In the rapidly evolving semiconductor industry, ON Semiconductor Corporation (ON) and indie Semiconductor, Inc. (INDI) are two compelling players attracting investor attention. Both companies focus on automotive applications, yet they differ in their innovation strategies and market positioning. ON specializes in a broad range of intelligent sensing and power solutions, while INDI targets advanced driver assistance and connected car technologies. Join me as we delve into a comparison that will help you determine which company might be a more intriguing addition to your investment portfolio.

Table of contents

Company Overview

ON Semiconductor Corporation Overview

ON Semiconductor Corporation, headquartered in Phoenix, Arizona, stands as a key player in the semiconductor industry, with a market capitalization of approximately $20.2B. The company is dedicated to providing intelligent sensing and power solutions that drive the electrification of the automotive sector and promote sustainable energy. Its product portfolio spans across three segments: Power Solutions, Advanced Solutions, and Intelligent Sensing, offering a diverse range of semiconductor products including analog, discrete, and integrated solutions. This focus enables ON Semiconductor to cater to various applications such as electric vehicles and renewable energy systems.

indie Semiconductor, Inc. Overview

indie Semiconductor, Inc., based in Aliso Viejo, California, specializes in automotive semiconductors and software solutions, aiming to enhance user experience and support advanced driver assistance systems. With a market cap of about $704M, indie Semiconductor leverages its expertise in photonic components and connectivity solutions to address emerging demands in the automotive market. Its offerings include devices for parking assistance, in-car wireless charging, and telematics, positioning the company favorably within the growing automotive tech landscape.

Key similarities between ON Semiconductor and indie Semiconductor lie in their focus on the semiconductor industry and their commitment to automotive applications. However, their business models differ significantly, with ON Semiconductor offering a broader range of semiconductor solutions across various industries, while indie Semiconductor concentrates primarily on automotive-specific technologies and software.

Income Statement Comparison

Below is a comparative analysis of the Income Statements for ON Semiconductor Corporation and indie Semiconductor, Inc. for the most recent fiscal year, which provides insight into their financial health and performance metrics.

| Metric | ON Semiconductor (2024) | indie Semiconductor (2024) |

|---|---|---|

| Revenue | 7.08B | 216.68M |

| EBITDA | 2.54B | -93.94M |

| EBIT | 1.90B | -136.99M |

| Net Income | 1.57B | -132.60M |

| EPS | 3.68 | -0.76 |

Interpretation of Income Statement

In the latest fiscal year, ON Semiconductor reported a revenue of 7.08B, indicating a decline from the previous year’s 8.25B. Despite this drop, net income also decreased but remained positive at 1.57B, reflecting a stable net income margin. Conversely, indie Semiconductor continues to struggle with increasing losses, reporting a net income of -132.60M, which indicates an ongoing operational challenge. Both companies show differing financial trajectories, with ON Semiconductor maintaining profitability while indie Semiconductor exhibits significant operating losses.

Financial Ratios Comparison

Below is a comparative table showcasing the most recent revenue and key financial ratios for ON Semiconductor Corporation (ON) and indie Semiconductor, Inc. (INDI).

| Metric | ON | INDI |

|---|---|---|

| ROE | 17.88% | -31.73% |

| ROIC | 11.88% | -19.25% |

| P/E | 17.13 | -5.35 |

| P/B | 3.06 | 1.70 |

| Current Ratio | 5.06 | 4.82 |

| Quick Ratio | 3.38 | 4.23 |

| D/E | 0.38 | 0.95 |

| Debt-to-Assets | 23.90% | 42.34% |

| Interest Coverage | 28.37 | -18.37 |

| Asset Turnover | 0.50 | 0.23 |

| Fixed Asset Turnover | 1.61 | 4.30 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

On analyzing the financial ratios, ON demonstrates robust performance with strong ROE (17.88%) and manageable debt levels (D/E of 0.38), indicating effective use of equity and lower financial risk. In contrast, INDI’s negative ratios, particularly in ROE (-31.73%) and interest coverage (-18.37), raise significant concerns about its profitability and ability to meet debt obligations. Investors should proceed cautiously with INDI, given its financial instability.

Dividend and Shareholder Returns

ON Semiconductor Corporation (ticker: ON) does not pay dividends, opting instead to reinvest profits into growth opportunities and share buyback programs. This strategy aligns with their focus on innovation and long-term value creation, despite potential risks like fluctuating cash flows. Conversely, indie Semiconductor, Inc. (ticker: INDI) also refrains from dividends due to ongoing net losses and a commitment to R&D. While both companies prioritize reinvestment, I advise caution as these approaches hinge on future profitability and market conditions.

Strategic Positioning

ON Semiconductor Corporation (ON) holds a significant market share in the semiconductor sector, particularly in power solutions for the automotive industry, with a market cap of $20.2B. Its technological advancements in electrification and sustainable energy are critical in a competitive landscape. Conversely, indie Semiconductor, Inc. (INDI), valued at $704M, focuses on automotive semiconductors for advanced applications but faces intense competitive pressure due to its smaller scale and higher beta (2.562), indicating greater volatility. Both companies must continually innovate to mitigate risks from technological disruption.

Stock Comparison

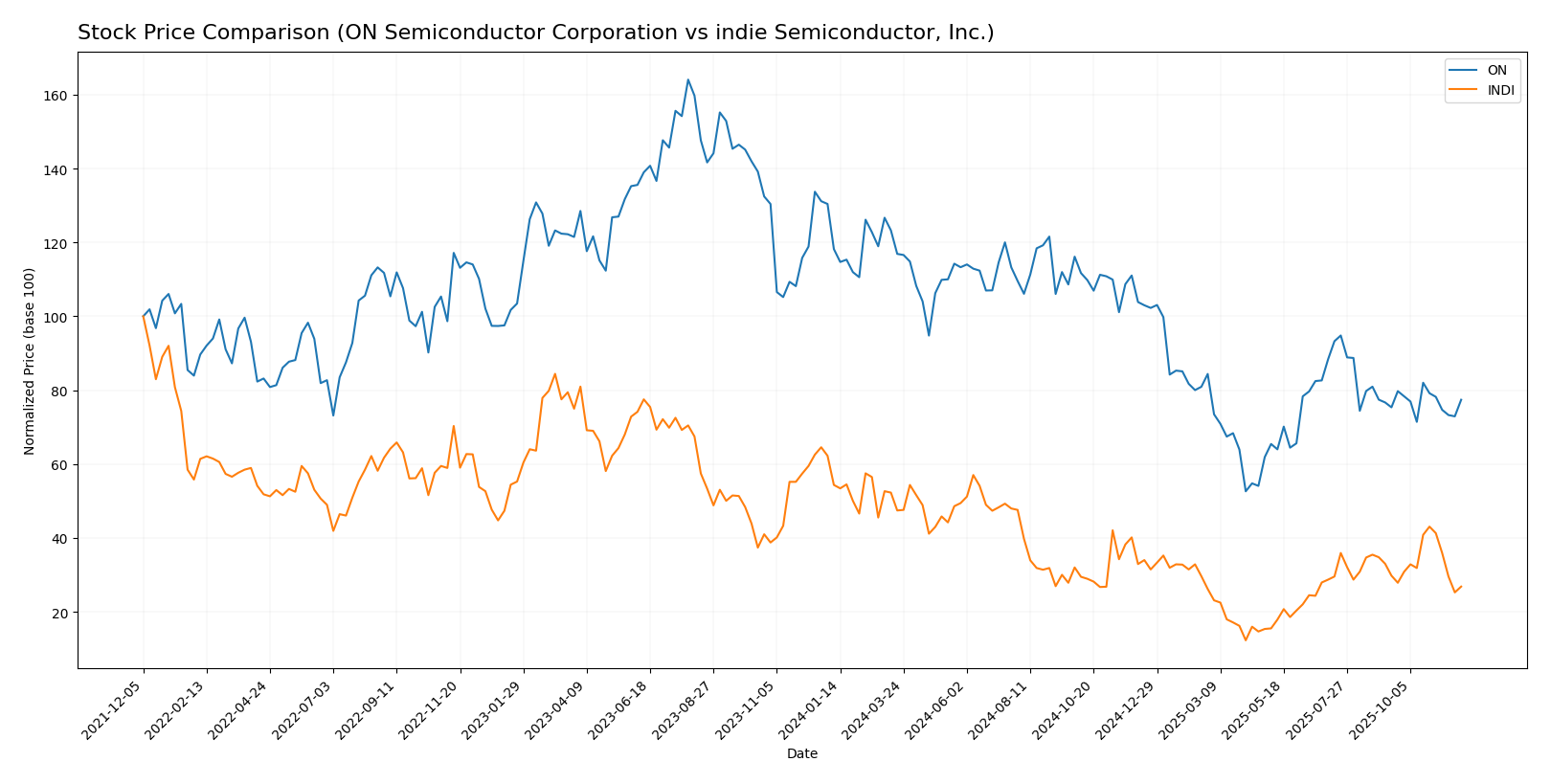

In this section, I will analyze the weekly stock price movements of ON Semiconductor Corporation (ON) and indie Semiconductor, Inc. (INDI) over the past year, focusing on key price dynamics and trading trends.

Trend Analysis

For ON Semiconductor Corporation (ON), the overall percentage change over the past year is -34.51%. This indicates a bearish trend, characterized by acceleration in the downward movement. The stock reached a high of 81.14 and a low of 33.7, with a standard deviation of 12.59, suggesting significant volatility in its price. Recently, ON has shown a slight recovery with a percentage change of 2.72% from September 14, 2025, to November 30, 2025. However, the trend slope remains negative at -0.15, indicating ongoing challenges despite the recent uptick.

For indie Semiconductor, Inc. (INDI), the overall percentage change over the past year is -50.64%, also reflecting a bearish trend with acceleration. The stock has fluctuated between a high of 7.49 and a low of 1.6, with a standard deviation of 1.5, indicating moderate volatility. In the recent analysis period from September 14, 2025, to November 30, 2025, INDI experienced a further decline of -9.92%, with a trend slope of -0.01, suggesting a slight deceleration in the rate of decline but still indicating a negative outlook.

Both stocks show alarming trends, and careful consideration is warranted when evaluating potential investment opportunities.

Analyst Opinions

Recent analyst recommendations for ON Semiconductor Corporation (ON) indicate a strong consensus to “buy,” with an overall score of 3. Analysts appreciate its robust return on assets and equity, reflecting solid operational efficiency. In contrast, indie Semiconductor, Inc. (INDI) has received a “hold” rating with an overall score of 2, mainly due to lower performance in discounted cash flow and return metrics. Analysts suggest caution with INDI as it faces challenges in profitability. Overall, the consensus favors ON as a buy for 2025, while INDI remains on watch.

Stock Grades

I have analyzed the most recent stock ratings for ON Semiconductor Corporation (ON) and indie Semiconductor, Inc. (INDI) to help you make informed investment decisions.

ON Semiconductor Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-11-24 |

| TD Cowen | maintain | Buy | 2025-11-04 |

| Truist Securities | maintain | Hold | 2025-11-04 |

| Baird | maintain | Neutral | 2025-11-04 |

| Rosenblatt | maintain | Neutral | 2025-11-04 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-04 |

| UBS | maintain | Neutral | 2025-10-27 |

| B of A Securities | maintain | Neutral | 2025-09-05 |

| Citigroup | maintain | Neutral | 2025-08-05 |

| JP Morgan | maintain | Neutral | 2025-08-05 |

indie Semiconductor, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | maintain | Neutral | 2025-11-10 |

| Benchmark | maintain | Buy | 2025-06-25 |

| Benchmark | maintain | Buy | 2025-06-11 |

| Benchmark | maintain | Buy | 2025-05-21 |

| Benchmark | maintain | Buy | 2025-05-13 |

| Craig-Hallum | maintain | Buy | 2025-05-13 |

| Keybanc | maintain | Overweight | 2025-05-13 |

| Benchmark | maintain | Buy | 2025-04-09 |

| Benchmark | maintain | Buy | 2025-02-21 |

| Keybanc | maintain | Overweight | 2025-02-21 |

Overall, ON Semiconductor shows a stable outlook with several maintain ratings, primarily around Neutral and Equal Weight. In contrast, indie Semiconductor has a stronger sentiment with multiple Buy ratings from Benchmark, indicating a positive trend in investor sentiment.

Target Prices

The consensus target prices for ON Semiconductor Corporation and indie Semiconductor, Inc. reflect optimistic expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ON Semiconductor Corporation | 64 | 51 | 58.33 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

For ON Semiconductor, analysts suggest a target consensus of 58.33, indicating potential upside from the current price of 49.46. Meanwhile, indie Semiconductor’s target consensus aligns perfectly with its current trading price of 3.48, suggesting a more stable outlook.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of ON Semiconductor Corporation (ON) and indie Semiconductor, Inc. (INDI) based on the most recent data.

| Criterion | ON Semiconductor Corporation | indie Semiconductor, Inc. |

|---|---|---|

| Diversification | Strong presence in multiple semiconductor markets | Focused primarily on automotive applications |

| Profitability | Net Profit Margin: 22.2% | Negative margins across the board |

| Innovation | High R&D investment in advanced technologies | Emerging player with potential in ADAS technologies |

| Global presence | Operates worldwide | Primarily US-based operations |

| Market Share | Significant share in the semiconductor industry | Smaller market share, targeting niche automotive sectors |

| Debt level | Debt to Equity Ratio: 0.43 | Debt to Equity Ratio: 0.95 |

Key takeaways from the table indicate that while ON Semiconductor demonstrates robust profitability and a strong global presence, indie Semiconductor faces challenges with negative margins and a narrower focus. Investors should weigh these factors carefully when considering their investment options.

Risk Analysis

The following table outlines the key risks associated with ON Semiconductor Corporation (ON) and indie Semiconductor, Inc. (INDI).

| Metric | ON Semiconductor Corporation | indie Semiconductor, Inc. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and operational risks, particularly indie Semiconductor, which has a higher exposure to market fluctuations and operational challenges. Recent supply chain disruptions in the semiconductor industry have amplified these risks, impacting overall performance and stability.

Which one to choose?

When comparing ON Semiconductor Corporation (ON) and indie Semiconductor, Inc. (INDI), ON presents stronger fundamentals. ON boasts a gross profit margin of 45.4% and a net profit margin of 22.2%, while INDI operates at a negative net profit margin of 61.2%. ON’s P/E ratio is 17.1, indicating a more favorable valuation compared to INDI’s negative earnings metrics. Analysts rate ON as a “B” with a price target suggesting potential upside, whereas INDI is rated “C” with less optimism.

For growth-oriented investors, ON appears favorable due to its solid profitability and analyst support. Conversely, those prioritizing higher risk and potential high reward might consider INDI, despite its current challenges.

Investors should remain cautious, as both companies face industry competition and market dependence that could impact performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of ON Semiconductor Corporation and indie Semiconductor, Inc. to enhance your investment decisions: