In today’s fast-paced market, making informed investment decisions is crucial. I will compare Roper Technologies, Inc. (ROP) and monday.com Ltd. (MNDY), two companies that operate in distinct yet overlapping sectors. ROP is entrenched in the industrial machinery space, while MNDY thrives in software applications. Both firms leverage innovation to stay competitive, making them intriguing prospects for investors. Join me as we explore which company offers the most compelling opportunity for your investment portfolio.

Table of contents

Company Overview

Roper Technologies, Inc. Overview

Roper Technologies, Inc. (ROP) is a diversified technology company headquartered in Sarasota, Florida, focusing on developing software and engineered products across various sectors. With a market capitalization of approximately $48B, Roper’s mission is to create innovative solutions that streamline operations and enhance productivity for industries such as healthcare, financial services, and industrial machinery. The company’s extensive portfolio includes cloud-based software, data analytics, and precision instruments, positioning it as a leader in the industrial technology space. Roper’s commitment to innovation and quality has allowed it to maintain a stable growth trajectory since its inception in 1981.

monday.com Ltd. Overview

monday.com Ltd. (MNDY), founded in 2012 and based in Tel Aviv, Israel, is a cloud-based software provider specializing in work management solutions. The company’s flagship product, Work OS, allows organizations to tailor their work processes using modular applications. With a market cap of around $7.6B, monday.com aims to simplify project management and enhance collaboration across teams. The company has carved a niche in the SaaS sector by focusing on user-friendly design and flexibility, catering to businesses of all sizes in various industries.

Key Similarities and Differences: Both Roper Technologies and monday.com operate in technology and software, but Roper emphasizes engineered solutions and industrial applications, while monday.com focuses on work management and collaborative tools. Roper serves a broader range of industries, whereas monday.com targets specific business functions within organizations.

Income Statement Comparison

In this section, I present a comparative analysis of the most recent income statements for Roper Technologies, Inc. and monday.com Ltd., highlighting key financial metrics.

| Metric | Roper Technologies, Inc. | monday.com Ltd. |

|---|---|---|

| Revenue | 7.04B | 972M |

| EBITDA | 3.04B | 58M |

| EBIT | 2.23B | 40M |

| Net Income | 1.55B | 32M |

| EPS | 14.47 | 0.65 |

Interpretation of Income Statement

Roper Technologies has shown a robust upward trend in revenue, increasing from 5.37B in 2022 to 7.04B in 2024. This reflects a healthy compound annual growth rate (CAGR), indicating strong operational performance. The net income also rose significantly, from 1.18B to 1.55B, showcasing improved efficiency and solid margins. Conversely, monday.com, while experiencing revenue growth from 519M to 972M, faced challenges with profitability, reflecting a net loss in the previous year. Their margins remain under pressure, indicating a need for strategic adjustments to achieve sustainable growth and profitability.

Financial Ratios Comparison

The table below presents a comparative analysis of the most recent financial metrics for Roper Technologies, Inc. (ROP) and monday.com Ltd. (MNDY).

| Metric | ROP | MNDY |

|---|---|---|

| ROE | 8.21% | 3.14% |

| ROIC | 5.50% | -1.73% |

| P/E | 35.94 | – |

| P/B | 2.95 | 11.41 |

| Current Ratio | 0.40 | 2.66 |

| Quick Ratio | 0.37 | 2.66 |

| D/E | 0.41 | 0.10 |

| Debt-to-Assets | 24.48% | 4.79% |

| Interest Coverage | 7.70 | – |

| Asset Turnover | 0.22 | 0.58 |

| Fixed Asset Turnover | 47.02 | 7.13 |

| Payout ratio | 20.78% | – |

| Dividend yield | 0.58% | – |

Interpretation of Financial Ratios

ROP demonstrates strong operational efficiency with a healthy ROE and ROIC, indicating effective capital utilization. However, its current and quick ratios suggest potential liquidity concerns. MNDY, while showcasing impressive asset turnover, faces challenges with profitability, evidenced by its negative P/E and ROIC. The high P/B ratio raises concerns about valuation sustainability. Overall, ROP appears more favorable for conservative investors, while MNDY may attract those willing to take on higher risk for potential growth.

Dividend and Shareholder Returns

Roper Technologies (ROP) pays a dividend with a payout ratio of around 21%, yielding approximately 0.58%. The consistent growth in its dividend per share reflects a commitment to shareholder returns, supported by strong free cash flow. In contrast, monday.com (MNDY) does not pay dividends, as it focuses on reinvestment for growth, particularly in R&D. While it engages in share buybacks, the lack of dividends raises questions about its strategy for long-term shareholder value creation. Overall, ROP’s dividend strategy appears more sustainable than MNDY’s growth-centric approach.

Strategic Positioning

Roper Technologies (ROP) holds a robust position in the Industrial Machinery sector with a market cap of $48B, focusing on diversified software and engineered products. Its competitive edge lies in its extensive product range and innovation, though it faces pressure from emerging technologies. Conversely, monday.com (MNDY) operates in the Software Application industry with a $7.6B market cap, leveraging its Work OS platform to gain market share against established players. Both companies navigate competitive landscapes and technological disruptions effectively.

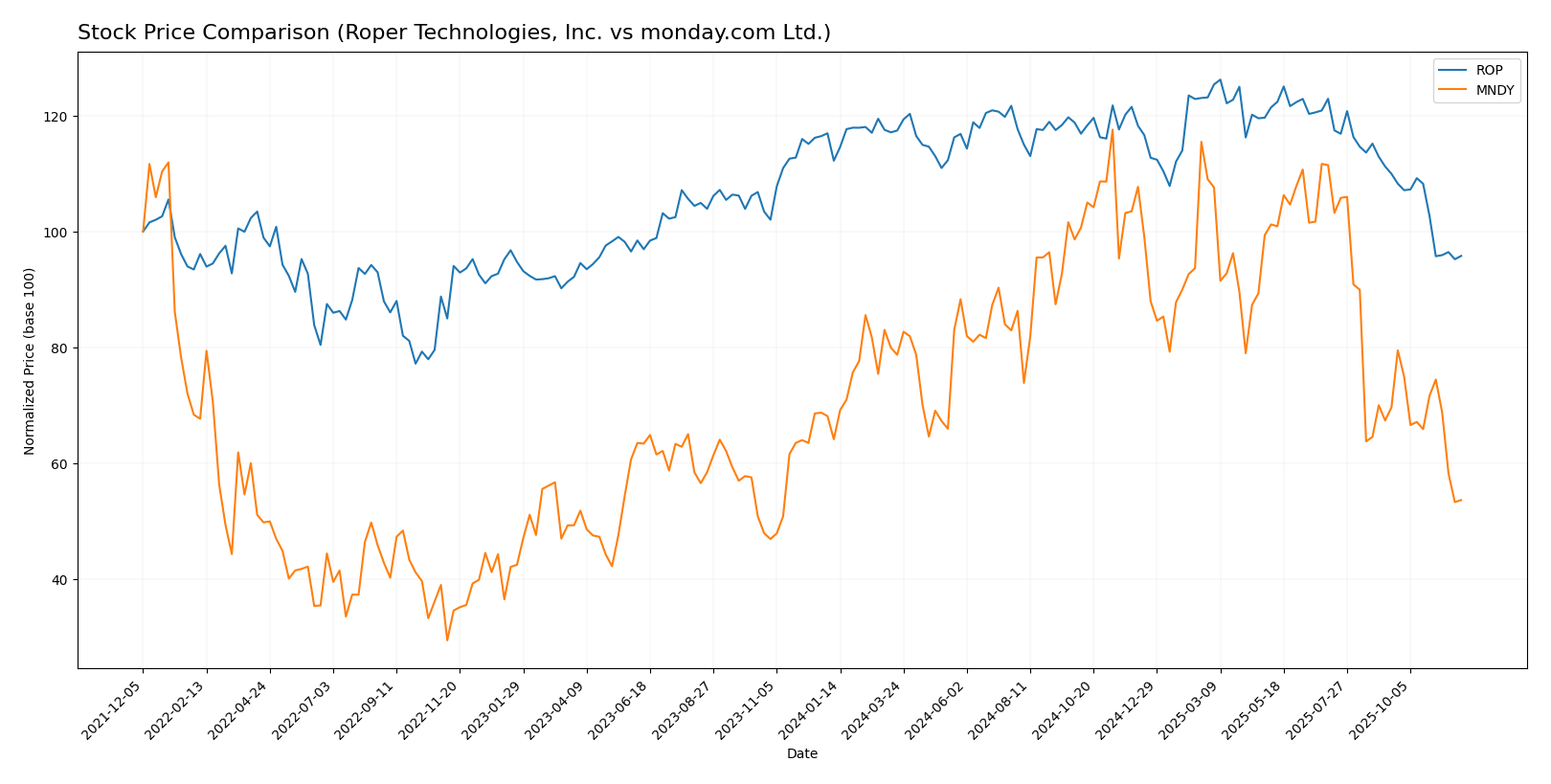

Stock Comparison

In this section, I will present a comparative analysis of Roper Technologies, Inc. (ROP) and monday.com Ltd. (MNDY), focusing on their stock price movements and trading dynamics over the past year.

Trend Analysis

Analyzing the stock trends over the past year:

Roper Technologies, Inc. (ROP)

- Percentage Change: -14.66%

- Trend Direction: Bearish

- Acceleration Status: Deceleration

- Volatility: Standard Deviation of 30.17

- Notable High/Low: Highest price at 588.38, lowest price at 443.75

monday.com Ltd. (MNDY)

- Percentage Change: -16.41%

- Trend Direction: Bearish

- Acceleration Status: Deceleration

- Volatility: Standard Deviation of 41.62

- Notable High/Low: Highest price at 324.31, lowest price at 146.85

Both stocks are exhibiting bearish trends with notable declines and deceleration in their price movements. The high standard deviations indicate a degree of volatility in their trading. As an investor, it’s prudent to monitor these developments closely, considering potential risks associated with continued bearish momentum.

Analyst Opinions

Recent analyses suggest a cautious optimism for Roper Technologies (ROP), with a B+ rating reflecting strong discounted cash flow and return ratios. Analysts highlight ROP’s solid operational efficiency and moderate debt levels, making it a “buy” for the current year. Conversely, monday.com (MNDY) holds a B rating, where analysts express concerns over its price-to-earnings and price-to-book ratios, leading to a “hold” recommendation. Overall, the consensus leans towards a “buy” for ROP and a “hold” for MNDY, emphasizing a selective approach in current market conditions.

Stock Grades

In this section, I present the latest stock grades from reliable grading companies for two companies, Roper Technologies, Inc. (ROP) and monday.com Ltd. (MNDY).

Roper Technologies, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | downgrade | Sector Perform | 2025-10-27 |

| Barclays | maintain | Underweight | 2025-10-27 |

| TD Cowen | maintain | Buy | 2025-10-24 |

| Raymond James | maintain | Strong Buy | 2025-10-24 |

| RBC Capital | maintain | Outperform | 2025-10-24 |

| Jefferies | maintain | Buy | 2025-10-24 |

| Mizuho | maintain | Neutral | 2025-10-17 |

| JP Morgan | downgrade | Underweight | 2025-10-15 |

| Barclays | maintain | Underweight | 2025-10-01 |

| Truist Securities | maintain | Buy | 2025-07-22 |

monday.com Ltd. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | maintain | Neutral | 2025-11-11 |

| Piper Sandler | maintain | Overweight | 2025-11-11 |

| Morgan Stanley | maintain | Overweight | 2025-11-11 |

| Jefferies | maintain | Buy | 2025-11-11 |

| Citigroup | maintain | Buy | 2025-11-11 |

| Barclays | maintain | Overweight | 2025-11-11 |

| UBS | maintain | Neutral | 2025-11-11 |

| JP Morgan | maintain | Overweight | 2025-11-11 |

| Wells Fargo | maintain | Overweight | 2025-11-11 |

| DA Davidson | maintain | Buy | 2025-11-11 |

In summary, Roper Technologies has seen a mix of downgrades and maintained grades, indicating some cautious sentiment among analysts. Conversely, monday.com exhibits a stable outlook with multiple “maintain” actions across its grades, suggesting a positive trend in investor sentiment.

Target Prices

For Roper Technologies, Inc. (ROP) and monday.com Ltd. (MNDY), verified target price data is available and reflects the consensus expectations of market analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Roper Technologies | 650 | 506 | 574.2 |

| monday.com | 365 | 202 | 293.78 |

Analysts are optimistic about ROP with a consensus target of 574.2, indicating potential upside from its current price of 446.41. Similarly, MNDY has a target consensus of 293.78, suggesting room for growth from its current price of 147.78.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Roper Technologies, Inc. (ROP) and monday.com Ltd. (MNDY) based on the latest financial metrics.

| Criterion | Roper Technologies (ROP) | monday.com (MNDY) |

|---|---|---|

| Diversification | High | Moderate |

| Profitability | Strong (Net Margin: 22%) | Weak (Net Margin: 3.3%) |

| Innovation | High | High |

| Global presence | Strong | Moderate |

| Market Share | Significant | Emerging |

| Debt level | Moderate (Debt/Equity: 0.41) | Low (Debt/Equity: 0.08) |

In summary, Roper Technologies demonstrates strong profitability and a robust global presence, while monday.com exhibits high innovation but struggles with profitability. Understanding these factors can guide informed investment decisions.

Risk Analysis

In the following table, I outline the key risks associated with Company A (Roper Technologies, Inc.) and Company B (monday.com Ltd.) to help you evaluate their potential impact on investment decisions.

| Metric | Roper Technologies, Inc. | monday.com Ltd. |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | Low |

| Operational Risk | Low | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | High |

Both companies face significant market risks due to volatile economic conditions. Roper Technologies has a moderate risk profile, while monday.com is exposed to higher operational and market risks, particularly as it scales in a competitive environment. Given that monday.com is still in a growth phase, investors should proceed with caution.

Which one to choose?

When comparing Roper Technologies, Inc. (ROP) and monday.com Ltd. (MNDY), ROP shows more robust financial fundamentals. ROP has a higher gross profit margin of 69.3% and a net profit margin of 22.0%, while MNDY’s margins are considerably lower, indicating operational efficiency. Furthermore, ROP’s price-to-earnings ratio stands at 35.9, suggesting a more attractive valuation compared to MNDY, which has a staggering P/E ratio of 363. ROP also has a stable B+ rating from analysts, compared to MNDY’s B rating.

For growth-oriented investors, ROP appears favorable for long-term investment, while those seeking high-risk, high-reward profiles might look at MNDY. However, caution is advised, as MNDY faces significant operational losses and competition in its sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Roper Technologies, Inc. and monday.com Ltd. to enhance your investment decisions: