In the ever-evolving landscape of technology, two companies stand out for their innovative approaches in the software industry: Teradata Corporation (TDC) and Elastic N.V. (ESTC). Both firms operate within the realm of data solutions, but they cater to different niches—Teradata focuses on multi-cloud data platforms while Elastic specializes in search and analytics technologies. This comparison will illuminate which of these companies presents a more compelling investment opportunity for savvy investors like you.

Table of contents

Company Overview

Teradata Corporation Overview

Teradata Corporation (TDC), headquartered in San Diego, California, specializes in providing integrated data solutions through its multi-cloud data platform, Teradata Vantage. The company aims to empower organizations by simplifying their data ecosystems and facilitating cloud migration. Established in 1979, Teradata has solidified its position in sectors such as financial services, healthcare, and telecommunications. Its comprehensive offerings include consulting services that help clients operationalize analytics for enhanced decision-making. As of now, Teradata holds a market cap of approximately $2.69B, reflecting its significant role in the enterprise analytics landscape.

Elastic N.V. Overview

Elastic N.V. (ESTC), based in Mountain View, California, is a leading provider of search and analytics solutions designed for diverse cloud environments. Founded in 2012, the company offers the Elastic Stack, a suite of products that enables users to ingest, store, analyze, and visualize data. Elastic’s technology serves industries ranging from e-commerce to IT, helping clients optimize search functionalities and insights through real-time analytics. With a market cap of about $7.41B, Elastic continues to innovate, offering a range of solutions that cater to modern data needs.

Key Similarities and Differences

Both Teradata and Elastic operate within the technology sector, focusing on data solutions. However, Teradata’s strength lies in its enterprise analytics and multi-cloud architecture, while Elastic emphasizes real-time search and analytics through its Elastic Stack. Their business models diverge in target markets, with Teradata catering primarily to large enterprises and Elastic serving a more diverse clientele across various sectors.

Income Statement Comparison

The following table presents a comparison of key income statement metrics for Teradata Corporation (TDC) and Elastic N.V. (ESTC) for their most recent fiscal years.

| Metric | Teradata Corporation (TDC) | Elastic N.V. (ESTC) |

|---|---|---|

| Revenue | 1.75B | 1.48B |

| EBITDA | 293M | 6M |

| EBIT | 193M | -6M |

| Net Income | 114M | -108M |

| EPS | 1.18 | -1.04 |

Interpretation of Income Statement

In the most recent fiscal year, Teradata Corporation reported a revenue of 1.75B, reflecting a slight decline from the previous year, while its net income increased significantly to 114M. This indicates improved operational efficiency with stable or improved margins. In contrast, Elastic N.V. continues to struggle, recording a revenue of 1.48B but a substantial net loss of 108M, suggesting ongoing challenges in managing operational expenses and profitability. Overall, TDC’s performance shows resilience in a competitive environment, while ESTC’s results highlight the need for strategic adjustments to enhance financial stability.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial metrics for Teradata Corporation (TDC) and Elastic N.V. (ESTC). This will help us assess their financial health and performance.

| Metric | [Company A: TDC] | [Company B: ESTC] |

|---|---|---|

| ROE | 85.71% | -11.66% |

| ROIC | 16.89% | -11.80% |

| P/E | 26.34 | -82.65 |

| P/B | 22.58 | 9.64 |

| Current Ratio | 0.81 | 1.92 |

| Quick Ratio | 0.79 | 1.92 |

| D/E | 4.33 | 0.64 |

| Debt-to-Assets | 33.80% | 22.95% |

| Interest Coverage | 7.21 | -2.17 |

| Asset Turnover | 1.03 | 0.57 |

| Fixed Asset Turnover | 9.07 | 51.28 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

The analysis reveals that TDC exhibits strong profitability metrics with a high ROE and ROIC, indicative of effective management and utilization of equity. In contrast, ESTC shows negative returns, suggesting significant operational challenges. TDC’s P/E ratio indicates higher investor confidence, while ESTC’s negative P/E reflects poor growth expectations. Furthermore, TDC’s liquidity ratios are below 1, indicating potential short-term challenges, whereas ESTC demonstrates better liquidity, though it still faces substantial operational risks.

Dividend and Shareholder Returns

Both Teradata Corporation (TDC) and Elastic N.V. (ESTC) do not pay dividends, indicating a focus on growth and reinvestment strategies. TDC has a consistent history of investing in R&D and operational improvements, while ESTC prioritizes expansion despite recent operating losses. Both companies engage in share buybacks, which can enhance shareholder value but could carry risks if funded by debt. Overall, their approaches suggest a commitment to long-term growth, albeit with inherent risks.

Strategic Positioning

In the competitive landscape of software solutions, Teradata Corporation (TDC) holds a significant share in the enterprise analytics segment with its multi-cloud data platform, Teradata Vantage. However, it faces considerable competitive pressure from Elastic N.V. (ESTC), which excels in data ingestion and analytics through its Elastic Stack. Both companies are navigating technological disruptions, particularly in cloud computing, which is reshaping market dynamics and customer expectations. While TDC focuses on comprehensive enterprise solutions, ESTC emphasizes real-time search and analytics capabilities, making them formidable players in their respective niches.

Stock Comparison

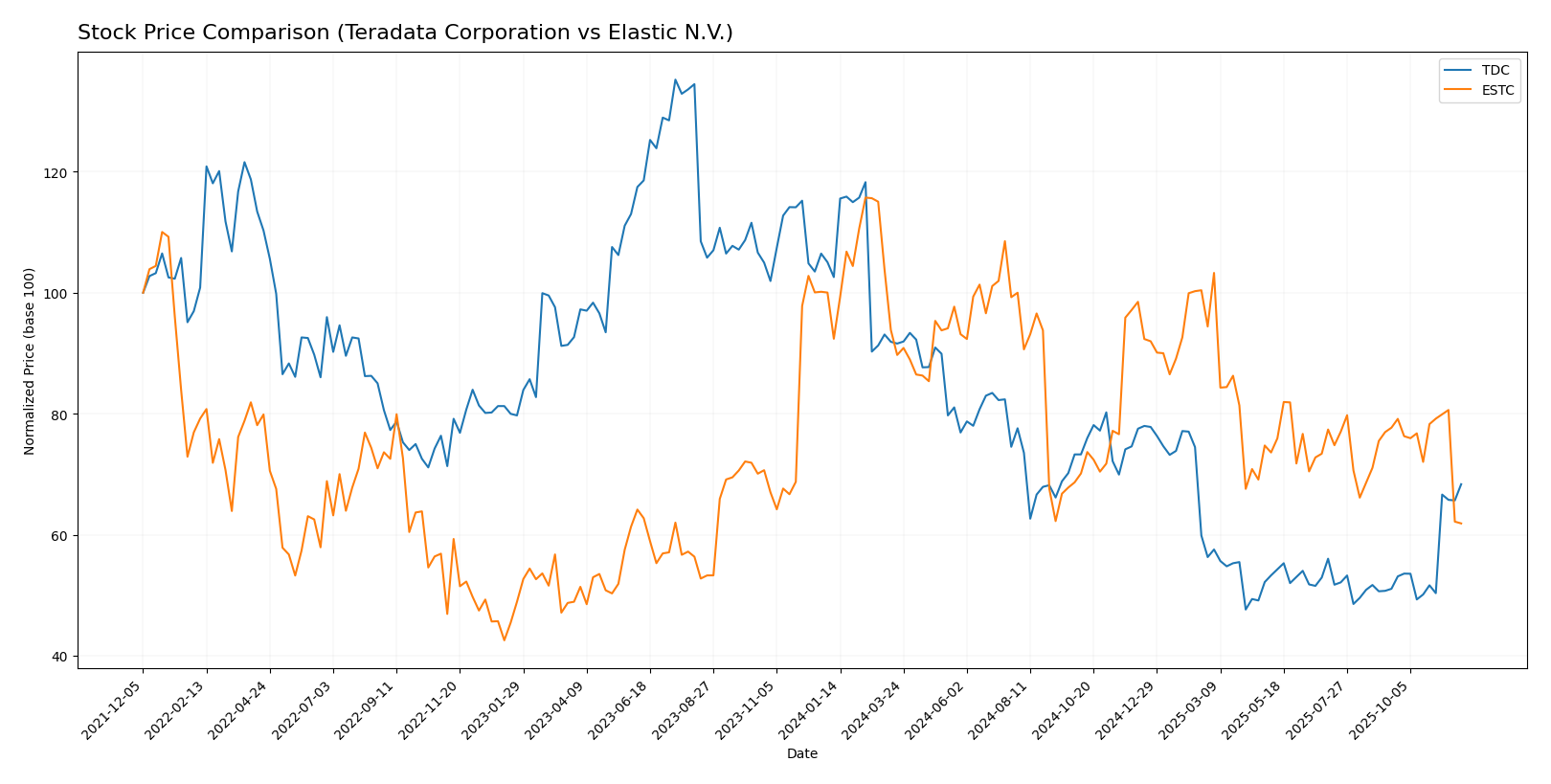

In the past year, both Teradata Corporation (TDC) and Elastic N.V. (ESTC) have experienced significant price movements, reflecting a range of trading dynamics and investor sentiment.

Trend Analysis

Analyzing Teradata Corporation (TDC), the stock has seen a percentage change of -33.37% over the past year, indicating a bearish trend. The stock reached a high of 48.99 and a low of 19.73, with an acceleration in the downward trend, as evidenced by a standard deviation of 7.27. Recently, however, the stock has shown a positive shift, with a price change of 33.85% from September 14, 2025, to November 30, 2025, with a lower standard deviation of 2.99, suggesting less volatility in the recent period.

For Elastic N.V. (ESTC), the overall percentage change stands at -33.04%, also reflecting a bearish trend. The stock peaked at 130.39 and dipped to a low of 69.71. The acceleration status indicates a deceleration in the downward movement, supported by a higher standard deviation of 14.92. In the recent analysis period, from September 14, 2025, to November 30, 2025, the stock has decreased by 20.37%, with a trend slope of -1.04, further indicating challenges ahead.

In summary, both companies are currently navigating bearish trends, with TDC showing signs of a possible rebound in the most recent weeks, while ESTC continues to exhibit a downward trajectory with deceleration.

Analyst Opinions

Recent recommendations for Teradata Corporation (TDC) indicate a consensus rating of “Buy” with a B+ rating. Analysts highlight strong return on equity and a solid discounted cash flow score as key strengths. In contrast, Elastic N.V. (ESTC) has received a “Sell” rating of C-, with concerns over low scores in return on equity and assets, suggesting significant weaknesses. Overall, while TDC is viewed positively, ESTC faces skepticism from analysts, reflecting varied investment potential in the current market.

Stock Grades

In the current market, reliable stock grades can provide valuable insights for investors. Here are the most recent grades for Teradata Corporation (TDC) and Elastic N.V. (ESTC).

Teradata Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citizens | upgrade | Market Outperform | 2025-11-10 |

| Evercore ISI Group | maintain | Outperform | 2025-11-05 |

| Barclays | maintain | Underweight | 2025-11-05 |

| TD Cowen | maintain | Hold | 2025-11-05 |

| UBS | maintain | Neutral | 2025-08-06 |

| Guggenheim | maintain | Buy | 2025-05-07 |

| Barclays | maintain | Underweight | 2025-04-21 |

| Citizens Capital Markets | maintain | Market Perform | 2025-03-18 |

| JMP Securities | maintain | Market Perform | 2025-02-13 |

| RBC Capital | maintain | Sector Perform | 2025-02-12 |

Elastic N.V. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-24 |

| JP Morgan | maintain | Overweight | 2025-11-21 |

| Piper Sandler | maintain | Overweight | 2025-11-21 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-21 |

| Wells Fargo | maintain | Equal Weight | 2025-11-21 |

| DA Davidson | maintain | Neutral | 2025-11-21 |

| Stifel | maintain | Buy | 2025-11-21 |

| Morgan Stanley | maintain | Overweight | 2025-11-21 |

| Truist Securities | maintain | Buy | 2025-11-21 |

| Guggenheim | maintain | Buy | 2025-11-21 |

Overall, Teradata shows a shift towards a more positive outlook with an upgrade to “Market Outperform,” while Elastic continues to receive consistent “Buy” and “Overweight” recommendations, indicating a strong investor sentiment for both stocks.

Target Prices

The target consensus for Teradata Corporation (TDC) and Elastic N.V. (ESTC) shows varied expectations among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Teradata Corporation (TDC) | 24 | 24 | 24 |

| Elastic N.V. (ESTC) | 134 | 76 | 108 |

For TDC, the consensus target price aligns with its current price of 28.33, indicating a slight downside potential. Conversely, ESTC’s consensus target of 108 suggests a significant upside from its current price of 69.74, reflecting positive analyst sentiment.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Teradata Corporation (TDC) and Elastic N.V. (ESTC) based on the latest financial data.

| Criterion | Teradata Corporation (TDC) | Elastic N.V. (ESTC) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Low (Net margin: 6.5%) | Negative (Net margin: -7.3%) |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Moderate | Growing |

| Debt level | High (Debt/Equity: 4.33) | Moderate (Debt/Equity: 0.64) |

Key takeaways from this analysis indicate that while Teradata demonstrates strong global presence and innovation, it struggles with profitability and has a high debt level. Conversely, Elastic N.V. shows growth potential but faces challenges with profitability and lower diversification.

Risk Analysis

The table below outlines the key risks associated with Teradata Corporation (TDC) and Elastic N.V. (ESTC) based on the latest available data.

| Metric | Teradata Corporation (TDC) | Elastic N.V. (ESTC) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Low | Moderate |

In summary, TDC faces moderate market and operational risks, with solid management practices in place. In contrast, ESTC is exposed to higher market and operational risks, with recent financial struggles leading to a negative net profit margin of -7.29% in FY 2025.

Which one to choose?

In analyzing Teradata Corporation (TDC) and Elastic N.V. (ESTC), TDC presents a stronger investment profile. TDC boasts a gross profit margin of 60.5% and a net profit margin of 6.5%, indicating sound profitability. Its current ratio stands at 0.81, suggesting liquidity challenges, yet it maintains a commendable debt-to-equity ratio of 4.33. In contrast, ESTC shows a gross margin of 74.4% but struggles with negative earnings, leading to a C- rating from analysts. TDC’s stock has recently exhibited a bullish trend, while ESTC’s remains bearish with significant price declines.

For investors seeking growth potential, TDC appears favorable, while those prioritizing high margins with higher risk might consider ESTC, despite its financial instability. The key risks include TDC’s liquidity concerns and ESTC’s ongoing operational losses.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Teradata Corporation and Elastic N.V. to enhance your investment decisions: