In the rapidly evolving landscape of technology, two companies stand out: Coherent, Inc. (COHR) and MKS Inc. (MKSI). Both operate within the Hardware, Equipment & Parts industry, offering innovative solutions that cater to similar markets, such as semiconductor and industrial applications. Their distinct approaches to innovation and market strategy make them intriguing subjects for comparison. In this article, I will help you determine which of these companies presents the most compelling investment opportunity.

Table of contents

Company Overview

Coherent, Inc. Overview

Coherent, Inc. specializes in providing advanced laser technologies and system solutions tailored for a wide array of commercial, industrial, and scientific applications. Founded in 1966 and headquartered in Santa Clara, California, the company operates in two main segments: Original Equipment Manufacturers (OEM) Laser Sources and Industrial Lasers & Systems. Coherent’s products are integral to sectors such as microelectronics, materials processing, and scientific research, positioning it as a leader within the hardware and equipment industry. As a subsidiary of II-VI Incorporated, Coherent continues to innovate and enhance its offerings, leveraging its extensive experience and market presence.

MKS Inc. Overview

MKS Inc., established in 1961 and based in Andover, Massachusetts, provides a comprehensive range of instruments, systems, and process control solutions that optimize manufacturing processes across various industries. The company’s diverse product portfolio includes vacuum control solutions, power delivery systems, and laser technologies, serving critical sectors like semiconductor manufacturing, life sciences, and defense. MKS emphasizes precision and reliability in its offerings, positioning itself as a key player in the hardware and equipment market, while its commitment to innovation drives continuous growth and market relevance.

Key similarities in the business models of Coherent and MKS include their focus on technological solutions for industrial applications and a commitment to innovation. However, they differ in their product offerings, with Coherent primarily centered on laser technologies and MKS providing a broader range of instrumentation and process control solutions.

Income Statement Comparison

The following table compares the income statements of Coherent, Inc. (COHR) and MKS Inc. (MKSI) for their most recent fiscal year, providing key financial metrics.

| Metric | Coherent, Inc. (COHR) | MKS Inc. (MKSI) |

|---|---|---|

| Revenue | 5.81B | 3.59B |

| EBITDA | 1.11B | 870M |

| EBIT | 551M | 522M |

| Net Income | 49M | 190M |

| EPS | -0.52 | 2.82 |

Interpretation of Income Statement

In the most recent fiscal year, Coherent, Inc. reported a revenue increase to 5.81B from 4.71B in 2024, signaling positive growth despite a net income of only 49M, indicating operational challenges. Conversely, MKS Inc. experienced a slight decrease in revenue from 3.62B to 3.59B but maintained a strong net income of 190M, demonstrating robust profitability and effective cost management. The contrasting trends in growth and profitability highlight the varying financial health of both companies, with Coherent facing significant challenges while MKS shows stability.

Financial Ratios Comparison

The following table compares the most recent Revenue and key financial ratios for Coherent, Inc. (COHR) and MKS Inc. (MKSI).

| Metric | COHR | MKSI |

|---|---|---|

| ROE | 0.61% | 8.18% |

| ROIC | 1.28% | 6.66% |

| P/E | 279.75 | 36.98 |

| P/B | 1.70 | 3.03 |

| Current Ratio | 2.19 | 3.19 |

| Quick Ratio | 1.39 | 2.04 |

| D/E | 0.48 | 2.06 |

| Debt-to-Assets | 26.11% | 55.65% |

| Interest Coverage | 2.20 | 1.44 |

| Asset Turnover | 0.39 | 0.42 |

| Fixed Asset Turnover | 3.09 | 3.55 |

| Payout Ratio | 23.17% | 31.05% |

| Dividend Yield | 0.08% | 0.84% |

Interpretation of Financial Ratios

Coherent, Inc.’s ratios indicate potential financial struggles, particularly with a very high P/E ratio of 279.75, suggesting overvaluation or low earnings. In contrast, MKS Inc. shows stronger profitability metrics with a more reasonable P/E and higher returns on equity and invested capital. However, MKS’s high debt-to-equity ratio of 2.06 raises concerns about financial leverage and risk management. Investors should consider these ratios carefully when evaluating potential investments.

Dividend and Shareholder Returns

Coherent, Inc. (COHR) pays a small dividend with a payout ratio of 23.17% and a yield of 0.08%. However, the company’s net profit margin is currently low at 0.85%, raising concerns about sustainability. In contrast, MKS Inc. (MKSI) offers a dividend yield of 0.84% and a payout ratio of 31.05%, indicating a commitment to returning value to shareholders. Both companies engage in share buybacks, but I recommend cautious monitoring of their financial health to ensure long-term value creation.

Strategic Positioning

Coherent, Inc. (COHR) holds a significant market share in the laser technology sector, focusing on OEM laser sources and industrial systems. It faces competitive pressure from MKS Inc. (MKSI), which offers a broader range of process control solutions and laser products. Both companies are navigating technological disruptions as advancements in manufacturing processes evolve. COHR’s market cap stands at 23B, while MKSI’s is 10B, reflecting their respective positions in the market.

Stock Comparison

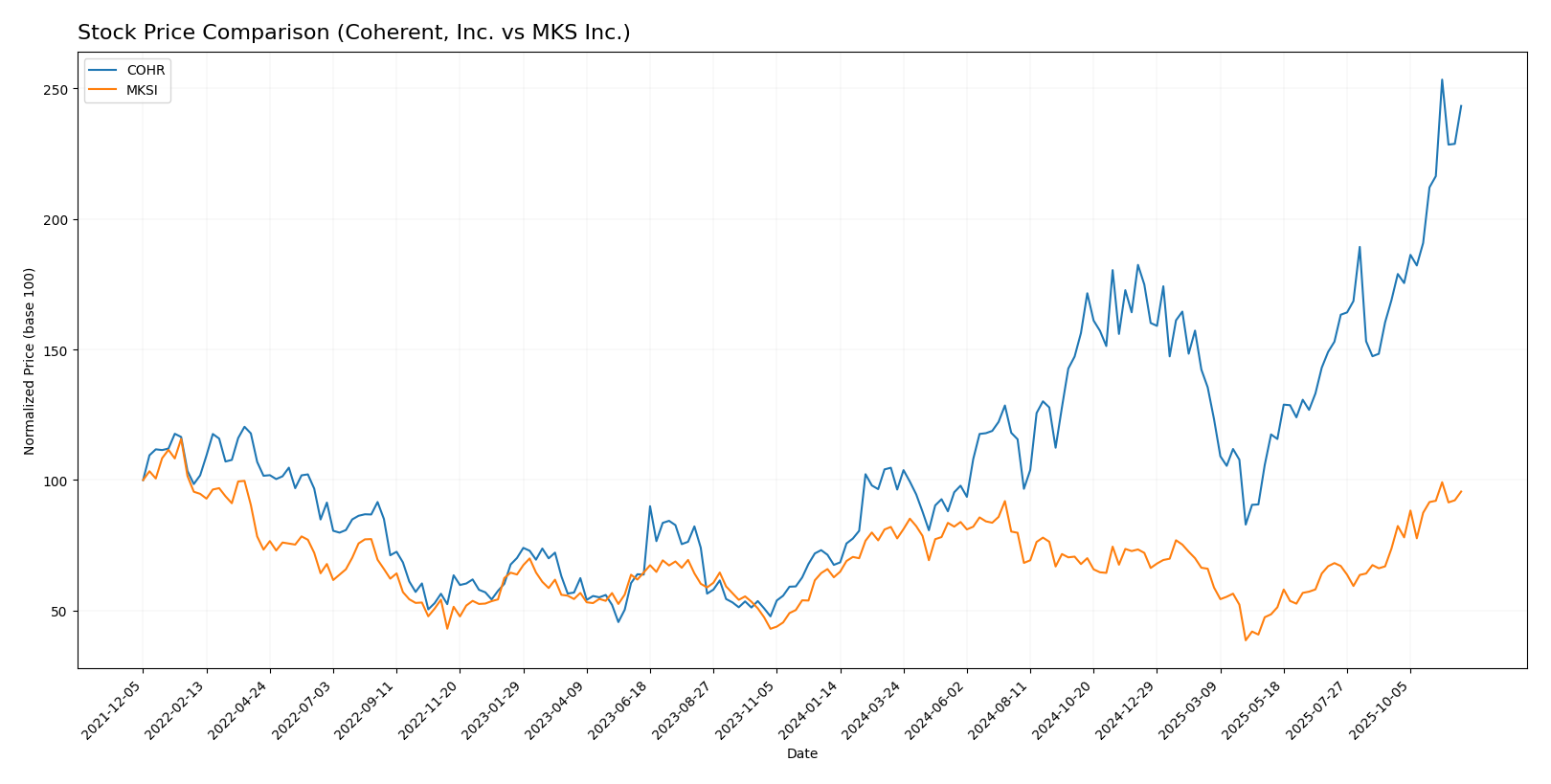

In analyzing the weekly stock price movements of Coherent, Inc. (COHR) and MKS Inc. (MKSI) over the past year, we observe significant bullish trends characterized by considerable price increases and active trading dynamics.

Trend Analysis

Coherent, Inc. (COHR) Over the past year, COHR’s stock price has experienced a remarkable increase of 260.36%. This substantial growth indicates a bullish trend with acceleration in price movements. The stock reached a notable high of 154.51 and a low of 41.17, with a standard deviation of 24.1, suggesting some volatility in its trading activity. Most recently, from September 14, 2025, to November 30, 2025, COHR’s price increased by 44.05% with a standard deviation of 16.73.

MKS Inc. (MKSI) Similarly, MKSI’s stock has shown a solid increase of 52.33% over the last year, which also qualifies as a bullish trend with signs of acceleration. The stock’s price peaked at 154.8 and recorded a low of 60.29, with a standard deviation of 18.98. In the recent timeframe from September 14, 2025, to November 30, 2025, MKSI’s price rose by 29.64%, accompanied by a standard deviation of 11.74.

Both companies are demonstrating strong buyer dominance in their trading volume, with COHR having a buyer percentage of 56.66% and MKSI at 55.94%, indicating a sustained interest from investors.

Analyst Opinions

Recent analyst recommendations for Coherent, Inc. (COHR) indicate a “B-” rating, with analysts pointing to moderate concerns regarding its price-to-earnings score and overall performance metrics. Meanwhile, MKS Inc. (MKSI) has received a “B+” rating, supported by strong return on assets and equity, suggesting a more favorable outlook. Overall, the consensus for the current year leans towards a “buy” for MKSI and a “hold” for COHR, reflecting the differing prospects of these companies in the market.

Stock Grades

In this section, I will provide you with the latest stock ratings from reputable grading companies for Coherent, Inc. (COHR) and MKS Inc. (MKSI).

Coherent, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-06 |

| Stifel | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-20 |

| Rosenblatt | Maintain | Buy | 2025-10-14 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-10 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-14 |

MKS Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Benchmark | Maintain | Buy | 2025-11-07 |

| Keybanc | Maintain | Overweight | 2025-11-07 |

| Needham | Maintain | Buy | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-10-16 |

| Needham | Maintain | Buy | 2025-10-13 |

| Goldman Sachs | Maintain | Sell | 2025-10-09 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-08 |

| Needham | Maintain | Buy | 2025-08-07 |

Overall, both Coherent, Inc. and MKS Inc. have maintained strong ratings from reputable analysts, with several “Buy” and “Overweight” recommendations indicating positive sentiment in the market. This consistent grading suggests stability and potential for growth, which may be worth considering for your investment portfolio.

Target Prices

The consensus target prices for Coherent, Inc. (COHR) and MKS Inc. (MKSI) indicate a positive outlook from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Coherent, Inc. | 190 | 85 | 144 |

| MKS Inc. | 180 | 136 | 163.4 |

For Coherent, Inc., the target consensus of 144 is slightly below its current price of 148.52, suggesting some caution among analysts. MKS Inc., with a consensus of 163.4, presents a more favorable outlook compared to its current price of 149.20, indicating potential for upward movement.

Strengths and Weaknesses

The table below outlines the strengths and weaknesses of Coherent, Inc. (COHR) and MKS Inc. (MKSI).

| Criterion | Coherent, Inc. (COHR) | MKS Inc. (MKSI) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Low (0.85% net margin) | Moderate (5.30% net margin) |

| Innovation | High | High |

| Global presence | Strong | Very strong |

| Market Share | Moderate | High |

| Debt level | Moderate (26%) | High (56%) |

In summary, while both companies exhibit strong innovation and global presence, MKS Inc. demonstrates superior profitability and market share. Coherent, Inc. has a more moderate debt level compared to MKS Inc., which carries a higher debt proportion.

Risk Analysis

Here’s a summary of the key risks associated with Coherent, Inc. (COHR) and MKS Inc. (MKSI).

| Metric | Coherent, Inc. | MKS Inc. |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

Both companies face significant market and regulatory risks. COHR has high exposure to market fluctuations due to its reliance on technology sectors, while MKSI’s heightened regulatory risk stems from its diverse industrial applications. Recent trends in global supply chain disruptions have further amplified these risks.

Which one to choose?

In comparing Coherent, Inc. (COHR) and MKS Inc. (MKSI), MKS appears to have a more favorable overall financial outlook. With a higher gross profit margin of 47.63% compared to COHR’s 35.17%, and a better return on equity score at 3 versus COHR’s 2, MKSI showcases stronger profitability fundamentals. Additionally, MKSI received a B+ rating versus COHR’s B-, indicating analyst confidence in its performance.

While both companies exhibit bullish stock trends, MKSI has shown a recent price change percentage of 29.64%, compared to COHR’s 44.05%, suggesting a more stable growth in a volatile market.

Investors focused on value and stability may prefer MKS, while those looking for higher growth potential might find COHR appealing. However, both companies face risks such as market dependence and competition, which could impact future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Coherent, Inc. and MKS Inc. to enhance your investment decisions: