In the evolving landscape of the energy sector, Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO) present compelling narratives for investors. Both companies operate within the nuclear energy industry but focus on different aspects—Centrus specializes in nuclear fuel supply, while Oklo develops innovative fission power plants. This article will delve into their market strategies, technological advancements, and potential for future growth, ultimately helping you determine which company might be the more intriguing investment opportunity.

Table of contents

Company Overview

Centrus Energy Corp. Overview

Centrus Energy Corp. (LEU) is a leading supplier of nuclear fuel and services tailored for the nuclear power sector, both domestically and internationally. The company operates primarily through two segments: Low-Enriched Uranium (LEU), which offers essential components for nuclear fuel, and Technical Solutions, providing extensive engineering and operational services. Founded in 1998 and headquartered in Bethesda, Maryland, Centrus aims to contribute to energy security and sustainability through reliable nuclear energy solutions. With a market capitalization of approximately $4.37B, Centrus is strategically positioned to capitalize on the rising demand for clean energy as global economies shift towards more sustainable practices.

Oklo Inc. Overview

Oklo Inc. (OKLO) specializes in designing and developing compact fission power plants, offering innovative energy solutions to meet the needs of customers across the United States. Founded in 2013 and based in Santa Clara, California, the company also focuses on recycling used nuclear fuel, enhancing the sustainability of nuclear energy. With a market capitalization of around $13.30B, Oklo is well-placed within the regulated electric industry, aiming to revolutionize energy production with its cutting-edge technology and commitment to safety and efficiency.

Key Similarities and Differences

Both Centrus Energy and Oklo operate within the nuclear energy sector, focusing on providing sustainable energy solutions. However, while Centrus primarily supplies nuclear fuel and technical services, Oklo emphasizes the development of compact power plants and recycling services. This distinction highlights Centrus’s role as a supplier and Oklo’s innovative approach to energy generation.

Income Statement Comparison

The following table provides a comparison of the most recent income statements for Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO), highlighting their financial performance metrics.

| Metric | Centrus Energy Corp. (LEU) | Oklo Inc. (OKLO) |

|---|---|---|

| Revenue | 442M | 0 |

| EBITDA | 86.5M | -52.5M |

| EBIT | 75.7M | -52.8M |

| Net Income | 73.2M | -73.6M |

| EPS | 4.49 | -0.7443 |

Interpretation of Income Statement

Centrus Energy Corp. demonstrated a solid revenue growth of approximately 38% year-over-year, with net income also increasing significantly from 84.4M to 73.2M. This growth was accompanied by stable EBITDA margins, reflecting effective cost management. Conversely, Oklo Inc. continues to face challenges, reporting no revenue and a widening net loss of 73.6M. The company’s operating expenses exceeded its income, indicating a need for strategic adjustments. Overall, while LEU shows promising growth, OKLO’s financial performance signals heightened operational risks that investors should monitor closely.

Financial Ratios Comparison

The table below presents a comparative analysis of the most recent revenue and key financial ratios for Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO).

| Metric | Centrus Energy Corp. (LEU) | Oklo Inc. (OKLO) |

|---|---|---|

| ROE | 45.35% | -29.35% |

| ROIC | 4.02% | -19.23% |

| P/E | 14.84 | N/A |

| P/B | 6.73 | -29.73 |

| Current Ratio | 2.93 | 43.47 |

| Quick Ratio | 2.46 | 43.47 |

| D/E | 0.97 | 0.01 |

| Debt-to-Assets | 14.36% | 0.46% |

| Interest Coverage | 17.78 | N/A |

| Asset Turnover | 0.40 | 0.00 |

| Fixed Asset Turnover | 47.02 | 0.00 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

Centrus Energy Corp. displays strong profitability and efficient asset utilization, evidenced by its high ROE and interest coverage ratios. However, its debt level is notable with a D/E ratio of 0.97. In contrast, Oklo Inc. shows significant liquidity with exceptional current and quick ratios, but its negative profitability metrics raise concerns regarding sustainability and operational effectiveness. Investors should exercise caution with OKLO due to its lack of revenue and negative returns.

Dividend and Shareholder Returns

Centrus Energy Corp. (LEU) does not currently pay dividends, aligning with its strategy of reinvesting earnings for growth. This approach is common among companies in high-growth phases, which prioritizes capital for expansion over shareholder payouts. They also engage in share buybacks, indicating a commitment to enhancing shareholder value. In contrast, Oklo Inc. (OKLO) also refrains from dividend distributions, reflecting its focus on R&D and operational development. Both companies’ strategies may support long-term value creation, although investors should remain cautious of potential cash flow constraints.

Strategic Positioning

Centrus Energy Corp. (LEU) holds a niche position in the uranium market, with a focus on low-enriched uranium and technical solutions. Its market cap of $4.37B suggests solid stability, but it faces competitive pressure from companies like Oklo Inc. (OKLO), which has a greater market cap of $13.30B and is innovating in fission power plants. Both companies must navigate technological disruptions and regulatory challenges within the nuclear energy sector to maintain their market shares effectively.

Stock Comparison

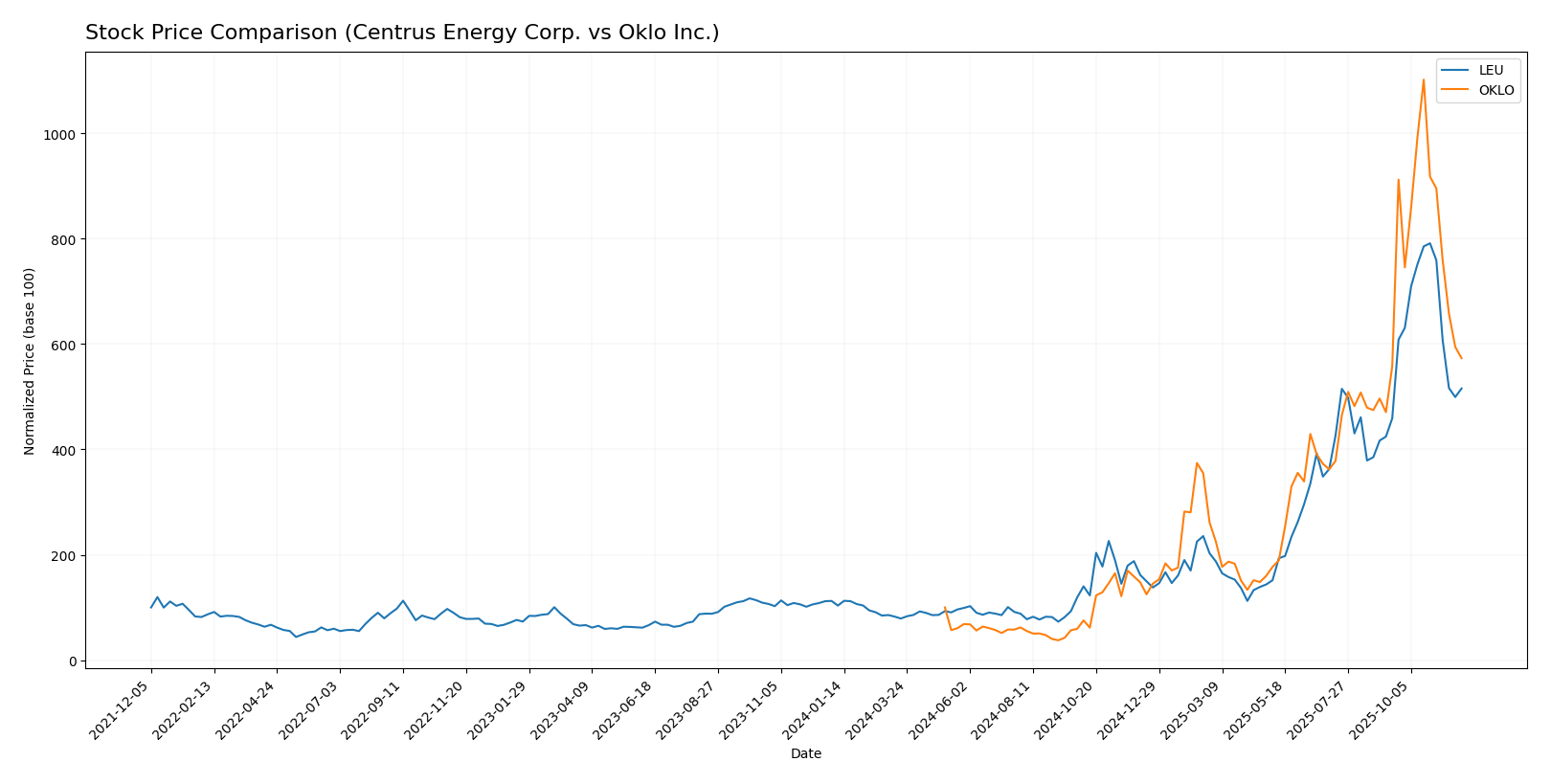

In this section, I will analyze the weekly stock price movements of Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO), highlighting key price dynamics and trends over the past year.

Trend Analysis

Centrus Energy Corp. (LEU) Over the past year, LEU has experienced a significant price change of +397.88%. This bullish trend is characterized by notable price fluctuations, with a high of 383.0 and a low of 35.36. However, the recent trend shows a more modest increase of +12.36% from September 14, 2025, to November 30, 2025, indicating a deceleration in momentum with a trend slope of -2.77. The standard deviation during this period is 56.02, reflecting considerable volatility.

Oklo Inc. (OKLO) OKLO has seen a striking price change of +473.1% over the last year, also indicating a bullish trend. The stock reached a high of 163.39 and a low of 5.59. In the recent period, from September 14, 2025, to November 30, 2025, the price increased by +2.76%, suggesting a neutral short-term trend with a trend slope of -2.21. The standard deviation of 25.11 illustrates less volatility compared to LEU.

Both stocks exhibit strong long-term growth, but recent trends indicate a slowing momentum, warranting cautious consideration for potential investors.

Analyst Opinions

Recent analyst recommendations indicate a cautious stance on Centrus Energy Corp. (LEU) with a rating of B-, suggesting a hold strategy. Analysts highlight strong return on equity and assets as positive factors, although concerns about debt levels persist. In contrast, Oklo Inc. (OKLO) received a C rating, indicating a sell recommendation due to weaker performance metrics across several categories, particularly return on equity and assets. The consensus for LEU leans toward hold, while OKLO is viewed as a sell for the current year.

Stock Grades

In this section, I present the latest stock grades from respected grading companies for Centrus Energy Corp. and Oklo Inc.

Centrus Energy Corp. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-26 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-08 |

| B of A Securities | Downgrade | Neutral | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-07 |

| B. Riley Securities | Maintain | Buy | 2025-06-23 |

| Evercore ISI Group | Maintain | Outperform | 2025-06-18 |

| B. Riley Securities | Maintain | Buy | 2024-10-30 |

| Roth MKM | Maintain | Neutral | 2024-10-30 |

Oklo Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Maintain | Outperform | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| B. Riley Securities | Maintain | Buy | 2025-11-12 |

| B of A Securities | Downgrade | Neutral | 2025-09-30 |

| Seaport Global | Downgrade | Neutral | 2025-09-23 |

| Wedbush | Maintain | Outperform | 2025-09-22 |

| Wedbush | Maintain | Outperform | 2025-08-14 |

| Wedbush | Maintain | Outperform | 2025-08-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-12 |

| Citigroup | Maintain | Neutral | 2025-07-22 |

Overall, both companies show a mix of maintain and downgrade actions, with Centrus Energy Corp. being rated as neutral by multiple analysts, while Oklo Inc. maintains a strong outperform rating from Wedbush, indicating a positive outlook despite some recent downgrades. As always, it’s essential to stay informed and consider your investment strategy while assessing these grades.

Target Prices

The consensus target prices for the selected companies indicate positive growth expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Centrus Energy Corp. | 275 | 245 | 257.33 |

| Oklo Inc. | 175 | 75 | 129.5 |

For Centrus Energy Corp. (LEU), the target consensus of 257.33 suggests a moderate upside potential compared to the current price of 250.04. Similarly, Oklo Inc. (OKLO) has a target consensus of 129.5, indicating a significant upside from its current price of 85.1.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO).

| Criterion | Centrus Energy Corp. (LEU) | Oklo Inc. (OKLO) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Strong (Net Profit Margin: 26.4%) | None |

| Innovation | High | Moderate |

| Global presence | Presence in multiple countries | Limited |

| Market Share | Growing | Emerging |

| Debt level | Moderate (Debt/Equity: 0.973) | Low (Debt/Equity: 0.005) |

Key takeaways indicate that Centrus Energy Corp. shows robust profitability and innovation, making it a strong contender in the uranium sector. In contrast, Oklo Inc. is still in the early stages with no profitability yet, suggesting higher risk but potential for significant growth.

Risk Analysis

The following table outlines key risks associated with Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO):

| Metric | Centrus Energy Corp. (LEU) | Oklo Inc. (OKLO) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | High |

| Operational Risk | Moderate | High |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | High | Moderate |

In summary, both companies face significant regulatory and market risks, particularly in the evolving energy sector. Centrus Energy’s exposure to geopolitical risks is notably high, given the international nature of its operations, while Oklo’s operational challenges may impact its growth trajectory.

Which one to choose?

When comparing Centrus Energy Corp. (LEU) and Oklo Inc. (OKLO), the fundamentals indicate that LEU is the more robust option for potential investors. LEU has demonstrated strong financial performance, with a revenue of $442M and a net profit margin of 16.6% in 2024. It boasts a B- rating from analysts, reflecting solid metrics in return on equity and assets. In contrast, OKLO has yet to generate revenue, posting a significant net loss of $73.6M in 2024 and a C rating, suggesting less favorable prospects.

For growth-focused investors, LEU appears favorable due to its bullish stock trend and recent price increase of nearly 12.36%. Conversely, conservative investors seeking stability might still consider OKLO, provided they assess its long-term potential carefully, though it faces substantial risks related to competition and financial performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Centrus Energy Corp. and Oklo Inc. to enhance your investment decisions: