In the rapidly evolving semiconductor industry, two companies stand out: Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI). Both firms are innovating within the automotive and technology sectors, focusing on advanced solutions that cater to a growing demand for smart devices and autonomous vehicles. By comparing their market strategies and technological advancements, this article will help you determine which company may be the more intriguing investment opportunity for your portfolio.

Table of contents

Company Overview

Ambarella, Inc. Overview

Ambarella, Inc. is a leading provider of semiconductor solutions specifically designed for video processing and artificial intelligence. Founded in 2004 and headquartered in Santa Clara, California, Ambarella focuses on high-definition and ultra-high-definition video compression and image processing technology. Its products are widely utilized in a variety of applications, including automotive cameras for advanced driver-assistance systems, security cameras, and consumer electronics such as drones and wearable devices. With a market capitalization of approximately $3.26B, Ambarella’s innovative approach and low-power consumption design position it as a key player in the technology sector, appealing to original design manufacturers and equipment manufacturers alike.

indie Semiconductor, Inc. Overview

indie Semiconductor, Inc., founded in 2007 and based in Aliso Viejo, California, specializes in automotive semiconductors and software solutions. The company’s offerings encompass advanced driver assistance systems, connected car technologies, and electrification applications. With a market cap of around $704M, indie is at the forefront of enhancing user experiences in vehicles through innovative devices for parking assistance, infotainment, and connectivity. The company’s focus on photonic components and low-noise electronics further solidifies its position as a pivotal player in the automotive semiconductor market.

Key Similarities and Differences

Both Ambarella and indie Semiconductor operate within the semiconductor industry, focusing on advanced technology solutions. However, Ambarella emphasizes video processing and AI applications across various sectors, while indie concentrates primarily on automotive technologies. This distinction highlights their differing target markets and product strategies, with Ambarella having a broader application scope compared to indie’s specialized automotive focus.

Income Statement Comparison

The following table compares the income statements of Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI) for the most recent fiscal year. This comparison will help you understand their financial performance.

| Metric | Ambarella, Inc. (AMBA) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Revenue | 285M | 217M |

| EBITDA | -101M | -94M |

| EBIT | -127M | -137M |

| Net Income | -117M | -133M |

| EPS | -2.84 | -0.76 |

Interpretation of Income Statement

In the most recent fiscal year, Ambarella, Inc. experienced a revenue increase to 285M from 226M, indicating a positive trend despite a continued net loss of 117M. INDI, however, saw a slight decline in revenue to 217M from 223M, coupled with a net loss of 133M. Both companies reported negative EBITDA and EBIT margins, reflecting ongoing operational challenges. Notably, while AMBA’s revenue growth is promising, it is crucial to address the rising operational expenses to improve profitability. Conversely, INDI’s revenue decline underscores the need for strategic adjustments to regain momentum in the market.

Financial Ratios Comparison

The following table presents a comparative analysis of the most recent revenue and financial ratios for Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI).

| Metric | AMBA | INDI |

|---|---|---|

| ROE | -20.86% | -31.73% |

| ROIC | -21.96% | -19.25% |

| P/E | -27.05 | -5.35 |

| P/B | 5.64 | 1.70 |

| Current Ratio | 2.65 | 4.82 |

| Quick Ratio | 2.36 | 4.23 |

| D/E | 0.01 | 0.95 |

| Debt-to-Assets | 0.01 | 0.21 |

| Interest Coverage | 0 | -15.65 |

| Asset Turnover | 0.41 | 0.23 |

| Fixed Asset Turnover | 19.96 | 4.30 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of Financial Ratios

Both companies exhibit negative returns on equity (ROE) and invested capital (ROIC), indicating challenges in profitability. AMBA has a strong asset turnover ratio, suggesting efficient use of assets, while INDI shows higher liquidity with a better current and quick ratio. However, INDI’s debt levels are concerning, with a significantly higher debt-to-equity ratio compared to AMBA, indicating potential risk in financial stability.

Dividend and Shareholder Returns

Ambarella, Inc. (AMBA) does not pay dividends, reflecting its focus on reinvesting in growth and innovation during a challenging financial period. The absence of dividends aligns with its strategy to enhance long-term shareholder value, despite facing losses. On the other hand, indie Semiconductor, Inc. (INDI) similarly refrains from dividend distributions, prioritizing capital for research and development. Both companies engage in share buybacks, indicating a commitment to returning value to shareholders. Overall, their current distribution strategies may support sustained growth but carry inherent risks if losses persist.

Strategic Positioning

Ambarella, Inc. (AMBA) holds a significant position in the semiconductor market, particularly in video processing solutions, with a market cap of 3.26B. However, its recent decline of 16.07% suggests growing competitive pressures and potential technological disruptions in its sector. On the other hand, indie Semiconductor, Inc. (INDI), with a market cap of 704M, focuses on automotive applications, facing increasing competition but also benefiting from the rising demand for advanced driver assistance systems. Both companies must navigate a rapidly evolving landscape to maintain their market shares.

Stock Comparison

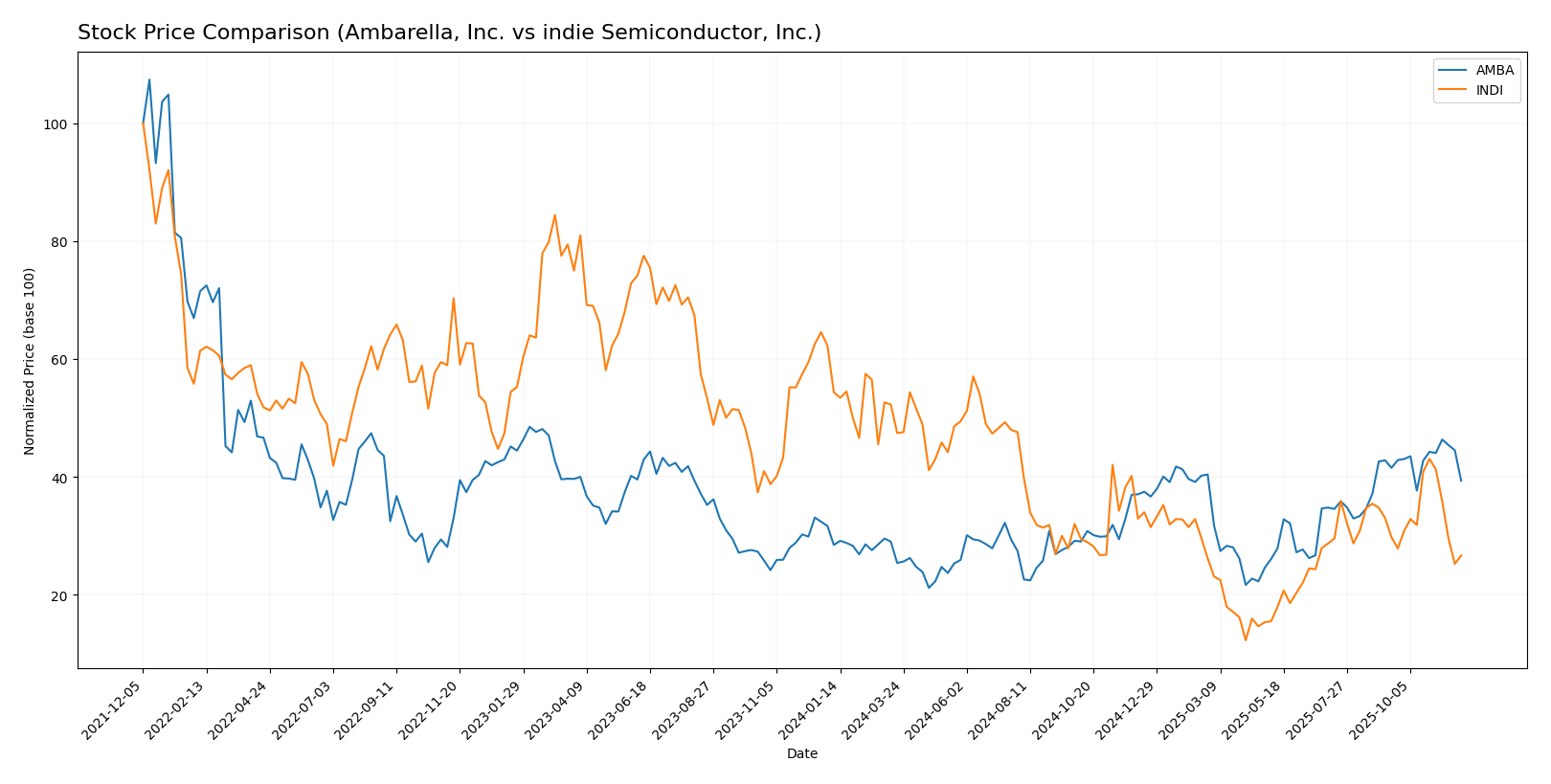

In the past year, Ambarella, Inc. (AMBA) has exhibited a significant bullish trend, with key price movements reflecting strong investor sentiment and trading dynamics. In contrast, indie Semiconductor, Inc. (INDI) has faced substantial bearish pressure, illustrating a stark divergence in performance between the two companies.

Trend Analysis

Ambarella, Inc. (AMBA): Over the past year, AMBA has experienced a price change of +38.24%, indicating a bullish trend. The stock has shown acceleration, with notable highs reaching 89.67 and lows of 40.99. The standard deviation of 12.7 suggests moderate volatility in its price movements.

Recent Performance: In the recent period from September 14, 2025, to November 30, 2025, AMBA’s price decreased by -5.28%, reflecting a neutral trend in this timeframe but maintaining an overall bullish outlook.

indie Semiconductor, Inc. (INDI): Conversely, INDI has seen a drastic price decrease of -50.97% over the analyzed period, categorizing it as a bearish trend, with acceleration noted as well. The stock reached a high of 7.49 and fell to a low of 1.6, indicating significant price fluctuations. The standard deviation of 1.5 points to lower volatility relative to AMBA.

Recent Performance: From September 14, 2025, to November 30, 2025, INDI’s price dropped by -10.53%, reinforcing its bearish trend during this shorter timeframe.

In summary, AMBA is positioned favorably with strong bullish indicators, while INDI continues to struggle under bearish conditions.

Analyst Opinions

Recent analyst recommendations for Ambarella, Inc. (AMBA) suggest a cautious stance, with a rating of C+. Analysts cite concerns over low return on equity and assets, although the company scores well on debt-to-equity. For indie Semiconductor, Inc. (INDI), the rating is C, indicating a hold, primarily due to weak cash flow and profitability metrics. Overall, the consensus for AMBA leans towards a hold, while INDI also reflects a cautious outlook, reinforcing a general sentiment of caution in the current market.

Stock Grades

I found some reliable stock grades for the companies of interest, which can help guide your investment decisions.

Ambarella, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | maintain | Buy | 2025-11-26 |

| Stifel | maintain | Buy | 2025-11-26 |

| Needham | maintain | Buy | 2025-11-26 |

| Rosenblatt | maintain | Buy | 2025-11-24 |

| Oppenheimer | maintain | Perform | 2025-08-29 |

| Needham | maintain | Buy | 2025-08-29 |

| Stifel | maintain | Buy | 2025-08-29 |

| Morgan Stanley | maintain | Overweight | 2025-08-29 |

| Northland Capital Markets | maintain | Outperform | 2025-08-29 |

| B of A Securities | maintain | Neutral | 2025-08-29 |

indie Semiconductor, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | maintain | Neutral | 2025-11-10 |

| Benchmark | maintain | Buy | 2025-06-25 |

| Benchmark | maintain | Buy | 2025-06-11 |

| Benchmark | maintain | Buy | 2025-05-21 |

| Benchmark | maintain | Buy | 2025-05-13 |

| Craig-Hallum | maintain | Buy | 2025-05-13 |

| Keybanc | maintain | Overweight | 2025-05-13 |

| Benchmark | maintain | Buy | 2025-04-09 |

| Benchmark | maintain | Buy | 2025-02-21 |

| Keybanc | maintain | Overweight | 2025-02-21 |

In summary, both Ambarella, Inc. and indie Semiconductor, Inc. have received consistent grades from respected grading companies, with Ambarella generally maintaining a “Buy” rating and indie Semiconductor showing a mix of “Buy” and “Neutral” ratings. This indicates a stable outlook for Ambarella, while indie Semiconductor’s performance may require closer analysis moving forward.

Target Prices

The consensus target prices for the selected companies indicate varying expectations among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Ambarella, Inc. (AMBA) | 115 | 80 | 97.5 |

| indie Semiconductor, Inc. (INDI) | 8 | 8 | 8 |

For Ambarella, analysts anticipate a target price of 97.5, significantly higher than its current price of 76.36. In contrast, indie Semiconductor’s consensus matches its current price of 3.48, suggesting a more stable market outlook.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI) based on the most recent financial data:

| Criterion | Ambarella, Inc. (AMBA) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins | Negative margins |

| Innovation | Strong technological focus | Emerging technology |

| Global presence | Established in automotive and security markets | Focused on automotive applications |

| Market Share | Small but growing | Niche market |

| Debt level | Low (Debt/Equity: 0.009) | High (Debt/Equity: 0.954) |

Key takeaways indicate that both companies face challenges with profitability, but Ambarella has a stronger focus on innovation and lower debt levels compared to indie Semiconductor, which carries higher debt and operates in a more niche market. Careful consideration of these factors can guide investment decisions.

Risk Analysis

The following table outlines key risks for two semiconductor companies, Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI):

| Metric | Ambarella, Inc. | indie Semiconductor, Inc. |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | High |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | Moderate | High |

Both companies face significant operational and market risks, particularly Ambarella, which is currently experiencing high volatility. The semiconductor sector is sensitive to regulatory changes and geopolitical tensions, especially regarding supply chain disruptions.

Which one to choose?

When comparing Ambarella, Inc. (AMBA) and indie Semiconductor, Inc. (INDI), the fundamental metrics present a stark contrast. AMBA demonstrates a higher gross profit margin of 60.5%, but struggles with negative operating and net profit margins, indicating operational challenges. In contrast, INDI exhibits a gross profit margin of 41.6% but faces significant losses, as reflected in its lower revenue growth and bearish stock trend, with a notable decline of -50.97% over the past year.

AMBA’s market cap stands at approximately 3.17B, showing resilience in investor interest despite its financial hurdles. Analyst ratings suggest a cautious outlook, with AMBA receiving a C+ rating compared to INDI’s C. Given these factors, investors focused on growth may prefer AMBA, while those prioritizing stability may find INDI more appealing despite its challenges.

Risks include competitive pressures in the semiconductor industry and reliance on technological advancements, which could impact both companies’ future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Ambarella, Inc. and indie Semiconductor, Inc. to enhance your investment decisions: