In the dynamic energy sector, the competition in uranium production intensifies as we explore the innovative strategies of two prominent players: Cameco Corporation (CCJ) and Energy Fuels Inc. (UUUU). Both companies operate within the same industry and share market overlap, yet they approach uranium extraction and sales from distinct angles. This analysis will delve into their respective strengths and strategies, helping you determine which company holds the most potential for your investment portfolio.

Table of contents

Company Overview

Cameco Corporation Overview

Cameco Corporation, trading under the ticker CCJ, is a leading player in the uranium sector, primarily engaged in the exploration, mining, and sale of uranium. Headquartered in Saskatoon, Canada, Cameco operates through two main segments: Uranium and Fuel Services. The Uranium segment focuses on the acquisition and sale of uranium concentrate, while the Fuel Services segment provides refining and fabrication services for nuclear utilities across the Americas, Europe, and Asia. With a market cap of approximately $37.8B, Cameco is well-positioned to capitalize on the growing demand for nuclear energy as a cleaner power source.

Energy Fuels Inc. Overview

Energy Fuels Inc., represented by the ticker UUUU, is another significant entity in the uranium industry, specializing in the extraction and recovery of uranium within the United States. The company manages several projects, including the Nichols Ranch and Alta Mesa, and operates the White Mesa Mill in Utah. With a market cap of around $3.4B, Energy Fuels is actively involved in both traditional and in situ uranium recovery methods, demonstrating flexibility in its operations. This adaptability positions the company favorably as market dynamics evolve.

Key Similarities and Differences

Both Cameco and Energy Fuels operate within the uranium industry, focusing on extraction and sales to nuclear utilities. However, Cameco has a broader international footprint, while Energy Fuels primarily targets the U.S. market. Additionally, Cameco emphasizes fuel services, whereas Energy Fuels is notable for its in situ recovery techniques, showcasing different operational strategies within the same sector.

Income Statement Comparison

Below is a comparative income statement for Cameco Corporation (CCJ) and Energy Fuels Inc. (UUUU) for the most recent fiscal year, providing insights into their financial performance.

| Metric | Cameco Corporation (CCJ) | Energy Fuels Inc. (UUUU) |

|---|---|---|

| Revenue | 3.14B | 78.11M |

| EBITDA | 789.34M | -43.02M |

| EBIT | 474.91M | -48.21M |

| Net Income | 171.85M | -47.77M |

| EPS | 0.40 | -0.28 |

Interpretation of Income Statement

In the most recent year, Cameco Corporation (CCJ) demonstrated strong revenue growth, increasing from 2.59B in the prior year to 3.14B, while its net income fell from 360.85M to 171.85M, indicating potential margin compression. Conversely, Energy Fuels Inc. (UUUU) reported a significant increase in revenue from 37.93M to 78.11M, but it continued to post net losses, reflecting ongoing operational challenges. The negative EBITDA and EBIT indicate that UUUU still faces profitability issues, despite improved revenues, suggesting a need for strategic operational changes to enhance margins. Overall, CCJ shows more stability and profitability compared to UUUU, which remains in a vulnerable position.

Financial Ratios Comparison

The following table provides a comparative overview of key financial ratios for Cameco Corporation (CCJ) and Energy Fuels Inc. (UUUU) based on the most recent available data.

| Metric | CCJ (2024) | UUUU (2024) |

|---|---|---|

| ROE | 2.70% | -9.05% |

| ROIC | 3.79% | -6.67% |

| P/E | 187.01 | -18.47 |

| P/B | 5.05 | 1.67 |

| Current Ratio | 1.62 | 3.88 |

| Quick Ratio | 0.80 | 2.76 |

| D/E | 0.20 | 0.004 |

| Debt-to-Assets | 13.08% | 0.36% |

| Interest Coverage | 3.98 | N/A |

| Asset Turnover | 0.32 | 0.13 |

| Fixed Asset Turnover | 0.95 | 1.42 |

| Payout Ratio | 40.52% | 0% |

| Dividend Yield | 0.22% | 0% |

Interpretation of Financial Ratios

Analyzing these ratios, I observe that Cameco (CCJ) exhibits strong profitability metrics, particularly with a high P/E ratio indicating robust earnings relative to its share price. In contrast, Energy Fuels (UUUU) presents significant challenges with negative returns on equity and investment, alongside high debt levels and low asset efficiency. The substantial disparity in interest coverage also raises concerns about UUUU’s ability to meet its financial obligations. Overall, while CCJ shows potential stability and growth, UUUU’s financial position warrants caution and closer scrutiny.

Dividend and Shareholder Returns

Cameco Corporation (CCJ) offers a modest dividend with a payout ratio of 40.5% and a yield of 2.17%, supported by a solid free cash flow coverage ratio. However, the high price-to-earnings ratio (187) raises concerns about sustainability. In contrast, Energy Fuels Inc. (UUUU) does not pay dividends, focusing instead on reinvestment for growth amidst negative net income. Both companies engage in share buybacks, contributing to shareholder returns. While CCJ’s dividends support value creation, UUUU’s strategy must yield future profits to align with long-term shareholder interests.

Strategic Positioning

Cameco Corporation (CCJ) holds a significant share in the uranium market, benefiting from its established operations in mining and fuel services. With a market cap of 37.8B, it faces competitive pressure from Energy Fuels Inc. (UUUU), which has a market cap of 3.4B and is focused on in situ recovery methods. Technological advancements and regulatory changes in the energy sector could further influence market dynamics, making it crucial for investors to stay informed about these developments.

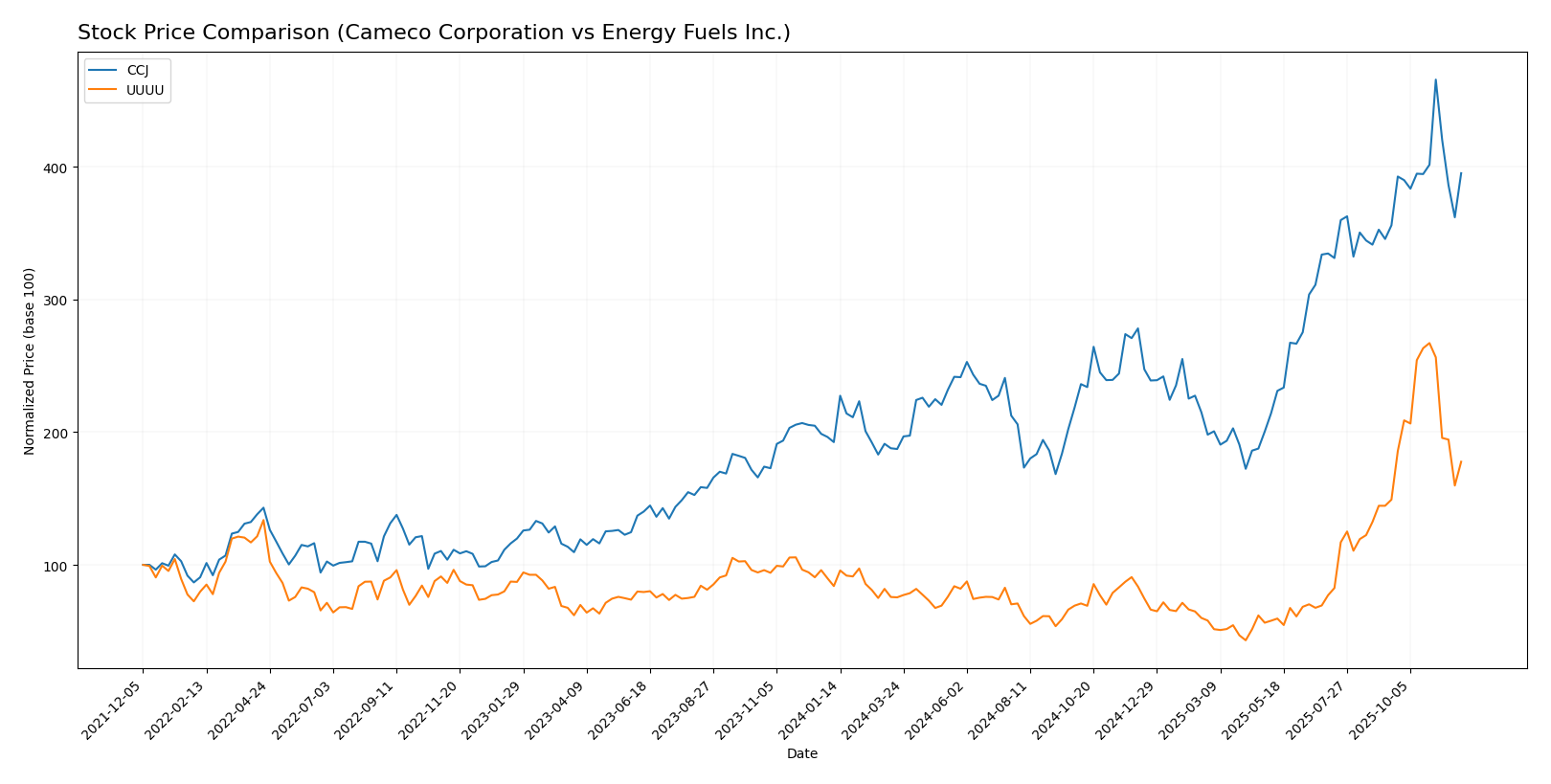

Stock Comparison

In the past year, both Cameco Corporation (CCJ) and Energy Fuels Inc. (UUUU) have exhibited significant stock price movements, reflecting strong market dynamics and investor interest.

Trend Analysis

For Cameco Corporation (CCJ), the overall percentage change over the last year is +105.28%, indicating a bullish trend. The stock has experienced notable price volatility with a standard deviation of 15.32, alongside a high of 102.21 and a low of 36.96. Moreover, the recent trend from September 14, 2025, to November 30, 2025, shows an 11.04% increase, with a standard deviation of 5.86, suggesting acceleration in its upward momentum.

In contrast, Energy Fuels Inc. (UUUU) has achieved a remarkable overall percentage change of +111.53%, also reflecting a bullish trend. However, this trend demonstrates deceleration with a standard deviation of 3.95. The highest price reached was 21.37, while the lowest was 3.45. Recent analysis from September 14, 2025, to November 30, 2025, reveals a 19.15% increase, but the trend slope indicates a slight decrease in momentum, with a standard deviation of 3.14.

Both companies show strong performance, but investors should remain vigilant regarding the deceleration seen in UUUU’s recent trend.

Analyst Opinions

Recent analysis of Cameco Corporation (CCJ) shows a cautious optimism, with a rating of B- from several analysts, including a favorable assessment of its return on assets and equity. They recommend a “buy” stance, citing strong fundamentals and growth potential in the uranium market. In contrast, Energy Fuels Inc. (UUUU) has received a D+ rating, leading analysts to suggest a “sell” position due to weak financial metrics and high risk. Overall, the consensus for CCJ is a “buy,” while UUUU is generally viewed as a “sell.”

Stock Grades

In this section, I present the latest stock grades for Cameco Corporation (CCJ) and Energy Fuels Inc. (UUUU), providing insights into their current investment outlooks based on reliable grading data.

Cameco Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2025-11-13 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| Goldman Sachs | Maintain | Buy | 2025-10-29 |

| RBC Capital | Maintain | Outperform | 2025-08-01 |

| RBC Capital | Maintain | Outperform | 2025-06-20 |

| GLJ Research | Maintain | Buy | 2025-06-12 |

| Goldman Sachs | Maintain | Buy | 2025-06-11 |

| GLJ Research | Maintain | Buy | 2025-03-12 |

| RBC Capital | Maintain | Outperform | 2025-03-04 |

| Scotiabank | Maintain | Outperform | 2024-08-19 |

Energy Fuels Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | Downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-21 |

| B. Riley Securities | Maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-08 |

| Canaccord Genuity | Maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2025-05-09 |

| HC Wainwright & Co. | Maintain | Buy | 2025-02-28 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-11 |

Overall, the trend for CCJ shows consistent support from analysts with multiple “Outperform” and “Buy” ratings, indicating confidence in the company’s future performance. Conversely, UUUU has experienced a recent downgrade to “Sell” by Roth Capital, suggesting a cautious approach for investors considering this stock at this time.

Target Prices

The consensus target prices for the companies analyzed indicates strong investor expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cameco Corporation (CCJ) | 109 | 70 | 95.75 |

| Energy Fuels Inc. (UUUU) | 26.75 | 11.5 | 19.13 |

For Cameco Corporation, the target consensus of 95.75 suggests a potential upside from the current price of 86.725. Meanwhile, Energy Fuels Inc. shows a target consensus of 19.13 against its current price of 14.215, indicating room for growth as well.

Strengths and Weaknesses

The following table summarizes the strengths and weaknesses of Cameco Corporation (CCJ) and Energy Fuels Inc. (UUUU) based on the most recent data.

| Criterion | Cameco Corporation (CCJ) | Energy Fuels Inc. (UUUU) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | High (Net Margin: 14%) | Negative |

| Innovation | Strong | Moderate |

| Global presence | Extensive (Global Sales) | Limited (U.S. Focus) |

| Market Share | Significant in Uranium | Emerging |

| Debt level | Low (Debt/Assets: 13%) | Very Low (Debt/Assets: 0.4%) |

Key takeaways reveal that Cameco Corporation demonstrates strong profitability and a significant global presence, while Energy Fuels Inc. faces challenges with profitability and limited diversification. Investors should weigh these factors when considering their investment options.

Risk Analysis

The following table outlines the key risks associated with Cameco Corporation (CCJ) and Energy Fuels Inc. (UUUU).

| Metric | Cameco Corporation (CCJ) | Energy Fuels Inc. (UUUU) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | High |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | High | Moderate |

Both companies face significant market and regulatory risks due to their positions in the uranium sector, which is sensitive to price volatility and regulatory changes. The geopolitical landscape also adds uncertainty, particularly for CCJ, which has substantial operations in Canada.

Which one to choose?

When comparing Cameco Corporation (CCJ) and Energy Fuels Inc. (UUUU), it is evident that CCJ shows stronger fundamentals. With a market cap of approximately 32.1B CAD, CCJ boasts a solid net profit margin of 5.5% and a more favorable debt-to-equity ratio at 0.2, indicating better financial health. In contrast, UUUU’s market cap is around 882M USD, with a concerning negative profit margin. Analysts have rated CCJ with a solid B- while UUUU received a D+, underscoring the latter’s operational struggles.

For growth-oriented investors, CCJ appears favorable for long-term investment. However, those prioritizing speculative opportunities might lean toward UUUU, despite its clear financial challenges.

Specific risks for both companies include market dependence and competition within the uranium sector, which can significantly impact performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Cameco Corporation and Energy Fuels Inc. to enhance your investment decisions: