In today’s rapidly evolving tech landscape, Snowflake Inc. (SNOW) and Elastic N.V. (ESTC) stand out as two prominent players in the software application industry. Both companies offer innovative data solutions, yet they cater to different market needs and strategies. While Snowflake excels in providing a cloud-based data platform for comprehensive data management, Elastic focuses on search and analytics capabilities across diverse data types. Join me as we explore which of these companies presents the more compelling investment opportunity.

Table of contents

Company Overview

Snowflake Inc. Overview

Snowflake Inc. is a leading player in the cloud-based data platform sector. Founded in 2012 and based in Bozeman, Montana, the company specializes in providing a unified Data Cloud that allows businesses to consolidate their data into a single source of truth. This capability enables organizations to derive actionable insights, build data-driven applications, and facilitate data sharing across various industries. Snowflake’s innovative approach has positioned it as a vital tool for enterprises aiming to harness the power of data, making it particularly attractive for companies looking to enhance their operational efficiency and decision-making processes.

Elastic N.V. Overview

Elastic N.V., established in 2012 and headquartered in Mountain View, California, is recognized for its robust search technology solutions tailored for both public and private cloud environments. The company’s flagship product, the Elastic Stack, provides a suite of tools that facilitate data ingestion, storage, search, and visualization across diverse data formats. With offerings like Elasticsearch, Kibana, and Logstash, Elastic enables businesses to analyze and derive insights from their data effectively. As a result, Elastic has carved out a significant niche, particularly among organizations seeking to improve their data handling and analysis capabilities.

Key Similarities and Differences

Both Snowflake and Elastic operate within the software application industry, focusing on data management and analysis solutions. However, while Snowflake emphasizes a unified cloud data platform for consolidated data insights, Elastic concentrates on providing search and analytics capabilities through its Elastic Stack. This distinction highlights their unique approaches to data utilization and the specific needs they address in the marketplace.

Income Statement Comparison

In this section, I present a comparative analysis of the most recent income statements for Snowflake Inc. (SNOW) and Elastic N.V. (ESTC), highlighting their respective financial performances.

| Metric | Snowflake Inc. | Elastic N.V. |

|---|---|---|

| Revenue | 3.63B | 1.48B |

| EBITDA | -1.10B | 6M |

| EBIT | -1.28B | -6M |

| Net Income | -1.29B | -108M |

| EPS | -3.86 | -1.04 |

Interpretation of Income Statement

In the latest fiscal year, Snowflake’s revenue surged to 3.63B, a significant increase from 2.81B in the previous year, showcasing robust growth despite a net loss of 1.29B. Conversely, Elastic N.V. reported a revenue of 1.48B, reflecting an upward trend from 1.27B. However, it continues to face challenges with a net loss of 108M. Snowflake’s widening losses indicate ongoing investments impacting margins, while Elastic’s stable revenue growth and reduced net loss suggest improving operational efficiency. Overall, both companies exhibit potential but require careful risk assessment due to their current financial positions.

Financial Ratios Comparison

In the following table, I present a comparative analysis of key financial ratios for Snowflake Inc. (SNOW) and Elastic N.V. (ESTC) based on the most recent fiscal year data.

| Metric | [Company A: SNOW] | [Company B: ESTC] |

|---|---|---|

| ROE | -42.86% | -11.66% |

| ROIC | -25.32% | -11.80% |

| P/E | -46.97 | -82.65 |

| P/B | 20.13 | 9.64 |

| Current Ratio | 1.75 | 1.92 |

| Quick Ratio | 1.75 | 1.92 |

| D/E | 0.90 | 0.64 |

| Debt-to-Assets | 29.72% | 22.95% |

| Interest Coverage | -527.73 | -2.17 |

| Asset Turnover | 0.40 | 0.57 |

| Fixed Asset Turnover | 5.53 | 51.28 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Both companies currently demonstrate negative returns on equity (ROE) and invested capital (ROIC), indicating challenges in generating profits. Snowflake’s significantly higher P/B ratio suggests a market premium, but also potential overvaluation risks. Elastic shows a better current ratio, indicating stronger liquidity. However, interest coverage ratios are concerning for both, suggesting difficulties in meeting interest obligations. Caution is advised when considering investments in these companies, given their financial instability.

Dividend and Shareholder Returns

Both Snowflake Inc. (SNOW) and Elastic N.V. (ESTC) do not pay dividends, which is indicative of their ongoing reinvestment strategies aimed at fostering growth and innovation. They prioritize R&D and expanding market share rather than returning cash to shareholders. Additionally, both companies engage in share buybacks, reflecting a commitment to returning value. This approach, while potentially riskier, aligns with long-term value creation as it positions them for future profitability.

Strategic Positioning

Snowflake Inc. (SNOW) commands a significant market share in the cloud data platform sector, leveraging its innovative Data Cloud technology to provide comprehensive data solutions. In contrast, Elastic N.V. (ESTC), while also positioned in the software application industry, faces competitive pressure from established players in search and data analytics. Both companies are navigating technological disruptions, but Snowflake’s robust growth trajectory and market cap of $83B suggest a stronger foothold compared to Elastic’s $7.4B.

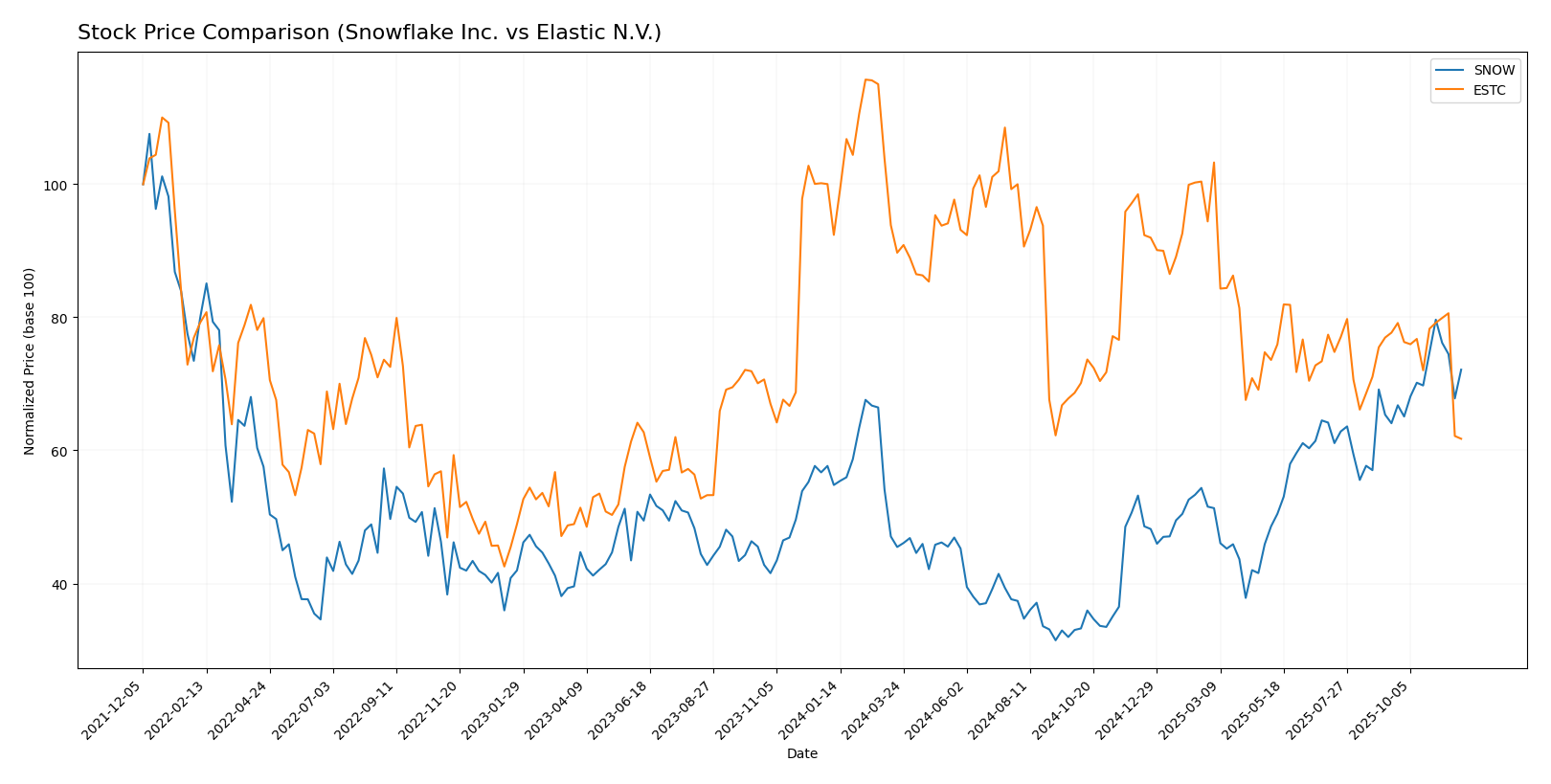

Stock Comparison

In the past year, Snowflake Inc. (SNOW) has demonstrated significant price movements, with a notable bullish trend, while Elastic N.V. (ESTC) has faced substantial declines, indicating a bearish sentiment in the market.

Trend Analysis

Snowflake Inc. (SNOW) has experienced a price change of +31.63% over the past year, confirming a bullish trend. The stock has shown acceleration, with notable highs at 274.88 and lows at 108.56. The standard deviation of 42.05 indicates a higher level of volatility, which could be a factor for investors to consider.

In the recent analysis period from September 14, 2025, to November 30, 2025, SNOW has recorded a change of +12.57%. The trend slope of 2.86 further supports the bullish outlook, although the decreasing volume trend may warrant caution.

Elastic N.V. (ESTC), on the other hand, has experienced a price decline of -33.17% over the past year, indicating a bearish trend. The stock is facing deceleration, with highs of 130.39 and lows of 69.57. The standard deviation of 14.92 suggests moderate volatility, which can add to the risk profile for potential investors.

In its recent analysis from September 14, 2025, to November 30, 2025, ESTC has seen a decline of -20.53%. The trend slope of -1.04 implies continued bearish momentum, though the increasing volume trend with a buyer percentage of 56.93% could indicate some interest among investors.

Analyst Opinions

Recent analyst recommendations for both Snowflake Inc. (SNOW) and Elastic N.V. (ESTC) have garnered a “C-” rating, indicating a cautious stance. Analysts suggest holding these stocks, citing concerns over their overall financial health and low scores in key areas such as return on equity and price-to-earnings ratios. Both companies face challenges that could hinder substantial growth. Therefore, the consensus for the current year leans towards a hold recommendation rather than a buy, reflecting a need for caution in these investments.

Stock Grades

I have gathered the latest stock ratings from reputable grading companies for two companies: Snowflake Inc. (SNOW) and Elastic N.V. (ESTC). Here’s a detailed look at their grades.

Snowflake Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-11-17 |

| B of A Securities | maintain | Buy | 2025-11-17 |

| BTIG | maintain | Buy | 2025-11-12 |

| JMP Securities | maintain | Market Outperform | 2025-10-28 |

| Wedbush | maintain | Outperform | 2025-10-20 |

| Rosenblatt | maintain | Buy | 2025-10-17 |

| UBS | maintain | Buy | 2025-10-08 |

| Macquarie | maintain | Neutral | 2025-08-28 |

| Scotiabank | maintain | Sector Outperform | 2025-08-28 |

| Mizuho | maintain | Outperform | 2025-08-28 |

Elastic N.V. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-24 |

| JP Morgan | maintain | Overweight | 2025-11-21 |

| Piper Sandler | maintain | Overweight | 2025-11-21 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-21 |

| Wells Fargo | maintain | Equal Weight | 2025-11-21 |

| DA Davidson | maintain | Neutral | 2025-11-21 |

| Stifel | maintain | Buy | 2025-11-21 |

| Morgan Stanley | maintain | Overweight | 2025-11-21 |

| Truist Securities | maintain | Buy | 2025-11-21 |

| Guggenheim | maintain | Buy | 2025-11-21 |

In summary, both Snowflake Inc. and Elastic N.V. have maintained strong ratings across multiple reputable grading companies, indicating positive investor sentiment. Snowflake shows a trend of “Outperform” and “Buy” grades, while Elastic carries a mix of “Buy” and “Overweight,” suggesting a favorable outlook for both stocks.

Target Prices

The consensus target prices from reliable analysts for Snowflake Inc. and Elastic N.V. indicate a favorable outlook for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Snowflake Inc. | 325 | 221 | 276.46 |

| Elastic N.V. | 134 | 76 | 108 |

For Snowflake Inc., the current stock price of 249.07 is below the consensus target, suggesting potential upside. Similarly, Elastic N.V.’s stock price at 69.58 is significantly lower than its target consensus, indicating a positive analyst sentiment for future growth.

Strengths and Weaknesses

The following table outlines the key strengths and weaknesses of Snowflake Inc. (SNOW) and Elastic N.V. (ESTC) based on the most recent data.

| Criterion | Snowflake Inc. (SNOW) | Elastic N.V. (ESTC) |

|---|---|---|

| Diversification | Moderate | Moderate |

| Profitability | Negative margins | Negative margins |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Growing | Stable |

| Debt level | Low | Moderate |

In summary, while both companies face profitability challenges, Snowflake stands out with its innovative edge and strong global presence. Elastic has a stable market position but shows moderate innovation and higher debt levels.

Risk Analysis

Below is a summary of the key risks associated with two companies I am analyzing: Snowflake Inc. and Elastic N.V.

| Metric | Snowflake Inc. | Elastic N.V. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Low | High |

Both companies face considerable market and operational risks, particularly in the current volatile tech landscape. Snowflake’s reliance on regulatory compliance increases its exposure, while Elastic’s operational challenges could hinder growth.

Which one to choose?

When comparing Snowflake Inc. (SNOW) and Elastic N.V. (ESTC), both companies exhibit signs of struggle despite their potential. Snowflake reported a gross profit margin of 66.5% and a current ratio of 1.75, indicating solid financial health but negative earnings with a price-to-earnings ratio of -47. Elastic, on the other hand, showcases a stronger gross profit margin of 74.4% but has recently experienced a bearish trend with a price change of -33.2%. Analyst ratings for both companies sit at C-, reflecting similar caution.

For growth-oriented investors, SNOW may offer more upside potential given its bullish stock trend, while those seeking value stability might lean towards ESTC due to its higher gross margins despite recent stock declines.

Be mindful of industry risks such as competition and market dependence that could impact both companies’ performances.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Snowflake Inc. and Elastic N.V. to enhance your investment decisions: