In the rapidly evolving tech landscape, two companies stand out for their innovative approaches in the automotive sector: indie Semiconductor, Inc. (INDI) and Ouster, Inc. (OUST). Both firms operate within the broader technology industry, focusing on advanced driver assistance and 3D vision systems, respectively. Their overlapping market interests and commitment to innovation make them compelling subjects for comparison. In this article, I will help you determine which company presents the more attractive investment opportunity.

Table of contents

Company Overview

indie Semiconductor, Inc. Overview

indie Semiconductor, Inc. operates in the semiconductor industry, focusing on providing advanced technologies for automotive applications. The company’s mission is to enable the future of mobility through innovative semiconductor solutions that enhance user experiences in connected cars and advanced driver assistance systems (ADAS). With a market capitalization of approximately $704M, indie is positioned to leverage the growing demand for electrification and connectivity in vehicles. Their diverse product range includes devices for parking assistance, infotainment, and telematics, catering to the evolving needs of the automotive sector.

Ouster, Inc. Overview

Ouster, Inc. is a leading provider of high-resolution digital lidar sensors, essential for enabling 3D vision in various applications, including vehicles, machinery, and robotics. The company’s mission emphasizes advancing the perception capabilities of autonomous systems through cutting-edge sensor technology. With a market cap of around $1.32B, Ouster holds a significant position in the hardware sector, aiming to redefine safety and efficiency in autonomous navigation. Their product portfolio features innovative scanning and solid-state sensors, showcasing their commitment to technological advancement.

Key similarities between indie and Ouster include their focus on technology and innovation within the automotive sector, albeit through different means. indie specializes in semiconductor solutions while Ouster concentrates on lidar sensors. The primary difference lies in their core offerings: indie develops semiconductor devices for connectivity and user experience, whereas Ouster emphasizes 3D vision technologies for enhanced automation and safety.

Income Statement Comparison

The following table provides a detailed comparison of key income statement metrics for indie Semiconductor, Inc. (INDI) and Ouster, Inc. (OUST) for the most recent fiscal year.

| Metric | INDI | OUST |

|---|---|---|

| Revenue | 216.7M | 111.1M |

| EBITDA | -93.9M | -79.9M |

| EBIT | -137.0M | -94.7M |

| Net Income | -132.6M | -97.0M |

| EPS | -0.76 | -2.08 |

Interpretation of Income Statement

In the recent fiscal year, indie Semiconductor (INDI) reported a revenue of 216.7M, a slight decline from the previous year, while Ouster (OUST) showed a significant increase in revenue to 111.1M. However, both companies are struggling with negative EBITDA and net income, indicating ongoing operational challenges. INDI’s net income improved slightly compared to last year, showing a narrowing of losses, while OUST’s net losses remained substantial, reflecting their ongoing investment in growth. The trends suggest that both companies need to focus on improving operational efficiency and managing costs to enhance margins.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent revenue and financial ratios for Indie Semiconductor, Inc. (INDI) and Ouster, Inc. (OUST).

| Metric | INDI | OUST |

|---|---|---|

| ROE | -31.73% | -53.64% |

| ROIC | -19.25% | -51.12% |

| P/E | -5.35 | -5.86 |

| P/B | 1.70 | 3.15 |

| Current Ratio | 4.82 | 2.80 |

| Quick Ratio | 4.23 | 2.59 |

| D/E | 0.95 | 0.39 |

| Debt-to-Assets | 0.42 | 0.21 |

| Interest Coverage | -18.37 | -57.15 |

| Asset Turnover | 0.23 | 0.40 |

| Fixed Asset Turnover | 4.30 | 4.54 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

The financial ratios for both companies indicate significant challenges. INDI displays a strong current and quick ratio, suggesting good short-term liquidity, yet its negative ROE and ROIC raise concerns about profitability. OUST, while having a lower debt-to-equity ratio, also struggles with negative returns and high losses, particularly evident in the interest coverage ratio. Both companies warrant caution for investors seeking stability and profitability.

Dividend and Shareholder Returns

Both indie Semiconductor, Inc. (INDI) and Ouster, Inc. (OUST) do not pay dividends, reflecting a focus on reinvestment and growth. INDI’s negative net income and significant operational losses indicate a high-risk profile, while OUST’s similar financial struggles suggest a challenging growth phase. Neither company engages in share buybacks, which limits immediate shareholder returns. This lack of dividends or buybacks raises concerns about long-term value creation and sustainability for shareholders.

Strategic Positioning

In the competitive landscape of the semiconductor and hardware sectors, indie Semiconductor, Inc. (INDI) holds a niche market share in automotive applications, focusing on advanced driver assistance and connectivity solutions. Ouster, Inc. (OUST), on the other hand, leads in the lidar sensor market, leveraging high-resolution technology. Both firms face intense competitive pressure due to rapid technological advancements, requiring constant innovation to mitigate risks of disruption and to maintain their market positions.

Stock Comparison

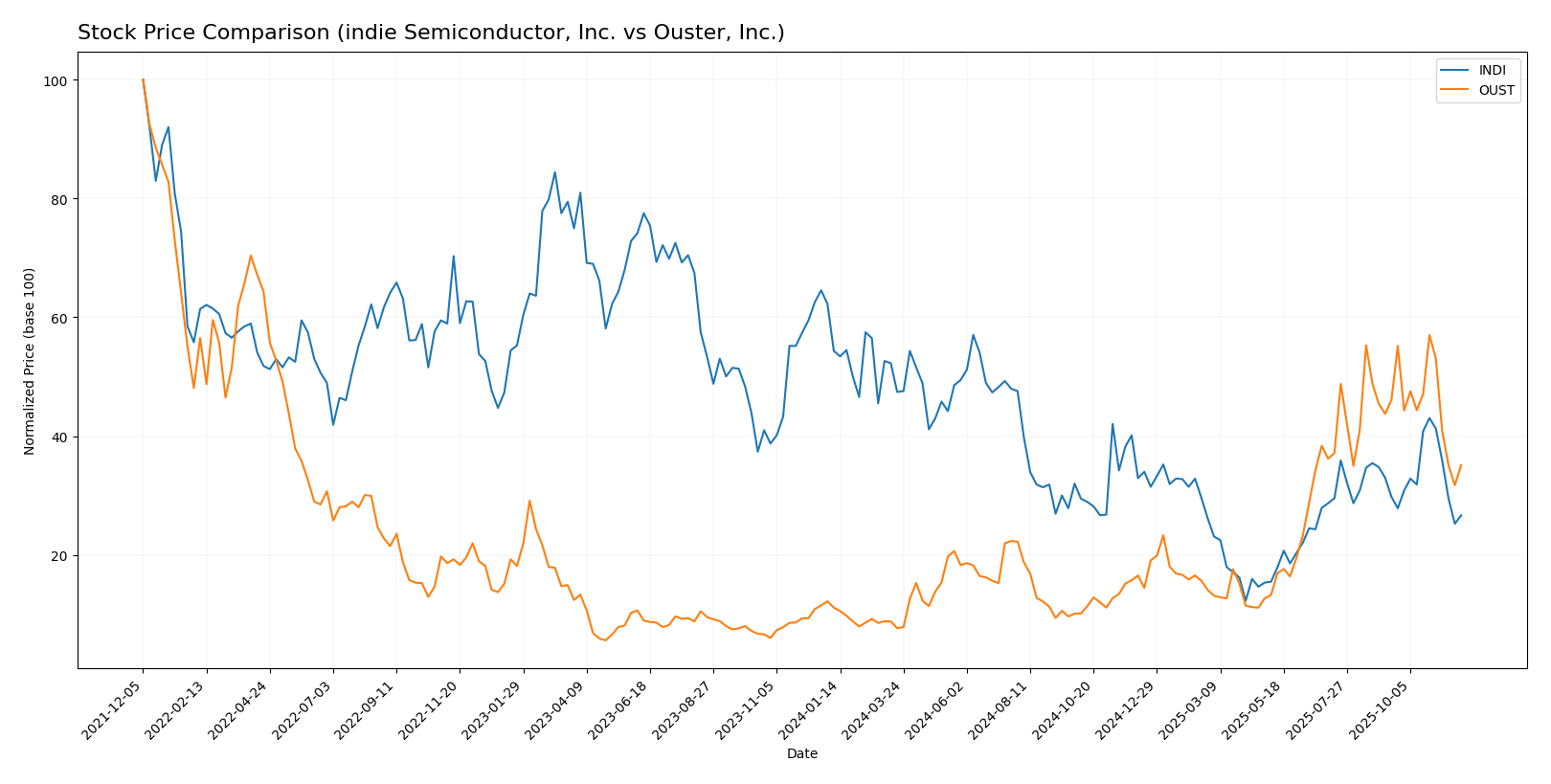

Over the past year, the stock prices of indie Semiconductor, Inc. (INDI) and Ouster, Inc. (OUST) have exhibited significant fluctuations, reflecting the dynamic trading conditions and investor sentiment surrounding these companies.

Trend Analysis

For indie Semiconductor, Inc. (INDI), the overall price change over the past year is -50.92%, indicating a bearish trend. The stock experienced a notable high of 7.49 and a low of 1.6, with acceleration in the downward movement suggested by a standard deviation of 1.5. Recent performance shows a price change of -10.43% since mid-September, with a standard deviation of 0.75, indicating some volatility but overall a consistent downward trend.

In contrast, Ouster, Inc. (OUST) has seen a substantial price increase of 215.45% over the past year, establishing a bullish trend despite a recent decline of -23.83% since mid-September. The stock reached a high of 35.8 and a low of 4.82, with a standard deviation of 8.42 suggesting considerable volatility. The recent trend analysis indicates deceleration, with a trend slope of -0.86, pointing to potential stabilization after a period of rapid growth.

Analyst Opinions

Recent analyst recommendations for indie Semiconductor, Inc. (INDI) indicate a cautious stance with a rating of C. Analysts point to concerns over low discounted cash flow and return metrics, although the company has a stronger debt-to-equity ratio. Ouster, Inc. (OUST) fares slightly worse with a C- rating, primarily due to similar issues in cash flow and returns. Overall, the consensus for both companies leans towards a hold position for 2025, emphasizing the need for further evaluation before making significant investment decisions.

Stock Grades

I have analyzed the latest stock grades for indie Semiconductor, Inc. (INDI) and Ouster, Inc. (OUST) from reliable grading companies, providing insights to help you in your investment decisions.

indie Semiconductor, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | maintain | Neutral | 2025-11-10 |

| Benchmark | maintain | Buy | 2025-06-25 |

| Benchmark | maintain | Buy | 2025-06-11 |

| Benchmark | maintain | Buy | 2025-05-21 |

| Benchmark | maintain | Buy | 2025-05-13 |

| Craig-Hallum | maintain | Buy | 2025-05-13 |

| Keybanc | maintain | Overweight | 2025-05-13 |

| Benchmark | maintain | Buy | 2025-04-09 |

| Benchmark | maintain | Buy | 2025-02-21 |

| Keybanc | maintain | Overweight | 2025-02-21 |

Ouster, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | upgrade | Overweight | 2025-11-07 |

| Cantor Fitzgerald | upgrade | Overweight | 2025-11-06 |

| WestPark Capital | maintain | Buy | 2025-11-05 |

| Rosenblatt | maintain | Buy | 2025-11-05 |

| WestPark Capital | upgrade | Buy | 2025-08-13 |

| Oppenheimer | maintain | Outperform | 2025-07-16 |

| WestPark Capital | downgrade | Hold | 2025-06-12 |

| WestPark Capital | upgrade | Buy | 2025-05-09 |

| Cantor Fitzgerald | maintain | Overweight | 2025-03-21 |

| WestPark Capital | maintain | Hold | 2025-03-21 |

In summary, indie Semiconductor, Inc. maintains a stable outlook with consistent “Buy” ratings, indicating confidence in its performance. On the other hand, Ouster, Inc. has seen a recent upgrade to “Overweight,” suggesting growing optimism among analysts. Both companies present interesting opportunities, but careful consideration of their respective market positions and trends is essential for effective investment strategies.

Target Prices

The current consensus among analysts for the target prices of indie Semiconductor, Inc. and Ouster, Inc. reflects a positive outlook on their potential growth.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| indie Semiconductor, Inc. | 8 | 8 | 8 |

| Ouster, Inc. | 39 | 33 | 36.67 |

For indie Semiconductor, Inc., the consensus target price of 8 is significantly above its current trading price of 3.475, indicating strong growth expectations. Ouster, Inc. has a target consensus of 36.67, compared to its current price of 22.08, suggesting an attractive upside potential as well.

Strengths and Weaknesses

Below is a summary of the strengths and weaknesses of indie Semiconductor, Inc. (INDI) and Ouster, Inc. (OUST).

| Criterion | indie Semiconductor, Inc. (INDI) | Ouster, Inc. (OUST) |

|---|---|---|

| Diversification | Limited product diversification | Strong product range |

| Profitability | Negative net profit margin (-61.2%) | Negative net profit margin (-87.3%) |

| Innovation | Focus on automotive semiconductors | Focus on lidar technology |

| Global presence | Limited international reach | Growing global footprint |

| Market Share | Emerging player in semiconductors | Competitive in lidar market |

| Debt level | Moderate (debt-to-equity ratio: 0.95) | Low (debt-to-equity ratio: 0.11) |

Key takeaways: While both companies face profitability challenges, indie Semiconductor shows potential with its automotive focus, whereas Ouster has a broader product range in lidar technology. Risk management is crucial for investors considering these stocks.

Risk Analysis

Below is a table summarizing the key risks associated with indie Semiconductor, Inc. (INDI) and Ouster, Inc. (OUST).

| Metric | indie Semiconductor, Inc. | Ouster, Inc. |

|---|---|---|

| Market Risk | High (Beta: 2.56) | High (Beta: 2.96) |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant risks, particularly market and operational risks. For instance, Ouster is heavily reliant on the evolving regulations around autonomous vehicles, while indie’s volatility is reflected in its high beta.

Which one to choose?

In comparing indie Semiconductor, Inc. (INDI) and Ouster, Inc. (OUST), both companies face significant challenges. INDI has a market cap of approximately $709M, while OUST is at around $569M. INDI’s gross profit margin stands at 41.68%, but it operates at a net loss, with a bearish stock trend showing a price decrease of 50.92%. OUST, on the other hand, boasts a bullish trend with a remarkable price increase of 215.45% over the past year, although recent performance indicates a decline of 23.83%. Both companies have received a rating of “C” and “C-“, respectively, indicating a cautious outlook.

Investors focused on growth may prefer OUST due to its strong price momentum, while those prioritizing stability may favor INDI, given its higher gross margin and better liquidity ratios. However, both firms are susceptible to industry competition and supply chain issues.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of indie Semiconductor, Inc. and Ouster, Inc. to enhance your investment decisions: