In the ever-evolving landscape of the utilities sector, Exelon Corporation (EXC) and Oklo Inc. (OKLO) stand out as two distinct players with much to offer. While Exelon represents a long-established entity in regulated electric services, Oklo is an innovative newcomer focused on fission power technologies. Both share a commitment to energy generation and sustainability, yet their approaches and market strategies differ significantly. In this article, I will guide you through their key differentiators to help you determine which company may be the most compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Exelon Corporation Overview

Exelon Corporation (EXC) is a leading utility services holding company based in Chicago, Illinois, specializing in energy generation, delivery, and marketing across the United States and Canada. With a diverse portfolio that includes nuclear, fossil, wind, hydroelectric, biomass, and solar facilities, Exelon is well-positioned in the regulated electric industry. The company serves a wide array of customers, from distribution utilities to residential clients, and offers electricity, natural gas, and renewable energy products. With approximately 20,000 employees, Exelon aims to provide reliable energy solutions while also pursuing sustainable practices in its operations.

Oklo Inc. Overview

Oklo Inc. (OKLO) is an innovative player in the utility sector, focusing on the design and development of fission power plants that deliver reliable, commercial-scale energy. Founded in 2013 and based in Santa Clara, California, Oklo is also involved in recycling used nuclear fuel, showcasing its commitment to sustainability. Although smaller than Exelon, with just 120 employees, Oklo is carving out its niche in the regulated electric industry, positioning itself as a pioneer in advanced nuclear technology.

Key similarities between Exelon and Oklo include their focus on the regulated electric industry and commitment to providing reliable energy solutions. However, their business models differ significantly; Exelon operates a vast array of energy generation facilities and services, while Oklo is centered on developing compact nuclear technology and recycling services, reflecting a more specialized approach to energy generation.

Income Statement Comparison

The following table presents a comparison of the most recent income statements for Exelon Corporation and Oklo Inc., highlighting key financial metrics.

| Metric | Exelon Corporation | Oklo Inc. |

|---|---|---|

| Revenue | 23.03B | 0 |

| EBITDA | 8.18B | -52.53M |

| EBIT | 4.58B | -52.80M |

| Net Income | 2.46B | -73.62M |

| EPS | 2.45 | -0.74 |

Interpretation of Income Statement

Exelon Corporation has shown a consistent upward trend in both revenue and net income over the last year, with revenue increasing from 21.73B to 23.03B, and net income rising from 2.33B to 2.46B. This performance indicates improved operational efficiency and stability in margins. In contrast, Oklo Inc. continues to report zero revenue, reflecting ongoing challenges in monetization, while their net loss has widened significantly. This stark divergence highlights Exelon’s strong market position and financial health relative to Oklo’s precarious situation. Investors should remain cautious, particularly with Oklo’s negative earnings trajectory.

Financial Ratios Comparison

Below is a comparative table highlighting the most recent financial ratios for Exelon Corporation (EXC) and Oklo Inc. (OKLO).

| Metric | Exelon Corporation (EXC) | Oklo Inc. (OKLO) |

|---|---|---|

| ROE | 9.14% | -29.35% |

| ROIC | 3.93% | -19.23% |

| P/E | 15.35 | N/A |

| P/B | 1.40 | N/A |

| Current Ratio | 0.87 | 43.47 |

| Quick Ratio | 0.78 | 43.47 |

| D/E | 1.73 | 0.01 |

| Debt-to-Assets | 43.28% | 1.56% |

| Interest Coverage | 2.26 | 0.00 |

| Asset Turnover | 0.21 | 0.00 |

| Fixed Asset Turnover | 0.29 | 0.00 |

| Payout ratio | 61.95% | N/A |

| Dividend yield | 4.04% | 0% |

Interpretation of Financial Ratios

Exelon Corporation demonstrates stronger financial health with positive returns, manageable debt levels, and a solid dividend yield, indicating a well-established company. Conversely, Oklo Inc. presents concerning metrics, such as negative returns and high current ratios, suggesting liquidity but insufficient operational performance. The lack of revenue and profit margins raises significant risks for potential investors. Overall, investors should approach Oklo with caution.

Dividend and Shareholder Returns

Exelon Corporation (EXC) consistently pays dividends, currently yielding 4.04% with a payout ratio of approximately 62%. The dividend per share has shown a stable trend, supported by healthy cash flow, although concerns about sustainability arise given the high payout. Conversely, Oklo Inc. (OKLO) does not pay dividends, focusing on reinvestment during its growth phase. While it engages in share buybacks, the lack of dividends raises questions about long-term value creation for shareholders. Overall, EXC’s approach appears to support sustainable value, whereas OKLO’s strategy may align with future growth potential.

Strategic Positioning

Exelon Corporation (EXC) holds a significant market share in the regulated electric utility sector, leveraging its diverse energy generation portfolio, including nuclear and renewable sources. With a market cap of $46.2B, it faces moderate competitive pressure from emerging players like Oklo Inc. (OKLO), which specializes in innovative fission power plants. Oklo, with a market cap of $13.3B, represents a technological disruption in the energy space, focusing on sustainable energy solutions. Both companies must navigate this evolving landscape to maintain their competitive edge.

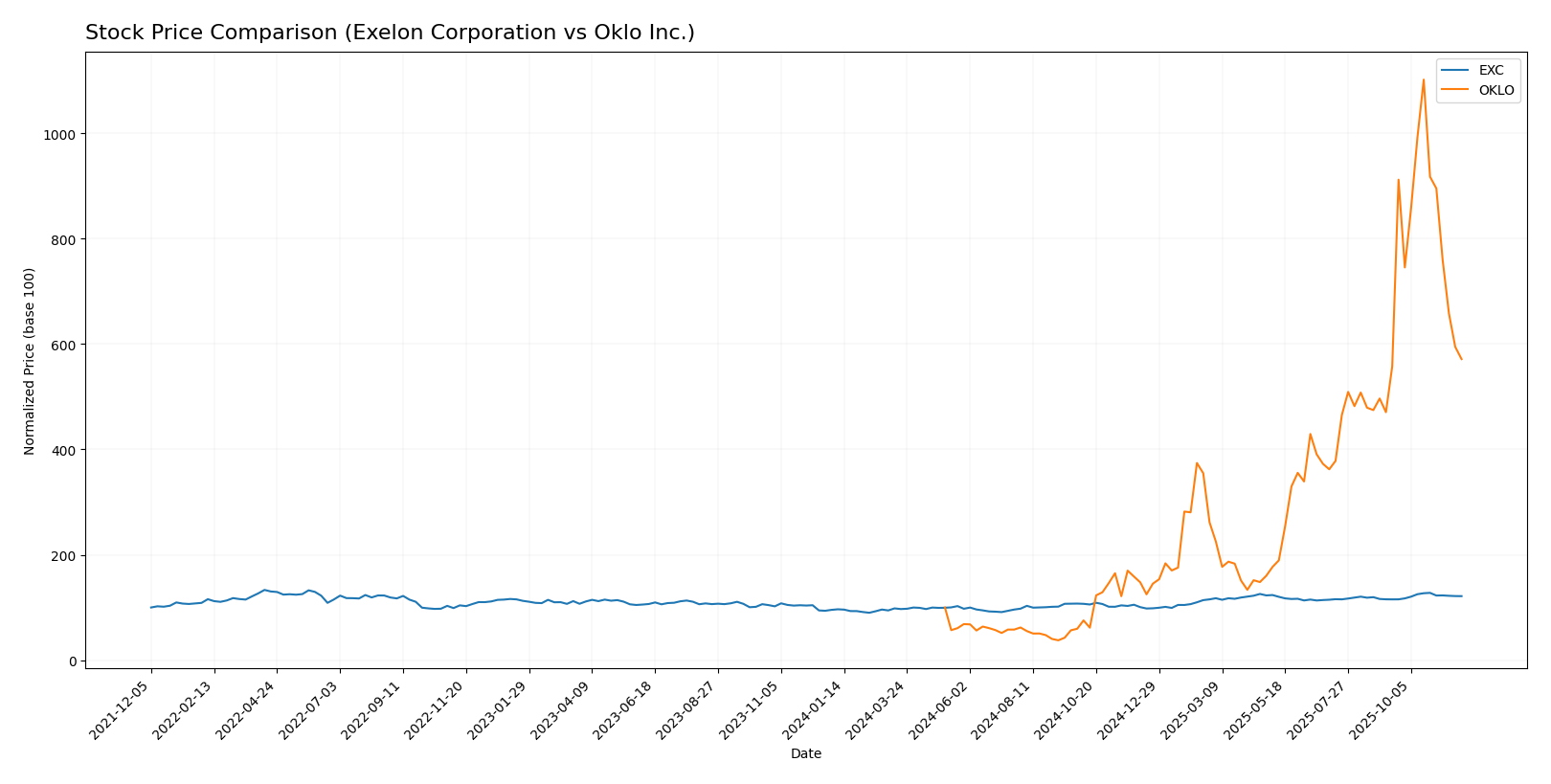

Stock Comparison

In this section, I will analyze the stock price movements and trading dynamics of Exelon Corporation (EXC) and Oklo Inc. (OKLO) over the past year, highlighting key trends and changes.

Trend Analysis

For Exelon Corporation (EXC), the stock has shown a 25.85% increase over the past year, indicating a bullish trend. The overall trend is characterized by acceleration, with notable price fluctuations ranging from a low of 33.84 to a high of 48.04. The standard deviation of 3.92 suggests some volatility, but the overall momentum appears strong.

In the recent period from September 14, 2025, to November 30, 2025, EXC experienced a 5.34% increase, with a trend slope of 0.21. The standard deviation during this timeframe was 1.46, indicating less volatility compared to the longer-term trend.

For Oklo Inc. (OKLO), the stock has seen a remarkable 471.38% increase over the past year, also indicating a bullish trend. However, the trend is currently experiencing deceleration. The price has fluctuated between a low of 5.59 and a high of 163.39, with a substantial standard deviation of 38.3, reflecting significant volatility in its trading patterns.

In the recent analysis period from September 14, 2025, to November 30, 2025, OKLO’s price increased by 2.45%, with a trend slope of -2.22, suggesting a slight pullback. The standard deviation during this period was 25.14.

In summary, both stocks exhibit strong long-term bullish trends, with EXC showing acceleration and OKLO facing deceleration despite its impressive overall price growth.

Analyst Opinions

Recent analyst sentiments indicate a mixed outlook for Exelon Corporation (EXC) and Oklo Inc. (OKLO). Analysts recommend a “Buy” for EXC, supported by its strong discounted cash flow and solid return on assets, with a B rating from several experts. Conversely, OKLO has received a “Hold” recommendation, reflecting concerns over its low return on equity and overall C rating. The consensus for EXC is bullish, while OKLO leans towards caution. As I assess these recommendations, I emphasize the importance of evaluating individual risk profiles before making investment decisions.

Stock Grades

I have reviewed the stock grades for two companies, Exelon Corporation (EXC) and Oklo Inc. (OKLO), and here are the insights based on recent evaluations by reputable analysts.

Exelon Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-10-22 |

| Keybanc | maintain | Underweight | 2025-10-15 |

| Jefferies | maintain | Buy | 2025-10-15 |

| Barclays | maintain | Overweight | 2025-10-14 |

| UBS | maintain | Neutral | 2025-10-10 |

| Morgan Stanley | maintain | Equal Weight | 2025-09-25 |

| Keybanc | maintain | Underweight | 2025-07-16 |

| UBS | maintain | Neutral | 2025-07-11 |

| UBS | maintain | Neutral | 2025-06-02 |

| Morgan Stanley | maintain | Equal Weight | 2025-05-22 |

Oklo Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | maintain | Outperform | 2025-11-12 |

| B of A Securities | maintain | Neutral | 2025-11-12 |

| B. Riley Securities | maintain | Buy | 2025-11-12 |

| B of A Securities | downgrade | Neutral | 2025-09-30 |

| Seaport Global | downgrade | Neutral | 2025-09-23 |

| Wedbush | maintain | Outperform | 2025-09-22 |

| Wedbush | maintain | Outperform | 2025-08-14 |

| Wedbush | maintain | Outperform | 2025-08-12 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-12 |

| Citigroup | maintain | Neutral | 2025-07-22 |

In summary, Exelon Corporation maintains a mix of grades, with a significant number of analysts recommending a neutral to underweight stance, while Oklo Inc. shows a generally positive outlook with multiple maintain ratings at outperform and buy. This reflects a cautious optimism for Oklo, whereas Exelon appears to be viewed more conservatively.

Target Prices

The consensus target prices for Exelon Corporation and Oklo Inc. reflect optimistic expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Exelon Corporation | 57 | 42 | 51.67 |

| Oklo Inc. | 175 | 75 | 129.5 |

For Exelon Corporation, the current stock price of 45.70 is well below the consensus target of 51.67, indicating potential upside. Oklo Inc. is trading at 85.02, also below its consensus target of 129.5, suggesting strong growth expectations from analysts.

Strengths and Weaknesses

The following table provides an overview of the strengths and weaknesses of Exelon Corporation (EXC) and Oklo Inc. (OKLO).

| Criterion | Exelon Corporation (EXC) | Oklo Inc. (OKLO) |

|---|---|---|

| Diversification | High (diverse energy sources) | Low (niche focus on fission) |

| Profitability | Moderate (net profit margin: 10.68%) | Negative (currently unprofitable) |

| Innovation | Strong (ongoing renewable projects) | Moderate (focus on new tech) |

| Global presence | Significant (North America) | Limited (US-focused) |

| Market Share | Large (leading utility provider) | Small (emerging player) |

| Debt level | Moderate (debt-to-equity: 1.73) | Very low (debt-to-equity: 0.005) |

Key takeaways: Exelon benefits from diversification and market leadership, while Oklo’s innovative approach is offset by its limited market presence and current unprofitability. Investors should assess their risk tolerance when considering these stocks.

Risk Analysis

In the following table, I outline the key risks associated with Exelon Corporation (EXC) and Oklo Inc. (OKLO) to help you assess their potential impact on investment decisions.

| Metric | Exelon Corporation (EXC) | Oklo Inc. (OKLO) |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | High | Moderate |

| Operational Risk | Moderate | High |

| Environmental Risk | High | Moderate |

| Geopolitical Risk | Low | High |

Both companies face notable risks, particularly in regulatory and operational aspects. Exelon has a high regulatory risk due to its utility sector operations, while Oklo faces significant market and operational risks given its emerging technology in nuclear energy.

Which one to choose?

In comparing Exelon Corporation (EXC) and Oklo Inc. (OKLO), EXC presents a more stable investment opportunity. EXC has a market cap of 38B and a solid gross profit margin of 41% with a net profit margin of 11%. Its P/E ratio stands at approximately 15, indicating reasonable valuation. Analysts rate EXC with a “B” and target a price increase, supported by a bullish stock trend with a 25.85% price change over the past year.

In contrast, OKLO, with a market cap of 2.1B, shows a significant price change of 471.38%, but lacks revenue and carries high operational losses. Analysts rate OKLO with a “C,” reflecting higher risks with its financial performance and volatility.

Recommendation: Investors focused on stability may prefer EXC, while those with a higher risk appetite seeking potential growth may consider OKLO, albeit with caution regarding its financial health.

Specific risks include competition in the energy sector for EXC and operational viability for OKLO.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Exelon Corporation and Oklo Inc. to enhance your investment decisions: