In the rapidly evolving semiconductor industry, two key players stand out: Advanced Micro Devices, Inc. (AMD) and Analog Devices, Inc. (ADI). Both companies are at the forefront of innovation, yet they target different segments within the market. AMD focuses on high-performance computing and graphics, while ADI excels in analog and mixed-signal technologies. As we delve into their strategies, financial health, and growth potential, I aim to help you determine which company presents the more compelling investment opportunity.

Table of contents

Company Overview

Advanced Micro Devices, Inc. Overview

Advanced Micro Devices, Inc. (AMD) is a leading semiconductor company, headquartered in Santa Clara, California. Founded in 1969, AMD specializes in the design and manufacture of computer processors and graphics solutions. The company operates through two main segments: Computing and Graphics, and Enterprise, Embedded, and Semi-Custom. AMD’s product portfolio includes the popular Ryzen and EPYC processors, as well as Radeon graphics cards, catering to a wide range of customers from individual consumers to large-scale data centers. With a market capitalization of approximately $335B, AMD has established itself as a formidable competitor in the semiconductor industry, focusing on innovation and performance in high-demand markets such as gaming and data centers.

Analog Devices, Inc. Overview

Analog Devices, Inc. (ADI), established in 1965 and based in Wilmington, Massachusetts, is a premier designer and manufacturer of integrated circuits (ICs) and subsystems that leverage both analog and digital signal processing technologies. ADI’s diverse product range includes data converters, amplifiers, and power management solutions, serving industries such as automotive, communications, and industrial markets. With a market cap of around $125B, ADI is recognized for its commitment to high-performance solutions that translate real-world signals into digital data and vice versa, making it a vital player in the semiconductor sector.

Key Similarities and Differences

Both AMD and ADI operate within the semiconductor industry and focus on innovation to meet market demands. While AMD primarily targets computing and graphics markets with processors and GPUs, ADI emphasizes analog and mixed-signal solutions for a broader range of industries. Their business models differ notably in product focus, with AMD leaning towards consumer and enterprise computing, whereas ADI caters to industrial and automotive applications.

Income Statement Comparison

The following table compares the income statements of Advanced Micro Devices, Inc. (AMD) and Analog Devices, Inc. (ADI) for the most recent fiscal year, highlighting key financial metrics.

| Metric | AMD | ADI |

|---|---|---|

| Revenue | 25.79B | 11.02B |

| EBITDA | 5.26B | 5.03B |

| EBIT | 2.08B | 3.03B |

| Net Income | 1.64B | 2.27B |

| EPS | 1.01 | 4.59 |

Interpretation of Income Statement

In the most recent fiscal year, AMD experienced a revenue increase to 25.79B from 22.68B, indicating a growth trend, while ADI’s revenue decreased slightly from 12.31B to 11.02B. AMD’s net income rose to 1.64B, reflecting improved operational performance despite increasing costs, whereas ADI maintained a strong net income of 2.27B, showcasing solid profitability. Notably, AMD’s EBITDA margin improved, suggesting better cost management, while ADI’s margins remained stable, indicating resilience in a challenging market. Overall, AMD demonstrated significant growth potential, while ADI continues to perform consistently well.

Financial Ratios Comparison

The table below presents a comparative overview of the most recent financial ratios for Advanced Micro Devices, Inc. (AMD) and Analog Devices, Inc. (ADI).

| Metric | AMD | ADI |

|---|---|---|

| ROE | 2.85% | 6.70% |

| ROIC | 2.48% | 5.55% |

| P/E | 123.59 | 51.05 |

| P/B | 3.52 | 3.42 |

| Current Ratio | 2.62 | 2.19 |

| Quick Ratio | 1.83 | 1.68 |

| D/E | 0.04 | 0.25 |

| Debt-to-Assets | 3.35% | 17.90% |

| Interest Coverage | 20.65 | 9.45 |

| Asset Turnover | 0.37 | 0.23 |

| Fixed Asset Turnover | 10.63 | N/A |

| Payout Ratio | 0% | 85% |

| Dividend Yield | 0% | 1.66% |

Interpretation of Financial Ratios

In the current analysis, AMD exhibits a substantially higher P/E ratio, indicating a premium valuation, whereas ADI’s lower P/E may suggest it is undervalued relative to its earnings. AMD’s current and quick ratios reflect solid liquidity, while its minimal debt levels (D/E) indicate lower financial risk. However, ADI’s higher return metrics (ROE and ROIC) showcase efficient capital utilization. Overall, AMD shows growth potential but at a higher risk, while ADI demonstrates stability and returns, albeit with higher debt levels.

Dividend and Shareholder Returns

Advanced Micro Devices, Inc. (AMD) does not pay dividends, focusing on reinvestment for growth and innovation. Its financials reflect a high free cash flow, supporting substantial share buyback programs. In contrast, Analog Devices, Inc. (ADI) maintains an attractive dividend yield of 1.66%, with a reasonable payout ratio of 0.85. ADI’s commitment to returning capital to shareholders aligns well with long-term value creation, whereas AMD’s approach emphasizes growth potential. Both strategies carry distinct risks and opportunities for investors.

Strategic Positioning

In the semiconductor industry, Advanced Micro Devices, Inc. (AMD) holds a significant market share, particularly in CPUs and GPUs, competing closely with giants like Intel and NVIDIA. With a market cap of $335B, AMD faces competitive pressure from Analog Devices, Inc. (ADI), which specializes in integrated circuits and has a market cap of $125B. Both companies are experiencing technological disruption, driven by advancements in AI and machine learning, necessitating ongoing innovation to maintain their positions.

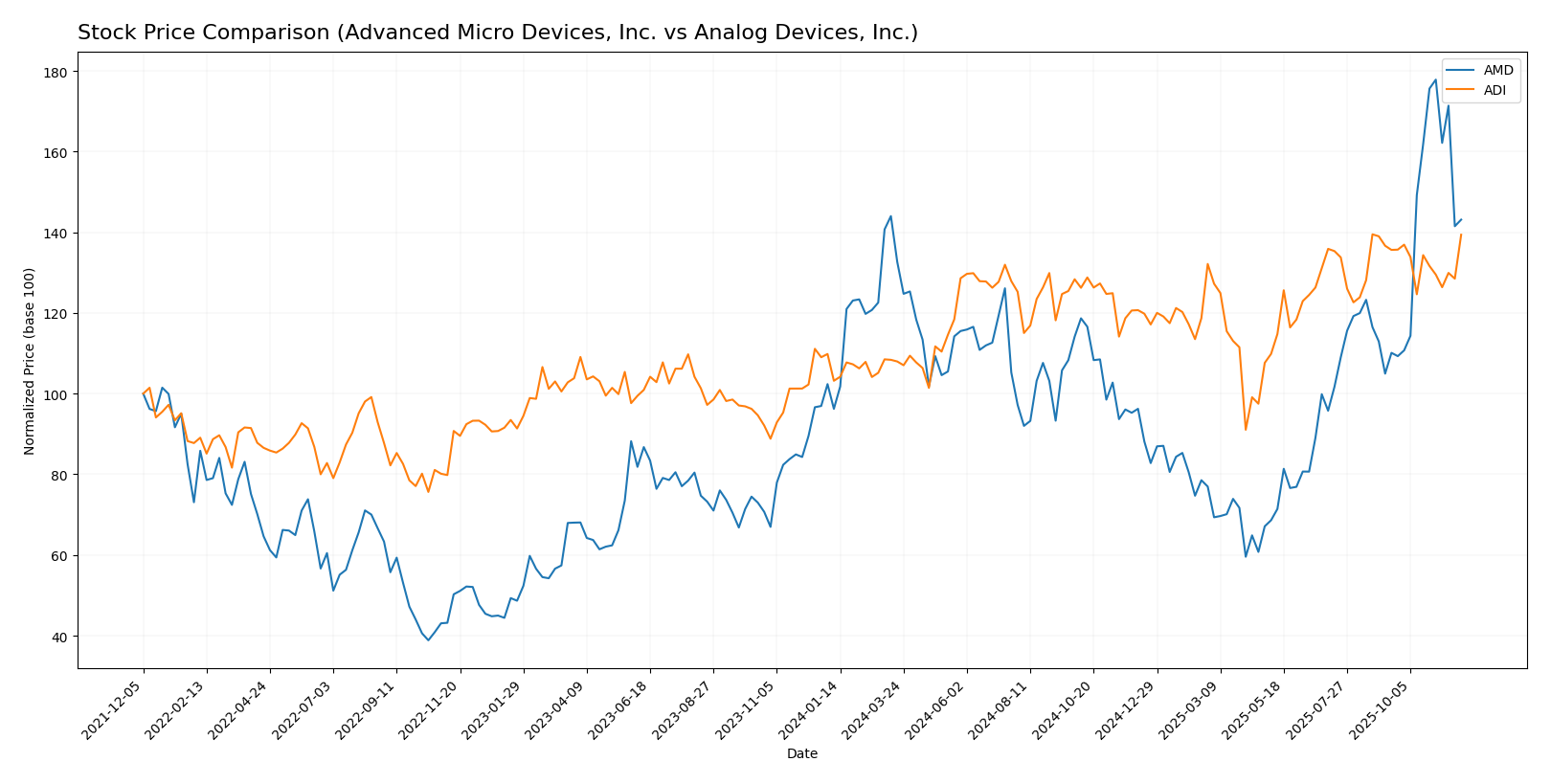

Stock Comparison

Over the past year, the stock prices of Advanced Micro Devices, Inc. (AMD) and Analog Devices, Inc. (ADI) have exhibited significant movements, reflecting varied trading dynamics in the semiconductor sector.

Trend Analysis

For AMD, the price has increased by 48.74% over the past year, indicating a strong bullish trend. The stock has experienced notable acceleration, with a maximum price of 256.12 and a minimum of 85.76. The standard deviation of 35.61 suggests considerable volatility in the price movements.

In the recent period from September 14, 2025, to November 30, 2025, the price rose by 29.99%, maintaining a bullish trend with an upward trend slope of 7.13. The volatility is highlighted by a standard deviation of 36.99 during this timeframe.

For ADI, the stock has increased by 35.1% over the past year, also reflecting a bullish trend, although with deceleration in momentum. The highest price reached was 252.2, while the lowest was 164.6, with a standard deviation of 19.0, indicating moderate volatility.

In the recent period, ADI’s price change was 2.78%, resulting in a neutral trend, with a slight downward slope of -0.62. The standard deviation here is lower at 7.8, suggesting reduced volatility compared to AMD.

In summary, AMD shows stronger growth and momentum compared to ADI, which is still on an upward trajectory but with signs of deceleration in its recent performance.

Analyst Opinions

Recent analyst recommendations for Advanced Micro Devices, Inc. (AMD) and Analog Devices, Inc. (ADI) indicate a consensus rating of “B” for both stocks. Analysts highlight AMD’s stable return on assets and overall performance, despite concerns over its price-to-earnings ratio. Conversely, ADI’s strength lies in its discounted cash flow score and return on assets, though it also faces challenges with its price-to-earnings ratio. Given these insights, I recommend investors consider both stocks for a hold position in their portfolios.

Stock Grades

I have gathered the latest stock grades for Advanced Micro Devices, Inc. (AMD) and Analog Devices, Inc. (ADI) from reliable grading companies, offering insights into their current market positions.

Advanced Micro Devices, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-11-12 |

| Evercore ISI Group | maintain | Outperform | 2025-11-12 |

| Rosenblatt | maintain | Buy | 2025-11-12 |

| B of A Securities | maintain | Buy | 2025-11-12 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-12 |

| Wedbush | maintain | Outperform | 2025-11-12 |

| Piper Sandler | maintain | Overweight | 2025-11-12 |

| Wells Fargo | maintain | Overweight | 2025-11-12 |

| Roth Capital | maintain | Buy | 2025-11-12 |

| Wedbush | maintain | Outperform | 2025-11-10 |

Analog Devices, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | maintain | Buy | 2025-11-26 |

| B of A Securities | maintain | Buy | 2025-11-26 |

| Cantor Fitzgerald | maintain | Overweight | 2025-09-30 |

| Piper Sandler | maintain | Neutral | 2025-08-21 |

| Barclays | maintain | Equal Weight | 2025-08-21 |

| JP Morgan | maintain | Overweight | 2025-08-21 |

| Keybanc | maintain | Overweight | 2025-08-21 |

| Wells Fargo | maintain | Equal Weight | 2025-08-21 |

| Needham | maintain | Hold | 2025-08-21 |

| Truist Securities | maintain | Hold | 2025-08-21 |

Overall, both AMD and ADI maintain strong ratings with multiple “Buy” and “Outperform” grades. This reflects a generally positive sentiment from analysts regarding their future performance, suggesting that they continue to be favorable options for investors.

Target Prices

The consensus target prices for two prominent semiconductor companies are as follows:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Advanced Micro Devices, Inc. | 380 | 200 | 295.24 |

| Analog Devices, Inc. | 300 | 265 | 288.38 |

Advanced Micro Devices, Inc. (AMD) has a target consensus of 295.24, significantly above its current price of 206.13, indicating positive analyst expectations. Similarly, Analog Devices, Inc. (ADI) has a consensus of 288.38, also above its current price of 252.02, suggesting a favorable outlook.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of two companies in the semiconductor industry: Advanced Micro Devices, Inc. (AMD) and Analog Devices, Inc. (ADI).

| Criterion | AMD | ADI |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Low (Net Margin: 6.36%) | High (Net Margin: 20.58%) |

| Innovation | Strong | Strong |

| Global presence | Strong | Strong |

| Market Share | Moderate | High |

| Debt level | Low (Debt/Equity: 0.04) | Moderate (Debt/Equity: 0.25) |

Key takeaways show that while both companies exhibit strengths in innovation and global presence, ADI outperforms AMD in profitability and market share, indicating a more stable financial outlook. Conversely, AMD maintains a lower debt level, which can be seen as a strength in risk management.

Risk Analysis

In this section, I will outline the key risks associated with Advanced Micro Devices, Inc. (AMD) and Analog Devices, Inc. (ADI) to help you evaluate potential investments.

| Metric | AMD | ADI |

|---|---|---|

| Market Risk | High (Beta: 1.91) | Moderate (Beta: 1.05) |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | Moderate | Low |

| Environmental Risk | Low | Low |

| Geopolitical Risk | High | Moderate |

Both companies face significant market risks, particularly AMD, which has a higher beta indicating greater volatility. Geopolitical risks are also notable, especially for AMD, due to its global supply chain. Investors should carefully consider these factors when investing.

Which one to choose?

When analyzing Advanced Micro Devices, Inc. (AMD) and Analog Devices, Inc. (ADI), both companies exhibit strong fundamentals but serve different market segments. AMD reported a revenue of $25.8B with a net profit margin of 6.4%, while ADI’s revenue stood at $11B with a higher net profit margin of 20.5%. AMD has a price-to-earnings (P/E) ratio of 123.6, reflecting high growth expectations, whereas ADI’s P/E ratio is more reasonable at 51.1, indicating a more stable valuation.

Analyst ratings for both companies are a solid “B,” suggesting they are considered relatively good investments. However, the stock performance shows AMD trending bullish with a 48.7% increase recently, while ADI’s growth is steady but slowing, with a recent change of only 2.8%.

Investors focused on growth may prefer AMD due to its higher revenue growth potential, while those prioritizing stability and profitability may favor ADI.

Specific risks include intense competition in the semiconductor sector and potential supply chain disruptions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Advanced Micro Devices, Inc. and Analog Devices, Inc. to enhance your investment decisions: