In today’s rapidly evolving automotive landscape, two companies stand out for their innovative contributions: Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI). Both firms operate at the intersection of technology and transportation, focusing on advanced driver assistance systems and automotive semiconductors, respectively. Their overlapping market presence makes this comparison particularly intriguing. As an investor, you’ll want to explore which company offers the most promising opportunities for growth and returns. Let’s delve into their strategies and prospects to find out!

Table of contents

Company Overview

Mobileye Global Inc. Overview

Mobileye Global Inc. (ticker: MBLY) is a leader in the development of advanced driver assistance systems (ADAS) and autonomous driving technologies. Founded in 1999 and headquartered in Jerusalem, Israel, Mobileye operates as a subsidiary of Intel. The company’s mission is to enhance vehicle safety and enable a future of autonomous driving through innovative solutions like Mobileye SuperVision and Mobileye Drive. With a robust market capitalization of approximately $9.24B, Mobileye is strategically positioned in the auto parts industry, focusing on both safety and user experience.

indie Semiconductor, Inc. Overview

indie Semiconductor, Inc. (ticker: INDI) specializes in automotive semiconductors and software solutions for connected cars and advanced driver assistance systems. Incorporated in 2007 and based in Aliso Viejo, California, indie aims to drive innovation in user experience, electrification, and connectivity within the automotive sector. With a market cap of around $703M, indie’s product offerings include ultrasound for parking assistance and telematics, positioning the company as a key player in the semiconductor industry.

Key Similarities and Differences

Both Mobileye and indie Semiconductor focus on the automotive sector, but their business models differ significantly. Mobileye is primarily centered on software and systems for vehicle safety and autonomy, while indie Semiconductor targets the hardware side, providing semiconductor solutions for various automotive applications. This distinction highlights the complementary nature of their offerings in the rapidly evolving automotive landscape.

Income Statement Comparison

Below is a comparison of the income statements for Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI) for the most recent fiscal year, providing insights into their financial performance.

| Metric | Mobileye Global Inc. | indie Semiconductor, Inc. |

|---|---|---|

| Revenue | 1.65B | 216.68M |

| EBITDA | -2.66B | -93.94M |

| EBIT | -3.16B | -137.00M |

| Net Income | -3.09B | -132.60M |

| EPS | -3.82 | -0.76 |

Interpretation of Income Statement

In the latest fiscal year, both companies experienced declining revenues, with Mobileye’s revenue decreasing from 2.08B to 1.65B, while INDI saw a slight drop from 223.17M to 216.68M. Mobileye’s net income worsened significantly, dropping to -3.09B, indicating substantial losses and deteriorating financial health. Conversely, INDI’s losses also expanded, although at a smaller scale. Both companies exhibited negative growth, with margins remaining under pressure, highlighting the need for strategic adjustments to improve profitability going forward.

Financial Ratios Comparison

In this section, I present a comparative overview of key financial ratios for Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI) based on the most recent data available.

| Metric | Mobileye Global Inc. (MBLY) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | -0.26 | -0.32 |

| ROIC | -0.26 | -0.19 |

| P/E | -5.24 | -5.35 |

| P/B | 1.34 | 1.70 |

| Current Ratio | 6.53 | 4.82 |

| Quick Ratio | 5.28 | 4.23 |

| D/E | 0.004 | 0.95 |

| Debt-to-Assets | 0.004 | 0.21 |

| Interest Coverage | 0 | -18.37 |

| Asset Turnover | 0.13 | 0.23 |

| Fixed Asset Turnover | 3.61 | 4.30 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of Financial Ratios

The financial ratios present a mixed picture. Mobileye exhibits a higher current and quick ratio, indicating better short-term liquidity compared to indie Semiconductor. However, both companies show negative ROE and ROIC, raising concerns about their profitability. The high debt-to-assets ratio for INDI indicates greater leverage risk, while MBLY’s low ratio suggests minimal debt exposure. Investors should approach both stocks cautiously due to their current financial weaknesses.

Dividend and Shareholder Returns

Both Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI) do not pay dividends, reflecting their focus on reinvesting capital for growth. MBLY, with a negative net income and substantial free cash flow, is prioritizing R&D and expansion, which may align with long-term shareholder value creation, albeit with inherent risks. Similarly, INDI shows a commitment to growth despite negative margins. Both companies engage in share buybacks, indicating a proactive approach to enhancing shareholder value, although the lack of dividends could suggest a higher risk profile.

Strategic Positioning

Mobileye Global Inc. (MBLY) holds a significant market share in advanced driver assistance systems (ADAS) and is well-positioned against competitors due to its comprehensive technology offerings, such as Mobileye SuperVision and Mobileye Drive. Conversely, indie Semiconductor, Inc. (INDI) operates in the semiconductor space, focusing on automotive applications. While both companies face competitive pressure and technological disruption, Mobileye’s established market presence and innovative solutions may offer a more stable investment opportunity compared to the higher volatility and risk associated with indie’s growth phase.

Stock Comparison

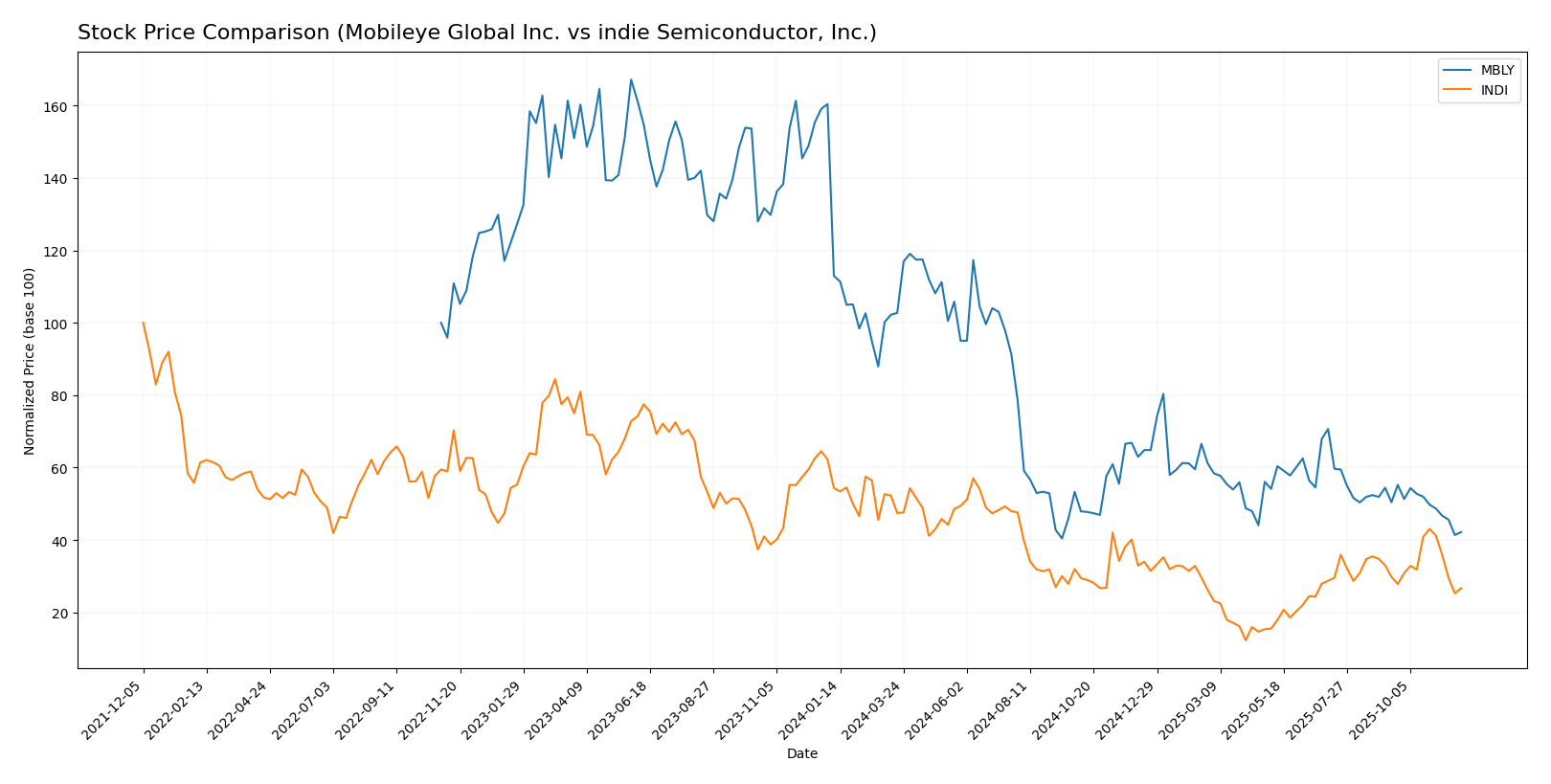

Over the past year, the stock price dynamics of Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI) have shown significant movements, reflecting a bearish trend for both companies amid varying levels of trading activity.

Trend Analysis

Analyzing the trends over the past year, Mobileye Global Inc. (MBLY) has experienced a price change of -62.65%. This indicates a bearish trend, with notable highs of 32.15 and lows of 10.91. The acceleration status is currently decelerating, suggesting a continued decline, albeit at a slower pace. The recent trend from September 14, 2025, to November 30, 2025, shows a further decrease of -16.34% and a standard deviation of 1.15, indicating relatively low volatility in this period.

In contrast, indie Semiconductor, Inc. (INDI) has seen a price change of -50.92%, also reflecting a bearish trend. The stock reached a high of 7.49 and a low of 1.6 during this timeframe. Notably, the trend shows acceleration, indicating a steepening decline. The recent trend from September 14, 2025, to November 30, 2025, reveals a decrease of -10.44% with a standard deviation of 0.75, suggesting a lower volatility compared to MBLY.

In summary, both stocks demonstrate significant downward trends, with MBLY showing signs of deceleration, while INDI is experiencing accelerated declines. Investors should approach these stocks with caution, considering the prevailing bearish conditions.

Analyst Opinions

Recent analyst recommendations suggest a cautious approach towards both Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI). Analysts have rated MBLY with a C+ grade, reflecting concerns about its return on equity and assets, while its price-to-book ratio shows some strength. INDI has received a C rating, indicating similar concerns, particularly in discounted cash flow metrics. Both companies have not garnered a strong consensus; however, the overall sentiment leans slightly towards a hold position for 2025, reflecting the analysts’ reservations about their growth potential amidst current market conditions.

Stock Grades

In this section, I present the latest stock ratings for Mobileye Global Inc. and indie Semiconductor, Inc., based on reliable assessments from recognized grading companies.

Mobileye Global Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | maintain | Buy | 2025-10-30 |

| TD Cowen | maintain | Buy | 2025-10-24 |

| Mizuho | maintain | Neutral | 2025-10-24 |

| Barclays | maintain | Equal Weight | 2025-10-10 |

| Goldman Sachs | maintain | Neutral | 2025-09-29 |

| B of A Securities | maintain | Neutral | 2025-09-10 |

| Baird | maintain | Outperform | 2025-09-03 |

| RBC Capital | maintain | Sector Perform | 2025-07-29 |

| Mizuho | maintain | Neutral | 2025-07-25 |

| Baird | maintain | Outperform | 2025-07-25 |

indie Semiconductor, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | maintain | Neutral | 2025-11-10 |

| Benchmark | maintain | Buy | 2025-06-25 |

| Benchmark | maintain | Buy | 2025-06-11 |

| Benchmark | maintain | Buy | 2025-05-21 |

| Benchmark | maintain | Buy | 2025-05-13 |

| Craig-Hallum | maintain | Buy | 2025-05-13 |

| Keybanc | maintain | Overweight | 2025-05-13 |

| Benchmark | maintain | Buy | 2025-04-09 |

| Benchmark | maintain | Buy | 2025-02-21 |

| Keybanc | maintain | Overweight | 2025-02-21 |

Overall, both companies show a stable trend in their grades, with Mobileye maintaining strong ratings, primarily from firms like Tigress Financial and TD Cowen. Indie Semiconductor also demonstrates consistent support from Benchmark, indicating a generally favorable outlook among analysts.

Target Prices

The consensus target prices for the following companies indicate potential upside based on analyst projections.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Mobileye Global Inc. (MBLY) | 25 | 13 | 18.33 |

| indie Semiconductor, Inc. (INDI) | 8 | 8 | 8 |

For Mobileye Global Inc. (MBLY), analysts suggest a target consensus of 18.33, significantly higher than its current price of 11.35. Meanwhile, indie Semiconductor, Inc. (INDI) has a stable target price of 8, which aligns closely with its current price of 3.47, indicating a potential for growth.

Strengths and Weaknesses

The table below outlines the strengths and weaknesses of Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI), providing a concise comparison for potential investors.

| Criterion | Mobileye Global Inc. | indie Semiconductor, Inc. |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins | Negative margins |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Growing | Niche |

| Debt level | Very low | High |

Key takeaways reveal that while Mobileye exhibits strong innovation and a robust global presence, indie Semiconductor faces challenges in profitability and has a higher debt level. Investors should weigh these factors carefully when considering their investment strategies.

Risk Analysis

In examining the potential risks associated with investing in Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI), I’ve compiled a summary table that highlights various risk factors for each company.

| Metric | Mobileye Global Inc. | indie Semiconductor, Inc. |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | High | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Medium |

| Geopolitical Risk | Medium | High |

Both companies face significant market risks, particularly due to their exposure to the volatile automotive and semiconductor sectors. Mobileye’s reliance on regulatory approvals for autonomous technologies presents a high regulatory risk, while indie Semiconductor has a higher operational risk due to reliance on complex supply chains.

Which one to choose?

When comparing Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI), both companies exhibit bearish stock trends with notable challenges. MBLY’s gross profit margin stands at 44.8%, but it faces significant losses reflected in a net profit margin of -1.9% and a C+ rating. Conversely, INDI shows a gross profit margin of 41.7% with a net profit margin of -61.2%, earning a C rating. While MBLY has a higher market cap of $16.2B, INDI’s market cap is $708M, indicating different scales of operation.

For investors focusing on growth, MBLY appears more favorable, despite its significant losses and higher valuation ratios. However, risk factors for both include competition and market dependence, which could impact future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Mobileye Global Inc. and indie Semiconductor, Inc. to enhance your investment decisions: