In the dynamic world of uranium mining, two key players stand out: Cameco Corporation (CCJ) and Denison Mines Corp. (DNN). Both companies operate within the same industry, focusing on uranium exploration and production, yet they adopt distinct strategies to innovate and capture market share. With increasing global demand for nuclear energy, understanding the nuances of these companies is crucial. Join me as I dissect their strengths and weaknesses to uncover which company presents the most compelling investment opportunity.

Table of contents

Company Overview

Cameco Corporation Overview

Cameco Corporation (CCJ) is a leading global supplier of uranium, focusing on the exploration, mining, and milling of uranium concentrate. Founded in 1987 and headquartered in Saskatoon, Canada, Cameco operates primarily through two segments: Uranium and Fuel Services. The company serves nuclear utilities across the Americas, Europe, and Asia, providing essential fuel for nuclear reactors. With a market capitalization of approximately $37.8B, Cameco is well-positioned in the energy sector, benefiting from the ongoing global push towards cleaner energy sources. The firm has demonstrated a strong commitment to sustainability, emphasizing responsible mining practices and the development of nuclear fuel technologies.

Denison Mines Corp. Overview

Denison Mines Corp. (DNN) is an exploration and development company focused on uranium properties in Canada, particularly known for its flagship Wheeler River project in the Athabasca Basin. Established in 1997 and based in Toronto, Denison engages in acquiring and developing uranium assets to meet the increasing demand for nuclear energy. With a market cap of around $2.2B, Denison is a smaller player in the uranium sector compared to Cameco, but it has carved out a niche by focusing on innovative extraction and processing methods. The company is committed to environmental stewardship and community engagement in its operational areas.

Key Similarities and Differences

Both Cameco and Denison operate within the uranium industry, focusing on the exploration and production of uranium. However, Cameco is a larger entity with diversified operations including fuel services, while Denison concentrates on exploration and development projects. This distinction highlights Cameco’s established market presence compared to Denison’s more focused, growth-oriented strategy.

Income Statement Comparison

Below is a comparison of the most recent income statements for Cameco Corporation and Denison Mines Corp., highlighting key financial metrics.

| Metric | Cameco Corporation (CCJ) | Denison Mines Corp. (DNN) |

|---|---|---|

| Revenue | 3.14B | 4.02M |

| EBITDA | 789.34M | -81.79M |

| EBIT | 474.91M | -91.72M |

| Net Income | 171.85M | -91.12M |

| EPS | 0.40 | -0.10 |

Interpretation of Income Statement

In the most recent year, Cameco Corporation (CCJ) reported a significant increase in revenue, up from 2.59B to 3.14B, reflecting a robust demand for its products. Its net income decreased from 360.85M to 171.85M, indicating pressure on margins due to rising costs. Conversely, Denison Mines Corp. (DNN) faced persistent challenges, with revenues declining and a significant net loss of 91.19M. The company’s margins remain under pressure, as evidenced by negative EBITDA and EBIT figures. Overall, CCJ shows resilience, while DNN struggles to achieve profitability.

Financial Ratios Comparison

The following table compares the most recent revenue and financial ratios of Cameco Corporation (CCJ) and Denison Mines Corp. (DNN).

| Metric | CCJ | DNN |

|---|---|---|

| ROE | 2.70% | -16.15% |

| ROIC | 3.79% | -10.03% |

| P/E | 187 | -25.35 |

| P/B | 5.05 | 4.09 |

| Current Ratio | 1.62 | 3.65 |

| Quick Ratio | 0.80 | 3.54 |

| D/E | 0.20 | 0.00 |

| Debt-to-Assets | 0.13 | 0.00 |

| Interest Coverage | 3.98 | N/A |

| Asset Turnover | 0.32 | 0.01 |

| Fixed Asset Turnover | 0.95 | 0.01 |

| Payout Ratio | 40.52% | 0.00% |

| Dividend Yield | 0.22% | 0.00% |

Interpretation of Financial Ratios

Cameco Corporation shows a positive ROE and ROIC, indicating solid profitability and effective capital use. However, its high P/E ratio suggests that the stock may be overvalued. Conversely, Denison Mines Corp. reveals negative profitability with alarming ratios, particularly in ROE and ROIC, coupled with no debt, which could be a sign of financial distress. Caution is recommended when considering investments in DNN due to its weak performance metrics.

Dividend and Shareholder Returns

Cameco Corporation (CCJ) provides dividends, with a payout ratio of 40.5% and an annual yield of 0.22%. Their dividend per share has shown a positive trend, supported by a coverage ratio of 3.22 by free cash flow. However, risks of unsustainable distributions and excessive repurchases must be monitored. In contrast, Denison Mines Corp. (DNN) does not pay dividends, focusing on reinvestment for growth. They engage in share buybacks, but the lack of dividends could hinder immediate shareholder returns. Overall, CCJ’s strategy appears more aligned with sustainable long-term value creation compared to DNN.

Strategic Positioning

Cameco Corporation (CCJ) holds a significant market share in the uranium sector, leveraging its extensive resources and operations in uranium mining and fuel services. With a market cap of approximately $37.78B and a beta of 1.31, it faces competitive pressure from Denison Mines Corp. (DNN), which has a market cap of about $2.18B and a higher beta at 2.04, indicating greater volatility. Both companies are navigating technological disruptions and evolving regulatory landscapes, making strategic positioning crucial for maintaining their competitive edges.

Stock Comparison

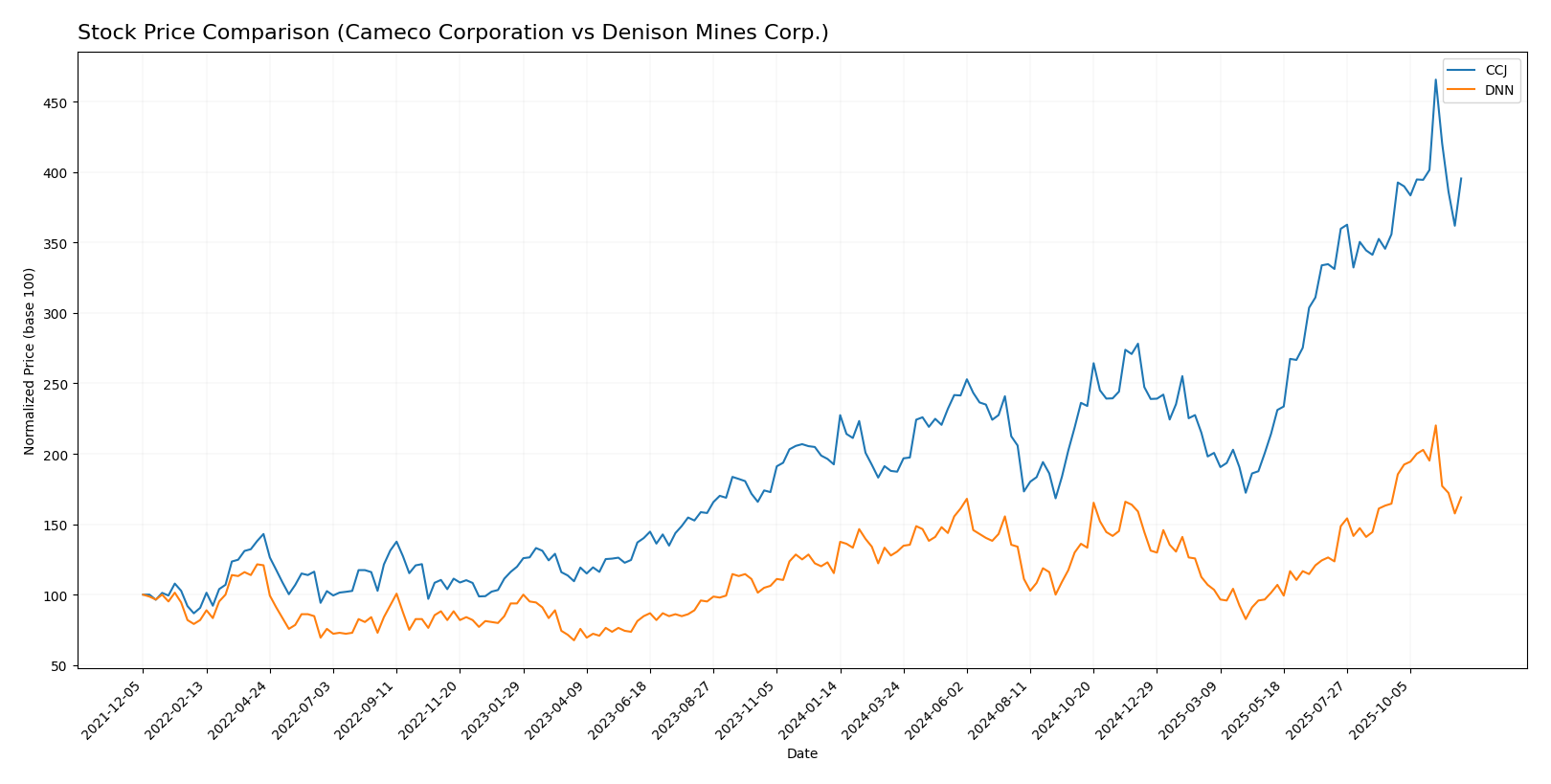

In this section, I will analyze the stock price movements and trading dynamics of Cameco Corporation (CCJ) and Denison Mines Corp. (DNN) over the past year, highlighting key price fluctuations and overall trends.

Trend Analysis

Cameco Corporation (CCJ): Over the past year, CCJ has experienced a significant price increase of 105.44%. This bullish trend is marked by notable acceleration, with the stock reaching a high of 102.21 and a low of 36.96. Additionally, the recent trend analysis indicates an 11.13% price change since mid-September 2025, with a standard deviation of 5.86, suggesting moderate volatility in the short term.

Denison Mines Corp. (DNN): DNN has also shown a positive trend, with a price increase of 46.69% over the past year, characterized as bullish yet with signs of deceleration. The stock’s highest price was 3.17, while the lowest was 1.19. In the recent trend, DNN recorded a price increase of 2.74% since mid-September 2025, accompanied by a low standard deviation of 0.25, indicating lower volatility compared to CCJ.

In summary, both stocks are experiencing bullish trends, though CCJ shows stronger momentum and volatility compared to DNN, which is currently exhibiting signs of deceleration in its recent price movements.

Analyst Opinions

Recent analyst recommendations for Cameco Corporation (CCJ) indicate a cautious optimism, with a rating of B- reflecting solid fundamentals, particularly in return on assets. Analysts suggest it may be a good buy due to its stable performance metrics. Conversely, Denison Mines Corp. (DNN) received a C- rating, indicating weaker performance across several key metrics, leading analysts to recommend a hold or potential sell. The consensus for the current year leans towards a buy for CCJ while DNN remains a hold.

Stock Grades

In the latest evaluations from recognized grading companies, we can see how Cameco Corporation (CCJ) and Denison Mines Corp. (DNN) are currently rated. Here are the details:

Cameco Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | maintain | Outperform | 2025-11-13 |

| RBC Capital | maintain | Outperform | 2025-10-31 |

| Goldman Sachs | maintain | Buy | 2025-10-29 |

| RBC Capital | maintain | Outperform | 2025-08-01 |

| RBC Capital | maintain | Outperform | 2025-06-20 |

| GLJ Research | maintain | Buy | 2025-06-12 |

| Goldman Sachs | maintain | Buy | 2025-06-11 |

| GLJ Research | maintain | Buy | 2025-03-12 |

| RBC Capital | maintain | Outperform | 2025-03-04 |

| Scotiabank | maintain | Outperform | 2024-08-19 |

Denison Mines Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | maintain | Buy | 2024-10-23 |

| TD Securities | maintain | Speculative Buy | 2023-06-27 |

| Raymond James | maintain | Outperform | 2023-06-27 |

| TD Securities | maintain | Speculative Buy | 2023-06-26 |

| Raymond James | maintain | Outperform | 2023-06-26 |

| Credit Suisse | downgrade | Underperform | 2017-07-18 |

| Credit Suisse | downgrade | Underperform | 2017-07-17 |

| Roth Capital | maintain | Buy | 2016-02-10 |

| Credit Suisse | upgrade | Neutral | 2014-04-01 |

| Credit Suisse | upgrade | Neutral | 2014-03-31 |

The overall trend shows a consistent positivity for Cameco Corporation with multiple maintain ratings at “Outperform” and “Buy”. Denison Mines Corp. also reflects a stable sentiment, maintaining “Buy” and “Speculative Buy” ratings despite previous downgrades. This suggests a cautious yet optimistic outlook for both stocks, indicating potential opportunities for investors.

Target Prices

Currently, I have reliable target price data for both Cameco Corporation (CCJ) and Denison Mines Corp. (DNN).

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cameco Corporation (CCJ) | 109 | 70 | 95.75 |

| Denison Mines Corp. (DNN) | 2.6 | 2.6 | 2.6 |

Analysts have a consensus target price of 95.75 for CCJ, suggesting a potential upside compared to its current price of 86.78. For DNN, the consensus aligns exactly with its current price at 2.435, indicating a stable outlook.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Cameco Corporation (CCJ) and Denison Mines Corp. (DNN) based on recent data.

| Criterion | Cameco Corporation (CCJ) | Denison Mines Corp. (DNN) |

|---|---|---|

| Diversification | High, operates in multiple segments (Uranium and Fuel Services) | Low, focused primarily on uranium properties |

| Profitability | Strong net profit margin at 13.9% | Negative profitability with recent net margins around -22.6% |

| Innovation | Investment in advanced extraction technologies | Limited innovation reported |

| Global presence | Operates in Americas, Europe, and Asia | Primarily focused on Canadian properties |

| Market Share | Significant, leading player in uranium sector | Smaller player with limited market share |

| Debt level | Moderate, debt-to-equity ratio at 0.20 | Minimal, no reported debt |

Key takeaways indicate that while Cameco Corporation shows strong profitability, diversification, and market presence, Denison Mines faces challenges in profitability and innovation, making it a riskier investment option.

Risk Analysis

In this section, I will outline the key risks associated with Cameco Corporation (CCJ) and Denison Mines Corp. (DNN) to help you understand their investment profiles better.

| Metric | Cameco Corporation (CCJ) | Denison Mines Corp. (DNN) |

|---|---|---|

| Market Risk | Medium | High |

| Regulatory Risk | High | Medium |

| Operational Risk | Medium | High |

| Environmental Risk | Medium | Medium |

| Geopolitical Risk | High | Medium |

Both companies face notable risks, particularly in regulatory and market dynamics. CCJ is impacted by high regulatory scrutiny, while DNN’s operational risks remain elevated due to its developmental phase. As of 2025, the uranium sector experiences volatility amid geopolitical tensions, which could significantly affect performance.

Which one to choose?

When comparing Cameco Corporation (CCJ) and Denison Mines Corp. (DNN), it’s clear that CCJ demonstrates stronger fundamentals. With a market cap of CAD 32.1B, it has a robust gross profit margin of 33.9% and a solid net income margin of 5.5%. Its Price-to-Earnings (P/E) ratio stands at 187, indicating high expectations, yet its recent bullish stock trend, with a 105.4% price change, suggests positive market sentiment.

Conversely, DNN shows a troubling performance, with a C- rating and net losses reflected in its negative gross profit margin. Its market cap is only CAD 2.3B, with a P/E ratio of -25.3, which raises concerns about its valuation and profitability potential.

Recommendation: Investors with a growth focus might lean towards Cameco (CCJ) given its proven track record and strong market trend, while those prioritizing speculative opportunities may find DNN intriguing but should be cautious of its inherent risks.

Specific risks include DNN’s struggle with profitability and CCJ’s high valuation relative to earnings.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cameco Corporation and Denison Mines Corp. to enhance your investment decisions: