In the rapidly evolving landscape of technology and automotive innovation, ON Semiconductor Corporation and Mobileye Global Inc. stand out as key players. Both companies are deeply entrenched in the semiconductor and automotive industries, respectively, focusing on cutting-edge solutions that drive electrification and autonomous vehicle technology. Their overlapping interests in providing advanced technologies offer a fertile ground for comparison. In this article, I will delve into their strategies, performance, and future potential to help you, the investor, decide which company may be the more compelling addition to your portfolio.

Table of contents

Company Overview

ON Semiconductor Corporation Overview

ON Semiconductor Corporation focuses on providing intelligent sensing and power solutions globally. Its mission centers on enabling the electrification of the automotive sector, which supports the development of lighter, longer-range electric vehicles and efficient energy systems for various applications. The company operates through three segments: Power Solutions Group, Advanced Solutions Group, and Intelligent Sensing Group, catering to a wide range of end-users with its extensive portfolio of semiconductor products. These include analog, discrete, and integrated solutions essential for modern electronic devices. With a market capitalization of approximately $20.3B, ON Semiconductor stands as a key player in the semiconductor industry, headquartered in Phoenix, Arizona.

Mobileye Global Inc. Overview

Mobileye Global Inc. specializes in advanced driver assistance systems (ADAS) and autonomous driving technologies. Founded in 1999, the company’s mission is to enhance road safety through innovative solutions that provide real-time detection of road users and assistive driving features. Mobileye offers a variety of solutions, including cloud-enhanced driver assist systems and Level 4 autonomous driving technologies. With its market capitalization at around $9.3B, Mobileye, a subsidiary of Intel, is positioned as a leader in the auto-parts industry, based in Jerusalem, Israel.

Key similarities between ON Semiconductor and Mobileye include their focus on technology-driven solutions and strong market positioning in their respective sectors. However, their business models diverge; ON specializes in semiconductor manufacturing, while Mobileye focuses on software and hardware solutions for automotive safety and automation.

Income Statement Comparison

The following table provides a detailed comparison of the most recent income statements for ON Semiconductor Corporation and Mobileye Global Inc., highlighting key financial metrics.

| Metric | [Company A: ON] | [Company B: MBLY] |

|---|---|---|

| Revenue | 7.08B | 1.65B |

| EBITDA | 2.54B | -2.66B |

| EBIT | 1.90B | -3.16B |

| Net Income | 1.57B | -3.09B |

| EPS | 3.68 | -3.82 |

Interpretation of Income Statement

In the latest fiscal year, ON Semiconductor (ON) demonstrated robust revenue of 7.08B, albeit a decline from the previous year’s 8.25B, resulting in a net income of 1.57B. This indicates a stable operational performance despite a slight dip in revenue. In contrast, Mobileye Global (MBLY) faced significant challenges, reporting a net loss of 3.09B with declining revenues from 2.08B the previous year. Their margins have weakened, as evidenced by the negative EBITDA, reflecting ongoing investment pressures. The contrasting performances underline ON’s established profitability against MBLY’s need for strategic reevaluation.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent revenue and financial ratios for ON Semiconductor Corporation (ON) and Mobileye Global Inc. (MBLY). These metrics will help you assess the financial health and performance of both companies.

| Metric | ON | MBLY |

|---|---|---|

| ROE | 17.88% | -25.56% |

| ROIC | 11.88% | -25.70% |

| P/E | 17.13 | N/A |

| P/B | 3.06 | 1.34 |

| Current Ratio | 5.06 | 6.53 |

| Quick Ratio | 3.38 | 5.28 |

| D/E | 0.38 | 0.004 |

| Debt-to-Assets | 0.24 | 0.004 |

| Interest Coverage | 28.37 | N/A |

| Asset Turnover | 0.50 | 0.13 |

| Fixed Asset Turnover | 1.61 | 3.61 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

ON demonstrates strong profitability ratios with a positive ROE and ROIC, indicating efficient use of equity and capital. In contrast, MBLY shows negative profitability, raising concerns about its operational viability. While MBLY has a higher current and quick ratio, suggesting liquidity strength, its negative earnings metrics may indicate underlying operational challenges that investors should closely monitor.

Dividend and Shareholder Returns

ON Semiconductor Corporation (ON) does not pay dividends, opting instead to reinvest earnings for growth. This strategy aligns with a high-growth phase, prioritizing R&D and capital expenditures. Their robust share buyback program indicates confidence in their long-term value creation. Conversely, Mobileye Global Inc. (MBLY) also refrains from dividends, focusing on expansion amidst negative net income. Their approach, prioritizing growth over immediate returns, may support sustainable shareholder value if managed prudently. Both companies’ lack of dividends suggests a commitment to long-term growth but poses risks if growth fails to materialize.

Strategic Positioning

ON Semiconductor Corporation (ON) holds a significant market share in the semiconductor industry, driven by its advanced power solutions and intelligent sensing technologies. With a market cap of $20.3B, ON faces moderate competitive pressure from peers, yet its innovative product portfolio positions it favorably against technological disruptions. Conversely, Mobileye Global Inc. (MBLY), valued at $9.3B, leads in autonomous driving technology but must navigate fierce competition from emerging players in the ADAS market. Effective risk management strategies are essential for both companies in this rapidly evolving landscape.

Stock Comparison

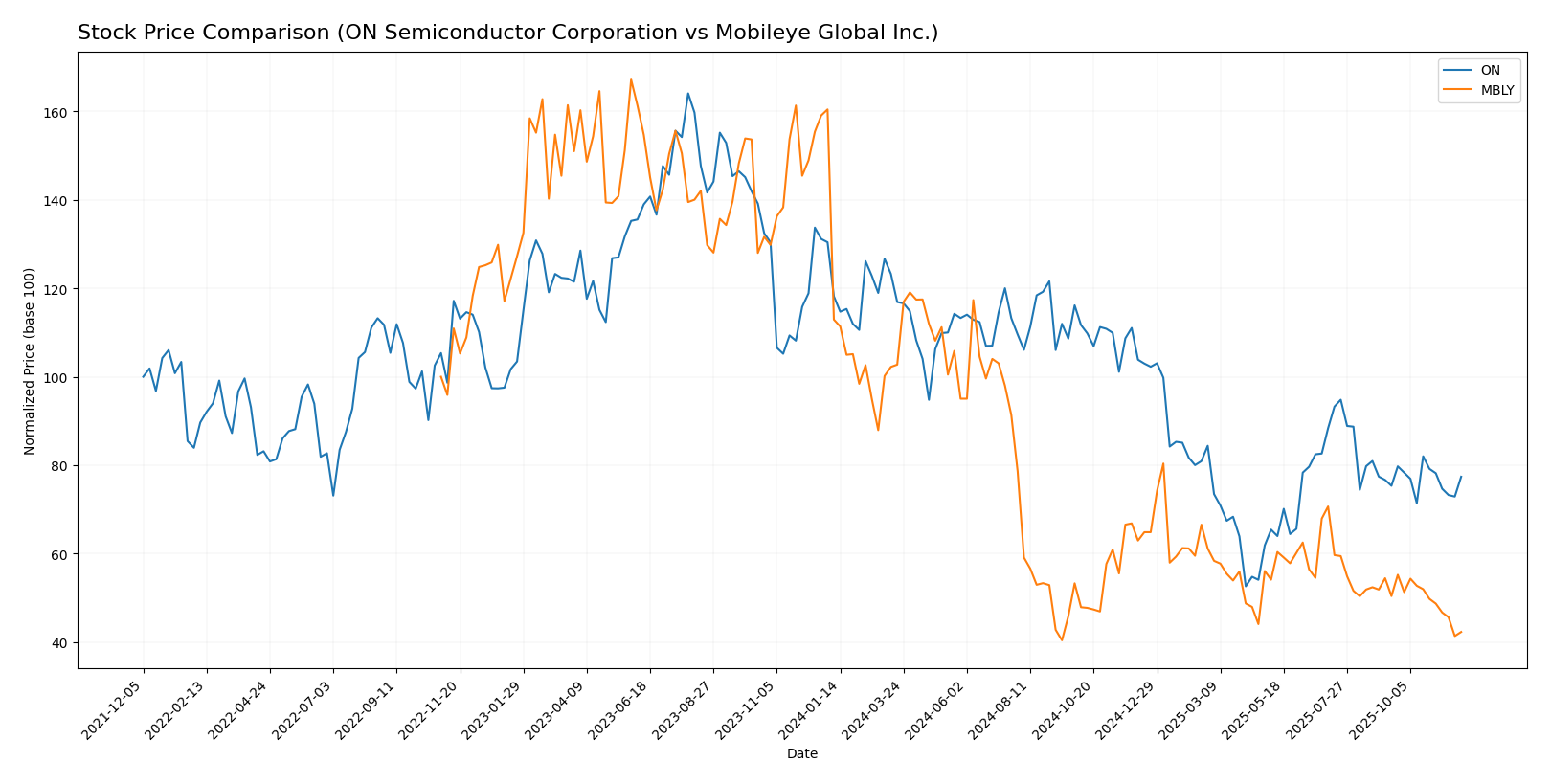

In this section, I will analyze the weekly stock price movements of ON Semiconductor Corporation (ON) and Mobileye Global Inc. (MBLY) over the past year, highlighting key price dynamics and trading trends.

Trend Analysis

For ON Semiconductor Corporation (ON), the overall percentage change over the past year is -34.51%, indicating a bearish trend. The stock experienced notable highs at 81.14 and lows at 33.7, with a standard deviation of 12.59 suggesting moderate volatility. Recently, the stock had a slight uptick of 2.72% from September 14, 2025, to November 30, 2025. This recent performance indicates a neutral trend, albeit still within a bearish overall context, with a trend slope of -0.15, suggesting a continued acceleration in the downward movement.

For Mobileye Global Inc. (MBLY), the overall percentage change for the last year stands at -62.55%, also reflecting a bearish trend. The stock’s highest price reached 32.15 and its lowest was 10.91, with a standard deviation of 6.39, pointing to lower volatility compared to ON. More recently, MBLY has seen a decrease of 16.09% from September 14, 2025, to November 30, 2025, further reinforcing its bearish trend, with a trend slope of -0.29, indicating deceleration in its recent price movements.

In conclusion, both stocks are currently in bearish trends, with ON showing some neutral movement recently, while MBLY continues to decline. Investors should exercise caution and consider the overall market dynamics when assessing these stocks for their portfolios.

Analyst Opinions

Recent analyst recommendations show a mixed outlook for key players. ON Semiconductor Corporation (ON) received a “B” rating from analysts, indicating a “buy” consensus, driven by strong discounted cash flow and return on assets scores. In contrast, Mobileye Global Inc. (MBLY) holds a “C+” rating, suggesting a “hold” stance, primarily due to lower performance in return on equity and debt-to-equity metrics. Overall, the consensus for ON is bullish, while MBLY reflects caution.

Stock Grades

In this section, I will present the latest stock ratings from reliable grading companies for ON Semiconductor Corporation (ON) and Mobileye Global Inc. (MBLY).

ON Semiconductor Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-11-24 |

| TD Cowen | maintain | Buy | 2025-11-04 |

| Truist Securities | maintain | Hold | 2025-11-04 |

| Baird | maintain | Neutral | 2025-11-04 |

| Rosenblatt | maintain | Neutral | 2025-11-04 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-04 |

| UBS | maintain | Neutral | 2025-10-27 |

| B of A Securities | maintain | Neutral | 2025-09-05 |

| Citigroup | maintain | Neutral | 2025-08-05 |

| JP Morgan | maintain | Neutral | 2025-08-05 |

Mobileye Global Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | maintain | Buy | 2025-10-30 |

| TD Cowen | maintain | Buy | 2025-10-24 |

| Mizuho | maintain | Neutral | 2025-10-24 |

| Barclays | maintain | Equal Weight | 2025-10-10 |

| Goldman Sachs | maintain | Neutral | 2025-09-29 |

| B of A Securities | maintain | Neutral | 2025-09-10 |

| Baird | maintain | Outperform | 2025-09-03 |

| RBC Capital | maintain | Sector Perform | 2025-07-29 |

| Mizuho | maintain | Neutral | 2025-07-25 |

| Baird | maintain | Outperform | 2025-07-25 |

Overall, the ratings for both ON and MBLY indicate a cautious stance from analysts, with many maintaining their previous grades and a mix of “Buy” and “Neutral” recommendations. This suggests a stable outlook, but investors should remain vigilant and consider market conditions before making any investment decisions.

Target Prices

The consensus target prices for ON Semiconductor Corporation and Mobileye Global Inc. indicate positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ON Semiconductor Corporation | 64 | 51 | 58.33 |

| Mobileye Global Inc. | 25 | 13 | 18.33 |

For ON Semiconductor, the current price of 49.58 is below the consensus target of 58.33, suggesting potential upside. Similarly, Mobileye’s current price of 11.416 is below the consensus of 18.33, indicating room for growth as well.

Strengths and Weaknesses

The following table outlines the key strengths and weaknesses of ON Semiconductor Corporation (ON) and Mobileye Global Inc. (MBLY) based on their most recent financial data.

| Criterion | ON Semiconductor Corporation (ON) | Mobileye Global Inc. (MBLY) |

|---|---|---|

| Diversification | High; operates in multiple segments (Power, Advanced, and Intelligent Sensing) | Low; focused on ADAS and autonomous driving solutions |

| Profitability | Strong; net profit margin at 22.2% | Weak; net profit margin at -1.87% |

| Innovation | High; invests in advanced semiconductor technologies | Moderate; focuses on ADAS innovations |

| Global presence | Significant; operates worldwide | Growing; expanding internationally but primarily in Israel and the US |

| Market Share | Strong in semiconductor sector | Limited; niche market in auto technology |

| Debt level | Moderate; debt-to-equity ratio at 0.43 | Very low; debt-to-equity ratio at 0.004 |

Key takeaways: ON Semiconductor exhibits strong profitability and diversification, making it an attractive option for investors, while Mobileye’s niche focus and current losses present higher risks but potential for future growth.

Risk Analysis

The table below summarizes the key risks associated with ON Semiconductor Corporation and Mobileye Global Inc.

| Metric | ON Semiconductor | Mobileye Global |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

In summary, both companies face significant operational and regulatory risks. Mobileye’s high exposure to regulatory and operational challenges, especially in the evolving autonomous vehicle market, could impact its performance substantially.

Which one to choose?

In comparing ON Semiconductor Corporation (ON) and Mobileye Global Inc. (MBLY), ON shows stronger financial fundamentals. With a market cap of $27B and a net profit margin of approximately 22%, its ratios indicate solid performance and growth potential, reflected in its B rating. Conversely, MBLY, with a market cap of $16B and a negative net profit margin, reports higher debt levels and a C+ rating, suggesting greater risk and limited profitability.

While ON’s stock trend has been bearish, showing a 34.51% decline, MBLY’s performance is worse, with a 62.55% drop. Thus, for risk-averse investors, ON appears more resilient.

Investors focused on stability and sustainable returns may prefer ON, while those willing to take on more risk for potential high rewards could consider MBLY.

However, both companies face challenges, including market competition and valuation uncertainties.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of ON Semiconductor Corporation and Mobileye Global Inc. to enhance your investment decisions: