In the fast-evolving semiconductor industry, two players stand out: Advanced Micro Devices, Inc. (AMD) and CEVA, Inc. Both companies are positioned within the technology sector, yet they approach innovation from different angles—AMD focuses on high-performance computing solutions, while CEVA specializes in wireless connectivity and smart sensing technologies. This article will analyze their strengths and market strategies, helping you determine which company presents the most compelling investment opportunity.

Table of contents

Company Overview

Advanced Micro Devices, Inc. Overview

Advanced Micro Devices, Inc. (AMD) is a key player in the global semiconductor market, primarily focused on the design and manufacturing of high-performance computing and graphics solutions. Founded in 1969 and headquartered in Santa Clara, California, AMD operates in two main segments: Computing and Graphics, and Enterprise, Embedded and Semi-Custom solutions. Its wide array of products includes microprocessors, GPUs, and semi-custom System-on-Chip (SoC) products, catering to various sectors, including personal computing, data centers, and gaming. With a market capitalization of approximately $335B, AMD aims to drive innovation in technology through competitive performance and efficiency, positioning itself as a formidable competitor against other tech giants.

CEVA, Inc. Overview

CEVA, Inc., established in 1999 and based in Rockville, Maryland, specializes in licensing wireless connectivity and smart sensing technologies to semiconductor and OEM companies. CEVA’s innovative product lineup includes digital signal processors and AI processors designed for diverse applications, from IoT to automotive and consumer electronics. With a market cap of around $486M, CEVA focuses on enabling advanced wireless technologies and sensor fusion, ensuring that clients can integrate cutting-edge capabilities into their products. Its commitment to R&D allows it to maintain a strong foothold in the rapidly evolving technology landscape.

Both AMD and CEVA operate within the semiconductor industry, but their business models differ significantly. AMD focuses on manufacturing and selling its own proprietary hardware, while CEVA operates primarily as a technology licensor, providing essential IP solutions to other companies for integration into their products.

Income Statement Comparison

In this section, I present a comparative view of the income statements for Advanced Micro Devices, Inc. (AMD) and CEVA, Inc. for the most recent fiscal year.

| Metric | AMD | CEVA |

|---|---|---|

| Revenue | 25.79B | 106.94M |

| EBITDA | 5.26B | -3.41M |

| EBIT | 2.08B | -7.55M |

| Net Income | 1.64B | -8.79M |

| EPS | 1.01 | -0.37 |

Interpretation of Income Statement

Over the most recent fiscal year, AMD has shown strong growth in revenue, increasing from 22.68B to 25.79B, while its net income rose significantly from 854M to 1.64B, indicating improved profitability. The EBITDA margin also indicates healthy operational efficiency. In contrast, CEVA experienced a decline in revenue from 97.42M to 106.94M, but its net loss deepened, reflecting ongoing challenges in cost management and operational efficiency. The significant negative EBITDA for CEVA suggests that it continues to face hurdles in achieving profitability despite a modest revenue increase. Overall, AMD demonstrates robust performance, while CEVA highlights the importance of maintaining cost control in a competitive landscape.

Financial Ratios Comparison

In this section, I present a comparison of the financial metrics for Advanced Micro Devices, Inc. (AMD) and CEVA, Inc. to help you better understand their performance.

| Metric | AMD | CEVA |

|---|---|---|

| ROE | 2.85% | -3.30% |

| ROIC | 2.48% | -8.56% |

| P/E | 123.59 | -44.90 |

| P/B | 3.52 | 2.79 |

| Current Ratio | 2.62 | 7.09 |

| Quick Ratio | 1.83 | 7.09 |

| D/E | 0.04 | 0.02 |

| Debt-to-Assets | 3.35% | 2.18% |

| Interest Coverage | 20.65 | N/A |

| Asset Turnover | 0.37 | 0.32 |

| Fixed Asset Turnover | 10.63 | 8.43 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

AMD demonstrates stronger financial health when compared to CEVA, particularly in terms of return on equity (ROE) and return on invested capital (ROIC), both of which indicate effective utilization of capital. CEVA’s negative ratios suggest potential operational challenges, particularly in profitability. Notably, AMD maintains a stable current ratio, reflecting its liquidity, while CEVA’s significantly higher ratio may indicate excess liquidity. Investors should be cautious with CEVA due to its overall negative financial performance.

Dividend and Shareholder Returns

Both Advanced Micro Devices, Inc. (AMD) and CEVA, Inc. do not pay dividends, focusing instead on reinvestment strategies to fuel growth. AMD, despite its lack of dividends, has engaged in share buybacks, reflecting a commitment to returning value to shareholders. CEVA, on the other hand, struggles with negative net income and prioritizes R&D, impacting its short-term financial health. This approach for both companies aligns with long-term value creation, but investors should remain cautious about sustainability risks related to their growth strategies.

Strategic Positioning

Advanced Micro Devices, Inc. (AMD) holds a significant share in the semiconductor market, particularly in computing and graphics, with a market cap of $335B. Its competitive pressure is high due to rivals like Intel and NVIDIA, but AMD’s innovative product line, including EPYC processors and Radeon graphics, positions it well against technological disruptions. Conversely, CEVA, Inc., with a market cap of $486M, operates in niche segments like wireless connectivity and AI, facing moderate competition but benefiting from growing IoT demand.

Stock Comparison

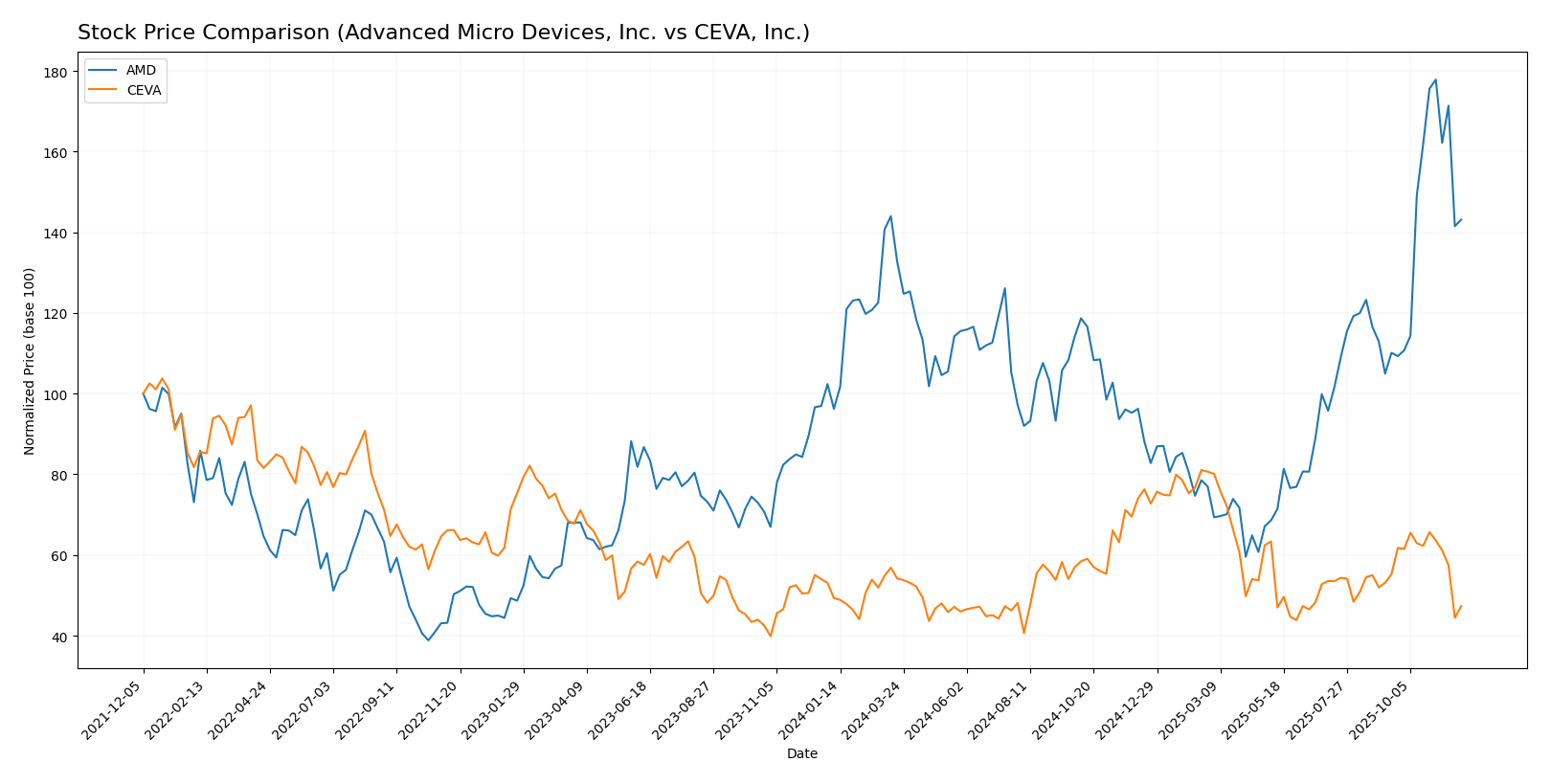

Over the past year, both Advanced Micro Devices, Inc. (AMD) and CEVA, Inc. (CEVA) have experienced significant price movements, reflecting the underlying trading dynamics in their respective markets.

Trend Analysis

For AMD, the price has increased by 48.74% over the past year, indicating a bullish trend. The highest price reached was 256.12, while the lowest was 85.76. The trend is characterized by acceleration and notable volatility, with a standard deviation of 35.61. Over the recent period from September 14, 2025, to November 30, 2025, the stock saw a 29.99% increase with a trend slope of 7.13, suggesting continued upward momentum.

In contrast, CEVA has experienced a 4.03% decline over the past year, signaling a bearish trend. Its price fluctuated between a high of 34.67 and a low of 17.39. The trend shows deceleration and relatively low volatility with a standard deviation of 4.48. During the recent period from September 14, 2025, to November 30, 2025, CEVA’s price fell by 14.27%, with a trend slope of -0.43, indicating a consistent downward trajectory.

Investors should consider these trends carefully, keeping in mind the distinct trajectories of each stock when making portfolio decisions.

Analyst Opinions

Recent analyst recommendations for Advanced Micro Devices, Inc. (AMD) show a consensus rating of “Buy,” with analysts highlighting its strong return on assets and manageable debt levels. The firm has an overall score of 3, reflecting solid financial health, although concerns about its price-to-earnings ratio were noted. On the other hand, CEVA, Inc. has received a “Hold” rating, with a C+ overall score, mainly due to weaker performance in return on equity and assets. Analysts suggest caution with CEVA, given its mixed financial metrics.

Stock Grades

I have gathered the latest stock grades from reliable grading companies for two companies: Advanced Micro Devices, Inc. (AMD) and CEVA, Inc. (CEVA). Below are the details of their current ratings.

Advanced Micro Devices, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2025-11-12 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-12 |

| B of A Securities | Maintain | Buy | 2025-11-12 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-12 |

| Wedbush | Maintain | Outperform | 2025-11-12 |

| Piper Sandler | Maintain | Overweight | 2025-11-12 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Roth Capital | Maintain | Buy | 2025-11-12 |

| Wedbush | Maintain | Outperform | 2025-11-10 |

CEVA, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-11 |

| Rosenblatt | Maintain | Buy | 2025-08-14 |

| Oppenheimer | Maintain | Outperform | 2025-05-09 |

| Barclays | Maintain | Overweight | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-04-23 |

| Rosenblatt | Maintain | Buy | 2025-02-14 |

| Barclays | Maintain | Overweight | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-11 |

Overall, the grades for both AMD and CEVA indicate a consistent level of confidence among analysts, with multiple “Buy” and “Outperform” ratings. This suggests a positive outlook on both stocks, making them potentially attractive options for investors.

Target Prices

For Advanced Micro Devices, Inc. (AMD), the target consensus reflects a promising outlook among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Advanced Micro Devices | 380 | 200 | 295.24 |

Analysts expect AMD’s stock to reach a consensus target of 295.24, significantly above its current price of 206.13, indicating potential upside. Unfortunately, no verified target price data is available for CEVA, Inc. (CEVA), suggesting a more uncertain outlook amidst general market sentiment.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Advanced Micro Devices, Inc. (AMD) and CEVA, Inc. (CEVA).

| Criterion | AMD | CEVA |

|---|---|---|

| Diversification | Strong product portfolio across computing and graphics | Focused on wireless and smart sensing technologies |

| Profitability | Net profit margin ~6.36% in 2024 | Negative net profit margin ~-8.22% in 2024 |

| Innovation | High investment in R&D; leading in AI and gaming | Innovative in DSP and AI technologies |

| Global presence | Well-established worldwide with significant market share | Emerging presence, primarily in niche markets |

| Market Share | Significant in the semiconductor industry | Limited market share in specialized areas |

| Debt level | Low debt-to-equity ratio ~0.04 | Very low debt-to-equity ratio ~0.02 |

Key takeaways: AMD showcases strong profitability, innovation, and low debt levels, while CEVA excels in niche technologies but struggles with profitability and market presence. Investors should weigh these aspects carefully before making decisions.

Risk Analysis

In the table below, I outline the primary risks associated with Advanced Micro Devices, Inc. (AMD) and CEVA, Inc. (CEVA) to help you make informed investment decisions.

| Metric | AMD | CEVA |

|---|---|---|

| Market Risk | High | Medium |

| Regulatory Risk | Medium | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Medium | Low |

The most significant risks for AMD include high market volatility due to its competitive sector and geopolitical tensions affecting supply chains. CEVA faces considerable operational risks as it works on cutting-edge technologies, which may face regulatory scrutiny.

Which one to choose?

In comparing Advanced Micro Devices, Inc. (AMD) and CEVA, Inc. (CEVA), AMD appears to be the more promising investment option. AMD boasts a strong market capitalization of $203B, a gross profit margin of 49.4%, and a positive stock trend with a recent price increase of nearly 49%. Analyst ratings for AMD are solid with a grade of B, particularly in return on assets and equity. In contrast, CEVA’s performance is less favorable, with a market cap of just $745M, a declining price trend of -4.03%, and a rating of C+.

For growth-focused investors, AMD may be the better choice due to its robust fundamentals and upward trend. Conversely, those more interested in stability might consider CEVA, but should be wary of its declining performance and profitability challenges.

Risks include potential market competition and the volatility inherent in tech investments.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Advanced Micro Devices, Inc. and CEVA, Inc. to enhance your investment decisions: