In the fast-paced world of semiconductors, understanding the nuances between industry players is crucial for investors. Today, I will compare Texas Instruments Incorporated (TXN) and Lattice Semiconductor Corporation (LSCC), both prominent names in the semiconductor sector. Their overlapping markets and differing innovation strategies offer intriguing insights into their growth potential. Join me as we explore which company stands out as the more compelling choice for investment in this dynamic industry.

Table of contents

Company Overview

Texas Instruments Overview

Texas Instruments Incorporated (TXN), based in Dallas, Texas, is a leading designer and manufacturer of semiconductors. Established in 1930, the company operates primarily in two segments: Analog and Embedded Processing. The Analog segment provides essential power management solutions and signal chain products, catering to diverse markets such as automotive and industrial. Meanwhile, the Embedded Processing segment focuses on microcontrollers and digital signal processors, integral to modern electronic devices. With a market capitalization of approximately $151B and a strong dividend history, Texas Instruments positions itself as a robust player in the semiconductor industry, known for its innovation and comprehensive product offerings.

Lattice Semiconductor Overview

Lattice Semiconductor Corporation (LSCC), founded in 1983 and headquartered in Hillsboro, Oregon, specializes in developing field programmable gate arrays (FPGAs) and related semiconductor products. The company serves a wide array of markets, including communications, computing, and automotive. Lattice’s products, such as the Certus-NX and iCE40 families, are tailored for high-performance applications. With a market cap of around $9.65B, Lattice emphasizes licensing its technology portfolio and offers products both directly and through distributors, showcasing its strategic approach to market penetration and customer engagement.

Key Similarities and Differences

Both Texas Instruments and Lattice Semiconductor operate in the semiconductor industry and focus on innovation in their respective product lines. However, TXN emphasizes analog and embedded processing solutions, while LSCC specializes in FPGAs and licensing technology. This difference highlights their unique positioning within the broader market landscape.

Income Statement Comparison

The following table provides a comparison of the income statements for Texas Instruments (TXN) and Lattice Semiconductor (LSCC) for the most recent fiscal year, 2024.

| Metric | Texas Instruments (TXN) | Lattice Semiconductor (LSCC) |

|---|---|---|

| Revenue | 15.64B | 509.40M |

| EBITDA | 7.54B | 106.94M |

| EBIT | 5.96B | 60.68M |

| Net Income | 4.80B | 61.13M |

| EPS | 5.24 | 0.44 |

Interpretation of Income Statement

In 2024, Texas Instruments experienced a notable decline in revenue, down from 17.52B in 2023, while Lattice Semiconductor’s revenue also decreased from 737.15M in 2023 to 509.40M. However, TXN maintained a strong EBITDA margin of approximately 48% compared to Lattice’s 21%. Both companies showed stability in their net income margins, but Texas Instruments faced a significant drop in net income, reflecting a challenging market environment. Additionally, TXN’s EPS decreased from 7.13 to 5.24, indicating potential investor concerns about future growth prospects.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent revenue and financial ratios for Texas Instruments (TXN) and Lattice Semiconductor (LSCC).

| Metric | TXN | LSCC |

|---|---|---|

| ROE | 28.39% | 8.60% |

| ROIC | 14.75% | 7.75% |

| P/E | 35.63 | 132.74 |

| P/B | 10.12 | 11.41 |

| Current Ratio | 4.12 | 3.66 |

| Quick Ratio | 2.88 | 2.62 |

| D/E | 0.80 | 0.02 |

| Debt-to-Assets | 38.29% | 1.81% |

| Interest Coverage | 10.76 | 129.54 |

| Asset Turnover | 0.44 | 0.60 |

| Fixed Asset Turnover | 1.38 | 7.62 |

| Payout Ratio | 99.92% | 0.00% |

| Dividend Yield | 2.80% | 0.00% |

Interpretation of Financial Ratios

Texas Instruments shows strong profitability with a high ROE and ROIC, indicating effective capital utilization. However, its P/E ratio suggests a premium valuation compared to Lattice Semiconductor, which has a significantly higher P/E, indicating potential overvaluation or growth expectations. LSCC maintains low debt levels, enhancing financial stability, whereas TXN’s high payout ratio and debt reliance raise concerns about future cash flow sustainability. Overall, both companies exhibit strengths and weaknesses that warrant careful consideration in investment decisions.

Dividend and Shareholder Returns

Texas Instruments (TXN) actively rewards shareholders with a dividend yield of 2.8% and a payout ratio of approximately 99.9%, indicating a commitment to return profits while balancing capital needs. In contrast, Lattice Semiconductor (LSCC) does not distribute dividends, as it prioritizes reinvestment for growth in a high-demand market, evidenced by a robust cash flow coverage ratio. While TXN’s approach supports immediate returns, LSCC’s strategy may position it for long-term value creation, albeit with inherent risks associated with growth-focused investments.

Strategic Positioning

Texas Instruments (TXN) holds a strong market share in the analog and embedded processing segments, leveraging its extensive product range and established customer relationships. In contrast, Lattice Semiconductor (LSCC) focuses on niche markets with its field programmable gate arrays, facing competitive pressure from larger semiconductor firms. Both companies are impacted by technological disruptions, such as advancements in AI and IoT, which necessitate ongoing innovation to maintain their market positions.

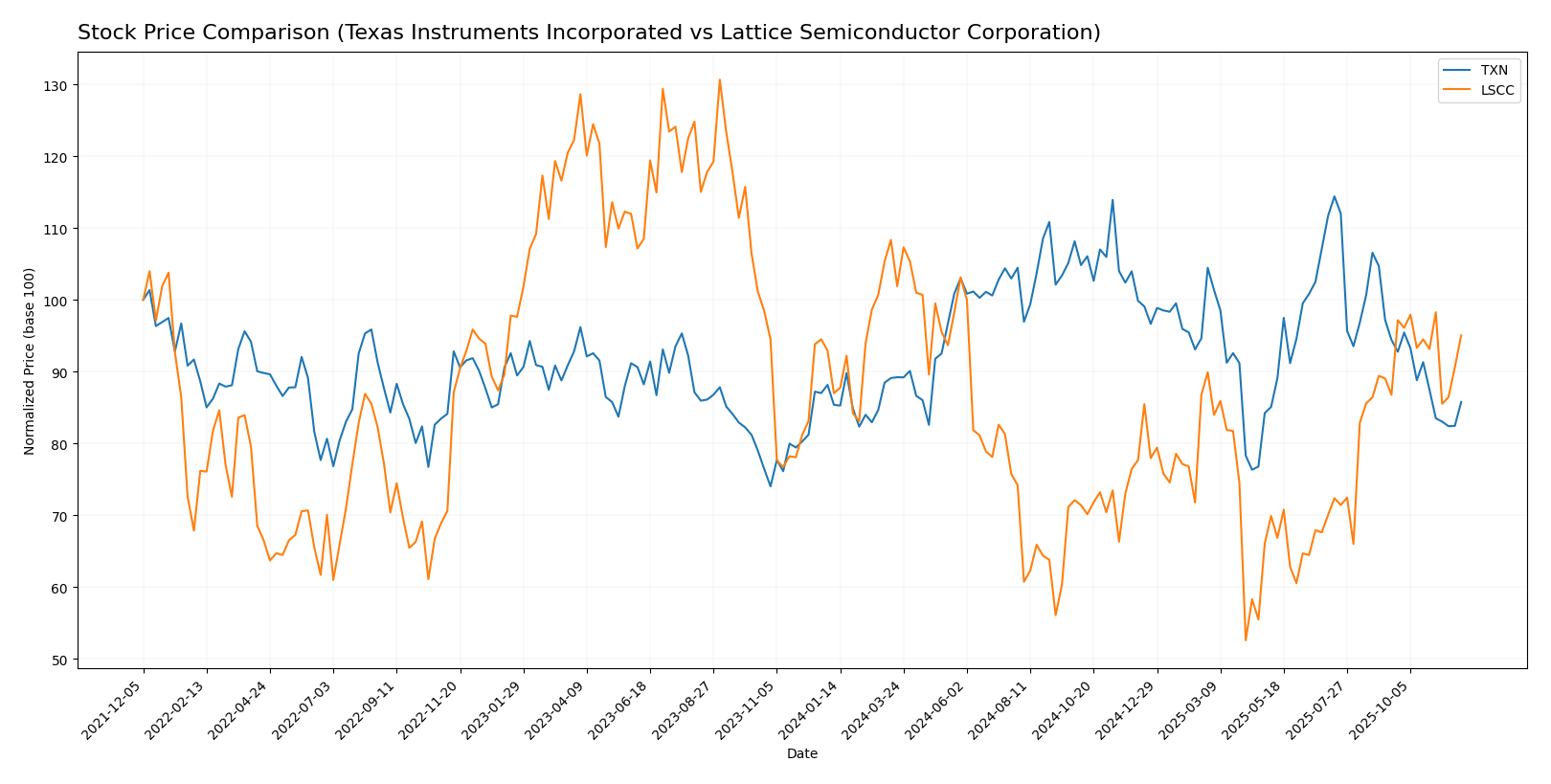

Stock Comparison

In this section, I will analyze the weekly stock price movements for Texas Instruments Incorporated (TXN) and Lattice Semiconductor Corporation (LSCC), highlighting key price dynamics from the past year.

Trend Analysis

Texas Instruments Incorporated (TXN) Over the past year, TXN has experienced a percentage change of +0.44%. This indicates a bullish trend, although the trend is showing deceleration. The stock reached a notable high of 221.25 and a low of 147.6, with a standard deviation of 16.91 suggesting some level of volatility. Recently, from September 14, 2025, to November 30, 2025, the stock exhibited a decline of -9.18% with a standard deviation of 9.16, indicating a seller-dominant behavior in the market.

Lattice Semiconductor Corporation (LSCC) LSCC has performed significantly better over the past year, with a percentage change of +9.26%, indicating a bullish trend but also showing deceleration in its upward momentum. The stock’s highest price was 80.45, while the lowest was 39.03, with a standard deviation of 9.95, pointing to moderate volatility. In the recent period from September 14, 2025, to November 30, 2025, LSCC recorded a solid increase of +9.56%, with a standard deviation of 3.25, reflecting a buyer-dominant market behavior.

Analyst Opinions

Recent analyst recommendations indicate a cautious yet optimistic outlook for both Texas Instruments (TXN) and Lattice Semiconductor (LSCC). I found that analysts have rated TXN with a solid “B,” highlighting strong performance in return on equity and assets. Conversely, LSCC has received a “B-” rating, reflecting a balanced performance but with some concerns regarding its price-to-earnings ratio. Notably, the consensus for TXN leans towards a buy, while LSCC is recommended as a hold. Analysts emphasize the potential for growth in the semiconductor market, but advise careful monitoring of market conditions.

Stock Grades

In the current market environment, I have analyzed recent stock ratings for Texas Instruments Incorporated (TXN) and Lattice Semiconductor Corporation (LSCC) to provide you with reliable insights.

Texas Instruments Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Rosenblatt | Maintain | Buy | 2025-10-22 |

| Truist Securities | Maintain | Hold | 2025-10-22 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-22 |

| Goldman Sachs | Maintain | Buy | 2025-10-22 |

| JP Morgan | Maintain | Overweight | 2025-10-22 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-22 |

| Stifel | Maintain | Hold | 2025-10-22 |

| TD Cowen | Maintain | Buy | 2025-10-22 |

| Mizuho | Downgrade | Underperform | 2025-10-20 |

Lattice Semiconductor Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2025-11-04 |

| Needham | Maintain | Buy | 2025-11-04 |

| Benchmark | Maintain | Buy | 2025-11-04 |

| Stifel | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Outperform | 2025-11-04 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Keybanc | Maintain | Overweight | 2025-09-30 |

| Needham | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-09-11 |

| Benchmark | Maintain | Buy | 2025-08-05 |

Overall, both TXN and LSCC show a strong tendency towards maintaining positive ratings, with multiple “Buy” and “Outperform” recommendations from various reputable grading companies. This suggests a favorable outlook for investors considering these stocks for their portfolios. However, I advise remaining cautious, especially regarding TXN’s recent downgrade by Mizuho, which indicates potential volatility.

Target Prices

The consensus target prices for the companies under review indicate optimistic potential for growth.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Texas Instruments Incorporated | 245 | 145 | 190.45 |

| Lattice Semiconductor Corporation | 85 | 65 | 79 |

For Texas Instruments (TXN), the current stock price of 165.82 is below the target consensus of 190.45, suggesting a potential upside. Similarly, Lattice Semiconductor (LSCC) is currently priced at 70.555, which is also below the consensus target of 79, indicating room for growth. Overall, both companies have favorable analyst expectations based on their target prices.

Strengths and Weaknesses

The table below summarizes the strengths and weaknesses of Texas Instruments Incorporated (TXN) and Lattice Semiconductor Corporation (LSCC) based on recent data.

| Criterion | Texas Instruments | Lattice Semiconductor |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (30.68% Net Margin) | Moderate (12.00% Net Margin) |

| Innovation | High | Moderate |

| Global presence | Extensive | Moderate |

| Market Share | Significant | Emerging |

| Debt level | Moderate (38.29% Debt to Assets) | Low (1.80% Debt to Assets) |

Key takeaways: Texas Instruments demonstrates strong profitability and diversification, making it a solid choice for investors seeking stability. Lattice Semiconductor, while innovative, shows potential for growth but has lower profitability and market presence.

Risk Analysis

In the following table, I present a comparative analysis of the risks associated with Texas Instruments Incorporated (TXN) and Lattice Semiconductor Corporation (LSCC).

| Metric | TXN | LSCC |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face varying degrees of market and geopolitical risks, particularly influenced by ongoing trade tensions and semiconductor industry volatility. TXN’s strong operational efficiency mitigates risks, while LSCC’s exposure to higher market volatility could impact performance significantly.

Which one to choose?

When comparing Texas Instruments (TXN) and Lattice Semiconductor (LSCC), both companies exhibit strengths but cater to different investor preferences. TXN boasts impressive profitability metrics, including a net profit margin of 30.68% and a robust return on equity (ROE) of 28.39%, alongside a solid dividend yield of 2.8%. Conversely, LSCC shows rapid growth potential, with a higher revenue growth rate, however, its ROE stands lower at 8.60%, and it does not offer dividends.

Analysts rate TXN at a “B,” reflecting strong fundamentals, while LSCC receives a “B-,” highlighting potential but with greater risk. Investors focused on stability and consistent returns may prefer TXN, while those seeking growth and are comfortable with volatility might find LSCC more appealing.

Risk Note: Both companies face industry competition, but TXN’s established market presence offers a cushion against potential market fluctuations.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Texas Instruments Incorporated and Lattice Semiconductor Corporation to enhance your investment decisions: