In the rapidly evolving realm of quantum computing, two companies stand out: Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT). Both operate within the computer hardware industry, yet they adopt distinct innovation strategies—Rigetti focuses on building quantum computers and their integrated systems, while Quantum Computing specializes in software tools for quantum applications. As we delve into their strengths and market positions, this article aims to uncover which company may offer the most promising investment opportunity for you.

Table of contents

Company Overview

Rigetti Computing, Inc. Overview

Rigetti Computing, Inc. is at the forefront of quantum computing, specializing in the development of quantum computers and the superconducting quantum processors that power them. Founded in 2013 and based in Berkeley, California, Rigetti integrates its quantum machines into various cloud environments through its Quantum Cloud Services platform. With a market capitalization of approximately $8.6B, the company operates within the technology sector, emphasizing innovation and accessibility in quantum computing solutions for diverse clients.

Quantum Computing, Inc. Overview

Quantum Computing, Inc. focuses on enhancing the software landscape for quantum computing. Established in 2018 and headquartered in Leesburg, Virginia, it offers products like Qatalyst, which enables developers to create applications that are both quantum-ready and executable on conventional systems. With a market cap of around $1.58B, the company serves commercial and government sectors, positioning itself as a key player in the quantum software domain.

Key similarities in their business models include a focus on quantum computing technology and integration into cloud services. However, while Rigetti emphasizes hardware development, Quantum Computing, Inc. concentrates on software solutions, showcasing the diverse approaches within the quantum computing industry.

Income Statement Comparison

The following table summarizes the income statements of Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) for the most recent fiscal year.

| Metric | RGTI | QUBT |

|---|---|---|

| Revenue | 10.79M | 0.37M |

| EBITDA | -190.83M | -62.25M |

| EBIT | -197.73M | -66.05M |

| Net Income | -200.99M | -68.54M |

| EPS | -1.09 | -0.73 |

Interpretation of Income Statement

In the latest fiscal year, Rigetti Computing (RGTI) experienced a decline in revenue to 10.79M, down from 12.01M in the previous year, while Quantum Computing (QUBT) improved slightly from 0.36M to 0.37M. Both companies reported substantial net losses, with RGTI’s net income at -200.99M and QUBT at -68.54M. RGTI’s margins continue to deteriorate, reflecting significant increases in operational costs and R&D expenses. QUBT, while still operating at a loss, showed marginal growth in revenue, indicating potential stabilization. Overall, both companies face ongoing challenges, with RGTI’s performance particularly concerning due to its larger net loss and negative EBITDA.

Financial Ratios Comparison

The table below compares the most recent financial metrics of Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) to help you evaluate their financial health.

| Metric | RGTI | QUBT |

|---|---|---|

| ROE | -158.77% | -63.89% |

| ROIC | -24.91% | -17.41% |

| P/E | -14.02 | -22.67 |

| P/B | 22.26 | 14.48 |

| Current Ratio | 17.42 | 17.36 |

| Quick Ratio | 17.42 | 17.36 |

| D/E | 0.07 | 0.01 |

| Debt-to-Assets | 3.09% | 0.77% |

| Interest Coverage | -21.05 | -10.39 |

| Asset Turnover | 0.037 | 0.002 |

| Fixed Asset Turnover | 0.205 | 0.038 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 1.42% |

Interpretation of Financial Ratios

Both companies exhibit negative return ratios, indicating challenges in generating profit relative to equity and invested capital. RGTI shows a significantly higher P/B ratio, suggesting that investors are paying a premium for its assets compared to QUBT. A high current ratio for both companies indicates strong liquidity, but the negative interest coverage ratios raise concerns about their ability to manage debt obligations effectively. Overall, both firms face financial difficulties that warrant caution for potential investors.

Dividend and Shareholder Returns

Rigetti Computing, Inc. (RGTI) does not pay dividends, reflecting its focus on reinvestment during a challenging growth phase, evidenced by negative net income and ongoing operational losses. Instead, the company engages in share buybacks, which can enhance shareholder value if executed prudently. On the other hand, Quantum Computing, Inc. (QUBT) similarly refrains from dividends but provides a small annual yield of approximately 1.42%, indicating a cautious approach to shareholder returns. Neither company’s current strategies fully support sustainable long-term value creation, given their financial struggles.

Strategic Positioning

In the competitive landscape of quantum computing, Rigetti Computing, Inc. (RGTI) holds a significant market share with its integrated systems and Quantum Cloud Services. With a market cap of $8.61B, RGTI is a formidable player despite facing competitive pressure from Quantum Computing, Inc. (QUBT), which, with a market cap of $1.58B, focuses on software tools for quantum applications. The technological disruption in this sector demands continuous innovation and adaptability to maintain a competitive edge.

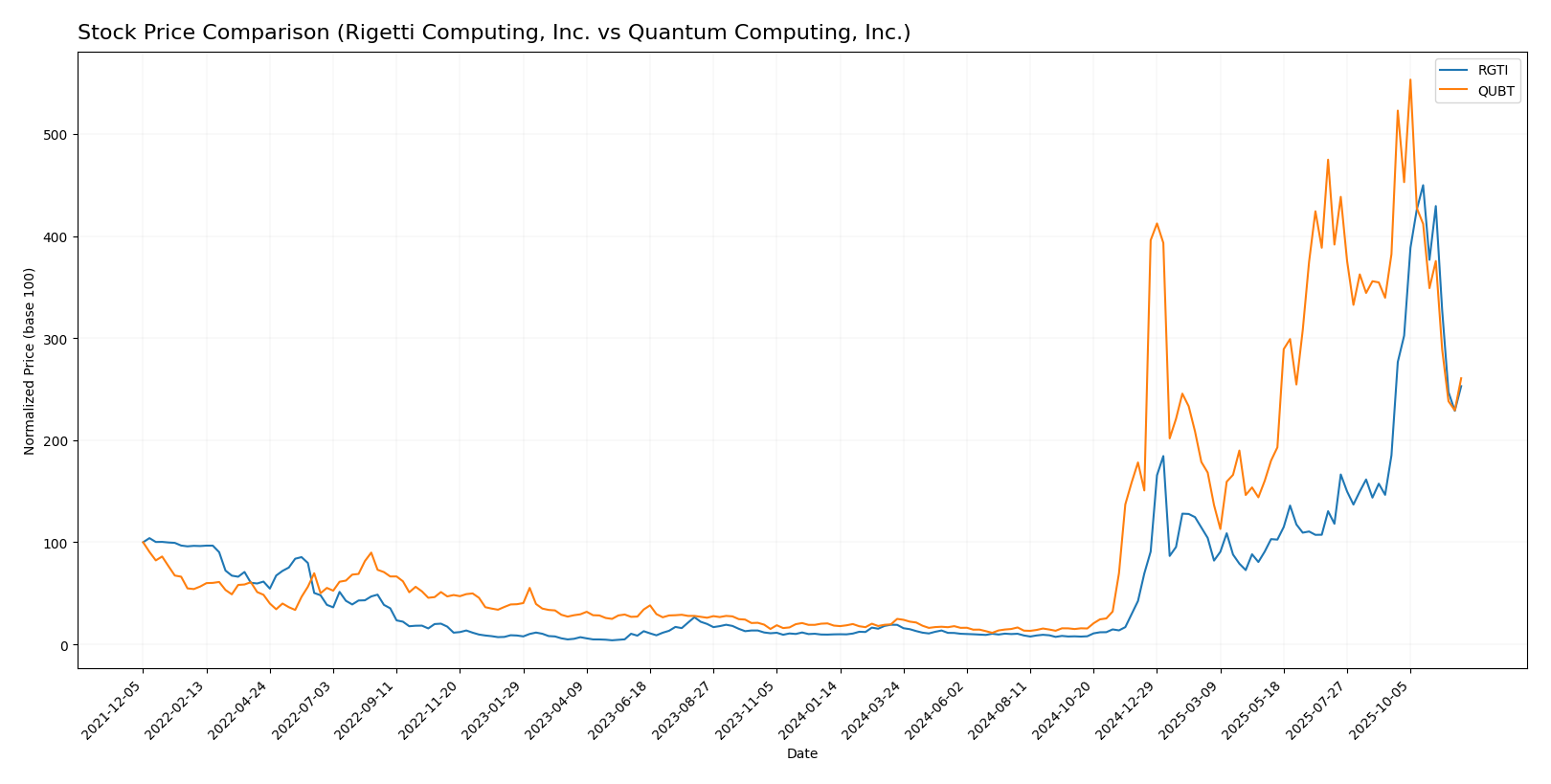

Stock Comparison

In this section, I will analyze the weekly stock price performance of Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) over the past year, highlighting significant price movements and trading dynamics.

Trend Analysis

For Rigetti Computing, Inc. (RGTI), the overall price change over the past year is a remarkable +2482.18%. This indicates a strong bullish trend, although the acceleration status is showing deceleration. The stock has experienced notable highs of 46.38 and lows of 0.75, with a standard deviation of 10.82, suggesting some volatility in its price movement.

In the recent analysis period from September 14, 2025, to November 30, 2025, RGTI showed a price change of +36.62% with a standard deviation of 8.74. The trend slope is slightly negative at -0.16, indicating a potential cooling off from the recent highs.

For Quantum Computing, Inc. (QUBT), the overall price change over the past year stands at +1318.09%, which also reflects a bullish trend but with a deceleration status. The stock has fluctuated between a high of 24.62 and a low of 0.5, with a standard deviation of 7.07.

However, during the recent period from September 14, 2025, to November 30, 2025, QUBT has seen a decline of -31.8%. The standard deviation here is 4.54, indicating lower volatility compared to RGTI. The trend slope is -1.09, reinforcing the bearish movement in this short timeframe.

In summary, while both companies have experienced significant bullish trends over the year, recent performance indicates a contrasting picture, with RGTI maintaining upward momentum despite a deceleration, while QUBT is facing challenges in the short term.

Analyst Opinions

Recent recommendations for Rigetti Computing, Inc. (RGTI) are generally cautious, with analysts assigning a rating of C-. The primary concerns include low scores in discounted cash flow and return metrics. In contrast, Quantum Computing, Inc. (QUBT) has a slightly more favorable C+ rating, driven by better debt-to-equity performance. However, both companies face challenges. The consensus for RGTI leans towards a hold, while QUBT is similarly rated. Analysts emphasize the importance of careful evaluation before making investment decisions in this sector.

Stock Grades

I have reviewed the stock ratings for Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) based on recent evaluations from reputable grading companies.

Rigetti Computing, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | maintain | Neutral | 2025-11-12 |

| Benchmark | maintain | Buy | 2025-11-12 |

| B. Riley Securities | downgrade | Neutral | 2025-11-03 |

| Benchmark | maintain | Buy | 2025-10-07 |

| B. Riley Securities | maintain | Buy | 2025-09-22 |

| Benchmark | maintain | Buy | 2025-08-13 |

| Needham | maintain | Buy | 2025-08-04 |

| B. Riley Securities | maintain | Buy | 2025-07-23 |

| Benchmark | maintain | Buy | 2025-05-15 |

| Needham | maintain | Buy | 2025-05-14 |

Quantum Computing, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Lake Street | maintain | Buy | 2025-11-17 |

| Ascendiant Capital | maintain | Buy | 2025-10-03 |

| Ascendiant Capital | maintain | Buy | 2025-06-06 |

| Ascendiant Capital | maintain | Buy | 2025-04-28 |

| Ascendiant Capital | maintain | Buy | 2024-11-13 |

| Ascendiant Capital | maintain | Buy | 2023-11-24 |

In summary, both companies exhibit a consistent trend in their grades. RGTI has seen some fluctuations, with a recent downgrade to Neutral by B. Riley Securities, while Benchmark continues to maintain a Buy rating. On the other hand, QUBT has maintained a solid Buy rating across several assessments, indicating strong investor confidence.

Target Prices

The current consensus target prices from analysts for Rigetti Computing, Inc. and Quantum Computing, Inc. indicate a positive outlook for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rigetti Computing, Inc. | 42 | 18 | 33.33 |

| Quantum Computing, Inc. | 40 | 10 | 22 |

For Rigetti Computing, the consensus target price of 33.33 suggests a significant upside potential compared to its current price of 26.08. Meanwhile, Quantum Computing’s consensus of 22 indicates a favorable outlook relative to its current price of 11.6, highlighting overall analyst optimism for both stocks.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT) based on the most recent financial data.

| Criterion | Rigetti Computing, Inc. (RGTI) | Quantum Computing, Inc. (QUBT) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins (-18.63%) | Negative margins (-183.76%) |

| Innovation | Strong focus on quantum systems | Moderate software focus |

| Global presence | Limited | Limited |

| Market Share | Growing | Emerging |

| Debt level | Low (3.09% debt-to-assets) | Very low (0.77% debt-to-assets) |

Key takeaways: Rigetti shows potential in innovation and market growth, though profitability remains a concern. Quantum Computing’s negative margins highlight the challenges ahead, but its low debt level offers some financial stability. Both companies present unique risks and opportunities for investors.

Risk Analysis

In the table below, I outline key risks associated with Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT).

| Metric | RGTI | QUBT |

|---|---|---|

| Market Risk | High | Very High |

| Regulatory Risk | Medium | High |

| Operational Risk | High | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Medium | Medium |

Both companies face significant market and operational risks, primarily driven by their positions in the volatile technology sector. Recent market fluctuations and regulatory changes may further exacerbate these challenges.

Which one to choose?

In comparing Rigetti Computing, Inc. (RGTI) and Quantum Computing, Inc. (QUBT), RGTI shows a higher market capitalization of approximately $2.82B compared to QUBT’s $1.55B. RGTI has a better overall rating of C- against QUBT’s C+, indicating a more favorable financial outlook. However, both companies are grappling with significant net losses, with RGTI reporting a net income of -$201M for 2024, while QUBT’s loss stands at -$68.5M.

RGTI has demonstrated a remarkable bullish price trend with a percentage change of +2482.18%, though it faces high volatility. In contrast, QUBT’s recent performance indicates a decline of -31.8%. Investors aiming for growth may prefer RGTI, while those prioritizing stability may lean towards QUBT, despite its recent struggles.

Both companies carry risks related to competition and market dependence, which could impact their recovery trajectories.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Rigetti Computing, Inc. and Quantum Computing, Inc. to enhance your investment decisions: