In the dynamic world of technology, two semiconductor giants, Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN), stand out for their innovative approaches and market strategies. Both companies operate within the same industry, yet they target different segments and cater to varied customer needs. AMD focuses on high-performance computing and graphics solutions, while TXN specializes in analog and embedded processing technologies. In this article, I will analyze their strengths and potential to help you decide which company deserves a place in your investment portfolio.

Table of contents

Company Overview

Advanced Micro Devices, Inc. Overview

Advanced Micro Devices, Inc. (AMD) has positioned itself as a formidable competitor in the semiconductor industry, primarily focusing on high-performance computing and graphics solutions. The company operates through two main segments: Computing and Graphics; and Enterprise, Embedded and Semi-Custom. AMD’s diverse product offerings include x86 microprocessors, chipsets, and graphics processing units (GPUs) for various applications, such as gaming and data centers. Founded in 1969 and headquartered in Santa Clara, California, AMD aims to deliver innovative technologies that empower customers in sectors like gaming and enterprise computing. With a market cap of approximately $353B, AMD continues to push boundaries in performance and efficiency, making it a key player in the technology landscape.

Texas Instruments Incorporated Overview

Texas Instruments Incorporated (TXN) has established itself as a leader in the semiconductor market, specializing in analog and embedded processing solutions. Founded in 1930 and based in Dallas, Texas, TXN develops a wide range of semiconductor products designed to manage power and process signals for various applications, including industrial, automotive, and personal electronics. The company’s commitment to innovation is evident in its extensive portfolio, which features microcontrollers, digital signal processors, and power management solutions. With a market cap of around $153B, Texas Instruments focuses on delivering high-quality products that meet the evolving needs of electronics designers and manufacturers globally.

Key similarities and differences

Both AMD and Texas Instruments operate within the semiconductor industry, focusing on high-performance technology solutions. However, while AMD emphasizes computing and graphics products, TXN specializes in analog and embedded processing solutions. Additionally, AMD is known for its aggressive approach to gaming and data center markets, whereas Texas Instruments prioritizes power management and signal processing applications.

Income Statement Comparison

The following table provides a comprehensive comparison of the income statements for Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN) for the most recent fiscal year, allowing for a clearer analysis of their financial health.

| Metric | AMD | TXN |

|---|---|---|

| Market Cap | 353.04B | 152.78B |

| Revenue | 25.79B | 15.64B |

| EBITDA | 5.26B | 7.54B |

| EBIT | 2.08B | 5.96B |

| Net Income | 1.64B | 4.80B |

| EPS | 1.01 | 5.24 |

| Fiscal Year | 2024 | 2024 |

Interpretation of Income Statement

In the most recent fiscal year, AMD reported revenue growth to 25.79B, an increase from 22.68B in the previous year, reflecting a positive trend. However, its net income also grew but at a slower pace, reaching 1.64B compared to 0.85B previously, indicating improved profitability. Conversely, TXN’s revenue declined from 17.52B to 15.64B, while net income also decreased from 6.52B to 4.80B, suggesting a challenging year. The stability in AMD’s margins highlights better operational efficiency, whereas TXN’s declining margins may necessitate a closer examination of their cost management strategies moving forward.

Financial Ratios Comparison

The following table presents a comparative analysis of key financial ratios for Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN) based on the most recent data.

| Metric | [AMD] | [TXN] |

|---|---|---|

| ROE | 2.85% | 28.39% |

| ROIC | 2.49% | 14.75% |

| P/E | 123.59 | 23.78 |

| P/B | 3.52 | 10.12 |

| Current Ratio | 2.62 | 4.12 |

| Quick Ratio | 1.83 | 2.88 |

| D/E | 0.038 | 0.664 |

| Debt-to-Assets | 0.044 | 0.347 |

| Interest Coverage | 20.65 | 10.76 |

| Asset Turnover | 0.37 | 0.54 |

| Fixed Asset Turnover | 10.63 | 1.38 |

| Payout Ratio | 0% | 99.92% |

| Dividend Yield | 0% | 2.94% |

Interpretation of Financial Ratios

AMD shows weaker profitability metrics, with a significantly higher P/E ratio, indicating higher market expectations. Although its debt levels are low, the company’s return on equity (ROE) is notably low compared to TXN, suggesting it may not be generating sufficient profit relative to shareholder equity. TXN exhibits strong profitability and liquidity ratios, signaling better financial health and stability. The high payout ratio indicates a commitment to returning value to shareholders but also raises concerns about sustainability in capital investments. Overall, while TXN appears to be the stronger candidate for investment, AMD’s growth potential should not be overlooked.

Dividend and Shareholder Returns

Advanced Micro Devices, Inc. (AMD) does not pay dividends, reflecting a focus on reinvestment, growth, and innovation in the competitive semiconductor sector. The company prioritizes R&D, which aligns with its long-term value creation strategy. Meanwhile, Texas Instruments Incorporated (TXN) maintains a robust dividend policy, with a payout ratio of approximately 70% and a yield of about 2.9%. This sustainable distribution supports shareholder returns while allowing for continued investment in growth.

Strategic Positioning

In the semiconductor market, Advanced Micro Devices, Inc. (AMD) holds a significant market share, competing closely with Texas Instruments Incorporated (TXN). AMD’s focus on high-performance computing and graphics products positions it well against TXN’s stronghold in analog and embedded processing segments. While both companies face competitive pressure from emerging technologies and players, AMD’s aggressive innovation strategies, especially in GPUs, and TXN’s solid foundation in analog solutions create a dynamic landscape. Technological disruptions continue to reshape the market, requiring both companies to adapt swiftly to maintain their competitive edge.

Stock Comparison

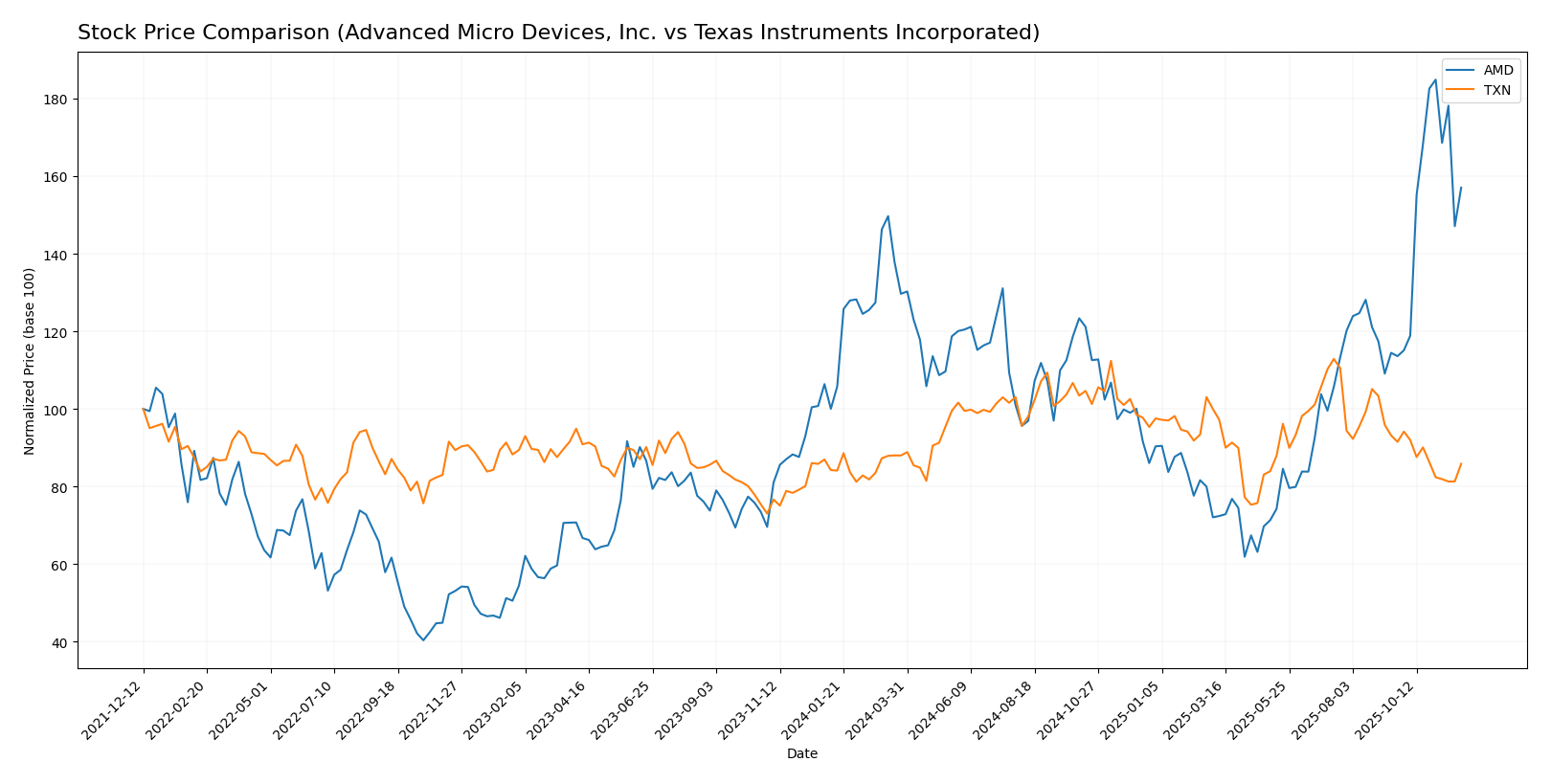

In assessing the stock price movements of Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN) over the past year, we observe notable fluctuations and trading dynamics that merit attention.

Trend Analysis

For AMD, the stock has experienced a significant price change of +56.97% over the past year. This bullish trend is characterized by acceleration, indicating strong upward momentum. The stock reached a high of 256.12 and a low of 85.76, with a standard deviation of 35.8, suggesting considerable volatility. In the recent trend from September 14, 2025, to November 30, 2025, AMD’s price increased by 37.18% with a standard deviation of 37.1, further reinforcing a bullish sentiment.

In contrast, TXN has posted a price change of +1.92% over the same period, also categorized as bullish but with a deceleration trend. The stock’s highest price was 221.25, while the lowest was 147.6, and it exhibited a standard deviation of 16.88. However, in the recent analysis period from September 14, 2025, to November 30, 2025, TXN experienced a decline of -7.85%, indicating a shift in momentum characterized by seller dominance, as evidenced by a trend slope of -2.28.

Analyst Opinions

Recent analyst recommendations for Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN) indicate a cautious stance with a rating of “B” for both companies. Analysts highlight AMD’s solid return on assets and equity, despite a low price-to-earnings score, suggesting a hold strategy. For TXN, strong performance metrics in return on equity and assets bolster its position, with recommendations leaning towards a buy. Overall, the consensus for 2025 appears to be a hold for AMD and a buy for TXN, reflecting differing investor confidence.

Stock Grades

Here is an overview of the latest stock grades for two prominent companies in the technology sector, Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN).

Advanced Micro Devices, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | maintain | Outperform | 2025-11-12 |

| Evercore ISI Group | maintain | Outperform | 2025-11-12 |

| Rosenblatt | maintain | Buy | 2025-11-12 |

| B of A Securities | maintain | Buy | 2025-11-12 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-12 |

| Wedbush | maintain | Outperform | 2025-11-12 |

| Piper Sandler | maintain | Overweight | 2025-11-12 |

| Wells Fargo | maintain | Overweight | 2025-11-12 |

| Roth Capital | maintain | Buy | 2025-11-12 |

| Wedbush | maintain | Outperform | 2025-11-10 |

Texas Instruments Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | maintain | Positive | 2025-10-22 |

| Wells Fargo | maintain | Equal Weight | 2025-10-22 |

| Truist Securities | maintain | Hold | 2025-10-22 |

| Rosenblatt | maintain | Buy | 2025-10-22 |

| Goldman Sachs | maintain | Buy | 2025-10-22 |

| JP Morgan | maintain | Overweight | 2025-10-22 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-22 |

| Stifel | maintain | Hold | 2025-10-22 |

| TD Cowen | maintain | Buy | 2025-10-22 |

| Mizuho | downgrade | Underperform | 2025-10-20 |

Overall, both AMD and TXN have maintained strong ratings from several analysts, reflecting a generally positive outlook for AMD while TXN shows a mix of stability and caution. Notably, TXN experienced a downgrade from Mizuho, which may suggest a need for careful consideration in the current market environment.

Target Prices

The current target consensus reflects optimistic expectations from analysts for both Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Advanced Micro Devices, Inc. | 380 | 200 | 295.24 |

| Texas Instruments Incorporated | 245 | 145 | 190.45 |

Analysts anticipate considerable upside for AMD, with a consensus price well above its current trading price of 217.52. TXN also shows a favorable outlook, as its consensus of 190.45 exceeds the current price of 168.15, suggesting potential for growth as well.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN).

| Criterion | AMD | TXN |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Moderate | High |

| Innovation | High | Moderate |

| Global presence | High | High |

| Market Share | Moderate | High |

| Debt level | Low | Moderate |

Key takeaways: AMD excels in innovation and global presence but has moderate profitability and market share. TXN demonstrates strength in diversification and profitability, making it a robust choice for conservative investors.

Risk Analysis

In the table below, I outline various risks associated with two semiconductor companies, Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN).

| Metric | AMD | TXN |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | Low |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | High | Moderate |

Both companies face significant market and geopolitical risks, particularly due to global supply chain issues and increasing regulatory scrutiny. AMD’s higher market risk reflects its more volatile business environment compared to TXN.

Which one to choose?

In comparing Advanced Micro Devices, Inc. (AMD) and Texas Instruments Incorporated (TXN), both companies exhibit strong fundamentals, but with different profiles. AMD has a current market cap of 202.8B and a high price-to-earnings (P/E) ratio of 124, indicating aggressive growth expectations. Its recent stock trend has shown significant bullish momentum with a 56.97% price change. Conversely, TXN stands at a market cap of 171B with a lower P/E ratio of 35, reflecting a more stable growth outlook and consistent profitability, evidenced by its strong net profit margins of 30.68%.

For growth-oriented investors, AMD may be appealing due to its higher growth potential, while those seeking stability and dividends might prefer TXN, which offers a dividend yield of ~2.8%. However, investors should remain cautious regarding AMD’s competitive landscape and reliance on market trends, as its valuation appears stretched compared to TXN.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Advanced Micro Devices, Inc. and Texas Instruments Incorporated to enhance your investment decisions: