In the rapidly evolving energy sector, companies like Uranium Energy Corp. (UEC) and Uranium Royalty Corp. (UROY) stand out as key players in the uranium market. While UEC focuses on the extraction and processing of uranium, UROY adopts a unique royalty model that allows it to capitalize on diverse uranium projects globally. This comparison will explore their differing strategies, market positions, and innovations, helping you determine which company may be the more compelling investment choice.

Table of contents

Company Overview

Uranium Energy Corp. Overview

Uranium Energy Corp. (UEC) is a prominent player in the uranium sector, engaged in the exploration, extraction, and processing of uranium and titanium concentrates across North America and Paraguay. The company boasts a diverse portfolio of uranium projects, including operational mines in Texas and developmental projects in states such as Arizona and Wyoming. Incorporated in 2003 and based in Corpus Christi, Texas, UEC aims to capitalize on the increasing demand for clean energy solutions. With a market cap of approximately $5.57B and a current stock price of $11.97, UEC is strategically positioned to respond to the global shift towards sustainable energy sources.

Uranium Royalty Corp. Overview

Uranium Royalty Corp. (UROY) operates as a specialized uranium royalty company, focusing on acquiring and managing a portfolio of royalty interests across multiple projects in North America and beyond. Established in 2017 and headquartered in Vancouver, Canada, UROY provides investors with exposure to uranium through its royalty agreements rather than direct mining operations. With a market capitalization of about $484M and a share price of $3.63, UROY’s business model allows it to benefit from the uranium market’s fluctuations while maintaining lower operational risks associated with mining.

Key Similarities and Differences

Both Uranium Energy Corp. and Uranium Royalty Corp. are entrenched in the uranium industry, yet their business models differ significantly. UEC focuses on direct uranium extraction and processing, while UROY operates on a royalty basis, minimizing operational risks by leveraging income from various projects without direct involvement in mining activities. This distinction highlights differing approaches to capitalize on uranium market opportunities.

Income Statement Comparison

Below is a comparison of the most recent income statements for Uranium Energy Corp. (UEC) and Uranium Royalty Corp. (UROY), highlighting key financial metrics.

| Metric | UEC | UROY |

|---|---|---|

| Revenue | 66.8M | 15.6M |

| EBITDA | -84.5M | -4.8M |

| EBIT | -88.9M | -4.9M |

| Net Income | -87.7M | -5.7M |

| EPS | -0.20 | -0.0446 |

Interpretation of Income Statement

In the most recent year, UEC reported a significant drop in revenue compared to the prior year, reflecting a challenging operational environment. UROY, while also facing losses, demonstrated a moderate revenue decline compared to the previous year. Both companies experienced negative EBITDA and EBIT, indicating operational inefficiencies that need to be addressed. UEC’s margins deteriorated, unlike UROY, which maintained a more stable cost structure relative to its revenue. Overall, both companies are facing headwinds, but UROY’s performance appears relatively more resilient in terms of cost management.

Financial Ratios Comparison

In the following table, I present a comparison of key financial metrics for Uranium Energy Corp. (UEC) and Uranium Royalty Corp. (UROY) based on the most recent data available.

| Metric | UEC | UROY |

|---|---|---|

| ROE | -8.91% | -1.92% |

| ROIC | -6.57% | -1.73% |

| P/E | -42.30 | -56.00 |

| P/B | 3.77 | 1.07 |

| Current Ratio | 8.85 | 233.49 |

| Quick Ratio | 5.85 | 233.49 |

| D/E | 0.0023 | 0.0007 |

| Debt-to-Assets | 0.0021 | 0.0007 |

| Interest Coverage | -50.71 | -11.02 |

| Asset Turnover | 0.060 | 0.052 |

| Fixed Asset Turnover | 0.086 | 82.51 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of Financial Ratios

The financial ratios indicate that both companies are currently facing significant challenges, with negative returns on equity and invested capital. UEC has a better current and quick ratio, suggesting stronger short-term liquidity compared to UROY. However, UROY exhibits a notably higher asset turnover and a lower price-to-book ratio, which may indicate better management of resources relative to its asset base. Both companies share the absence of dividends, reflecting their reinvestment strategies amidst ongoing struggles.

Dividend and Shareholder Returns

Both Uranium Energy Corp. (UEC) and Uranium Royalty Corp. (UROY) do not currently pay dividends, attributed to their focus on reinvestment and growth strategies. UEC has reported negative net income, indicating a challenging financial position, while UROY’s solvency ratios have fluctuated. Importantly, both companies engage in share buyback programs, which can enhance shareholder value. However, the absence of dividends raises questions about their immediate returns, suggesting a cautious approach for long-term investors.

Strategic Positioning

In the uranium sector, Uranium Energy Corp. (UEC) holds a substantial market share with a market cap of $5.57B, positioning itself as a leader with extensive mining and processing operations across North America. Conversely, Uranium Royalty Corp. (UROY), with a market cap of $484M, focuses on royalties and has a diversified portfolio but operates under competitive pressure from UEC’s established projects. Technological advancements in extraction methods may further disrupt market dynamics, necessitating careful monitoring of both companies’ strategies.

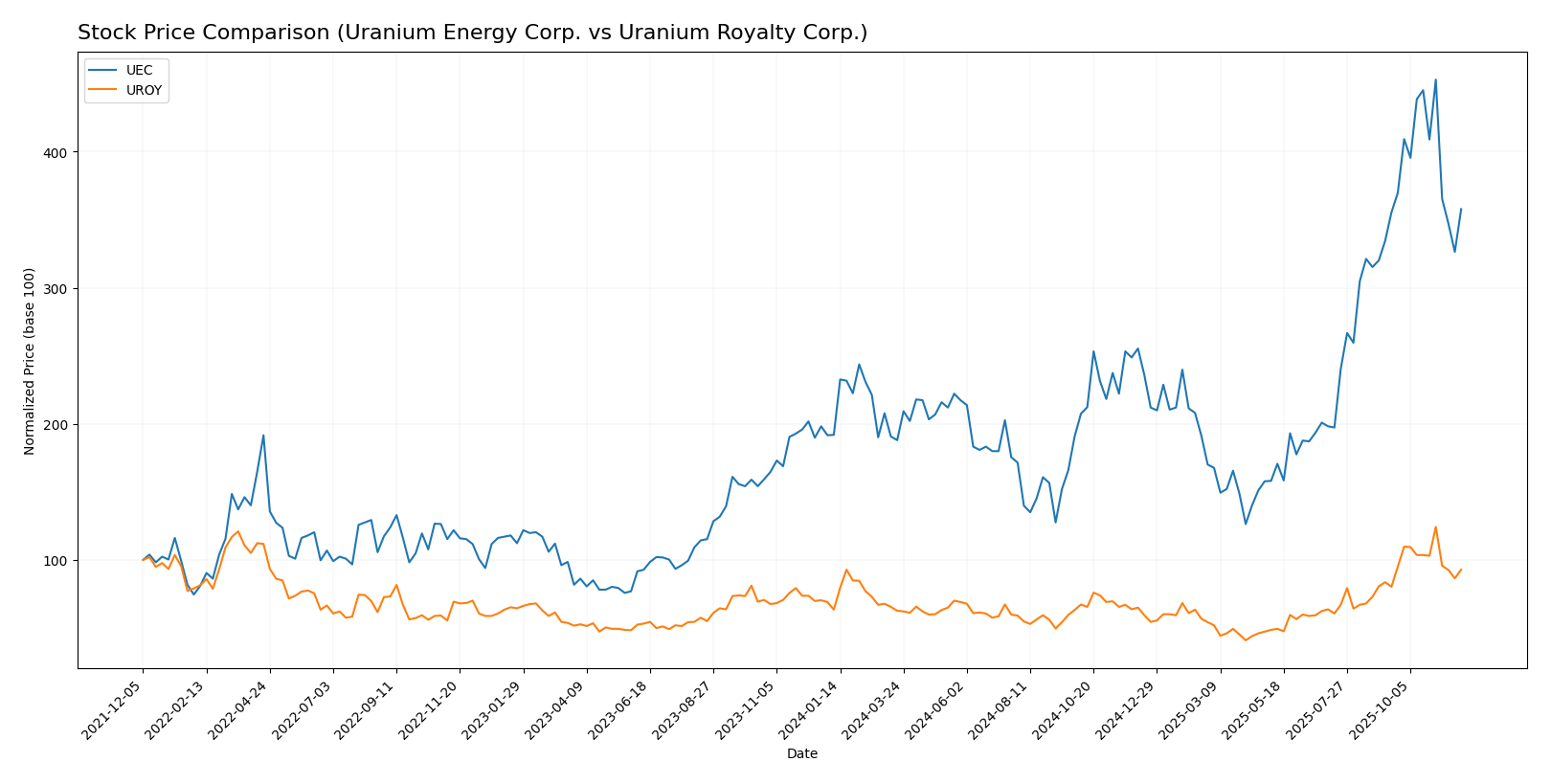

Stock Comparison

In the past year, Uranium Energy Corp. (UEC) and Uranium Royalty Corp. (UROY) have exhibited significant price movements, reflecting dynamic trading conditions and investor sentiment in the uranium sector.

Trend Analysis

Uranium Energy Corp. (UEC) has experienced an impressive price change of +86.43% over the past year, indicating a bullish trend. Notably, the stock reached a high of 15.13 and a low of 4.22. However, the recent trend analysis shows a slight increase of +0.67% from September 14, 2025, to November 30, 2025, while the acceleration status indicates deceleration. The standard deviation of 2.47 suggests moderate volatility in its price movements.

Uranium Royalty Corp. (UROY) has also shown a strong performance with a price change of +46.37% over the last year, marking a bullish trend as well. The stock’s highest price was 4.86, with a low of 1.6. In the recent analysis period from September 14, 2025, to November 30, 2025, UROY’s price increased by +15.61%, but the trend shows deceleration. The standard deviation of 0.62 indicates lower volatility compared to UEC.

In summary, both stocks are on a bullish trajectory over the long term, but recent trends indicate a slowdown in growth momentum. Investors should consider this deceleration while assessing their options in these companies.

Analyst Opinions

Recent analyst recommendations for Uranium Energy Corp. (UEC) and Uranium Royalty Corp. (UROY) suggest a cautious approach. UEC has received a rating of C-, indicating a sell or hold stance, primarily due to low scores in financial metrics such as return on equity and price-to-earnings ratios. UROY, with a C rating, shows slightly better performance but still reflects concerns, particularly regarding debt levels. The consensus for UEC is a sell, while UROY is leaning towards a hold. Analysts urge investors to remain vigilant amidst market volatility in the uranium sector.

Stock Grades

I have reviewed the latest stock grades from reliable grading companies for two companies in the uranium sector: Uranium Energy Corp. and Uranium Royalty Corp. Here’s the breakdown of their current ratings.

Uranium Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Buy | 2025-09-26 |

| BMO Capital | Downgrade | Market Perform | 2025-09-25 |

| Roth Capital | Maintain | Buy | 2025-09-25 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-25 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-03 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-06 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-13 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-09 |

| Roth MKM | Maintain | Buy | 2024-10-23 |

| Roth MKM | Maintain | Buy | 2024-09-25 |

Uranium Royalty Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-04-22 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-19 |

| HC Wainwright & Co. | Maintain | Buy | 2024-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-06-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-03-11 |

| HC Wainwright & Co. | Maintain | Buy | 2022-01-03 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-29 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-28 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-01 |

Overall, both companies show a consistent trend of maintaining “Buy” ratings from HC Wainwright & Co., indicating a strong sentiment among analysts. However, Uranium Energy Corp. has experienced a recent downgrade from BMO Capital, suggesting a need for caution.

Target Prices

Reliable target price data is available for Uranium Energy Corp. but not for Uranium Royalty Corp.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Uranium Energy Corp. | 19.75 | 14 | 17.08 |

Analysts expect Uranium Energy Corp.’s stock to reach a consensus target of 17.08, significantly higher than its current price of 11.965. This suggests positive sentiment and potential growth in the near term.

Strengths and Weaknesses

The table below summarizes the strengths and weaknesses of Uranium Energy Corp. (UEC) and Uranium Royalty Corp. (UROY).

| Criterion | Uranium Energy Corp. (UEC) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Negative | Negative |

| Innovation | Moderate | High |

| Global presence | Limited | Moderate |

| Market Share | Low | Moderate |

| Debt level | Very Low | Very Low |

Key takeaways: UEC shows moderate innovation and limited global presence, while UROY excels in diversification and innovation, albeit both companies currently face negative profitability.

Risk Analysis

In this section, I outline the key risks associated with two companies in the uranium sector, Uranium Energy Corp. (UEC) and Uranium Royalty Corp. (UROY).

| Metric | UEC | UROY |

|---|---|---|

| Market Risk | High | Medium |

| Regulatory Risk | Medium | High |

| Operational Risk | High | Medium |

| Environmental Risk | High | Medium |

| Geopolitical Risk | Medium | High |

Both companies face significant operational risks, particularly due to fluctuating uranium prices and regulatory challenges. With UEC’s recent high market risk and UROY’s exposure to geopolitical uncertainties, investors should proceed with caution.

Which one to choose?

When comparing Uranium Energy Corp. (UEC) and Uranium Royalty Corp. (UROY), several factors come into play. UEC has a market cap of approximately $3.71B, with a significant price-to-sales ratio of 55.48, indicating high expectations for future revenue growth despite its current negative profit margins. In contrast, UROY has a smaller market cap of about $316M and a more reasonable price-to-sales ratio of 20.30, reflecting a more stable financial outlook.

Analyst ratings show UEC at a C- with a focus on improvement, while UROY holds a slightly better C rating. Both companies exhibit bullish stock trends, though UEC has shown a higher price change of 86.43% recently compared to UROY’s 46.37%.

Investors focused on potential growth may prefer UEC due to its aggressive price performance, while those prioritizing stability might lean towards UROY. However, both companies face significant risks related to competition and market dependence in the volatile uranium sector.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Uranium Energy Corp. and Uranium Royalty Corp. to enhance your investment decisions: