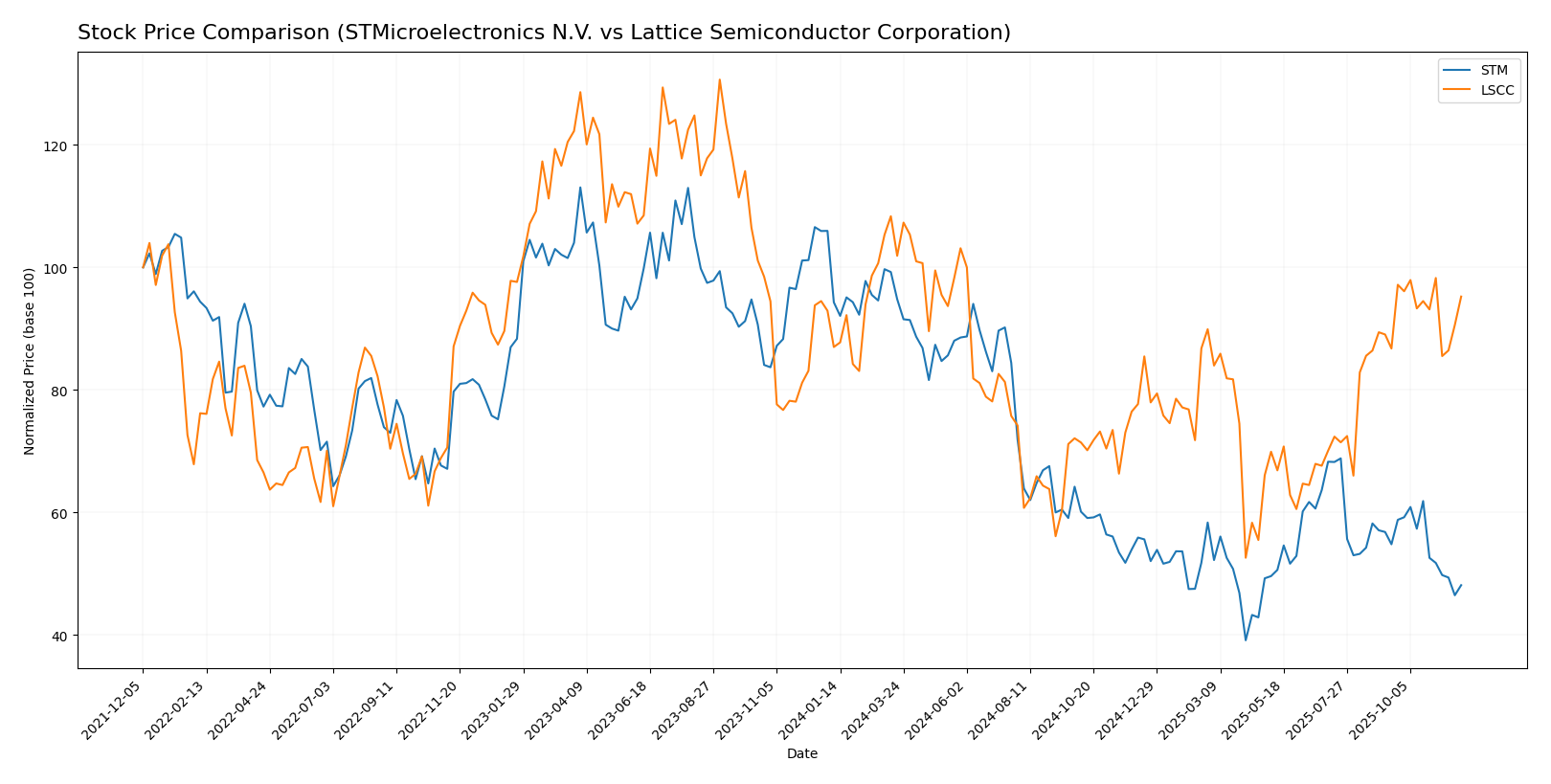

In this section, I will analyze the weekly stock price movements of STMicroelectronics N.V. (STM) and Lattice Semiconductor Corporation (LSCC) over the past year, highlighting key dynamics and price trends.

Trend Analysis

For STMicroelectronics N.V. (STM), the overall price change over the past year is -49.0%, indicating a bearish trend. The highest price reached was 47.17, while the lowest was 18.49. The trend shows deceleration, and the standard deviation is 8.0, reflecting notable volatility in the stock’s price. In the more recent analysis period from September 14, 2025, to November 30, 2025, STM experienced a further decline of 12.2%, with a standard deviation of 2.4, suggesting ongoing volatility but with a steeper slope of -0.55.

Conversely, Lattice Semiconductor Corporation (LSCC) has shown a positive overall price change of 9.48% over the past year, which places it in a bullish trend. The highest price recorded was 80.45, and the lowest was 39.03. The trend also indicates deceleration, with a standard deviation of 9.95 highlighting some price fluctuations. In the most recent period from September 14, 2025, to November 30, 2025, LSCC saw a price increase of 9.78% with a standard deviation of 3.25, and a trend slope of -0.21, suggesting a mild slowdown in the rate of price increase.

In summary, while LSCC is experiencing a stable bullish trend, STM is in a significant bearish trajectory, warranting careful consideration for potential investment decisions.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for STMicroelectronics N.V. (STM) and Lattice Semiconductor Corporation (LSCC). STM received a “B+” rating with analysts highlighting strong return on assets and a solid discounted cash flow score. Conversely, LSCC holds a “B-” rating, with concerns over its price-to-book ratio despite decent performance in other areas. Currently, the consensus leans toward a “buy” for STM, while LSCC is viewed more cautiously. Analysts emphasize the importance of monitoring market trends and operational performance in both companies.

Stock Grades

Recent stock ratings provide valuable insights into the market positions of STMicroelectronics N.V. (STM) and Lattice Semiconductor Corporation (LSCC). Here’s a summary of the latest grades from recognized grading companies.

STMicroelectronics N.V. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | maintain | Buy | 2025-10-24 |

| Susquehanna | maintain | Positive | 2025-10-22 |

| Susquehanna | maintain | Positive | 2025-07-25 |

| Susquehanna | maintain | Positive | 2025-07-22 |

| Baird | upgrade | Outperform | 2025-07-22 |

| Jefferies | upgrade | Buy | 2025-02-19 |

| Bernstein | downgrade | Market Perform | 2025-02-05 |

| Susquehanna | maintain | Positive | 2025-01-31 |

| Barclays | downgrade | Underweight | 2025-01-22 |

| JP Morgan | downgrade | Neutral | 2024-12-09 |

Lattice Semiconductor Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | maintain | Buy | 2025-11-04 |

| Needham | maintain | Buy | 2025-11-04 |

| Benchmark | maintain | Buy | 2025-11-04 |

| Stifel | maintain | Buy | 2025-11-04 |

| Baird | maintain | Outperform | 2025-11-04 |

| Susquehanna | maintain | Positive | 2025-10-22 |

| Keybanc | maintain | Overweight | 2025-09-30 |

| Needham | maintain | Buy | 2025-09-22 |

| Benchmark | maintain | Buy | 2025-09-11 |

| Benchmark | maintain | Buy | 2025-08-05 |

The overall trend for both companies shows a consistent maintaining of positive ratings, indicating strong investor confidence. Notably, STMicroelectronics has seen upgrades from several firms, while Lattice Semiconductor continues to hold a strong “Buy” rating from multiple analysts.

Target Prices

The current consensus target prices for the companies in question indicate a positive outlook from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| STMicroelectronics N.V. (STM) | 45 | 22 | 33.38 |

| Lattice Semiconductor Corporation (LSCC) | 85 | 65 | 79 |

For STM, the consensus target price of 33.38 is significantly above its current price of 22.76, suggesting potential upside. LSCC’s consensus of 79 is also above its current value of 70.76, indicating favorable analyst sentiment.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of STMicroelectronics N.V. and Lattice Semiconductor Corporation based on recent financial data.

| Criterion | STMicroelectronics N.V. | Lattice Semiconductor Corporation |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (Net Margin: 12%) | Moderate (Net Margin: 12%) |

| Innovation | High | Moderate |

| Global presence | Extensive | Moderate |

| Market Share | Significant | Growing |

| Debt level | Low (Debt to Equity: 0.18) | Very Low (Debt to Equity: 0.02) |

Key takeaways include STMicroelectronics’ strong global presence and profitability, while Lattice Semiconductor demonstrates very low debt levels, indicating solid financial health. Investors should weigh these factors against their risk tolerance and investment strategy.

Risk Analysis

Below is a summary table of the key risks associated with STMicroelectronics N.V. and Lattice Semiconductor Corporation:

| Metric | STMicroelectronics (STM) | Lattice Semiconductor (LSCC) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

In analyzing these companies, I find that the most significant risks include market volatility and geopolitical tensions, particularly for LSCC, which operates in a highly competitive sector and is more exposed to trade disputes. As the semiconductor industry evolves rapidly, firms must navigate these complexities carefully.

Which one to choose?

When comparing STMicroelectronics N.V. (STM) and Lattice Semiconductor Corporation (LSCC), several factors come into play. STM exhibits a strong financial performance with a gross profit margin of 39.34% and a net profit margin of 11.73%. Its recent bearish stock trend, with a price change of -49%, raises concerns. In contrast, LSCC shows a bullish trend with a price change of 9.48% and a higher gross profit margin of 66.82%. However, it faces a high valuation risk, reflected in its price-to-earnings ratio of 132.74.

Analyst ratings favor STM with a grade of B+, compared to LSCC’s B-. For investors focused on growth, LSCC may be attractive, while those prioritizing stability might prefer STM. Both companies face risks associated with competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of STMicroelectronics N.V. and Lattice Semiconductor Corporation to enhance your investment decisions: