In the ever-evolving uranium sector, two companies stand out: enCore Energy Corp. (EU) and Uranium Royalty Corp. (UROY). Both are engaged in the uranium industry but adopt distinct strategies—enCore focuses on resource development, while Uranium Royalty specializes in managing royalty interests. This article will delve into their operational models, market presence, and innovative approaches to help you discern which company might be a more compelling investment opportunity. Let’s explore the potential each company holds for your portfolio.

Table of contents

Company Overview

enCore Energy Corp. Overview

enCore Energy Corp. (EU) is a leading player in the uranium sector, focusing on the acquisition, exploration, and development of uranium resource properties across the United States. With a robust portfolio that includes projects in New Mexico, South Dakota, Wyoming, and Utah, enCore is well-positioned to capitalize on the growing demand for uranium, driven by the resurgence of nuclear energy initiatives. The company, headquartered in Corpus Christi, Texas, has a market capitalization of approximately $490M and operates with a strategic vision to secure a sustainable energy future.

Uranium Royalty Corp. Overview

Uranium Royalty Corp. (UROY) positions itself as a pure-play uranium royalty company, managing a diversified portfolio of uranium interests across North America and beyond. Established in 2017 and based in Vancouver, Canada, UROY’s royalty interests span key uranium mining projects, including well-known sites in Saskatchewan, Arizona, and New Mexico. With a market cap of around $486M, the company aims to leverage its royalty model to benefit from uranium production without the associated operational risks of mining.

Key similarities between enCore Energy and Uranium Royalty Corp. include their focus on uranium and the energy sector. However, their business models diverge significantly: enCore is directly engaged in exploration and development, while UROY operates as a royalty company, capitalizing on its diversified interests without taking on the operational risks of mining.

Income Statement Comparison

The following table provides a comparison of the most recent income statements for enCore Energy Corp. (EU) and Uranium Royalty Corp. (UROY), highlighting their financial performance metrics.

| Metric | enCore Energy Corp. (EU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Revenue | 58.33M | 15.60M |

| EBITDA | -67.59M | -4.75M |

| EBIT | -72.19M | -4.87M |

| Net Income | -61.39M | -5.65M |

| EPS | -0.34 | -0.045 |

Interpretation of Income Statement

In the most recent fiscal year, enCore Energy Corp. reported a significant increase in revenue to 58.33M from 22.15M the previous year, yet still incurred a net loss of 61.39M. This indicates a challenging cost structure, leading to negative margins. Conversely, Uranium Royalty Corp. experienced a decline in revenue to 15.60M from 42.71M in the prior year, resulting in a smaller net loss of 5.65M. Both companies face substantial operational losses; however, enCore’s revenue growth suggests potential for recovery, while UROY’s declining revenue raises concerns about sustainability.

Financial Ratios Comparison

The table below compares the most recent financial ratios for enCore Energy Corp. (EU) and Uranium Royalty Corp. (UROY), providing insights into their financial health and operational efficiency.

| Metric | enCore Energy Corp (EU) | Uranium Royalty Corp (UROY) |

|---|---|---|

| ROE | -21.49% | -1.92% |

| ROIC | -17.34% | -1.73% |

| P/E | -10.11 | -56.00 |

| P/B | 2.17 | 1.07 |

| Current Ratio | 2.91 | 233.49 |

| Quick Ratio | 2.21 | 233.49 |

| D/E | 0.07 | 0.0007 |

| Debt-to-Assets | 5.20% | 0.07% |

| Interest Coverage | -41.60 | -11.02 |

| Asset Turnover | 0.15 | 0.05 |

| Fixed Asset Turnover | 0.20 | 82.51 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

The financial ratios indicate significant challenges for both companies. EnCore Energy Corp. exhibits negative returns on equity (ROE) and invested capital (ROIC), reflecting profitability issues. The current ratio and quick ratio for UROY are exceptionally high, suggesting strong liquidity, but the negative P/E ratio raises concerns about its earnings stability. Both companies’ debt levels appear manageable, but the negative interest coverage ratios indicate potential difficulties in meeting interest obligations. Caution is advised when considering investments in these firms.

Dividend and Shareholder Returns

Both enCore Energy Corp. (EU) and Uranium Royalty Corp. (UROY) do not pay dividends, which reflects their focus on reinvestment for future growth, particularly in a high-growth phase. This strategy may enhance long-term shareholder value, especially as both companies utilize share buybacks to return value. However, the lack of dividends and negative profit margins highlight potential risks, suggesting that sustainable value creation will depend on successful execution of their growth strategies.

Strategic Positioning

In the uranium sector, enCore Energy Corp. (EU) and Uranium Royalty Corp. (UROY) are key players. enCore holds a substantial 100% interest in multiple uranium projects across the U.S., contributing to its competitive edge. Meanwhile, UROY operates as a royalty company, managing diverse global uranium interests, which mitigates risks from operational disruptions. Both companies face competitive pressure from emerging technologies and fluctuating uranium prices, requiring strategic agility to maintain and grow their market shares.

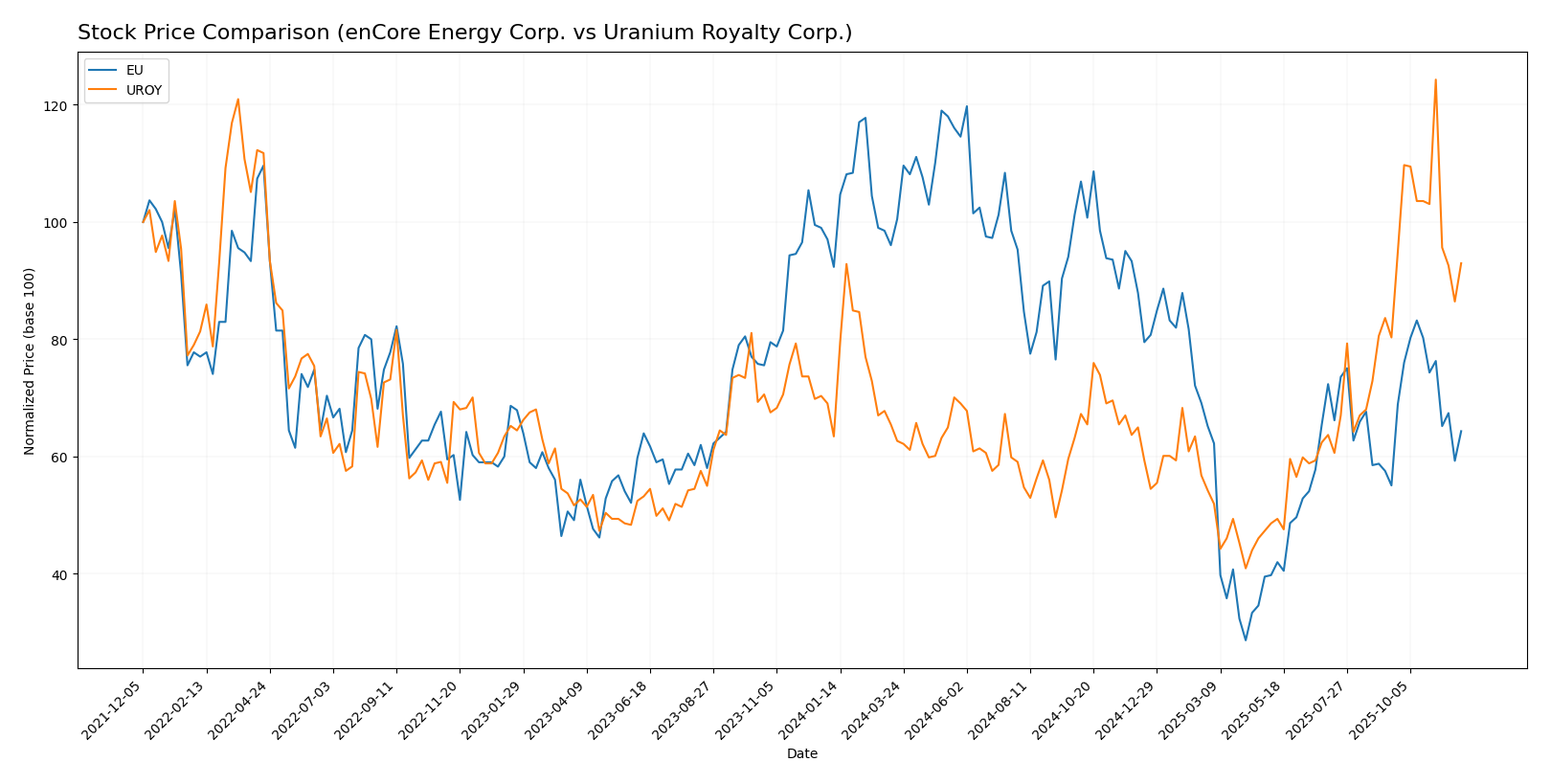

Stock Comparison

In assessing the weekly stock price movements of enCore Energy Corp. (EU) and Uranium Royalty Corp. (UROY) over the past year, we can observe significant price dynamics that reflect contrasting market sentiments and trading behaviors.

Trend Analysis

For enCore Energy Corp. (EU), the overall price change over the past year is -30.35%, indicating a bearish trend. The stock has shown notable acceleration in this downward movement, with the highest price recorded at 4.85 and the lowest at 1.16. The standard deviation of 0.96 suggests a moderate level of volatility in its price actions. In the recent period from September 14, 2025, to November 30, 2025, the stock experienced a price increase of 16.82%, although this reflects a slight deceleration in the trend slope (-0.02).

Conversely, Uranium Royalty Corp. (UROY) has exhibited a strong bullish trend with an overall price change of +46.57% over the same period. However, the trend is characterized by deceleration, as indicated by a trend slope of -0.01 despite achieving a high of 4.86 and a low of 1.6. The standard deviation of 0.62 further corroborates the stock’s price stability. In the recent analysis period, UROY saw a price increase of 15.76%, but with a notable shift to seller dominance in trading behavior, as evidenced by a buyer dominance percentage of only 39.13%.

In summary, while EU is trending downward with increased acceleration, UROY remains in a strong upward trajectory but is exhibiting signs of slowing momentum. Investors should consider these trends and their implications for future price movements when deciding on portfolio allocations.

Analyst Opinions

Recent analyst recommendations for enCore Energy Corp. (EU) indicate a cautious stance, with a rating of C- reflecting concerns over its financial metrics. Analysts argue that the company’s low return on equity and assets are red flags. Conversely, Uranium Royalty Corp. (UROY) holds a slightly better rating of C, suggesting a hold position. Analysts cite its higher debt-to-equity ratio as a potential risk. Overall, the consensus tilts towards a cautious hold for UROY and a clear sell for EU this year.

Stock Grades

In the current market landscape, it’s essential to stay informed about stock ratings from reputable sources. Below, I’ve compiled the latest grades for enCore Energy Corp. and Uranium Royalty Corp.

enCore Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | maintain | Buy | 2025-05-13 |

| HC Wainwright & Co. | maintain | Buy | 2025-03-18 |

| HC Wainwright & Co. | maintain | Buy | 2024-11-19 |

| HC Wainwright & Co. | maintain | Buy | 2024-10-07 |

| HC Wainwright & Co. | maintain | Buy | 2024-08-15 |

| HC Wainwright & Co. | maintain | Buy | 2024-06-14 |

| B. Riley Securities | maintain | Buy | 2024-05-15 |

Uranium Royalty Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-04-22 |

| HC Wainwright & Co. | maintain | Buy | 2024-12-19 |

| HC Wainwright & Co. | maintain | Buy | 2024-09-17 |

| HC Wainwright & Co. | maintain | Buy | 2024-06-17 |

| HC Wainwright & Co. | maintain | Buy | 2024-03-11 |

| HC Wainwright & Co. | maintain | Buy | 2022-01-03 |

| HC Wainwright & Co. | maintain | Buy | 2021-09-29 |

| HC Wainwright & Co. | maintain | Buy | 2021-09-28 |

| HC Wainwright & Co. | maintain | Buy | 2021-07-02 |

| HC Wainwright & Co. | maintain | Buy | 2021-07-01 |

Overall, both enCore Energy Corp. and Uranium Royalty Corp. maintain a consistent “Buy” rating from HC Wainwright & Co., reflecting a stable outlook in their respective markets. This trend indicates a strong investor sentiment towards these companies, suggesting confidence in their future performance.

Target Prices

The consensus target price for enCore Energy Corp. (EU) is highly optimistic, reflecting a strong expectation from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| enCore Energy Corp. | 7 | 7 | 7 |

Analysts expect enCore Energy Corp. to reach a target price of $7, significantly higher than its current price of $2.615, indicating a positive outlook. Unfortunately, no verified target price data is available for Uranium Royalty Corp. (UROY).

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of enCore Energy Corp. (EU) and Uranium Royalty Corp. (UROY), providing a clear comparison based on recent financial data.

| Criterion | enCore Energy Corp. (EU) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Diversification | Limited uranium projects | Broad portfolio of royalties |

| Profitability | Negative margins | Positive margins |

| Innovation | Low investment in R&D | Focus on acquisitions |

| Global presence | Primarily U.S. focused | Strong international footprint |

| Market Share | Emerging player | Established in royalty market |

| Debt level | Low debt-to-equity (0.071) | Extremely low debt (0.0007) |

Key takeaways indicate that while enCore Energy has a limited project range and faces profitability challenges, Uranium Royalty Corp. stands out with a diversified portfolio and positive margins, making it a potentially more stable investment choice in the uranium sector.

Risk Analysis

In the following table, I will outline the key risks associated with enCore Energy Corp. (EU) and Uranium Royalty Corp. (UROY).

| Metric | enCore Energy Corp. | Uranium Royalty Corp. |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | Moderate |

| Environmental Risk | Moderate | Low |

| Geopolitical Risk | Moderate | Moderate |

Both companies face significant market and operational risks due to their involvement in the volatile uranium sector. Notably, regulatory changes can substantially impact their operations and profitability. As of now, geopolitical tensions and environmental regulations are increasingly shaping the industry landscape.

Which one to choose?

When comparing enCore Energy Corp. (EU) and Uranium Royalty Corp. (UROY), it’s clear that both companies face challenges in profitability. EU has shown a bearish stock trend with a significant -30.35% price change over the past year, and its financial metrics indicate negative margins across the board. In contrast, UROY has a bullish trend, boasting a 46.57% price increase, although it still struggles with a negative net profit margin.

In terms of ratings, EU holds a C- while UROY has a C, reflecting a slight edge in overall performance. For investors seeking growth, UROY may present a more favorable opportunity given its recent upward trajectory. Conversely, those prioritizing stability might find EU’s current ratio of 2.91 appealing, though its profitability remains a concern.

It’s essential to note the risks related to both companies, including market competition and dependence on uranium prices, which can impact profitability.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of enCore Energy Corp. and Uranium Royalty Corp. to enhance your investment decisions: