In the rapidly evolving uranium sector, Energy Fuels Inc. (UUUU) and NexGen Energy Ltd. (NXE) stand out as two compelling companies. Both operate within the same industry, focusing on uranium extraction and exploration, yet they employ different strategies and target markets. Energy Fuels emphasizes conventional and in situ recovery processes in the U.S., while NexGen is dedicated to developing properties in Canada. As we explore their strengths and weaknesses, this article will help you determine which company might be the most interesting addition to your investment portfolio.

Table of contents

Company Overview

Energy Fuels Inc. Overview

Energy Fuels Inc. (ticker: UUUU) is a leading player in the U.S. uranium sector, focusing on the extraction and sale of uranium and vanadium. Headquartered in Lakewood, Colorado, the company operates several key projects, including the Nichols Ranch and Alta Mesa projects, alongside the White Mesa Mill, which is crucial for processing uranium. Energy Fuels aims to capitalize on the growing demand for clean energy solutions through its sustainable uranium production, addressing both domestic and global energy needs. With a market capitalization of approximately $3.39B and a beta of 2.049, the company exhibits significant volatility, which may appeal to risk-tolerant investors.

NexGen Energy Ltd. Overview

NexGen Energy Ltd. (ticker: NXE) is a Vancouver-based exploration and development company that focuses on uranium properties in Canada. Its flagship asset, the Rook I project, is located in the Athabasca Basin, a region known for high-grade uranium deposits. With a market cap of around $5.46B and a beta of 1.947, NexGen is positioned as a strong contender in the uranium market, driven by its potential for substantial resource discoveries and a commitment to sustainable practices. The company is strategically focused on advancing its projects through exploration and development phases to meet the increasing global energy demands.

In summary, both Energy Fuels and NexGen operate within the uranium industry, but they differ in their geographical focus and project stages. Energy Fuels emphasizes operational production in the U.S., while NexGen is concentrated on exploration in Canada.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Energy Fuels Inc. (UUUU) and NexGen Energy Ltd. (NXE), showcasing key financial metrics.

| Metric | Energy Fuels Inc. (UUUU) | NexGen Energy Ltd. (NXE) |

|---|---|---|

| Revenue | 78.1M | 0 |

| EBITDA | -43.0M | -76.8M |

| EBIT | -48.2M | -78.2M |

| Net Income | -47.8M | -77.6M |

| EPS | -0.28 | -0.14 |

Interpretation of Income Statement

In the most recent year, Energy Fuels Inc. reported a significant increase in revenue to 78.1M from 37.9M in the previous year. However, it continues to incur substantial net losses of 47.8M. In contrast, NexGen Energy showed no revenue for 2024, while its net loss widened to 77.6M, indicating ongoing financial challenges. Both companies face negative EBITDA, reflecting operational difficulties. The increase in Energy Fuels’ revenue is promising, but the persistent losses suggest caution for investors. Overall, while Energy Fuels shows some growth, the overall financial health of both companies requires careful monitoring.

Financial Ratios Comparison

In the following table, I present a comparative analysis of the most recent revenue and financial ratios for Energy Fuels Inc. (UUUU) and NexGen Energy Ltd. (NXE).

| Metric | Energy Fuels Inc. (UUUU) | NexGen Energy Ltd. (NXE) |

|---|---|---|

| ROE | -9.05% | -6.58% |

| ROIC | -6.67% | -4.39% |

| P/E | -18.47 | 57.92 |

| P/B | 1.67 | 4.46 |

| Current Ratio | 3.88 | 1.03 |

| Quick Ratio | 2.76 | 1.03 |

| D/E | 0.004 | 0.39 |

| Debt-to-Assets | 0.36% | 27.56% |

| Interest Coverage | 0 | -2.33 |

| Asset Turnover | 0.13 | 0 |

| Fixed Asset Turnover | 1.42 | 0 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

Both companies exhibit significant challenges, particularly in profitability metrics, as indicated by their negative ROE and ROIC. UUUU shows a strong current and quick ratio, suggesting good short-term liquidity, while NXE’s ratios are concerning, indicating higher leverage and lower liquidity. The absence of dividends from both firms highlights their focus on growth over immediate returns, which can be a risk for investors seeking income. Overall, both companies require cautious evaluation due to their financial instability.

Dividend and Shareholder Returns

Energy Fuels Inc. (UUUU) does not pay dividends, reflecting its ongoing reinvestment strategy amid negative net income and a focus on capital expenditures. Instead, the company has engaged in share buybacks, though this poses risks if cash flow does not improve. Conversely, NexGen Energy Ltd. (NXE) similarly refrains from distributing dividends, prioritizing growth and research investments. Both companies’ lack of dividend distributions aligns with their long-term strategies, but investors should assess the sustainability of their growth paths for value creation.

Strategic Positioning

In the uranium market, Energy Fuels Inc. (UUUU) holds a market cap of $3.39B, while NexGen Energy Ltd. (NXE) is valued at $5.46B. UUUU focuses on conventional uranium extraction in the U.S., while NXE is developing the Rook I project in Canada. Both companies face significant competitive pressure, particularly from technological advancements and fluctuating uranium prices, which could disrupt their operations. Staying aware of these dynamics is essential for informed investment decisions.

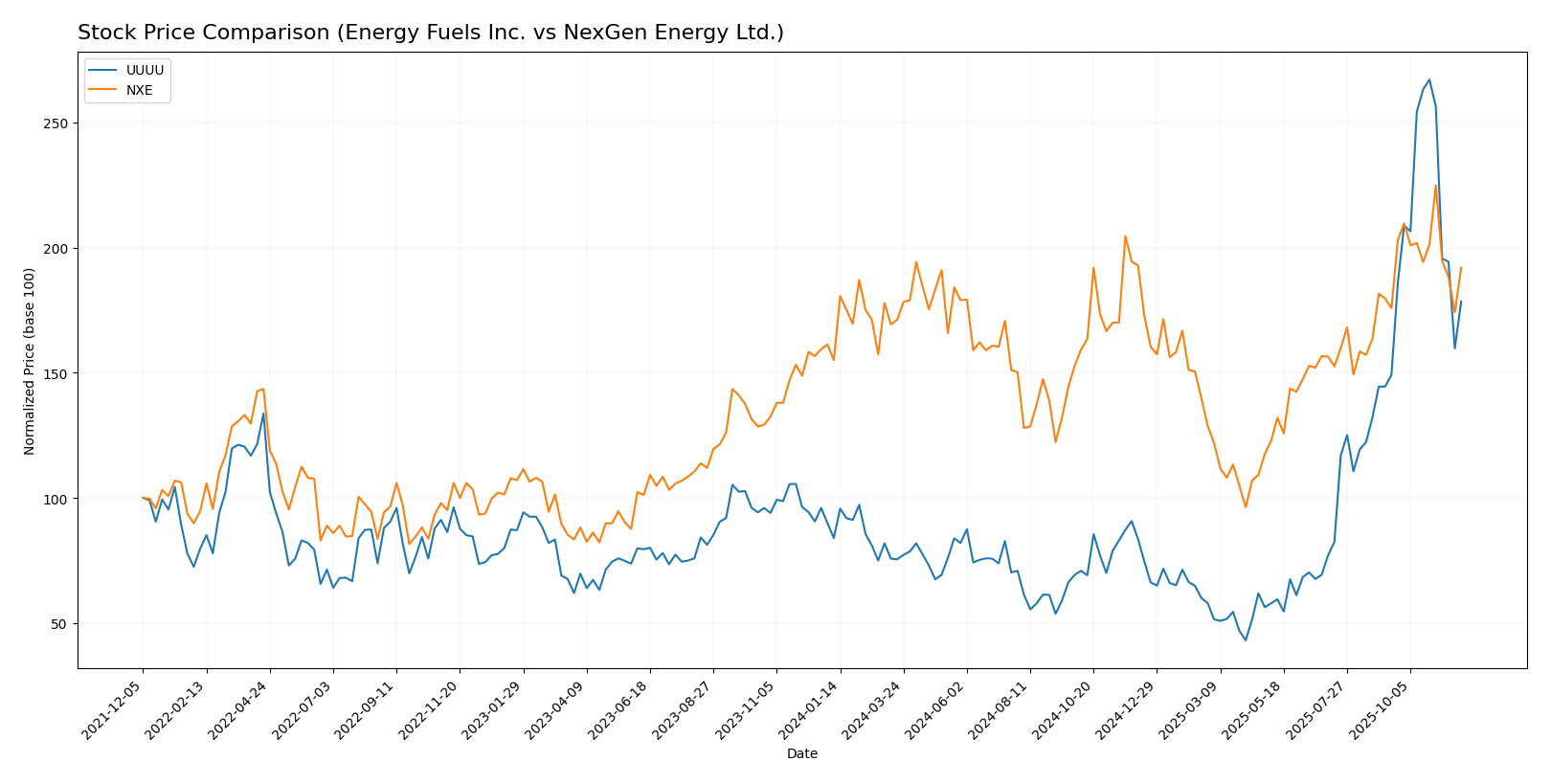

Stock Comparison

In this section, I will analyze the stock price movements and trading dynamics of Energy Fuels Inc. (UUUU) and NexGen Energy Ltd. (NXE) over the past year, highlighting key price fluctuations and overall market trends.

Trend Analysis

Energy Fuels Inc. (UUUU) Over the past year, UUUU has experienced a remarkable price change of +112.43%. This indicates a bullish trend, despite a recent deceleration in the trend slope, which shows a slight slowdown in upward momentum. The stock reached a high of $21.37 and a low of $3.45, with a standard deviation of 3.95 indicating moderate volatility. The recent period from September 14, 2025, to November 30, 2025, saw a 19.66% price increase, but with a slight downward trend slope of -0.02, suggesting cautious observation is warranted.

NexGen Energy Ltd. (NXE) NXE has shown a solid price increase of +23.77% over the past year, reflecting a bullish trend as well. Similar to UUUU, NXE’s recent performance indicates deceleration, with the stock achieving a high of $9.76 and a low of $4.18. The standard deviation of 1.13 points to low volatility in comparison to UUUU. In the recent timeframe from September 14, 2025, to November 30, 2025, NXE’s price rose by 9.17%, although with a trend slope of -0.03, indicating a potential slowdown in growth momentum.

Both stocks present promising upward trends, but investors should remain vigilant about the recent deceleration in price movements.

Analyst Opinions

Recent recommendations for Energy Fuels Inc. (UUUU) and NexGen Energy Ltd. (NXE) reflect a cautious outlook. Both companies received a rating of D+ from analysts, indicating concerns about their financial metrics. Notably, analysts have highlighted their low scores across various categories, including return on equity and discounted cash flow. As a result, the consensus for both stocks is a hold for the current year, suggesting that investors should closely monitor their performance before making any significant moves.

Stock Grades

I have gathered the latest stock ratings for Energy Fuels Inc. (UUUU), which show a mix of stability and a recent downgrade.

Energy Fuels Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | Downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-21 |

| B. Riley Securities | Maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-08 |

| Canaccord Genuity | Maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2025-05-09 |

| HC Wainwright & Co. | Maintain | Buy | 2025-02-28 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-11 |

The recent downgrade from Roth Capital to a “Sell” rating is a notable shift, although HC Wainwright & Co. continues to maintain a “Buy” rating. This mixed sentiment indicates a cautious outlook for UUUU, so I recommend keeping an eye on future developments and potential market reactions. For NexGen Energy Ltd. (NXE), no verified stock grades were available, indicating a gap in analyst coverage or sentiment.

Target Prices

Currently, I have verified target price data for Energy Fuels Inc. (UUUU) but not for NexGen Energy Ltd. (NXE).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Energy Fuels Inc. | 26.75 | 11.5 | 19.13 |

Analysts have set a consensus target price of 19.13 for UUUU, which indicates a potential upside from the current stock price of 14.29. This suggests a bullish outlook on the stock relative to its recent performance.

For NexGen Energy Ltd. (NXE), no verified target price data is available from recognized analysts.

Strengths and Weaknesses

The table below provides a comparative analysis of the strengths and weaknesses of Energy Fuels Inc. (UUUU) and NexGen Energy Ltd. (NXE).

| Criterion | Energy Fuels Inc. (UUUU) | NexGen Energy Ltd. (NXE) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins | No profitability |

| Innovation | Moderate | High |

| Global presence | Primarily US | Primarily Canada |

| Market Share | Growing | Emerging |

| Debt level | Very low | Moderate |

Key takeaways: Energy Fuels has a strong innovation pipeline and very low debt, but lacks profitability. NexGen is focusing on growth with innovative projects, albeit with no current profits and moderate debt levels.

Risk Analysis

The following table outlines key risks associated with Energy Fuels Inc. (UUUU) and NexGen Energy Ltd. (NXE):

| Metric | Energy Fuels Inc. (UUUU) | NexGen Energy Ltd. (NXE) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | High | High |

| Operational Risk | Moderate | Low |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | High | Moderate |

Both companies face significant market and regulatory risks primarily due to their operations in the uranium sector. Energy Fuels has experienced high volatility with a beta of 2.049, indicating sensitivity to market movements. Additionally, geopolitical tensions surrounding uranium mining can create uncertainty for both entities.

Which one to choose?

In comparing Energy Fuels Inc. (UUUU) and NexGen Energy Ltd. (NXE), both companies show significant challenges. UUUU has a market cap of 882M, with a net profit margin of -61.15% and a bearish trend, while NXE’s market cap stands at 5.26B, but it also reports no revenue with a net income loss of -77.56M. Both companies receive a rating of D+, indicating underlying financial issues. Analysts suggest cautious investment, as UUUU’s earnings yield is negative, and NXE lacks stable revenue streams.

Investors focused on growth may prefer NXE, given its larger market cap and potential for future gains, while those prioritizing stability might consider UUUU, which has shown some operational improvements. However, both face industry risks such as intense competition and valuation concerns.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Energy Fuels Inc. and NexGen Energy Ltd. to enhance your investment decisions: