In the rapidly evolving world of technology, Asana, Inc. (ASAN) and PagerDuty, Inc. (PD) stand out as key players in the software application sector. Both companies provide innovative platforms designed to enhance workplace efficiency and operational management. Asana focuses on work management, while PagerDuty specializes in digital operations management, creating a compelling overlap in their target markets. In this article, I will analyze these companies to help you determine which may be the more interesting investment opportunity.

Table of contents

Company Overview

Asana, Inc. Overview

Asana, Inc. is a leading work management platform that enables teams to coordinate tasks and projects effectively. Founded in 2008 and headquartered in San Francisco, California, Asana focuses on streamlining workflows for businesses across diverse sectors, including technology, retail, and healthcare. With a market capitalization of approximately 2.91B and a commitment to enhancing productivity, Asana’s platform is designed for users at all levels, from individual contributors to executives. The company empowers organizations to manage everything from daily tasks to large-scale strategic initiatives, reflecting its mission to help teams achieve their goals.

PagerDuty, Inc. Overview

PagerDuty, Inc., established in 2009 and also based in San Francisco, operates a digital operations management platform that collects and analyzes data from various software systems. With a market cap of around 1.08B, PagerDuty leverages machine learning to predict and resolve operational issues, catering to industries such as telecommunications, retail, and financial services. The company’s goal is to enhance operational efficiency and reliability, making it an essential tool for organizations aiming to optimize their digital infrastructure.

Key Similarities and Differences

Both Asana and PagerDuty operate within the software application industry, focusing on enhancing organizational productivity. However, their business models diverge: Asana centers on task and project management, while PagerDuty specializes in digital operations management. This distinction highlights Asana’s focus on team collaboration and project workflows compared to PagerDuty’s emphasis on operational incident response and system monitoring.

Income Statement Comparison

The following table presents a comparison of key income statement metrics for Asana, Inc. (ASAN) and PagerDuty, Inc. (PD) for the fiscal year 2025.

| Metric | Asana, Inc. (ASAN) | PagerDuty, Inc. (PD) |

|---|---|---|

| Revenue | 724M | 467M |

| EBITDA | -230M | -12M |

| EBIT | -247M | -32M |

| Net Income | -256M | -43M |

| EPS | -1.11 | -0.59 |

Interpretation of Income Statement

In 2025, Asana’s revenue increased to 724M, up from 652M in 2024, indicating a positive trend in sales growth. However, their net income remains negative at -256M, suggesting ongoing operational challenges. PagerDuty also showed revenue growth from 431M to 467M, but similarly struggled with a net loss of -43M. Both companies need to focus on improving their margins, as both EBITDA and EBIT remain deeply negative. Asana’s larger losses compared to PagerDuty highlight the need for more effective cost management strategies.

Financial Ratios Comparison

Below is a comparative table showing the most recent revenue and financial ratios for Asana, Inc. (ASAN) and PagerDuty, Inc. (PD).

| Metric | ASAN | PD |

|---|---|---|

| ROE | -1.12 | -0.33 |

| ROIC | -0.54 | -0.10 |

| P/E | -19.16 | -39.87 |

| P/B | 21.52 | 13.12 |

| Current Ratio | 1.44 | 1.87 |

| Quick Ratio | 1.44 | 1.87 |

| D/E | 1.18 | 3.57 |

| Debt-to-Assets | 0.30 | 0.50 |

| Interest Coverage | -72.42 | -6.46 |

| Asset Turnover | 0.81 | 0.50 |

| Fixed Asset Turnover | 2.76 | 16.61 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of Financial Ratios

Asana shows significant challenges with negative ROE and ROIC, indicating inefficiency in generating returns on equity and invested capital. Its high P/E and P/B ratios suggest overvaluation relative to its earnings and assets. Conversely, PagerDuty’s ratios also reflect struggles, particularly with a high debt-to-equity ratio and substantial negative interest coverage. The current and quick ratios are healthy for both companies, suggesting liquidity is not an immediate concern. However, both firms exhibit weaknesses that warrant caution for potential investors, particularly regarding profitability and leverage.

Dividend and Shareholder Returns

Neither Asana, Inc. (ASAN) nor PagerDuty, Inc. (PD) pays dividends, reflecting a focus on reinvestment strategies to fuel growth. Asana’s financials indicate a negative net income, prioritizing R&D and market expansion over immediate shareholder returns. PagerDuty similarly channels resources into growth initiatives. Both companies are actively engaged in share buyback programs, which can support share prices. This approach aligns with long-term value creation, though it carries risks associated with sustainability and financial stability.

Strategic Positioning

Asana, Inc. (ASAN) holds a market cap of approximately 2.91B, while PagerDuty, Inc. (PD) has a smaller market cap of around 1.08B. Both companies operate within the software application industry, facing stiff competition and technological disruption. Asana emphasizes work management, while PagerDuty focuses on digital operations management. Given their respective market positions, both face competitive pressure to innovate and adapt to shifting market demands, making strategic positioning critical for future growth.

Stock Comparison

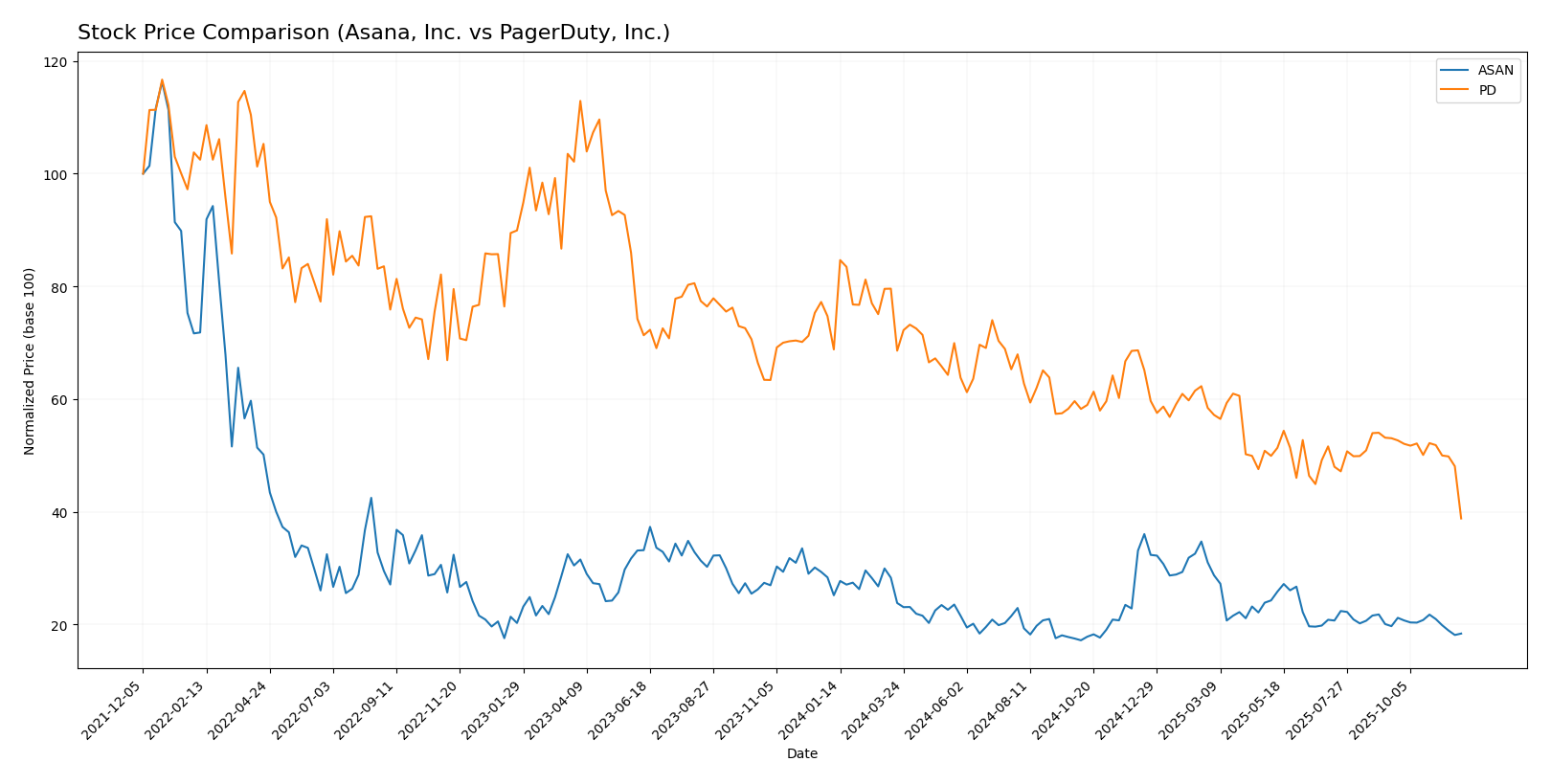

Over the past year, both Asana, Inc. (ASAN) and PagerDuty, Inc. (PD) have experienced significant fluctuations in their stock prices, reflecting the broader market dynamics and company-specific developments.

Trend Analysis

Asana, Inc. (ASAN)

- Percentage Change: The stock has decreased by -26.96% over the past year, indicating a bearish trend.

- Volatility: The standard deviation is 2.93, suggesting a moderate level of volatility.

- Notable Highs/Lows: The stock reached a high of 24.15 and a low of 11.53 during this period.

- Acceleration Status: The trend is showing deceleration, which may suggest a weakening bearish momentum.

PagerDuty, Inc. (PD)

- Percentage Change: The stock has declined by -43.57% over the past year, also reflecting a bearish trend.

- Volatility: The standard deviation stands at 2.97, indicating a similar level of volatility as ASAN.

- Notable Highs/Lows: The highest price recorded was 26.23, while the lowest was 12.03.

- Acceleration Status: This trend is also in deceleration, which further indicates a diminishing rate of decline.

Both stocks exhibit bearish trends with notable declines, and the deceleration in their respective price movements suggests that while the downward pressure persists, it may be weakening. Investors should exercise caution and consider these factors when evaluating their positions in these companies.

Analyst Opinions

Recent analyst recommendations indicate a clear divide between Asana, Inc. (ASAN) and PagerDuty, Inc. (PD). Asana has been rated a D+ by analysts, signaling a cautious stance with strong concerns about its financial metrics. Conversely, PagerDuty holds an A- rating, reflecting robust performance across key indicators like return on equity and assets. Analysts recommend a hold for ASAN, while PD garners a consensus buy. Overall, the current sentiment favors PagerDuty as a more favorable investment in 2025.

Stock Grades

In this section, I present the latest stock ratings for two companies: Asana, Inc. and PagerDuty, Inc. The following grades come from reputable grading companies and reflect recent evaluations.

Asana, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | maintain | Neutral | 2025-09-04 |

| Morgan Stanley | maintain | Underweight | 2025-09-04 |

| Piper Sandler | maintain | Overweight | 2025-09-04 |

| Baird | maintain | Neutral | 2025-06-04 |

| UBS | maintain | Neutral | 2025-06-04 |

| Jefferies | maintain | Hold | 2025-06-04 |

| RBC Capital | maintain | Underperform | 2025-06-04 |

| Morgan Stanley | maintain | Underweight | 2025-06-04 |

| JMP Securities | maintain | Market Outperform | 2025-06-04 |

| B of A Securities | maintain | Buy | 2025-06-04 |

PagerDuty, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | maintain | Outperform | 2025-11-26 |

| Truist Securities | maintain | Buy | 2025-11-19 |

| Canaccord Genuity | maintain | Buy | 2025-09-04 |

| Baird | maintain | Neutral | 2025-09-04 |

| RBC Capital | maintain | Outperform | 2025-09-04 |

| Canaccord Genuity | maintain | Buy | 2025-06-02 |

| JP Morgan | maintain | Underweight | 2025-05-30 |

| Truist Securities | maintain | Buy | 2025-05-30 |

| RBC Capital | maintain | Outperform | 2025-05-30 |

| TD Securities | maintain | Hold | 2025-05-21 |

Overall, both companies show a trend of maintenance in their grades, with Asana generally leaning towards neutral evaluations, while PagerDuty maintains a more favorable outlook with several “Buy” and “Outperform” ratings.

Target Prices

The consensus target prices for the following companies reflect analysts’ expectations based on recent evaluations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Asana, Inc. | 88 | 10 | 23.41 |

| PagerDuty, Inc. | 16 | 15 | 15.5 |

For Asana, the target consensus of 23.41 is significantly higher than its current price of 12.34, indicating positive analyst sentiment. Similarly, PagerDuty’s consensus of 15.5 suggests potential upside compared to its current price of 11.79.

Strengths and Weaknesses

Here’s a comparative overview of the strengths and weaknesses of Asana, Inc. and PagerDuty, Inc.

| Criterion | Asana, Inc. (ASAN) | PagerDuty, Inc. (PD) |

|---|---|---|

| Diversification | Moderate | Moderate |

| Profitability | Negative margins | Negative margins |

| Innovation | Strong | Strong |

| Global presence | Limited | Medium |

| Market Share | Niche | Growing |

| Debt level | Moderate (30%) | High (50%) |

Key takeaways highlight that both companies exhibit strong innovation potentials, but face significant profitability challenges. Asana has a lower debt level compared to PagerDuty, which may impact their financial resilience.

Risk Analysis

Below is a comprehensive overview of the risks associated with Asana, Inc. and PagerDuty, Inc.:

| Metric | Asana, Inc. | PagerDuty, Inc. |

|---|---|---|

| Market Risk | High | Medium |

| Regulatory Risk | Medium | Medium |

| Operational Risk | High | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Medium | Medium |

In summary, Asana faces significant market and operational risks, primarily due to its volatile performance and a low profitability margin (net profit margin of -35.3%). Conversely, PagerDuty has better ratings (A-) and more stable operations, yet still contends with market and operational challenges.

Which one to choose?

When comparing Asana, Inc. (ASAN) and PagerDuty, Inc. (PD), the fundamentals suggest a contrasting outlook. ASAN has a market cap of approximately 4.9B, yet it struggles with negative profit margins and a D+ rating, indicating substantial operational challenges. Its stock trend remains bearish, with a significant price decline of 26.96% recently. Conversely, PD, valued at about 1.7B, boasts an A- rating, demonstrating stronger financial health and better management of resources despite its own bearish trend with a 43.57% price drop.

For growth-focused investors, PD may be more appealing due to its solid rating and operational efficiency. Conversely, ASAN may attract those willing to take risks for potential recovery. However, both companies face industry challenges, including competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Asana, Inc. and PagerDuty, Inc. to enhance your investment decisions: