In the dynamic world of semiconductors, Texas Instruments Incorporated (TXN) and STMicroelectronics N.V. (STM) stand out as key players driving innovation. Both companies operate in overlapping markets, focusing on sectors like automotive, industrial, and consumer electronics. Their distinct strategies in analog and digital solutions provide intriguing contrasts that investors should consider. This article will guide you through a comparative analysis of these two giants to help you identify which company may be the more compelling investment opportunity.

Table of contents

Company Overview

Texas Instruments Overview

Texas Instruments Incorporated (TXN) is a leading semiconductor company headquartered in Dallas, Texas, focusing on designing and manufacturing a wide range of analog and embedded processing products. Founded in 1930, Texas Instruments serves various markets, including automotive, industrial, and personal electronics, by offering power management solutions, microcontrollers, and digital signal processors. With a market cap of approximately $151B, the company is noted for its robust dividend history, providing a last dividend of $5.5. Texas Instruments is recognized for its innovation and reliability, making it a key player in the semiconductor industry.

STMicroelectronics Overview

STMicroelectronics N.V. (STM), incorporated in 1987 and based in Schiphol, the Netherlands, is a global semiconductor leader with a diverse portfolio that spans automotive, industrial, and consumer electronics markets. The company operates through various segments, including Automotive and Discrete Group, Analog, MEMS and Sensors Group, and Microcontrollers and Digital ICs Group. With a market capitalization of around $20.3B, STMicroelectronics has established itself as a vital supplier in advanced technologies, providing products that include automotive ICs, sensors, and microcontrollers. The company also focuses on innovation, particularly in energy efficiency and connectivity solutions.

Key similarities between Texas Instruments and STMicroelectronics lie in their shared focus on the semiconductor industry and diverse product offerings across multiple markets. However, Texas Instruments emphasizes analog and embedded processing products, while STMicroelectronics has a broader focus, including MEMS and automotive solutions. Both companies leverage innovation to maintain competitive advantages in their respective markets.

Income Statement Comparison

The following table presents a comparison of the recent income statements for Texas Instruments (TXN) and STMicroelectronics (STM), highlighting key financial metrics.

| Metric | Texas Instruments (TXN) | STMicroelectronics (STM) |

|---|---|---|

| Revenue | 15.64B | 13.27B |

| EBITDA | 7.54B | 3.72B |

| EBIT | 5.96B | 1.96B |

| Net Income | 4.80B | 1.56B |

| EPS | 5.24 | 1.73 |

Interpretation of Income Statement

In 2024, Texas Instruments experienced a decline in both revenue and net income compared to 2023, dropping from 17.52B to 15.64B in revenue and from 6.51B to 4.80B in net income. This indicates a contraction in sales and profitability, likely due to market saturation or increased competition. Conversely, STMicroelectronics showed a significant revenue decrease from 17.29B to 13.27B, with net income dropping from 4.21B to 1.56B. However, both companies maintained positive EBITDA margins, suggesting operational efficiency, albeit at reduced levels. Overall, both firms face challenges, and careful monitoring of their quarterly performance will be essential for investors.

Financial Ratios Comparison

The following table provides an overview of key financial ratios for Texas Instruments (TXN) and STMicroelectronics (STM) based on the most recent data available.

| Metric | TXN | STM |

|---|---|---|

| ROE | 28.39% | 8.92% |

| ROIC | 14.75% | 6.34% |

| P/E | 35.63 | 14.43 |

| P/B | 10.12 | 1.29 |

| Current Ratio | 4.12 | 3.11 |

| Quick Ratio | 2.88 | 2.37 |

| D/E | 0.80 | 0.19 |

| Debt-to-Assets | 38.29% | 12.80% |

| Interest Coverage | 10.76 | 19.72 |

| Asset Turnover | 0.44 | 0.54 |

| Fixed Asset Turnover | 1.38 | 1.22 |

| Payout ratio | 99.92% | 18.50% |

| Dividend yield | 2.80% | 1.28% |

Interpretation of Financial Ratios

In comparing TXN and STM, TXN shows significantly higher profitability ratios (ROE and ROIC), indicating strong returns on equity and invested capital. However, its P/E and P/B ratios suggest it may be overvalued compared to STM. TXN’s higher debt levels (D/E and Debt-to-Assets) raise concerns about leverage, while STM maintains a lower risk profile with its minimal debt. Overall, while TXN demonstrates strong performance, investors should consider its valuation and leverage when making portfolio decisions.

Dividend and Shareholder Returns

Texas Instruments (TXN) maintains a robust dividend strategy with a payout ratio of 99.9% and an annual yield of approximately 2.8%. While dividends are significant, the high payout ratio raises concerns about sustainability, particularly if earnings fluctuate. Furthermore, TXN engages in share buybacks, enhancing shareholder returns.

Conversely, STMicroelectronics (STM) pays a modest dividend yield of 0.5% and has a low payout ratio of 5.3%. This conservative approach allows STM to prioritize growth and reinvestment, aligning with long-term value creation, although it also indicates limited immediate returns for shareholders. STM also conducts share buybacks, which may support stock performance.

In conclusion, TXN’s high dividend distribution may attract income-focused investors, but raises sustainability risks, while STM’s strategy focuses on growth potential, which might better support long-term shareholder value.

Strategic Positioning

Texas Instruments (TXN) holds a significant market share in the analog and embedded processing segments, catering to diverse industries. With a market cap of 151B, it faces competitive pressure from STMicroelectronics (STM), which, with a market cap of 20.3B, emphasizes automotive and industrial applications. Both companies navigate technological disruptions in semiconductors, necessitating continuous innovation to maintain their positions. Risk management remains crucial, given the industry’s volatility and rapid advancements.

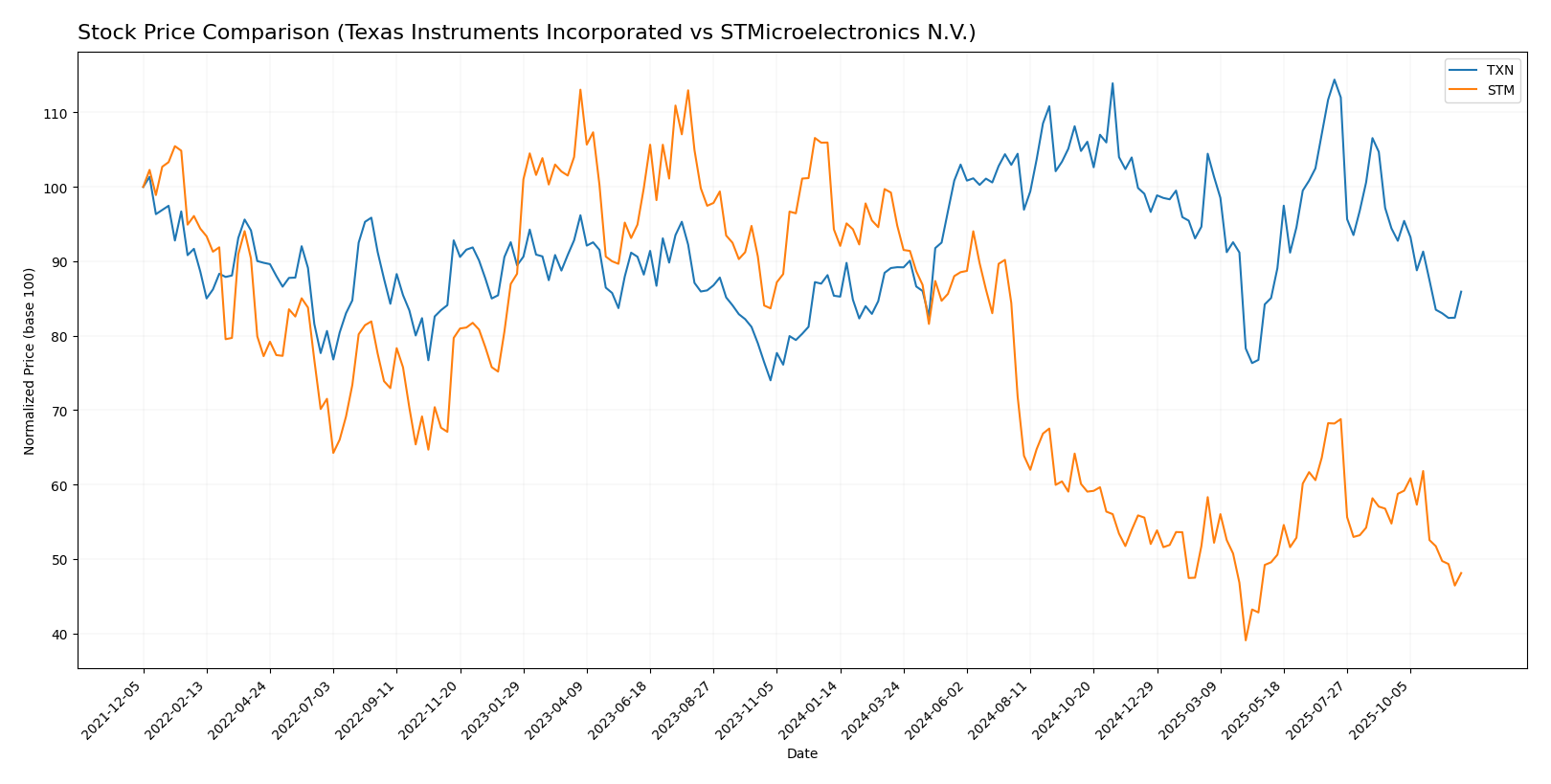

Stock Comparison

In analyzing the recent trading dynamics of Texas Instruments Incorporated (TXN) and STMicroelectronics N.V. (STM), we observe notable price movements and trends that have unfolded over the past year.

Trend Analysis

For Texas Instruments (TXN), the overall price change over the past year is +0.64%. This indicates a bullish trend, despite a recent decline of -9.0% from September 14 to November 30, 2025, suggesting a deceleration in momentum. The stock reached a high of 221.25 and a low of 147.6, with a standard deviation of 16.9, indicating moderate volatility.

Conversely, STMicroelectronics (STM) has experienced a significant price change of -48.97% over the last year, reflecting a bearish trend. The recent performance also shows a decline of -12.14% within the same specified period, alongside a standard deviation of 2.4, which indicates low volatility. The stock’s highest price was 47.17, while the lowest was 18.49, confirming the downward trajectory.

Both companies exhibit an increasing volume trend, yet the current buyer behavior in both stocks indicates a seller-dominant market in the recent period.

Analyst Opinions

Recent analyst recommendations for Texas Instruments (TXN) and STMicroelectronics (STM) indicate a consensus of “buy” for both companies. Analysts have rated TXN with a “B,” highlighting strong return on equity (5) and return on assets (5), despite a lower price-to-earnings score (2). STM received a “B+” rating, praised for its solid debt-to-equity ratio (3) and price-to-book score (4). Notable analysts emphasize the potential for continued growth in the semiconductor sector, supporting their positive outlook for these stocks.

Stock Grades

I have gathered the latest stock grades for two companies in the semiconductor industry: Texas Instruments (TXN) and STMicroelectronics (STM). Here’s a detailed look at their current ratings from recognized grading companies.

Texas Instruments Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Rosenblatt | Maintain | Buy | 2025-10-22 |

| Truist Securities | Maintain | Hold | 2025-10-22 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-22 |

| Goldman Sachs | Maintain | Buy | 2025-10-22 |

| JP Morgan | Maintain | Overweight | 2025-10-22 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-22 |

| Stifel | Maintain | Hold | 2025-10-22 |

| TD Cowen | Maintain | Buy | 2025-10-22 |

| Mizuho | Downgrade | Underperform | 2025-10-20 |

STMicroelectronics N.V. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2025-10-24 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Susquehanna | Maintain | Positive | 2025-07-25 |

| Susquehanna | Maintain | Positive | 2025-07-22 |

| Baird | Upgrade | Outperform | 2025-07-22 |

| Jefferies | Upgrade | Buy | 2025-02-19 |

| Bernstein | Downgrade | Market Perform | 2025-02-05 |

| Susquehanna | Maintain | Positive | 2025-01-31 |

| Barclays | Downgrade | Underweight | 2025-01-22 |

| JP Morgan | Downgrade | Neutral | 2024-12-09 |

Overall, both companies maintain a generally positive outlook with multiple “Buy” and “Positive” ratings from respected analysts. However, it’s worth noting the downgrades for Texas Instruments by Mizuho and for STMicroelectronics by Bernstein and JP Morgan, which indicate some caution in their assessments. As always, I recommend closely monitoring these trends and considering your risk tolerance when making investment decisions.

Target Prices

The target consensus for Texas Instruments and STMicroelectronics reflects positive analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Texas Instruments Incorporated (TXN) | 245 | 145 | 190.45 |

| STMicroelectronics N.V. (STM) | 45 | 22 | 33.38 |

For Texas Instruments (TXN), the consensus target price of 190.45 is significantly higher than the current stock price of 166.03, suggesting potential upside. Meanwhile, STMicroelectronics (STM) has a consensus of 33.38, also above its current price of 22.76, indicating favorable prospects as well.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Texas Instruments (TXN) and STMicroelectronics (STM) based on recent data.

| Criterion | Texas Instruments (TXN) | STMicroelectronics (STM) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (30.68% net margin) | Moderate (24.36% net margin) |

| Innovation | High | Moderate |

| Global presence | Extensive | Strong |

| Market Share | Significant | Growing |

| Debt level | Moderate (38% debt to assets) | Low (12.80% debt to assets) |

Key takeaways indicate that while Texas Instruments excels in profitability and innovation, STMicroelectronics shows remarkable strength in minimizing debt and maintaining a growing market presence.

Risk Analysis

In the following table, I will outline the key risks associated with Texas Instruments Incorporated (TXN) and STMicroelectronics N.V. (STM) based on the most recent data.

| Metric | Texas Instruments (TXN) | STMicroelectronics (STM) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and geopolitical risks, notably due to the semiconductor industry’s cyclical nature and global tensions. Recent supply chain disruptions have further amplified these challenges, impacting production and profitability.

Which one to choose?

When comparing Texas Instruments (TXN) and STMicroelectronics (STM), several key metrics stand out. TXN has a higher gross profit margin of 58.14% compared to STM’s 39.34%, indicating stronger profitability. Furthermore, TXN’s return on equity (ROE) is 28.39%, significantly above STM’s 8.92%, suggesting more effective management of shareholder equity. However, STM offers a lower price-to-earnings (P/E) ratio of 14.43, compared to TXN’s 35.63, which may imply a more attractive valuation given its growth potential.

In terms of stock trends, TXN has recently shown a bullish trend, while STM’s trend has been bearish with a notable decline of 48.97%. Analysts rate TXN with a grade of B and STM with B+, indicating a slight preference for STM regarding growth potential despite TXN’s financial strength.

For investors focused on value and stability, TXN appears favorable due to its robust margins and profitability. Conversely, those seeking growth opportunities might find STM appealing, albeit with higher associated risks.

Risks to consider include competition in the semiconductor industry and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Texas Instruments Incorporated and STMicroelectronics N.V. to enhance your investment decisions: