In the rapidly evolving semiconductor industry, NVIDIA Corporation (NVDA) and Microchip Technology Incorporated (MCHP) stand out as key players, each with unique approaches to innovation and market strategy. NVIDIA, renowned for its cutting-edge graphics and AI solutions, competes with Microchip, which specializes in embedded control solutions and microcontrollers. With overlapping markets and distinct product offerings, I aim to evaluate which of these companies presents a more compelling investment opportunity for you.

Table of contents

Company Overview

NVIDIA Corporation Overview

NVIDIA Corporation (Ticker: NVDA) is a leader in graphics processing units (GPUs) and AI computing technologies. Founded in 1993 and headquartered in Santa Clara, California, NVIDIA aims to transform industries through its innovative platforms in gaming, professional visualization, data centers, and automotive solutions. The company’s flagship products include GeForce GPUs and AI-driven data center solutions, catering to a diverse clientele ranging from gamers to enterprises. With a robust market capitalization of approximately $4.33T, NVIDIA is well-positioned in the semiconductor industry, focusing on high-performance computing and artificial intelligence applications.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated (Ticker: MCHP), established in 1989 and based in Chandler, Arizona, specializes in embedded control solutions. The company offers a broad range of microcontrollers, analog products, and development tools that serve various sectors, including automotive, industrial, and consumer electronics. With a market cap of around $27.92B, Microchip focuses on delivering secure and connected solutions, ensuring its products are integral to smart devices worldwide. The company is also recognized for its engineering services and wafer foundry capabilities, making it a versatile player in the semiconductor space.

Key Similarities and Differences

Both NVIDIA and Microchip operate in the semiconductor sector, yet their business models diverge significantly. NVIDIA primarily focuses on high-performance graphics and AI solutions, catering to gaming and data center markets, while Microchip emphasizes embedded control and microcontroller solutions across various industries. This distinction highlights NVIDIA’s strength in graphics and AI, contrasting with Microchip’s broad applications in embedded systems.

Income Statement Comparison

The following table compares the income statements of NVIDIA Corporation (NVDA) and Microchip Technology Incorporated (MCHP) for their most recent fiscal years.

| Metric | NVDA | MCHP |

|---|---|---|

| Revenue | 130.5B | 4.4B |

| EBITDA | 86.1B | 1.0B |

| EBIT | 84.3B | 290.3M |

| Net Income | 72.9B | -500K |

| EPS | 2.97 | -0.005 |

Interpretation of Income Statement

In the most recent fiscal year, NVIDIA (NVDA) experienced remarkable growth with a revenue increase to 130.5B, resulting in a substantial net income of 72.9B. In contrast, Microchip (MCHP) faced challenges, reporting a decline in revenue to 4.4B and a net loss of 500K. NVIDIA’s EBITDA margin remains strong, whereas Microchip’s margins have weakened significantly, indicating operational difficulties. Overall, NVDA’s performance reflects a robust market position and effective cost management, while MCHP needs to reassess its strategies to regain profitability.

Financial Ratios Comparison

In the table below, I present a comparative analysis of key financial metrics for NVIDIA Corporation (NVDA) and Microchip Technology Incorporated (MCHP) based on the most recent data available.

| Metric | NVDA | MCHP |

|---|---|---|

| ROE | 91.87% | -0.0071 |

| ROIC | 75.28% | 2.08% |

| P/E | 39.90 | 20.61 |

| P/B | 36.66 | 7.08 |

| Current Ratio | 4.44 | 0.98 |

| Quick Ratio | 3.88 | 0.56 |

| D/E | 0.13 | 1.01 |

| Debt-to-Assets | 0.09 | 0.40 |

| Interest Coverage | 329.77 | 15.28 |

| Asset Turnover | 1.17 | 0.52 |

| Fixed Asset Turnover | 16.16 | 7.16 |

| Payout ratio | 1.14% | 31.07% |

| Dividend yield | 0.03% | 1.51% |

Interpretation of Financial Ratios

NVIDIA showcases strong financial health with a high ROE and ROIC, indicating exceptional profitability and efficient capital use. In contrast, Microchip struggles with a negative ROE, highlighting potential concerns about its profitability. Furthermore, NVIDIA’s strong current and quick ratios suggest robust liquidity, while Microchip’s ratios indicate liquidity challenges. Investors should weigh these metrics carefully, especially considering Microchip’s higher debt levels relative to its assets.

Dividend and Shareholder Returns

NVIDIA (NVDA) has a modest dividend yield of 0.03% and a low payout ratio of approximately 1.1%, indicating a focus on reinvesting profits for growth. However, they also conduct share buybacks, which can enhance shareholder value. In contrast, Microchip Technology (MCHP) offers a more attractive dividend yield of 1.87% with a payout ratio of about 31%, suggesting a balanced approach between rewarding shareholders and maintaining growth potential. Both companies appear to support sustainable long-term value creation for their shareholders through their respective strategies.

Strategic Positioning

NVIDIA (NVDA) commands a significant market share in the semiconductor industry, particularly in graphics processing units (GPUs) and AI computing, with a market cap of 4.33T. Its competitive edge is bolstered by continuous innovation and strategic partnerships. In contrast, Microchip Technology (MCHP), with a market cap of 27.92B, focuses on embedded control solutions and faces competitive pressure, particularly from larger firms like NVDA. Both companies are navigating technological disruptions, but NVIDIA’s strong market position in AI and gaming offers it a robust advantage.

Stock Comparison

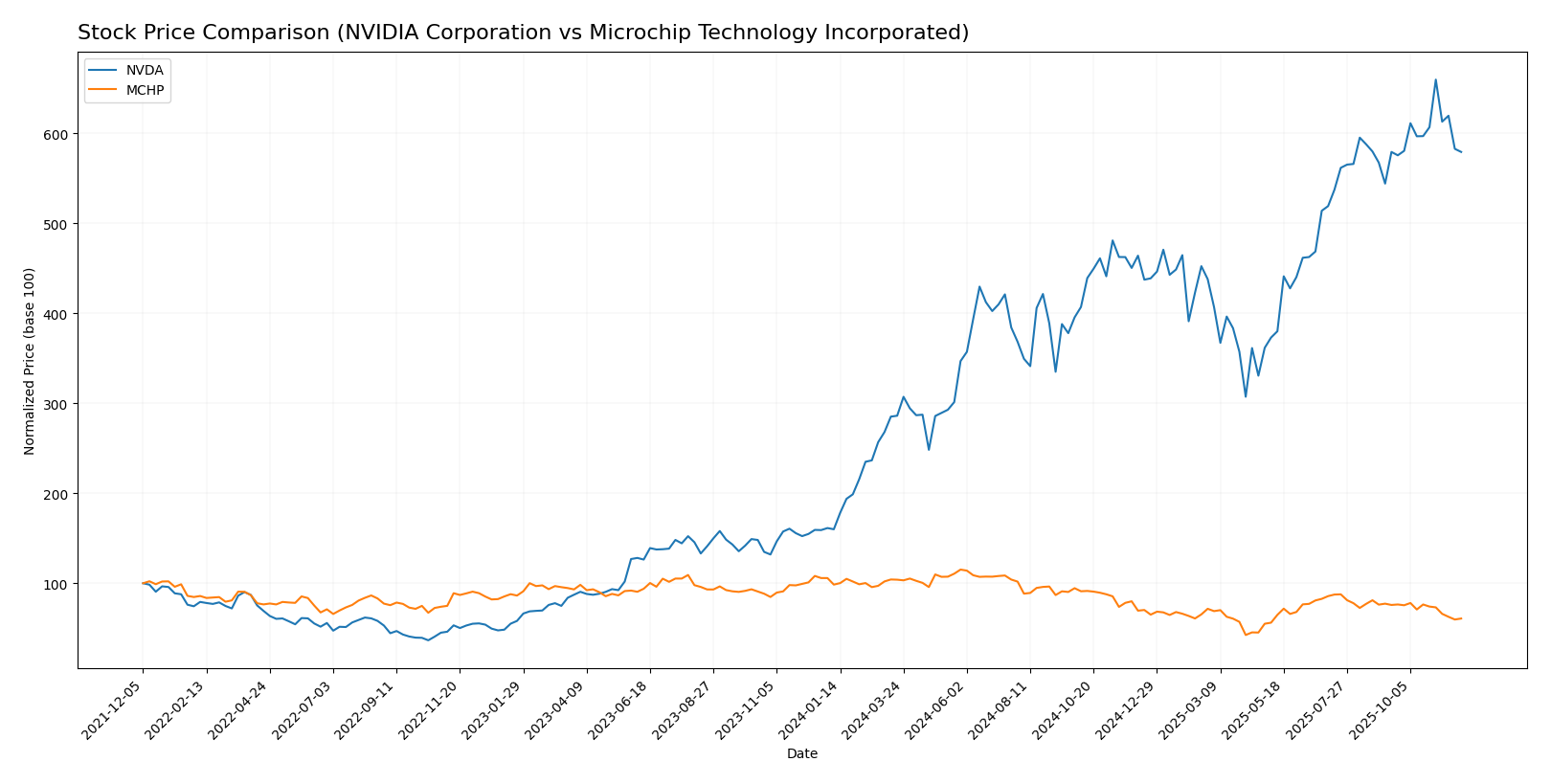

In analyzing the stock price movements of NVIDIA Corporation (NVDA) and Microchip Technology Incorporated (MCHP) over the past year, we observe significant fluctuations and trading dynamics that have shaped their respective market positions.

Trend Analysis

For NVIDIA Corporation (NVDA), the overall percentage change over the past year is a substantial +262.16%, indicating a bullish trend. Despite this impressive gain, the trend shows signs of deceleration, with the highest price recorded at 202.49 and the lowest at 49.1. The standard deviation of 35.0 suggests notable volatility in its price movements.

In the recent period from September 14, 2025, to November 30, 2025, the percentage change is stable at 0.0%, reflecting a neutral trend. The trend slope of 0.59 indicates minimal upward movement, and the standard deviation of 7.11 reaffirms the relative stability compared to the previous year.

Conversely, Microchip Technology Incorporated (MCHP) reveals a concerning overall percentage change of -38.29%, categorizing it as a bearish trend. The price has fluctuated between a high of 98.23 and a low of 36.22, with a standard deviation of 14.89 indicating moderate volatility in its trading behavior.

During the recent timeframe from September 14, 2025, to November 30, 2025, MCHP experienced a further decline of -19.89%, reinforcing its bearish trend. The trend slope of -1.38 and a standard deviation of 5.46 suggest that the stock is facing continued downward pressure with decreasing momentum.

In summary, NVDA shows strong upward potential despite recent stability, while MCHP is currently in a challenging position with declining prices. As always, I recommend cautious evaluation of both stocks based on these trends and their respective market conditions.

Analyst Opinions

Recent analyst recommendations indicate a mixed outlook for key players in the tech sector. NVIDIA Corporation (NVDA) has received a “B+” rating, suggesting a positive stance from analysts, with notable strengths in return on equity and assets. Conversely, Microchip Technology Incorporated (MCHP) holds a “C-” rating, reflecting concerns about its financial metrics. Analysts recommend buying NVDA, while MCHP is more of a hold. The consensus for NVDA is a strong buy, while MCHP leans towards a cautious hold for 2025.

Stock Grades

The latest stock ratings from recognized grading companies provide valuable insights into the market positions of NVIDIA and Microchip Technology.

NVIDIA Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Melius Research | maintain | Buy | 2025-11-20 |

| Argus Research | maintain | Buy | 2025-11-20 |

| Benchmark | maintain | Buy | 2025-11-20 |

| Keybanc | maintain | Overweight | 2025-11-20 |

| Rosenblatt | maintain | Buy | 2025-11-20 |

| JP Morgan | maintain | Overweight | 2025-11-20 |

| Bernstein | maintain | Outperform | 2025-11-20 |

| Citigroup | maintain | Buy | 2025-11-20 |

| Cantor Fitzgerald | maintain | Overweight | 2025-11-20 |

| Barclays | maintain | Overweight | 2025-11-20 |

Microchip Technology Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | maintain | Positive | 2025-11-07 |

| Truist Securities | maintain | Hold | 2025-11-07 |

| Citigroup | maintain | Buy | 2025-11-07 |

| Needham | maintain | Buy | 2025-11-07 |

| Stifel | maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-07 |

| Wells Fargo | maintain | Equal Weight | 2025-11-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-04 |

| Needham | maintain | Buy | 2025-08-08 |

| Piper Sandler | maintain | Overweight | 2025-08-08 |

Overall, both NVIDIA and Microchip Technology showcase a strong tendency for maintenance of their grades, reflecting stable confidence from analysts. Notably, NVIDIA consistently receives high ratings, while Microchip maintains a generally positive sentiment with a mix of holds and buys.

Target Prices

Based on the latest consensus from analysts, I have identified reliable target prices for two companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| NVIDIA Corporation (NVDA) | 352 | 200 | 261.77 |

| Microchip Technology Inc. (MCHP) | 83 | 60 | 71.33 |

For NVIDIA, analysts expect a target consensus of 261.77, significantly above its current price of 177.82, indicating strong upside potential. Microchip Technology has a consensus target of 71.33, also above its current price of 51.83, suggesting favorable expectations as well.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of NVIDIA Corporation (NVDA) and Microchip Technology Incorporated (MCHP).

| Criterion | NVIDIA Corporation (NVDA) | Microchip Technology Incorporated (MCHP) |

|---|---|---|

| Diversification | High (multiple sectors) | Moderate (focus on embedded solutions) |

| Profitability | Strong (net margin 55.8%) | Weak (net margin -0.01%) |

| Innovation | High (leading in AI tech) | Moderate (steady tech advancements) |

| Global presence | Extensive (operates globally) | Moderate (primarily in the Americas, Europe, and Asia) |

| Market Share | Significant (dominant in GPUs) | Growing (in niche embedded markets) |

| Debt level | Low (debt to equity 0.13) | High (debt to equity 0.80) |

Key takeaways indicate that while NVIDIA showcases strong profitability and innovation, Microchip Technology lags, particularly in profitability and debt levels. Diversification remains a strong suit for NVIDIA, which could mitigate risks better than Microchip.

Risk Analysis

The following table outlines the key risks associated with NVIDIA Corporation and Microchip Technology Incorporated based on the most recent data.

| Metric | NVIDIA Corporation | Microchip Technology Incorporated |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | High | Moderate |

In summary, both companies face significant market and geopolitical risks, particularly NVIDIA, which operates in a highly volatile semiconductor market. Microchip, while also exposed, has a slightly lower operational risk profile but faces high regulatory scrutiny.

Which one to choose?

In comparing NVIDIA (NVDA) and Microchip Technology (MCHP), the fundamentals indicate a clear distinction. NVIDIA showcases strong financial health with a market cap of $2.91T, a robust gross profit margin of 75%, and a B+ rating from analysts, reflecting high return on equity (ROE) and assets (ROA). The stock trend remains bullish with a price change of 262.16% over the past year, suggesting strong momentum.

Conversely, Microchip, with a market cap of $26B and a C- rating, faces challenges, including a bearish trend with a price decline of 38.29%. Its profit margins are notably lower, and the overall financial indicators reflect weaker performance.

For growth-oriented investors, I recommend NVDA for its strong fundamentals and bullish trend. In contrast, conservative investors seeking potential value may consider MCHP, though substantial risks exist due to its market dependence and competitive landscape.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of NVIDIA Corporation and Microchip Technology Incorporated to enhance your investment decisions: