In the rapidly evolving tech landscape, two companies stand out: EPAM Systems, Inc. and monday.com Ltd. Both operate within the technology sector but cater to distinct niches—EPAM focuses on information technology services while monday.com specializes in application software. Their innovative strategies and market overlaps make them intriguing subjects for comparison. As we delve deeper into their business models, growth potential, and risk factors, I invite you to consider which of these companies might be the most compelling addition to your investment portfolio.

Table of contents

Company Overview

EPAM Overview

EPAM Systems, Inc. is a leading global provider of digital platform engineering and software development services, founded in 1993 and headquartered in Newtown, Pennsylvania. With a market capitalization of approximately $10.24B, EPAM operates primarily in the Information Technology Services sector. The company specializes in a wide range of services, including software development, infrastructure management, and business consulting, serving diverse industries such as financial services, healthcare, and media. EPAM’s mission revolves around delivering high-quality, tailored technology solutions to help clients optimize their operations and drive innovation.

monday.com Overview

monday.com Ltd. is a cloud-based software company that offers a visual work operating system designed to facilitate project management and collaboration. Established in 2012 and headquartered in Tel Aviv, Israel, monday.com has a market cap of around $7.59B. The platform is built on modular building blocks, allowing users to create customized workflows across various functions, including marketing, CRM, and software development. The company’s mission is to empower teams by simplifying work management and enhancing productivity.

Key similarities and differences in their business models include a focus on technology and innovation; however, EPAM emphasizes custom software solutions and engineering services, while monday.com centers on providing a user-friendly platform for work management and collaboration. Both companies aim to enhance operational efficiency but cater to different aspects of the technology landscape.

Income Statement Comparison

The following table presents a comparison of the income statements for EPAM Systems, Inc. and monday.com Ltd. for the fiscal year 2024, highlighting key financial metrics.

| Metric | EPAM Systems, Inc. | monday.com Ltd. |

|---|---|---|

| Revenue | 4.73B | 972M |

| EBITDA | 671.69M | 57.99M |

| EBIT | 544.58M | 39.76M |

| Net Income | 454.53M | 32.37M |

| EPS | 7.93 | 0.65 |

Interpretation of Income Statement

In 2024, EPAM reported a revenue of 4.73B, showing a slight increase from 4.69B in 2023, while net income rose to 454.53M from 417.08M, indicating stable growth. The EBITDA margin improved, reflecting efficient cost management. In contrast, monday.com achieved a revenue of 972M, significantly up from 729M in the previous year, yet it still operates at a loss with a net income of 32.37M, a modest recovery from a net loss of 1.88M in 2023. Both companies show resilience, but EPAM’s stronger profitability and growth trajectory present a more stable investment opportunity.

Financial Ratios Comparison

The table below presents a comparative analysis of the most recent revenue and key financial ratios for EPAM Systems, Inc. and monday.com Ltd. This comparison will help us assess the financial health and performance of both companies.

| Metric | EPAM | monday.com |

|---|---|---|

| ROE | 12.52% | 3.14% |

| ROIC | 10.67% | -1.73% |

| P/E | 29.47 | -4839.47 |

| P/B | 3.69 | 11.41 |

| Current Ratio | 2.96 | 2.66 |

| Quick Ratio | 2.96 | 2.66 |

| D/E | 0.045 | 0.075 |

| Debt-to-Assets | 3.44% | 4.79% |

| Interest Coverage | N/A | N/A |

| Asset Turnover | 0.99 | 0.58 |

| Fixed Asset Turnover | 14.07 | 7.13 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of Financial Ratios

EPAM demonstrates stronger financial performance with a higher ROE and ROIC compared to monday.com, indicating better returns on equity and invested capital. The P/E ratio for monday.com is alarming, suggesting significant losses, while EPAM’s manageable P/E reflects stable earnings. Both companies maintain solid current and quick ratios, indicating sufficient liquidity. However, the elevated P/B ratio for monday.com raises concerns about overvaluation relative to its book value. Overall, EPAM appears to be a more favorable investment choice based on these ratios.

Dividend and Shareholder Returns

Neither EPAM Systems (EPAM) nor monday.com (MNDY) pays dividends, reflecting a reinvestment strategy to fuel growth and innovation. EPAM has maintained a strong free cash flow, which supports its operational needs, while MNDY focuses on growth during its early stages. Both companies engage in share buybacks to enhance shareholder value. Ultimately, this approach aligns with long-term value creation, provided they manage growth effectively without compromising financial stability.

Strategic Positioning

In the competitive landscape of technology services, EPAM Systems, Inc. holds a robust market share due to its diverse offerings in digital platform engineering and software development. With a market cap of $10.2B, EPAM faces significant competitive pressure from monday.com Ltd., valued at $7.6B, which specializes in cloud-based work management solutions. Both companies must navigate technological disruptions, such as advances in automation and AI, to maintain their market positions and capitalize on emerging opportunities.

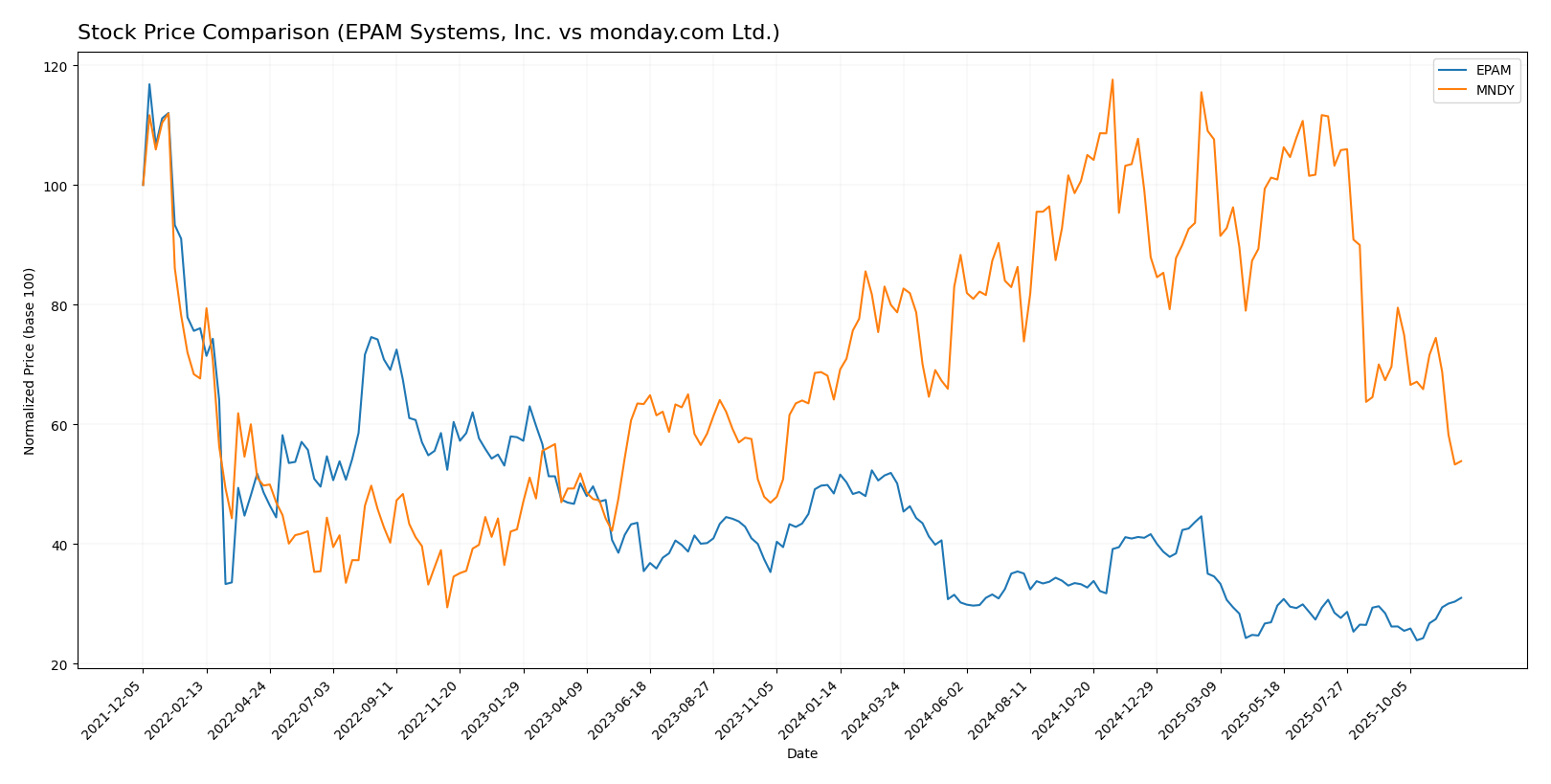

Stock Comparison

In this section, I will analyze the weekly stock price movements of EPAM Systems, Inc. (EPAM) and monday.com Ltd. (MNDY) over the past year, focusing on significant price changes and trading dynamics.

Trend Analysis

EPAM Systems, Inc. (EPAM) Over the past year, EPAM’s stock has experienced a price change of -36.05%, indicating a bearish trend. The stock has shown notable volatility with a standard deviation of 46.0. During this period, the highest price reached was 311.98, while the lowest was 142.38. Recently, from September 14, 2025, to November 30, 2025, EPAM’s stock saw a price increase of 18.34%. This recent uptick suggests a potential for recovery despite the overall bearish trend, although the acceleration status indicates that the stock is still in a phase of acceleration.

monday.com Ltd. (MNDY) MNDY’s stock has also displayed a decline of -16.05% over the past year, marking a bearish trend. The volatility is slightly lower than that of EPAM, with a standard deviation of 41.61. The stock’s highest price was 324.31, and the lowest was 146.85. In the recent period from September 14, 2025, to November 30, 2025, MNDY’s stock fell by 22.68%. This indicates a deceleration in the stock trend, suggesting that the downward movement is slowing, but the overall outlook remains negative.

In summary, both stocks are currently in bearish trends, with EPAM showing signs of potential recovery in the short term, while MNDY continues to face challenges.

Analyst Opinions

Recent analyst recommendations for EPAM Systems, Inc. indicate a strong buy with a rating of B+ from various analysts, highlighting its solid discounted cash flow and return on assets. Analysts recommend investors take advantage of its growth potential in the tech industry. In contrast, monday.com Ltd. has garnered a rating of B, suggesting a hold position. While its discounted cash flow score is promising, concerns about its price-to-earnings ratio may warrant caution. The overall consensus for EPAM is a buy, while monday.com leans towards a hold for 2025.

Stock Grades

In the current market, I have gathered reliable stock ratings for two companies, EPAM Systems, Inc. and monday.com Ltd., which can help guide your investment decisions.

EPAM Systems, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-11-11 |

| JP Morgan | maintain | Overweight | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-09-09 |

| JP Morgan | maintain | Overweight | 2025-08-20 |

| Barclays | maintain | Overweight | 2025-05-12 |

| Needham | maintain | Buy | 2025-05-09 |

| Guggenheim | maintain | Buy | 2025-05-09 |

| Piper Sandler | maintain | Neutral | 2025-05-09 |

| Morgan Stanley | maintain | Equal Weight | 2025-05-09 |

| Stifel | maintain | Buy | 2025-05-02 |

monday.com Ltd. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | maintain | Neutral | 2025-11-11 |

| Piper Sandler | maintain | Overweight | 2025-11-11 |

| Morgan Stanley | maintain | Overweight | 2025-11-11 |

| Jefferies | maintain | Buy | 2025-11-11 |

| Citigroup | maintain | Buy | 2025-11-11 |

| Barclays | maintain | Overweight | 2025-11-11 |

| UBS | maintain | Neutral | 2025-11-11 |

| JP Morgan | maintain | Overweight | 2025-11-11 |

| Wells Fargo | maintain | Overweight | 2025-11-11 |

| DA Davidson | maintain | Buy | 2025-11-11 |

Overall, both companies are receiving consistent grades from multiple reputable analysts, with EPAM maintaining a solid standing, primarily with “Outperform” and “Overweight” recommendations, while monday.com shows a strong trend with multiple “Overweight” and “Buy” ratings. This suggests a positive outlook for both stocks, although investor sentiment should always be monitored closely.

Target Prices

A consensus of target prices has been established from reliable analysts for both EPAM Systems, Inc. and monday.com Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| EPAM Systems, Inc. | 185 | 175 | 180 |

| monday.com Ltd. | 365 | 202 | 293.78 |

The target prices indicate that analysts expect EPAM’s stock to stabilize around 180, slightly below its current price of 185. In contrast, monday.com shows a higher consensus of 293.78, suggesting significant upside potential compared to its current trading price of 148.38.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of EPAM Systems, Inc. and monday.com Ltd.

| Criterion | EPAM Systems, Inc. | monday.com Ltd. |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Moderate | Low (Negative) |

| Innovation | High | High |

| Global presence | Strong | Moderate |

| Market Share | Moderate | Growing |

| Debt level | Low | Low |

In summary, EPAM exhibits strong diversification, profitability, and global presence compared to monday.com, which shows potential for growth but currently faces profitability challenges. Investors may weigh these factors based on their investment strategies and risk tolerance.

Risk Analysis

In this section, I outline the potential risks associated with investing in EPAM Systems, Inc. and monday.com Ltd.

| Metric | EPAM Systems, Inc. | monday.com Ltd. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Low |

Both companies face significant market and operational risks, primarily driven by economic fluctuations and competition. EPAM’s exposure to geopolitical tensions, particularly in Eastern Europe, adds complexity to its risk profile, while monday.com must navigate the challenges of a rapidly evolving tech landscape.

Which one to choose?

In comparing EPAM Systems, Inc. (EPAM) and monday.com Ltd. (MNDY), EPAM appears more attractive based on its financial fundamentals. EPAM boasts a higher gross profit margin of 30.7% compared to MNDY’s 89.3%, yet MNDY’s operating losses raise concerns about its sustainability. EPAM’s price-to-earnings ratio stands at 29.5, indicating a more reasonable valuation compared to MNDY’s extremely high ratio of 363.0, reflecting market skepticism. Analysts rate EPAM as a B+ versus MNDY’s B, suggesting a stronger outlook for EPAM.

For growth-focused investors, EPAM could be the more prudent choice, while those seeking higher volatility with potential upside may consider MNDY. However, both companies face risks from competition and market dependence that could impact their performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of EPAM Systems, Inc. and monday.com Ltd. to enhance your investment decisions: