In the rapidly evolving landscape of quantum computing, two companies stand out: Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS). Both operate within the computer hardware industry, focusing on innovative quantum solutions that cater to an array of sectors, from finance to healthcare. As they navigate this transformative market, I aim to provide you with a comprehensive comparison of their strategies and performances. Join me as we uncover which company presents the most compelling investment opportunity.

Table of contents

Company Overview

Rigetti Computing, Inc. Overview

Rigetti Computing, Inc. is a prominent player in the quantum computing sector, focused on building integrated quantum systems and superconducting quantum processors. Founded in 2013 and headquartered in Berkeley, CA, the company aims to democratize access to quantum computing through its Quantum Cloud Services platform, which allows users to integrate quantum machines into various cloud environments. With a market capitalization of approximately $8.61B and a current stock price of $26.08, Rigetti is positioned as a pivotal innovator in the technology landscape, emphasizing research and development to enhance quantum capabilities.

D-Wave Quantum Inc. Overview

D-Wave Quantum Inc. specializes in the development and delivery of quantum computing systems, software, and services on a global scale. Based in Burnaby, Canada, the company offers a comprehensive suite of products, including its fifth-generation quantum computer, Advantage, and cloud-based services like Leap, which provide real-time access to quantum computing resources. With a market cap of around $7.83B and a stock price of $22.57, D-Wave serves multiple industries such as finance, life sciences, and logistics, making it a competitive force in the evolving quantum landscape.

Key Similarities and Differences

Both Rigetti and D-Wave operate within the quantum computing industry and focus on providing cloud-based quantum solutions. However, Rigetti emphasizes integrated systems and superconducting processors, while D-Wave offers a broader range of software and professional services, catering to diverse industry applications. This distinction in their business models highlights a divergence in their strategic approaches to market penetration and customer engagement.

Income Statement Comparison

Below is a comparative analysis of the most recent income statements for Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS), highlighting their financial performance.

| Metric | RGTI | QBTS |

|---|---|---|

| Revenue | 10.79M | 8.83M |

| EBITDA | -190.83M | -138.05M |

| EBIT | -197.73M | -139.98M |

| Net Income | -200.99M | -143.88M |

| EPS | -1.09 | -0.75 |

Interpretation of Income Statement

In the latest fiscal year, both companies continued to experience significant losses, with RGTI reporting a revenue of 10.79M and a net income deficit of 200.99M, while QBTS generated 8.83M in revenue and a net income loss of 143.88M. Notably, both companies show a decrease in revenue compared to the previous year, indicating potential challenges in growth. The EBITDA margins remain deeply negative, reflecting high operational costs. Although QBTS’s losses are less severe than RGTI’s, both firms require strategic shifts to enhance profitability and improve investor confidence.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial ratios for Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS).

| Metric | RGTI | QBTS |

|---|---|---|

| ROE | -158.77% | -229.67% |

| ROIC | -24.91% | -45.51% |

| P/E | -14.02 | -11.22 |

| P/B | 22.26 | 25.76 |

| Current Ratio | 17.42 | 6.14 |

| Quick Ratio | 17.42 | 6.08 |

| D/E | 0.07 | 0.61 |

| Debt-to-Assets | 3.09% | 19.20% |

| Interest Coverage | -21.05 | -19.82 |

| Asset Turnover | 0.038 | 0.044 |

| Fixed Asset Turnover | 0.205 | 0.775 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

The financial ratios indicate that both companies face significant challenges. RGTI shows a notably high current and quick ratio, suggesting strong liquidity, while its negative returns on equity and invested capital raise concerns about profitability. QBTS also struggles with negative profitability metrics, albeit with relatively lower liquidity ratios. Both companies have yet to establish a sustainable dividend policy, reflecting their ongoing financial difficulties.

Dividend and Shareholder Returns

Neither Rigetti Computing, Inc. (RGTI) nor D-Wave Quantum Inc. (QBTS) pays dividends, as both companies are in growth phases, focusing on reinvestment and R&D. This strategy reflects their commitment to long-term shareholder value creation. Furthermore, both companies are engaged in share buyback programs, which can enhance shareholder value by reducing the total shares outstanding. However, the lack of dividends indicates potential risks, including reliance on future profitability for sustainable growth.

Strategic Positioning

In the competitive landscape of quantum computing, Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS) are prominent players. RGTI holds a market cap of $8.61B, leveraging its integrated quantum systems and cloud services. QBTS, with a market cap of $7.83B, differentiates itself through its fifth-generation quantum computer and comprehensive software suite. Both companies face intense pressure from emerging technologies and competitors, necessitating continuous innovation and strategic partnerships to maintain their market positions.

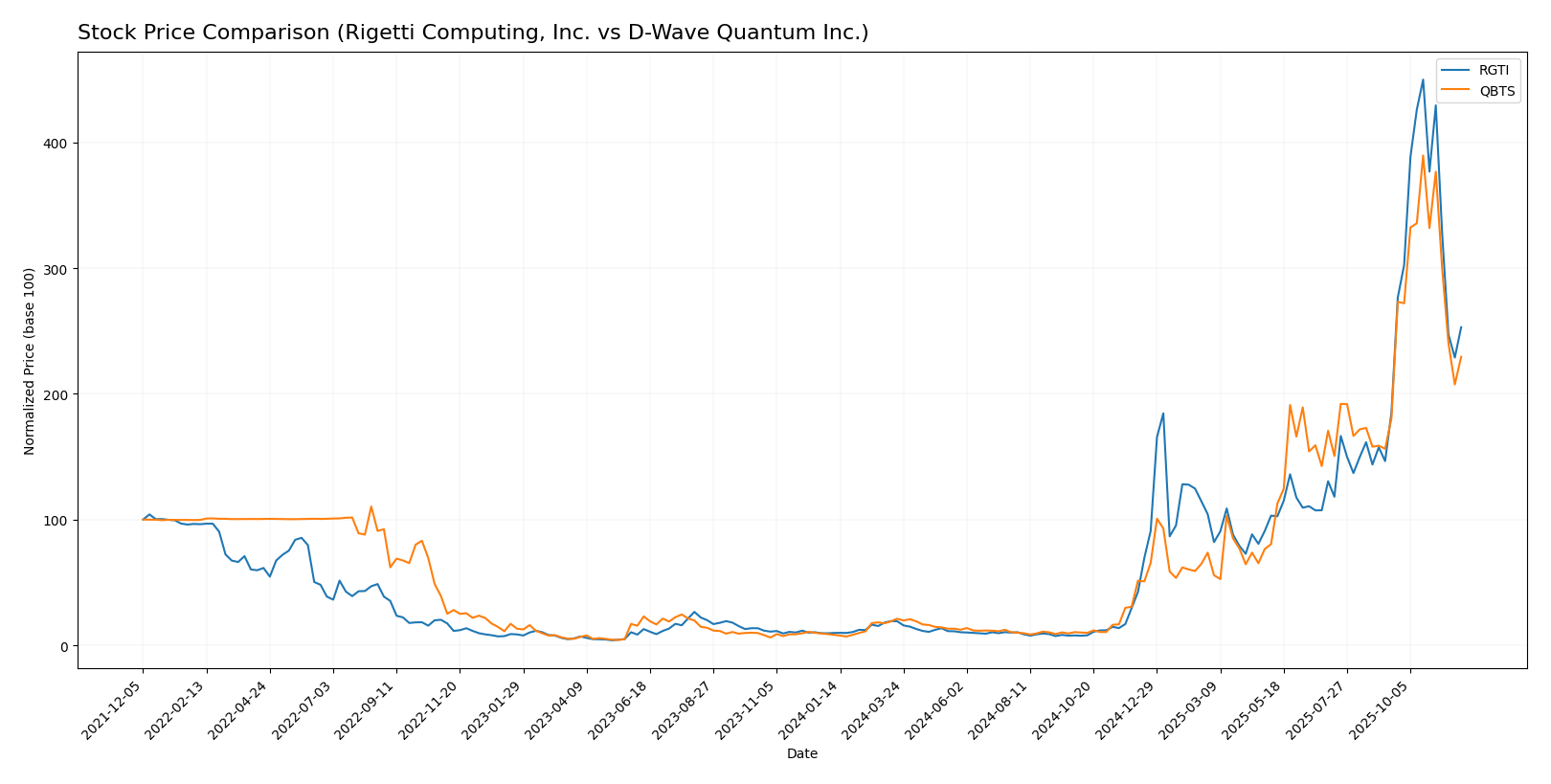

Stock Comparison

Over the past year, the stock prices of Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS) have exhibited remarkable movements, showcasing significant price advancements that highlight a robust trading dynamic.

Trend Analysis

Analyzing RGTI’s stock performance over the past year, I observe a remarkable price change of +2482.18%, which firmly establishes a bullish trend. Despite this considerable increase, the trend shows signs of deceleration, with notable highs reaching 46.38 and lows at 0.75. The standard deviation of 10.82 indicates moderate volatility, suggesting that while the stock has surged, the price fluctuations remain relatively stable.

In the recent period from September 14, 2025, to November 30, 2025, RGTI’s stock experienced a price change of +36.62%, with a standard deviation of 8.74, indicating a slight decline in trend slope at -0.16.

For QBTS, the analysis reveals an impressive price change of +2648.08% over the same timeframe, also categorizing it as bullish. This stock has similarly experienced deceleration in its price trend, with highs at 38.33 and lows at 0.69. The standard deviation of 9.45 suggests moderate volatility, reflecting a steady price increase amidst fluctuations.

In the recent analysis period from September 14, 2025, to November 30, 2025, QBTS showed a price change of +27.08%, with a standard deviation of 6.27 and a trend slope of -0.13, indicating a slight downward adjustment in momentum.

Analyst Opinions

Recent analyst opinions on Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS) reflect a cautious stance, with both companies receiving a “C-” rating. Analysts note concerns over their financial health, particularly in return on equity and cash flow metrics. Specifically, analysts emphasize the risks associated with high debt-to-equity ratios, which may hinder growth potential. Considering these factors, the consensus recommendation for both RGTI and QBTS is to hold, as they currently lack strong buy signals for 2025.

Stock Grades

In the ever-evolving landscape of the stock market, understanding the latest ratings from reputable grading companies can provide valuable insights for investors.

Rigetti Computing, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Neutral | 2025-11-12 |

| Benchmark | Maintain | Buy | 2025-11-12 |

| B. Riley Securities | Downgrade | Neutral | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Benchmark | Maintain | Buy | 2025-08-13 |

| Needham | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| Benchmark | Maintain | Buy | 2025-05-15 |

| Needham | Maintain | Buy | 2025-05-14 |

D-Wave Quantum Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2025-11-10 |

| Rosenblatt | Maintain | Buy | 2025-11-07 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

| Benchmark | Maintain | Buy | 2025-08-04 |

| B. Riley Securities | Maintain | Buy | 2025-07-23 |

| B. Riley Securities | Maintain | Buy | 2025-06-18 |

| Benchmark | Maintain | Buy | 2025-06-18 |

Overall, both Rigetti Computing and D-Wave Quantum are receiving consistent ratings, with notable support from Benchmark and B. Riley Securities. Rigetti’s grades reflect some recent volatility with a downgrade, while D-Wave maintains strong support across multiple grading companies. This suggests a stable outlook for D-Wave, while investors in Rigetti should monitor for further developments.

Target Prices

The consensus target prices for Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS) indicate positive expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Rigetti Computing, Inc. | 42 | 18 | 33.33 |

| D-Wave Quantum Inc. | 40 | 26 | 35.25 |

Analysts expect RGTI to reach a consensus price of 33.33, while QBTS has a consensus of 35.25. Both target prices suggest potential upside compared to their current stock prices of 26.08 and 22.57, respectively.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS).

| Criterion | Rigetti Computing, Inc. (RGTI) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins | Negative margins |

| Innovation | Strong in quantum tech | Strong in cloud solutions |

| Global presence | Limited | Moderate |

| Market Share | Emerging market | Established but niche |

| Debt level | Low | High |

In summary, both companies face profitability challenges, with RGTI showing stronger innovation capabilities. D-Wave has a more established presence, but its high debt level poses risks. Investors should weigh these factors carefully.

Risk Analysis

In the following table, I will outline key risks associated with Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS) for better decision-making in your investment strategies.

| Metric | Rigetti Computing, Inc. (RGTI) | D-Wave Quantum Inc. (QBTS) |

|---|---|---|

| Market Risk | High | High |

| Regulatory Risk | Moderate | Moderate |

| Operational Risk | High | High |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Both companies face high market and operational risks, primarily due to their positions in the rapidly evolving quantum computing sector. Recent volatility in tech stocks further amplifies these risks, necessitating cautious investment strategies.

Which one to choose?

In comparing Rigetti Computing, Inc. (RGTI) and D-Wave Quantum Inc. (QBTS), both companies exhibit similar challenges with substantial negative profit margins; RGTI’s net margin stands at -18.63%, while QBTS registers at -16.30%. RGTI has a higher market cap of 2.82B compared to QBTS at 1.61B. However, both companies have received a rating of C-, indicating limited growth potential and profitability concerns.

From a trend perspective, both stocks have experienced bullish movements over the past year, with RGTI showing a price change of 2482.18% and QBTS at 2648.08%. Analysts express caution, as both firms face industry risks related to competition and market dependence.

Investors focused on growth may prefer RGTI due to its larger market cap and higher price change percentage, while those prioritizing stability may find QBTS’s slightly better recent performance appealing.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Rigetti Computing, Inc. and D-Wave Quantum Inc. to enhance your investment decisions: