In the rapidly evolving tech landscape, two companies are making waves in the quantum computing sector: Quantum Computing, Inc. (QUBT) and Arqit Quantum Inc. (ARQQ). While both operate within the technology industry, QUBT focuses on software tools for quantum computers, whereas ARQQ specializes in cybersecurity solutions leveraging quantum technology. This comparison will delve into their market strategies and innovations, helping you determine which company may be a more compelling investment opportunity.

Table of contents

Company Overview

Quantum Computing, Inc. Overview

Quantum Computing, Inc. (QUBT), established in 2018, operates within the computer hardware industry with a focus on quantum computing applications. The company is headquartered in Leesburg, Virginia, and offers innovative software tools, including Qatalyst, which accelerates the development of quantum-ready applications. QUBT aims to bridge the gap between classical and quantum computing, serving both commercial and governmental sectors. With a market capitalization of approximately $1.58B, the company is positioned as a key player in the nascent quantum computing space, leveraging partnerships with leading quantum hardware providers.

Arqit Quantum Inc. Overview

Arqit Quantum Inc. (ARQQ), founded in 2021 and based in London, specializes in cybersecurity solutions through quantum technology. The company’s flagship product, QuantumCloud, allows devices to generate encryption keys securely, utilizing both satellite and terrestrial platforms. With a market cap of around $394M, Arqit focuses on enhancing security in a digital world increasingly susceptible to cyber threats. Its innovative approach positions it as a leader in the software-infrastructure sector, particularly in the realm of quantum-based cybersecurity.

Key Similarities and Differences

Both Quantum Computing, Inc. and Arqit Quantum Inc. are engaged in the technology sector, focusing on the application of quantum solutions. However, while QUBT emphasizes the development of quantum computing applications for broader use, ARQQ targets the niche market of cybersecurity, offering sophisticated encryption solutions. This distinction highlights their different strategic focuses within the evolving quantum landscape.

Income Statement Comparison

The following table compares the income statements of Quantum Computing, Inc. (QUBT) and Arqit Quantum Inc. (ARQQ) for their most recent fiscal years, offering insights into their financial performance.

| Metric | QUBT | ARQQ |

|---|---|---|

| Revenue | 373K | 293K |

| EBITDA | -62.2M | -20.2M |

| EBIT | -66.0M | -23.8M |

| Net Income | -68.5M | -54.6M |

| EPS | -0.73 | -10.79 |

Interpretation of Income Statement

In the most recent fiscal year, QUBT’s revenue of 373K reflects a modest increase from 358K the previous year, but its net income loss widened significantly from -27M to -68.5M. This indicates a deteriorating financial performance, driven by high operating expenses. Conversely, ARQQ’s revenue declined sharply from 640K in the prior year to 293K, contributing to a substantial net income loss of -54.6M. The drastic drop in revenue suggests operational challenges, despite significant past profitability. Overall, both companies face significant hurdles, with QUBT displaying marginal revenue growth but worsening net income, while ARQQ struggles with declining revenue and increasing losses.

Financial Ratios Comparison

The table below provides a comparative overview of the most recent financial ratios for Quantum Computing, Inc. (QUBT) and Arqit Quantum Inc. (ARQQ).

| Metric | QUBT | ARQQ |

|---|---|---|

| ROE | -63.89% | -4.62% |

| ROIC | -17.41% | -1.67% |

| P/E | -22.67 | -0.53 |

| P/B | 14.48 | 2.44 |

| Current Ratio | 17.36 | 1.94 |

| Quick Ratio | 17.36 | 1.94 |

| D/E | 0.011 | 0.084 |

| Debt-to-Assets | 0.008 | 0.084 |

| Interest Coverage | -10.39 | -110.72 |

| Asset Turnover | 0.0024 | 0.011 |

| Fixed Asset Turnover | 0.038 | 0.272 |

| Payout ratio | -0.003 | 0 |

| Dividend yield | 0.00014 | 0 |

Interpretation of Financial Ratios

The ratios indicate significant weaknesses for both companies. QUBT’s high P/B ratio suggests overvaluation relative to its book value, while ARQQ’s negative P/E indicates ongoing losses. The current and quick ratios for QUBT are exceptionally high, signaling strong liquidity, but also potential inefficiencies in asset management. Both companies show concerning debt levels in relation to their assets and earnings, emphasizing the need for cautious investment strategies.

Dividend and Shareholder Returns

Neither Quantum Computing, Inc. (QUBT) nor Arqit Quantum Inc. (ARQQ) pays dividends, primarily due to negative net incomes and a focus on reinvestment strategies for growth. Both companies engage in share buybacks, which might indicate a desire to provide shareholder returns despite the absence of dividends. This approach aligns with long-term value creation, as it allows them to allocate capital towards innovation and expansion, although it also carries risks if profitability remains elusive.

Strategic Positioning

Quantum Computing, Inc. (QUBT) holds a competitive market position in quantum software applications, with a market cap of $1.58B. Their Qatalyst platform positions them as a leader in enabling developers to transition to quantum computing. In contrast, Arqit Quantum Inc. (ARQQ), with a market cap of $394M, focuses on cybersecurity through its QuantumCloud service, which also faces competitive pressures from emerging technologies. Both companies are navigating rapid technological disruptions in their sectors.

Stock Comparison

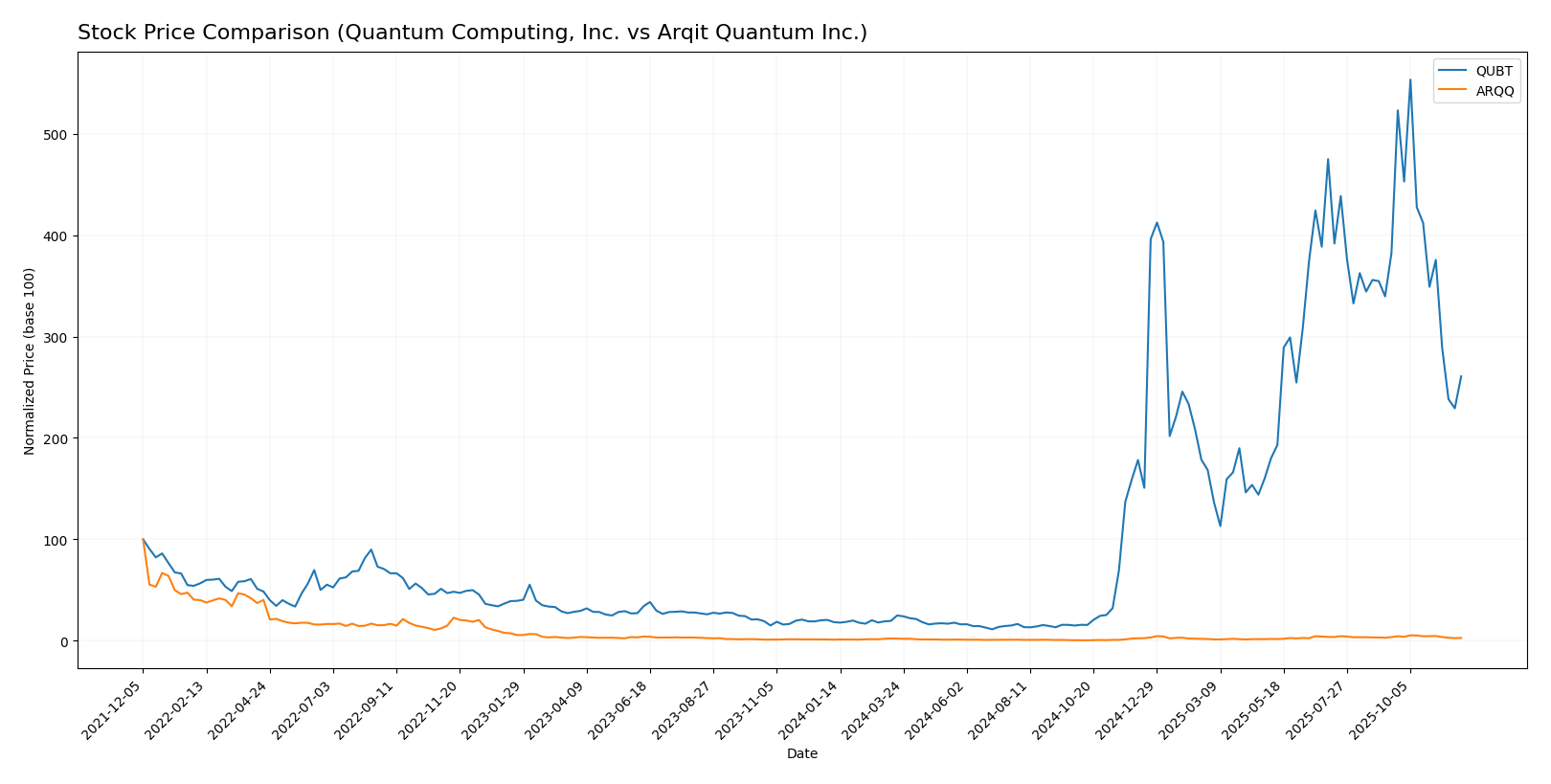

In this section, I will analyze the weekly stock price movements of Quantum Computing, Inc. (QUBT) and Arqit Quantum Inc. (ARQQ) over the past year, highlighting significant price trends and trading dynamics that may influence investor decisions.

Trend Analysis

Quantum Computing, Inc. (QUBT) Over the past year, QUBT has experienced an impressive price change of +1318.09%, indicating a bullish trend. However, from September 14, 2025, to November 30, 2025, the stock has seen a decline of -31.8%. The overall trend shows deceleration, with a highest price of 24.62 and a lowest price of 0.5. The standard deviation of 7.07 suggests moderate volatility.

Arqit Quantum Inc. (ARQQ) ARQQ has recorded a price change of +156.12% over the past year, also indicating a bullish trend. Similarly, the recent analysis from September 14, 2025, to November 30, 2025, shows a decline of -23.64%. The trend is characterized by deceleration, with a highest price of 49.92 and a lowest price of 4.19. The standard deviation of 11.8 indicates higher volatility compared to QUBT.

Both stocks exhibit notable long-term gains, but recent declines warrant cautious observation for potential investor strategies.

Analyst Opinions

Recent analyst recommendations for Quantum Computing, Inc. (QUBT) indicate a cautious stance with a rating of C+, reflecting concerns about its return on equity and earnings metrics. Analysts suggest holding the stock while monitoring its performance. In contrast, Arqit Quantum Inc. (ARQQ) received a C rating, prompting similar advice to hold, primarily due to its moderate financial health and low price-to-book ratio. Overall, the consensus for both companies leans towards holding, as analysts urge investors to stay informed about market developments before making significant moves.

Stock Grades

In the current market environment, it’s essential to keep an eye on the stock ratings provided by reputable grading companies. Below are the stock grades for two companies in the quantum computing sector.

Quantum Computing, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Lake Street | Maintain | Buy | 2025-11-17 |

| Ascendiant Capital | Maintain | Buy | 2025-10-03 |

| Ascendiant Capital | Maintain | Buy | 2025-06-06 |

| Ascendiant Capital | Maintain | Buy | 2025-04-28 |

| Ascendiant Capital | Maintain | Buy | 2024-11-13 |

| Ascendiant Capital | Maintain | Buy | 2023-11-24 |

Arqit Quantum Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-10-13 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-18 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-31 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-11 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-05-15 |

| HC Wainwright & Co. | Maintain | Buy | 2023-11-22 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-27 |

| HC Wainwright & Co. | Maintain | Buy | 2023-09-26 |

Overall, both Quantum Computing, Inc. and Arqit Quantum Inc. have consistently received a “Buy” rating from their respective grading companies. This trend indicates a positive outlook for both stocks, suggesting they may be solid options for investors looking to expand their portfolios in the quantum computing sector.

Target Prices

Based on the latest reliable data, here are the consensus target prices for the selected companies:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Quantum Computing, Inc. (QUBT) | 40 | 10 | 22 |

| Arqit Quantum Inc. (ARQQ) | 60 | 60 | 60 |

For Quantum Computing, Inc. (QUBT), the consensus target price of 22 suggests potential upside from its current price of 11.6. In contrast, Arqit Quantum Inc. (ARQQ) has a strong consensus target of 60, indicating robust analyst confidence as it trades at 25.74, suggesting significant growth potential.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Quantum Computing, Inc. (QUBT) and Arqit Quantum Inc. (ARQQ) based on recent data.

| Criterion | Quantum Computing, Inc. (QUBT) | Arqit Quantum Inc. (ARQQ) |

|---|---|---|

| Diversification | Limited product offerings | Diverse cybersecurity solutions |

| Profitability | Negative margins (-183.76%) | Negative margins (-186.28%) |

| Innovation | Focus on quantum applications | Novel encryption technology |

| Global presence | Primarily US-focused | UK-based with global reach |

| Market Share | Niche market | Emerging player |

| Debt level | Low debt (0.008) | Moderate debt (0.037) |

In summary, both companies face challenges with profitability and market presence, but they exhibit opportunities for innovation and growth in their respective fields.

Risk Analysis

The following table outlines key risks associated with Quantum Computing, Inc. (QUBT) and Arqit Quantum Inc. (ARQQ).

| Metric | QUBT | ARQQ |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | High |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

In summary, both companies face significant operational and market risks, with QUBT exhibiting greater volatility and regulatory concerns. ARQQ is subject to geopolitical and regulatory risks, particularly in the dynamic cybersecurity sector.

Which one to choose?

When comparing Quantum Computing, Inc. (QUBT) and Arqit Quantum Inc. (ARQQ), both companies exhibit significant challenges. QUBT has a market cap of $1.55B, with a troubling negative net profit margin of -183.76% and a price-to-earnings ratio of -22.67. ARQQ, with a market cap of $28.84M, also faces struggles, showcasing a net profit margin of -186.28%. However, ARQQ has shown a better overall trend with a price change of +156.12%, compared to QUBT’s +1318.09%, albeit with a recent decline of 23.64%. QUBT’s rating stands at C+, while ARQQ has a rating of C.

Investors focused on growth may prefer QUBT due to its higher overall trend percentage, while those prioritizing stability might favor ARQQ given its more manageable market cap and recent performance. Both face industry-specific risks, including competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Quantum Computing, Inc. and Arqit Quantum Inc. to enhance your investment decisions: