In the ever-evolving landscape of technology, investors must keenly analyze emerging companies that are reshaping the software industry. Today, I will compare two notable players: Informatica Inc. (INFA) and Domo, Inc. (DOMO). Both companies operate within the software sector but focus on different aspects of data management and business intelligence. Informatica leads in infrastructure solutions, while Domo specializes in application-driven insights. Join me as we uncover which of these innovative firms presents the most compelling investment opportunity.

Table of contents

Company Overview

Informatica Inc. Overview

Informatica Inc. (Ticker: INFA) is a leader in data management solutions, focusing on integrating and unifying data across multi-cloud and hybrid environments. Founded in 1993 and headquartered in Redwood City, California, Informatica aims to empower organizations with AI-driven insights, ensuring they manage their data effectively to enhance decision-making. The company serves a diverse clientele with its extensive suite of products, which includes data integration, quality, governance, and master data management tools. As of now, Informatica boasts a market capitalization of $7.54B, positioning itself strongly within the software infrastructure sector.

Domo, Inc. Overview

Domo, Inc. (Ticker: DOMO) provides a cloud-based business intelligence platform that connects various organizational levels, from executives to frontline workers, with real-time data and insights. Founded in 2010 and based in American Fork, Utah, Domo’s platform facilitates business management through accessible data analytics, enabling decision-making on mobile devices. With a market cap of $454M, Domo occupies a unique niche within the software application industry, focusing on user-friendly interfaces that democratize data access.

Both companies prioritize data management but differ in their approach: Informatica emphasizes a comprehensive suite of data management tools tailored for enterprise-scale needs, while Domo focuses on delivering a user-friendly analytics platform aimed at facilitating real-time decision-making across all organizational levels.

Income Statement Comparison

The following table summarizes the most recent income statements for Informatica Inc. and Domo, Inc., highlighting key financial metrics that are crucial for potential investors.

| Metric | Informatica Inc. | Domo, Inc. |

|---|---|---|

| Revenue | 1.64B | 317M |

| EBITDA | 338M | -50M |

| EBIT | 199M | -59M |

| Net Income | 9.93M | -82M |

| EPS | 0.033 | -2.13 |

Interpretation of Income Statement

Informatica Inc. has shown a positive trend in revenue growth, increasing from 1.59B in 2023 to 1.64B in 2024, while Domo, Inc. also reported a slight increase in revenue from 318M to 317M. However, Informatica’s net income improved significantly from a loss in the previous year to a modest profit, indicating margin stability and potential growth. Conversely, Domo continues to struggle with negative margins and increased losses, reflecting ongoing operational challenges. The contrasting performances of these companies highlight the importance of evaluating profitability alongside revenue growth when making investment decisions.

Financial Ratios Comparison

The following table provides a comparative analysis of the most recent financial ratios for Informatica Inc. (INFA) and Domo, Inc. (DOMO).

| Metric | INFA | DOMO |

|---|---|---|

| ROE | 0.43% | -46.23% |

| ROIC | 0.56% | -197.65% |

| P/E | -65.39 | -3.98 |

| P/B | 3.39 | -1.84 |

| Current Ratio | 1.82 | 0.56 |

| Quick Ratio | 1.82 | 0.56 |

| D/E | 0.81 | -0.76 |

| Debt-to-Assets | 0.35 | 0.63 |

| Interest Coverage | 0.87 | N/A |

| Asset Turnover | 0.31 | 1.48 |

| Fixed Asset Turnover | 8.75 | 8.17 |

| Payout Ratio | 0.00% | 0.00% |

| Dividend Yield | 0.00% | 0.00% |

Interpretation of Financial Ratios

Informatica shows relatively strong liquidity with a current ratio above 1, while Domo’s ratios indicate significant financial distress, particularly with a negative ROE and high debt levels. Domo’s asset turnover is commendably high, but its negative profitability metrics raise concerns about sustainability. Investors should be cautious with Domo due to its negative equity and low liquidity.

Dividend and Shareholder Returns

Informatica Inc. (INFA) maintains minimal dividends with a payout ratio of 0.0012, indicating a cautious approach to shareholder returns amid low profitability. While it does not engage in aggressive share buybacks, it utilizes free cash flow prudently. Conversely, Domo, Inc. (DOMO) does not pay dividends and focuses on reinvestment for growth, reflected in its negative net income. Both strategies may be viewed as aligned with long-term value creation, albeit with varying risk profiles.

Strategic Positioning

Informatica Inc. (INFA) commands a significant market share in the software infrastructure sector, leveraging its AI-powered data management platform to cater to enterprise needs. With a market cap of 7.54B, it faces moderate competitive pressure from Domo, Inc. (DOMO), which operates in the business intelligence space with a market cap of 454.52M. Both companies are navigating technological disruptions, but Informatica’s broader suite of solutions positions it favorably against Domo’s more focused offerings.

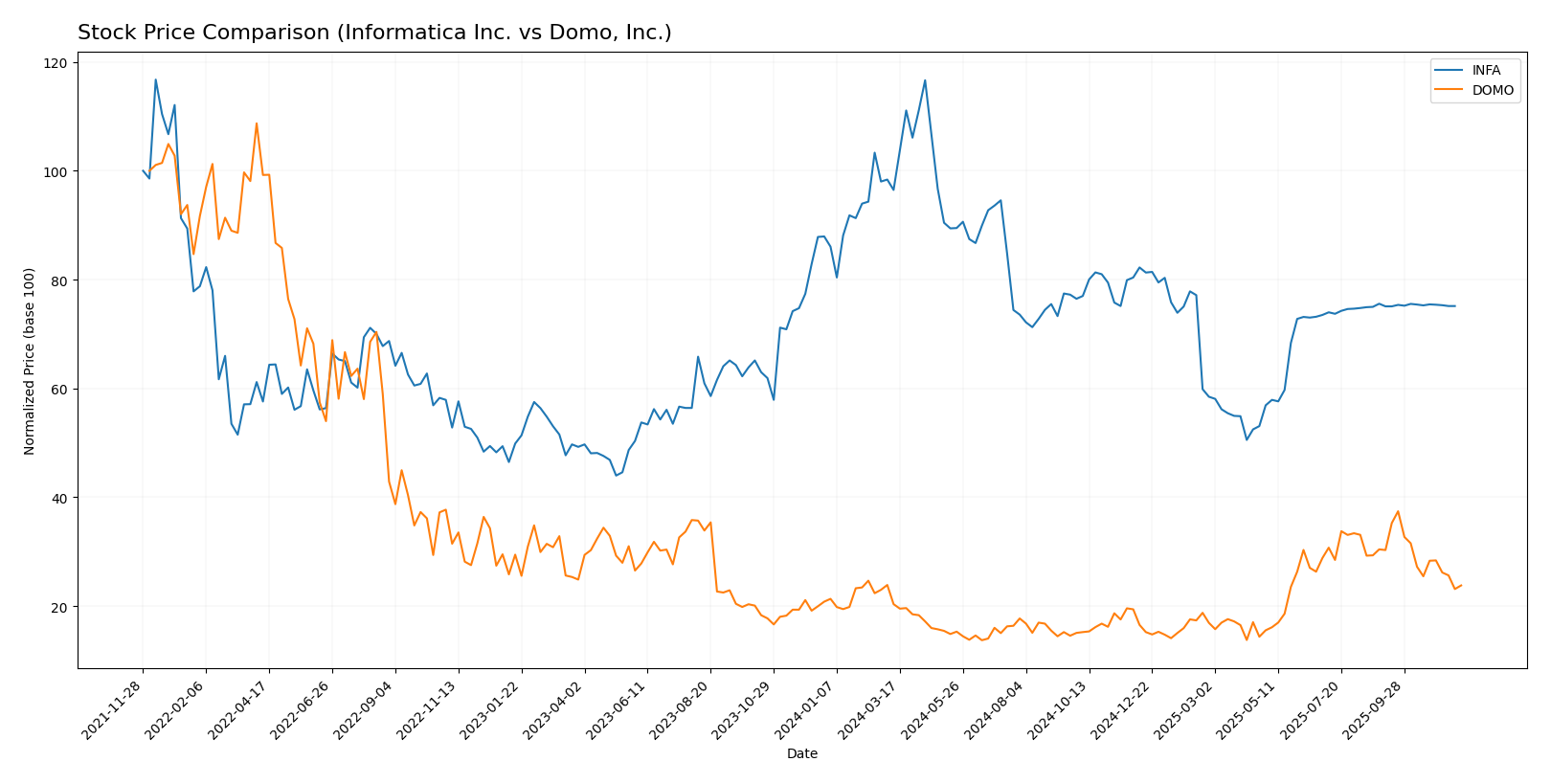

Stock Comparison

In this section, I will analyze the recent stock price movements and trading dynamics of Informatica Inc. (INFA) and Domo, Inc. (DOMO) over the past year, highlighting key price trends and metrics that may influence investor decisions.

Trend Analysis

Informatica Inc. (INFA)

Over the past year, INFA’s stock has experienced a price change of -12.68%, indicating a bearish trend. The highest price recorded was 38.48, while the lowest was 16.67. The trend shows signs of acceleration, with a standard deviation of 4.46 suggesting notable volatility in price movements. Recent data from September 7, 2025, to November 23, 2025, reflects a minimal price increase of 0.08%, further reinforcing the neutral sentiment in the short term.

Domo, Inc. (DOMO)

In contrast, DOMO has seen a significant price change of +20.08% over the past year, reflecting a bullish trend. The stock reached a high of 18.06 and a low of 6.62. However, the trend has been decelerating recently, with a standard deviation of 2.99. From September 14, 2025, to November 30, 2025, DOMO’s stock has dropped by -32.51%, indicating a shift in momentum that warrants careful observation.

In summary, while INFA struggles with a bearish trajectory, DOMO presents a more dynamic growth profile, albeit with recent volatility that investors should monitor closely.

Analyst Opinions

Recent analyst recommendations indicate a cautious outlook on Domo, Inc. (DOMO), with a rating of “C” reflecting concerns regarding its financial metrics. Analysts highlight weaknesses in discounted cash flow and asset returns, which contribute to a lower overall score of 2. As of now, there is no available rating for Informatica Inc. (INFA). The consensus for Domo is leaning towards a hold, given the mixed signals in its financial performance. It’s essential for investors to weigh these insights carefully when considering their positions.

Stock Grades

Recent stock ratings provide insights into how analysts view the potential of Informatica Inc. (INFA) and Domo, Inc. (DOMO). Here’s a breakdown of the current grades.

Informatica Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | downgrade | Neutral | 2025-08-07 |

| UBS | maintain | Neutral | 2025-08-07 |

| Baird | maintain | Neutral | 2025-05-28 |

| JP Morgan | downgrade | Neutral | 2025-05-28 |

| RBC Capital | maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | maintain | Equal Weight | 2025-05-28 |

| Truist Securities | downgrade | Hold | 2025-05-28 |

| RBC Capital | maintain | Sector Perform | 2025-05-27 |

| UBS | maintain | Neutral | 2025-05-16 |

Domo, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JMP Securities | maintain | Market Outperform | 2025-09-10 |

| Cantor Fitzgerald | maintain | Overweight | 2025-08-28 |

| DA Davidson | maintain | Neutral | 2025-08-28 |

| TD Cowen | upgrade | Buy | 2025-08-26 |

| Cantor Fitzgerald | maintain | Overweight | 2025-06-25 |

| JMP Securities | maintain | Market Outperform | 2025-06-25 |

| DA Davidson | maintain | Neutral | 2025-05-22 |

| Lake Street | maintain | Hold | 2025-05-22 |

| Cantor Fitzgerald | maintain | Overweight | 2025-05-22 |

| JMP Securities | maintain | Market Outperform | 2025-05-22 |

Overall, Informatica has seen several downgrades, particularly to a neutral stance, indicating a more cautious outlook among analysts. In contrast, Domo maintains a generally positive sentiment, with a recent upgrade to “Buy” and several consistent “Market Outperform” ratings, suggesting a strong position in the market.

Target Prices

A consensus of target prices from analysts is available for both Informatica Inc. and Domo, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Informatica Inc. | 27 | 25 | 26 |

| Domo, Inc. | 50 | 15 | 24.5 |

For Informatica Inc., the target consensus of $26 is slightly above the current stock price of $24.79, indicating a modest potential upside. Conversely, Domo, Inc.’s target consensus of $24.5 suggests a significant upside from its current price of $11.47, reflecting positive expectations from analysts.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Informatica Inc. (INFA) and Domo, Inc. (DOMO) based on the most recent data.

| Criterion | Informatica Inc. (INFA) | Domo, Inc. (DOMO) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Low | Negative |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Niche | Emerging |

| Debt level | Moderate | High |

Key takeaways indicate that Informatica demonstrates stronger profitability and global presence, while Domo struggles with high debt levels and profitability challenges. Investors should consider these factors carefully when evaluating their investment options.

Risk Analysis

In the following table, I present the key risks associated with Informatica Inc. (INFA) and Domo, Inc. (DOMO) for your analysis.

| Metric | Informatica Inc. | Domo, Inc. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Low | High |

Both companies face significant market risks, particularly Domo, which has a high exposure due to its volatility and operational challenges. Recent losses reported, such as a -0.258 net profit margin for Domo, indicate that operational risks may be the most impactful in the near term.

Which one to choose?

In comparing Informatica Inc. (INFA) and Domo, Inc. (DOMO), it’s clear that both companies exhibit significant challenges. INFA has a high market cap of 7.83B but struggles with profitability, posting a net profit margin of only 0.006, and its stock trend appears bearish with a price change of -12.68%. Conversely, DOMO, with a market cap of 0.33B, shows a bullish trend over the past year with a 20.08% price increase, yet it has not achieved profitability, as reflected by its negative net income margin of -0.258.

Investors focused on growth may prefer DOMO due to its recent upward price momentum, while those prioritizing stability might lean towards INFA, despite its current struggles. However, risks remain for both companies, particularly regarding competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Informatica Inc. and Domo, Inc. to enhance your investment decisions: