In the ever-evolving uranium market, Ur-Energy Inc. (URG) and Uranium Royalty Corp. (UROY) stand out as two intriguing players. While both companies operate within the uranium sector, their strategies differ, with URG focusing on mining operations and UROY specializing in royalty acquisitions. This comparison highlights their respective approaches to innovation and market positioning. As an investor, understanding these nuances will be crucial in determining which company aligns better with your investment strategy. Let’s dive deeper into their profiles to uncover the most compelling investment opportunity.

Table of contents

Company Overview

Ur-Energy Inc. Overview

Ur-Energy Inc. (ticker: URG) is a U.S.-based company focused on uranium acquisition, exploration, and production. Established in 2004 and headquartered in Littleton, Colorado, Ur-Energy operates primarily in the Great Divide Basin of Wyoming, boasting its flagship Lost Creek project. With a market capitalization of approximately $456M and a diverse portfolio of 12 projects, Ur-Energy aims to capitalize on the growing demand for uranium driven by the global shift towards nuclear energy. The company currently employs around 101 professionals and has a beta of 1.174, indicating moderate volatility compared to the broader market.

Uranium Royalty Corp. Overview

Uranium Royalty Corp. (ticker: UROY) is a Canadian firm established in 2017, specializing in acquiring and managing a diverse portfolio of uranium royalties. Headquartered in Vancouver, British Columbia, UROY’s interests span various projects in North America, including notable sites in Saskatchewan and New Mexico. With a market capitalization of about $488M, the company operates as a pure-play uranium royalty entity, leveraging its royalty model to mitigate operational risks associated with mining. UROY has a higher beta of 2.167, suggesting greater volatility and potential returns for investors.

Key Similarities and Differences Both companies focus on the uranium sector, but while Ur-Energy is involved in direct mining and production, Uranium Royalty Corp. operates as a royalty company, managing interests in multiple projects without direct operational involvement. This difference in business models reflects varied risk profiles and investment strategies.

Income Statement Comparison

The table below compares the key financial metrics of Ur-Energy Inc. and Uranium Royalty Corp. as of their most recent fiscal year, providing insight into their operational performance.

| Metric | Ur-Energy Inc. | Uranium Royalty Corp. |

|---|---|---|

| Revenue | 33.7M | 15.6M |

| EBITDA | -59.9M | -4.8M |

| EBIT | -63.1M | -4.9M |

| Net Income | -53.2M | -5.6M |

| EPS | -0.17 | -0.0446 |

Interpretation of Income Statement

In the most recent fiscal year, Ur-Energy Inc. reported a significant increase in revenue to 33.7M, compared to 17.7M in the previous year, indicating a robust upward trend. However, their net income remains negative at -53.2M, reflecting continued operational challenges. Uranium Royalty Corp. experienced a decline in revenue, down to 15.6M from 42.7M, resulting in a net income of -5.6M. Both companies are struggling with high operational costs, as seen in their negative EBITDA and EBIT margins. Ur-Energy’s performance indicates a potential recovery in revenue, but persistent losses necessitate careful risk assessment for investors.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial ratios for Ur-Energy Inc. (URG) and Uranium Royalty Corp. (UROY). This will help you understand their financial health and performance.

| Metric | Ur-Energy Inc. (URG) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| ROE | -40.05% | -1.92% |

| ROIC | -36.01% | -1.73% |

| P/E | N/A | -56.00 |

| P/B | 2.75 | 1.07 |

| Current Ratio | 5.99 | 233.49 |

| Quick Ratio | 4.91 | 233.49 |

| D/E | 0.01 | 0.00 |

| Debt-to-Assets | 0.01 | 0.00 |

| Interest Coverage | N/A | N/A |

| Asset Turnover | 0.17 | 0.05 |

| Fixed Asset Turnover | 0 | 82.51 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

The financial ratios indicate that both companies are facing significant challenges. Ur-Energy shows a high current and quick ratio, indicating good liquidity, but negative returns on equity and invested capital reflect underlying operational difficulties. UROY, while maintaining a robust current ratio, demonstrates negative profitability metrics, highlighting its financial instability. Investors should be cautious, as both companies exhibit signs of distress that may affect long-term viability.

Dividend and Shareholder Returns

Both Ur-Energy Inc. (URG) and Uranium Royalty Corp. (UROY) do not currently pay dividends, primarily due to ongoing investments in growth and operational challenges reflected in their negative profit margins. URG also engages in share buybacks, which may signal confidence in future performance, though risks remain regarding sustainability. UROY’s reinvestment strategy appears aligned with long-term value creation, yet its financial metrics suggest caution is warranted. Overall, the approaches taken by both companies may support sustainable value, contingent on future profitability improvements.

Strategic Positioning

In the uranium sector, Ur-Energy Inc. (URG) holds a market cap of approximately 456M, focusing on uranium mineral properties, with significant assets in Wyoming. Conversely, Uranium Royalty Corp. (UROY), with a market cap of about 488M, operates as a royalty company with diversified interests across North America and Namibia. Both companies face competitive pressure amid technological disruptions in energy sources, yet their unique business models present distinct advantages in this evolving market.

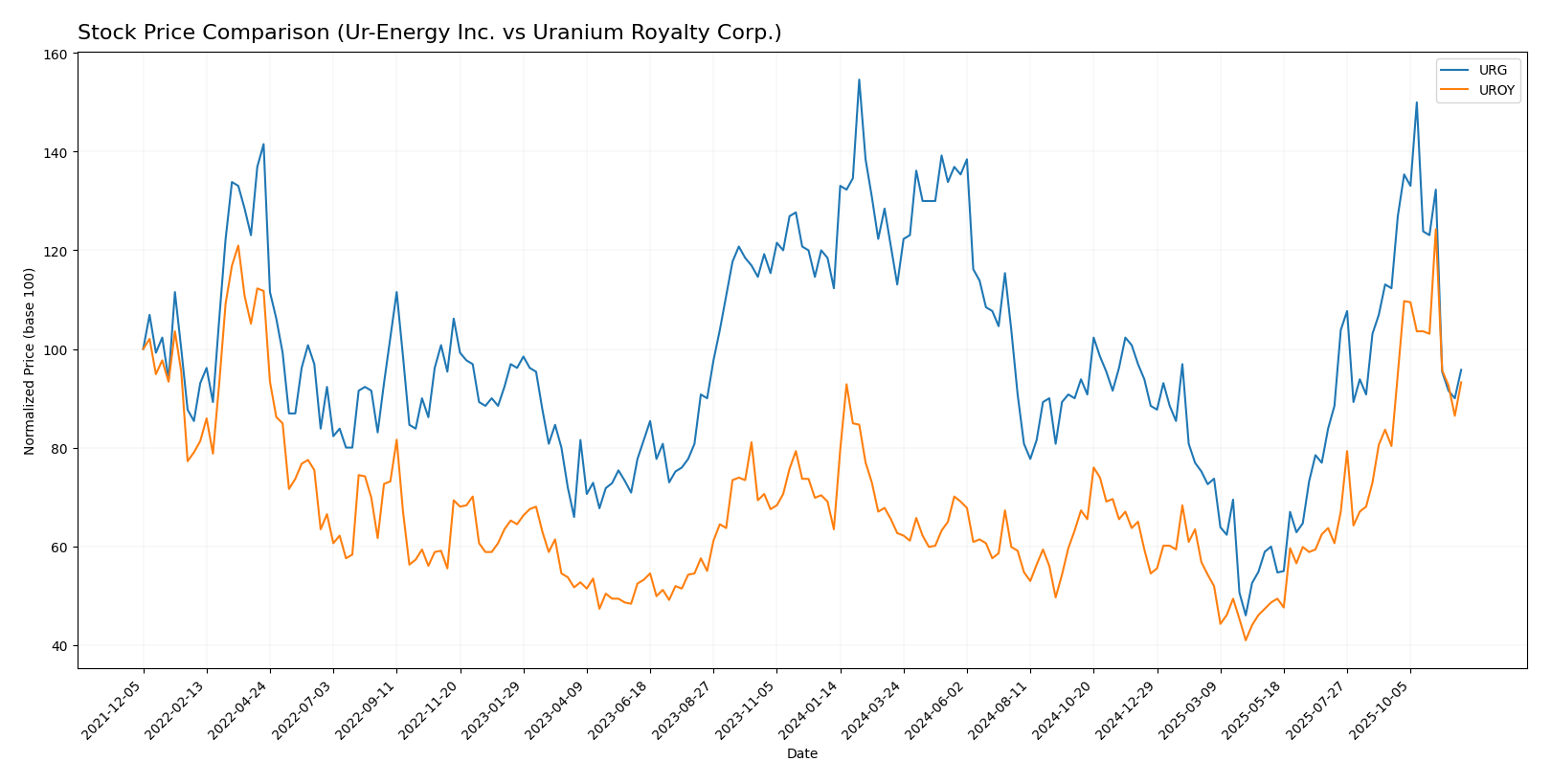

Stock Comparison

In this section, I will analyze the stock price movements of Ur-Energy Inc. (URG) and Uranium Royalty Corp. (UROY) over the past year, focusing on key price dynamics and trends.

Trend Analysis

Ur-Energy Inc. (URG) Over the past year, URG has experienced a percentage change of -14.73%. This indicates a bearish trend, characterized by deceleration. The highest price reached was 2.01, while the lowest was 0.60. The standard deviation of 0.33 suggests a moderate level of volatility in its stock price.

Uranium Royalty Corp. (UROY) In contrast, UROY has shown a significant percentage change of 46.98% over the past year, indicating a bullish trend, also with deceleration. The stock’s highest price was 4.86, and it experienced a low of 1.60. The standard deviation of 0.62 indicates a higher level of volatility compared to URG.

Both stocks exhibit trends of deceleration, which is crucial for understanding potential future movements.

Analyst Opinions

Recent analyst recommendations for Ur-Energy Inc. (URG) suggest a cautious stance, with a rating of C- indicating a “hold” position due to concerns about its financial metrics, particularly its debt-to-equity ratio. Analysts like those from FMP emphasize the company’s low scores in return on equity and assets. In contrast, Uranium Royalty Corp. (UROY) receives a slightly better rating of C, also suggesting a “hold” position. Analysts point to similar weaknesses in its financial performance, particularly its discounted cash flow. Overall, the consensus for both stocks leans towards holding rather than buying or selling.

Stock Grades

I have gathered the latest stock ratings for two companies in the uranium sector. Here’s what the grading companies have to say:

Ur-Energy Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-11-04 |

| B. Riley Securities | Maintain | Buy | 2025-09-25 |

| Roth Capital | Maintain | Buy | 2025-09-23 |

| HC Wainwright & Co. | Maintain | Buy | 2025-04-15 |

| HC Wainwright & Co. | Maintain | Buy | 2025-02-11 |

| Roth MKM | Maintain | Buy | 2024-10-23 |

| B. Riley Securities | Maintain | Buy | 2024-08-20 |

| HC Wainwright & Co. | Maintain | Buy | 2024-08-14 |

| HC Wainwright & Co. | Maintain | Buy | 2024-07-17 |

| Roth MKM | Maintain | Buy | 2024-05-09 |

Uranium Royalty Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-04-22 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-19 |

| HC Wainwright & Co. | Maintain | Buy | 2024-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-06-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-03-11 |

| HC Wainwright & Co. | Maintain | Buy | 2022-01-03 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-29 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-28 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-01 |

Overall, both Ur-Energy Inc. and Uranium Royalty Corp. are consistently rated as “Buy” across multiple grading companies, indicating strong investor confidence in their performance.

Target Prices

The consensus target price for Ur-Energy Inc. indicates a potential upside based on current market conditions.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Ur-Energy Inc. | 2.60 | 2.15 | 2.38 |

Analysts expect Ur-Energy Inc. to reach a consensus target price of 2.38, suggesting a significant upside compared to its current price of 1.25. Unfortunately, no verified target price data is available for Uranium Royalty Corp., reflecting uncertainty in market sentiment.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Ur-Energy Inc. (URG) and Uranium Royalty Corp. (UROY) based on the most recent data.

| Criterion | Ur-Energy Inc. (URG) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Diversification | Low | High |

| Profitability | Negative | Improving |

| Innovation | Moderate | Moderate |

| Global presence | Limited | Strong |

| Market Share | Niche | Growing |

| Debt level | Very low | Minimal |

In summary, UROY demonstrates a stronger position through better diversification and global presence, while URG faces challenges with profitability and a limited market share. Understanding these factors is key to making informed investment decisions.

Risk Analysis

The table below outlines the risks associated with Ur-Energy Inc. (URG) and Uranium Royalty Corp. (UROY) for 2025.

| Metric | Ur-Energy Inc. (URG) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | Moderate |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | High | Moderate |

Both companies face significant market risk due to the volatility in uranium prices, with URG being particularly vulnerable given its high operational risks. Regulatory pressures in the uranium sector remain strong, impacting both companies’ operations and profitability.

Which one to choose?

When comparing Ur-Energy Inc. (URG) and Uranium Royalty Corp. (UROY), several factors come into play. URG has faced significant losses, reflected in its low gross profit margin of -26.62% and a negative net profit margin of -15.78% for 2024. In contrast, UROY showed a positive gross profit margin of 9.98% in 2025, although it still operates at a loss with a net profit margin of -3.62%.

From a valuation perspective, UROY has a lower price-to-book ratio of 1.07 compared to URG’s 2.75, indicating better value relative to its assets. Moreover, UROY has demonstrated a bullish stock trend with a 46.98% price change over the past year, while URG experienced a bearish trend with a -14.73% decline.

For those seeking growth, UROY appears more favorable, while conservative investors may find URG’s high liquidity and potential for turnaround appealing. However, both companies face underlying risks, including industry competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Ur-Energy Inc. and Uranium Royalty Corp. to enhance your investment decisions: