In today’s rapidly evolving tech landscape, the competition between Mobileye Global Inc. (MBLY) and MicroVision, Inc. (MVIS) presents an intriguing study for investors. Both companies operate within the automotive sector but focus on different facets of innovation; Mobileye specializes in advanced driver assistance systems, while MicroVision develops cutting-edge lidar sensors. This comparison will explore their market strategies, technological advancements, and growth potential. Join me as we uncover which of these companies might be the more compelling investment opportunity.

Table of contents

Company Overview

Mobileye Global Inc. Overview

Mobileye Global Inc. (MBLY), headquartered in Jerusalem, Israel, specializes in advanced driver assistance systems (ADAS) and autonomous driving technologies. Founded in 1999, the company focuses on enhancing vehicle safety through real-time detection and interpretation of road conditions. Mobileye offers a range of products, including Driver Assist solutions and autonomous driving systems, such as Mobileye Chauffeur and Mobileye Drive. With a market cap of approximately $9.22B, Mobileye is positioned as a leader in the automotive technology sector, leveraging its integration with Intel to innovate in safety and mobility solutions.

MicroVision, Inc. Overview

MicroVision, Inc. (MVIS), based in Redmond, Washington, develops lidar sensors crucial for automotive safety and autonomous driving applications. Established in 1993, the company utilizes advanced laser beam scanning technology to create high-quality imaging solutions. MicroVision’s product portfolio includes lidar systems, augmented reality display technologies, and interactive display modules aimed at original equipment manufacturers. With a market cap of around $278M, MicroVision is carving a niche in the technology sector, focusing on innovative sensor solutions for a range of applications.

Mobileye and MicroVision share a commitment to enhancing automotive safety and autonomous driving capabilities. However, their business models diverge: Mobileye primarily focuses on comprehensive driver assistance and autonomous driving systems, while MicroVision specializes in lidar technology and optical solutions. Both companies represent significant opportunities in the evolving landscape of automotive technology, albeit through distinct approaches.

Income Statement Comparison

The following table summarizes the most recent income statement figures for Mobileye Global Inc. (MBLY) and MicroVision, Inc. (MVIS), providing a clear financial comparison.

| Metric | Mobileye Global Inc. | MicroVision, Inc. |

|---|---|---|

| Revenue | 1.65B | 4.70M |

| EBITDA | -2.66B | -70.98M |

| EBIT | -3.16B | -75.20M |

| Net Income | -3.09B | -96.92M |

| EPS | -3.82 | -0.46 |

Interpretation of Income Statement

In the latest fiscal year, Mobileye experienced a significant decline in revenue, dropping from 2.08B in 2023 to 1.65B in 2024, while Net Income worsened from -27M to -3.09B. Conversely, MicroVision’s revenue remained minimal, with a slight decrease from 7.26M to 4.70M, and its net income also deteriorated. Both companies are struggling with negative margins, indicating operational challenges. Mobileye’s drastic drop in revenue and increased losses suggest a critical need for strategic reevaluation, while MicroVision’s performance indicates persistent financial difficulties with little sign of recovery in the near term.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial ratios for Mobileye Global Inc. (MBLY) and MicroVision, Inc. (MVIS). This will help you evaluate their financial health and performance.

| Metric | Mobileye (MBLY) | MicroVision (MVIS) |

|---|---|---|

| ROE | -0.26 | -1.99 |

| ROIC | -0.26 | -0.83 |

| P/E | -5.24 | -2.83 |

| P/B | 1.34 | 5.63 |

| Current Ratio | 6.53 | 1.79 |

| Quick Ratio | 5.28 | 1.74 |

| D/E | 0.004 | 1.06 |

| Debt-to-Assets | 0.004 | 0.43 |

| Interest Coverage | 0 | -19.19 |

| Asset Turnover | 0.13 | 0.04 |

| Fixed Asset Turnover | 3.61 | 0.20 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of Financial Ratios

Mobileye shows a higher current and quick ratio, indicating better liquidity compared to MicroVision. However, both companies have negative ROE and ROIC, signaling poor profitability. Mobileye’s P/B ratio is lower, suggesting it might be undervalued relative to its book value. MicroVision’s high debt-to-assets ratio raises concerns about leverage and financial stability. Overall, both companies present significant risks, and I advise caution in investing.

Dividend and Shareholder Returns

Both Mobileye Global Inc. (MBLY) and MicroVision, Inc. (MVIS) do not pay dividends, reflecting their focus on reinvestment strategies and high growth phases. MBLY has a significant cash position, which supports operational stability, while MVIS faces challenges with negative margins and high debt levels. Both companies engage in share buybacks, which can enhance shareholder value. However, the lack of dividends raises questions about sustainable long-term value creation, particularly for MVIS, given its financial challenges.

Strategic Positioning

In the rapidly evolving automotive technology sector, Mobileye Global Inc. (MBLY) holds a significant market share with its advanced driver assistance systems (ADAS) and autonomous driving solutions. Its innovative products position it strongly against competitors, particularly as the demand for safety and autonomous technologies rises. Conversely, MicroVision, Inc. (MVIS) faces intense competitive pressure in the lidar sensor market, where it must navigate challenges from larger players while addressing the technological disruptions impacting its product offerings. Both companies are crucial players in shaping the future of automotive safety and automation.

Stock Comparison

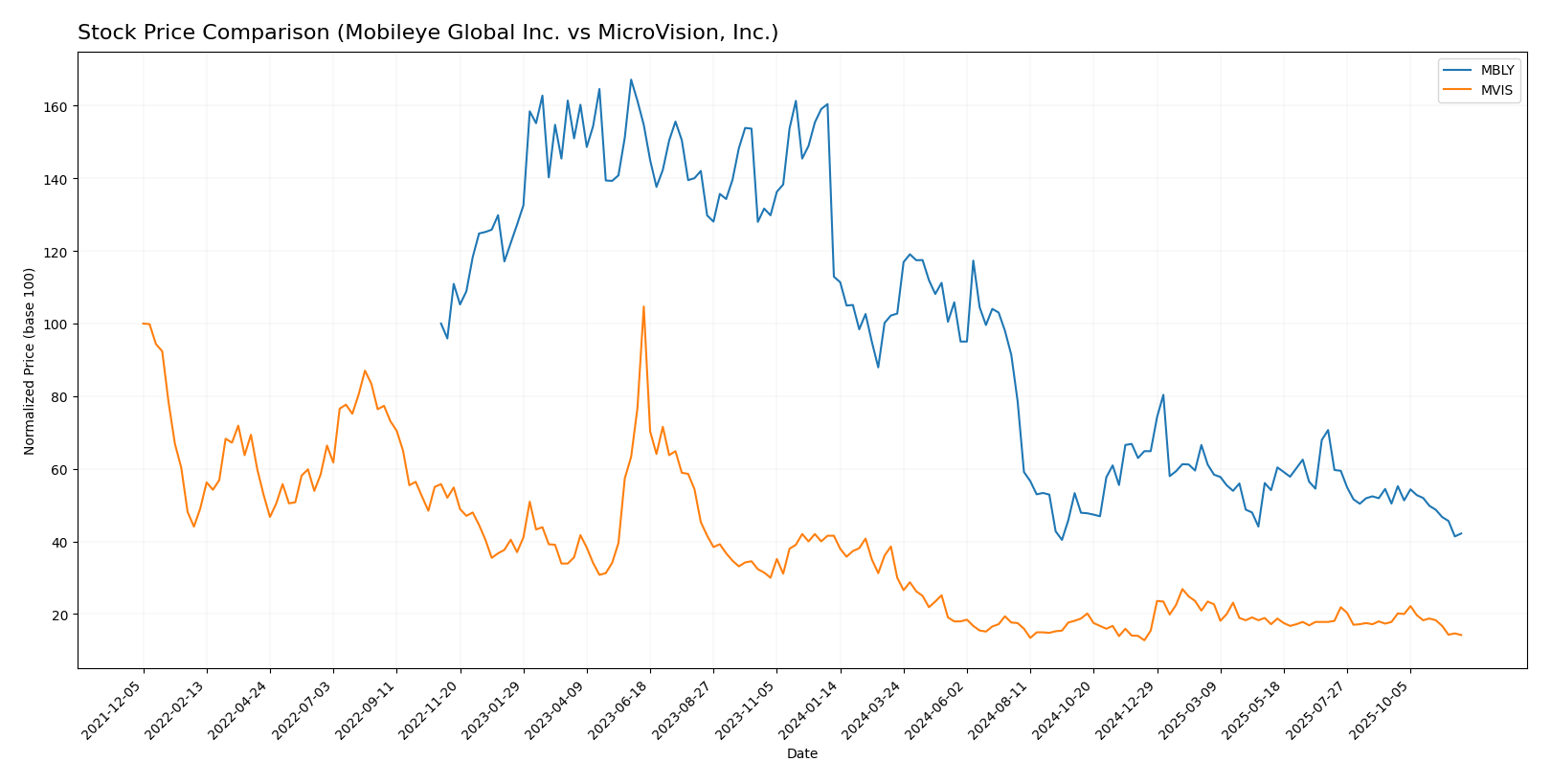

In the past year, both Mobileye Global Inc. (MBLY) and MicroVision, Inc. (MVIS) have experienced significant price declines, reflecting broader market challenges and company-specific issues. Their weekly stock price movements reveal critical dynamics that investors should carefully analyze.

Trend Analysis

Mobileye Global Inc. (MBLY) has seen a price change of -62.65% over the past year, indicating a bearish trend. The stock has experienced notable highs at $32.15 and lows at $10.91, with a deceleration in the trend observed. Recent data from September 14 to November 30, 2025, shows a further decline of -16.34%, with a standard deviation of 1.15, suggesting moderate volatility.

MicroVision, Inc. (MVIS) has also faced a significant downturn, with a -65.79% change over the past year, categorizing it as bearish as well. The stock’s price ranged from a high of $2.66 to a low of $0.82, also showing deceleration in its trend. In the recent period from September 14 to November 30, 2025, MVIS dropped by -20.18% with a standard deviation of 0.16, indicating low volatility.

Both companies are exhibiting strong downward trends, and the acceleration in their declines raises concerns for potential investors. Risk management strategies should be prioritized when considering positions in these stocks.

Analyst Opinions

Recent analyst recommendations for Mobileye Global Inc. (MBLY) indicate a cautious stance, with a rating of C+. Analysts highlight a solid discounted cash flow score, suggesting potential growth, but weak performance in return metrics raises concerns. Conversely, MicroVision, Inc. (MVIS) has a D+ rating, indicating significant risks and poor financial performance across various metrics. The consensus for MBLY leans towards a “hold,” while MVIS is generally viewed as a “sell.” Therefore, if I were to choose, I would exercise caution with both companies.

Stock Grades

In the current market landscape, it’s essential to stay updated on stock ratings from reliable grading companies. Here’s the latest information on the grades for Mobileye Global Inc. and MicroVision, Inc.

Mobileye Global Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2025-10-30 |

| TD Cowen | Maintain | Buy | 2025-10-24 |

| Mizuho | Maintain | Neutral | 2025-10-24 |

| Barclays | Maintain | Equal Weight | 2025-10-10 |

| Goldman Sachs | Maintain | Neutral | 2025-09-29 |

| B of A Securities | Maintain | Neutral | 2025-09-10 |

| Baird | Maintain | Outperform | 2025-09-03 |

| RBC Capital | Maintain | Sector Perform | 2025-07-29 |

| Mizuho | Maintain | Neutral | 2025-07-25 |

| Baird | Maintain | Outperform | 2025-07-25 |

MicroVision, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | Maintain | Buy | 2025-11-12 |

| WestPark Capital | Maintain | Buy | 2025-10-21 |

| WestPark Capital | Maintain | Buy | 2025-09-05 |

| D. Boral Capital | Maintain | Buy | 2025-09-02 |

| WestPark Capital | Maintain | Buy | 2025-08-27 |

| D. Boral Capital | Maintain | Buy | 2025-08-11 |

| D. Boral Capital | Maintain | Buy | 2025-05-21 |

| D. Boral Capital | Maintain | Buy | 2025-05-13 |

| WestPark Capital | Maintain | Buy | 2025-03-27 |

| D. Boral Capital | Maintain | Buy | 2025-03-25 |

The overall trend in grades for both companies indicates a strong preference for maintaining positions, particularly with multiple “Buy” ratings for MicroVision, suggesting positive investor sentiment. Mobileye shows a mix of grades, highlighting a more cautious outlook among analysts. Always consider these ratings in conjunction with your investment strategy and risk management practices.

Target Prices

The target consensus for the two companies shows a range of expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Mobileye Global Inc. | 25 | 13 | 18.33 |

| MicroVision, Inc. | 5 | 5 | 5 |

For Mobileye Global Inc., analysts expect a consensus target price of 18.33, significantly higher than its current price of 11.33. Meanwhile, MicroVision, Inc. has a consensus target price equal to its current price at 5, indicating a more cautious outlook compared to its peers.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Mobileye Global Inc. (MBLY) and MicroVision, Inc. (MVIS) based on the most recent data.

| Criterion | Mobileye Global Inc. (MBLY) | MicroVision, Inc. (MVIS) |

|---|---|---|

| Diversification | Moderate (focus on ADAS) | Limited (niche lidar tech) |

| Profitability | Negative margins (-1.87%) | Negative margins (-20.64%) |

| Innovation | Strong in autonomous tech | Advanced lidar technology |

| Global presence | Significant (global reach) | Limited (focus on OEMs) |

| Market Share | Growing in ADAS | Small in lidar market |

| Debt level | Low (debt to equity 0.004) | Moderate (debt to equity 1.059) |

Key takeaways indicate that while Mobileye shows a stronger position with lower debt and a global presence, MicroVision struggles with profitability and market share despite its innovative technology.

Risk Analysis

In this section, I will outline the key risks associated with Mobileye Global Inc. (MBLY) and MicroVision, Inc. (MVIS) that could impact their performance and investment potential.

| Metric | Mobileye Global Inc. (MBLY) | MicroVision, Inc. (MVIS) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

The most pressing risks for MBLY include moderate market and operational risks, particularly as they navigate the evolving automotive industry. Conversely, MVIS faces higher risks, notably from market volatility and operational challenges, which could hinder its growth trajectory.

Which one to choose?

When comparing Mobileye Global Inc. (MBLY) and MicroVision, Inc. (MVIS), Mobileye shows stronger fundamentals. With a market cap of approximately $16.2B and a C+ rating, its gross profit margin of 44.8% suggests operational efficiency, despite a net loss. Conversely, MicroVision, with a market cap of $0.27B and a D+ rating, reported a gross profit margin of -60.3% and significant losses, indicating severe operational challenges. Both companies exhibit bearish stock trends, with Mobileye’s price down 62.65% and MicroVision’s down 65.79%.

For investors focused on growth, I would recommend Mobileye due to its relatively better financial health and operational metrics. However, those prioritizing high-risk speculative investments may explore MicroVision, acknowledging its significant challenges.

Risks include competition and market dependence within their respective industries.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Mobileye Global Inc. and MicroVision, Inc. to enhance your investment decisions: